Building Life Depreciation

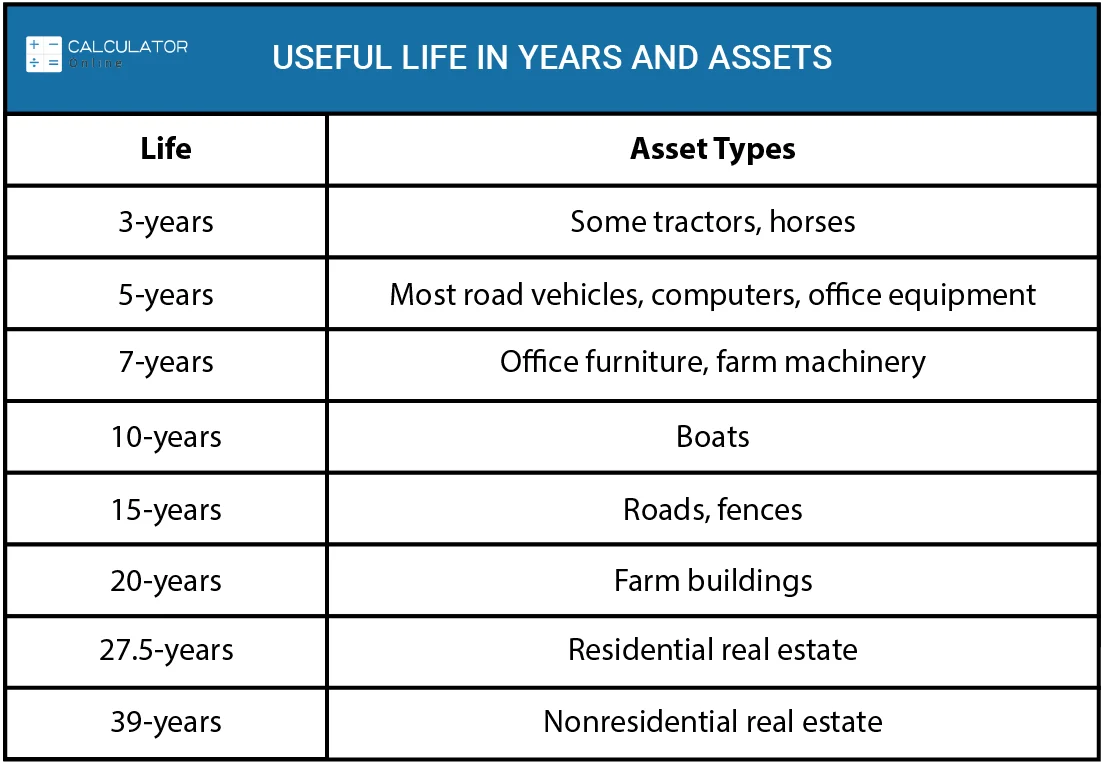

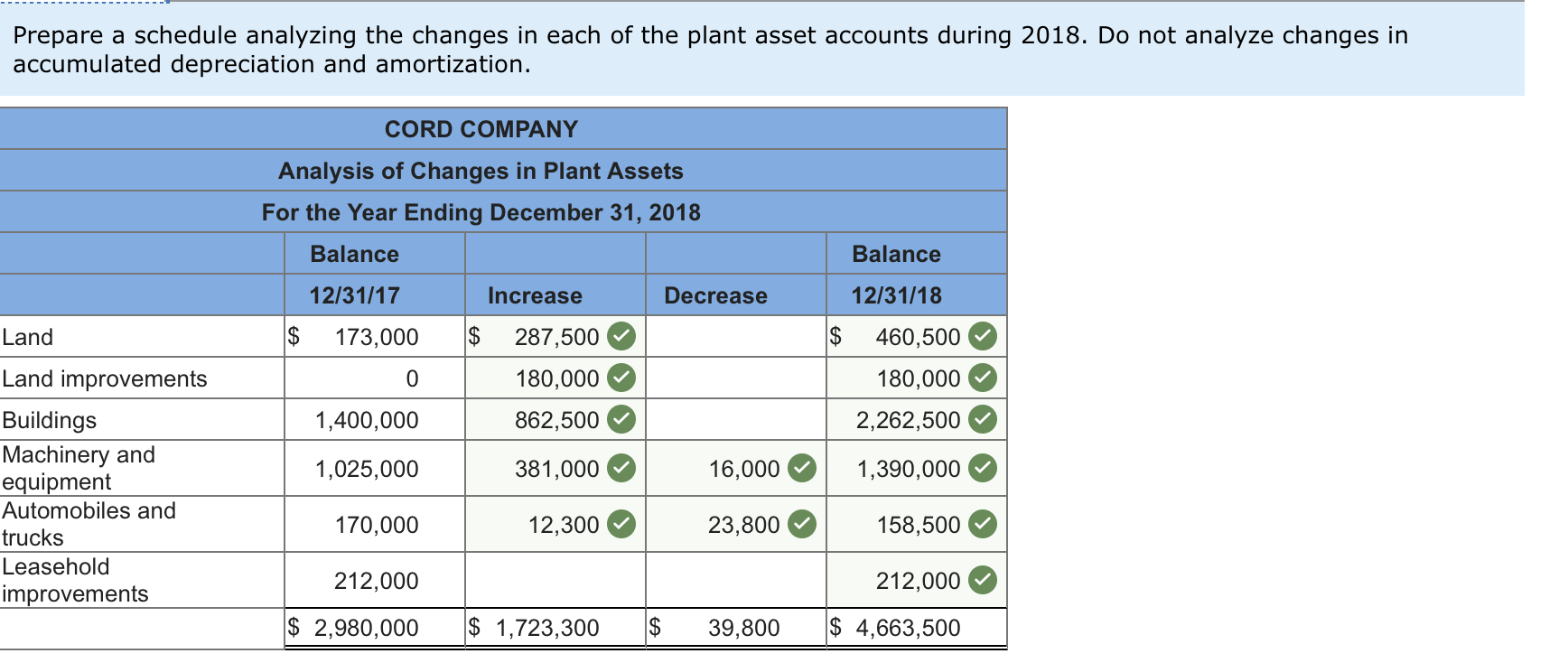

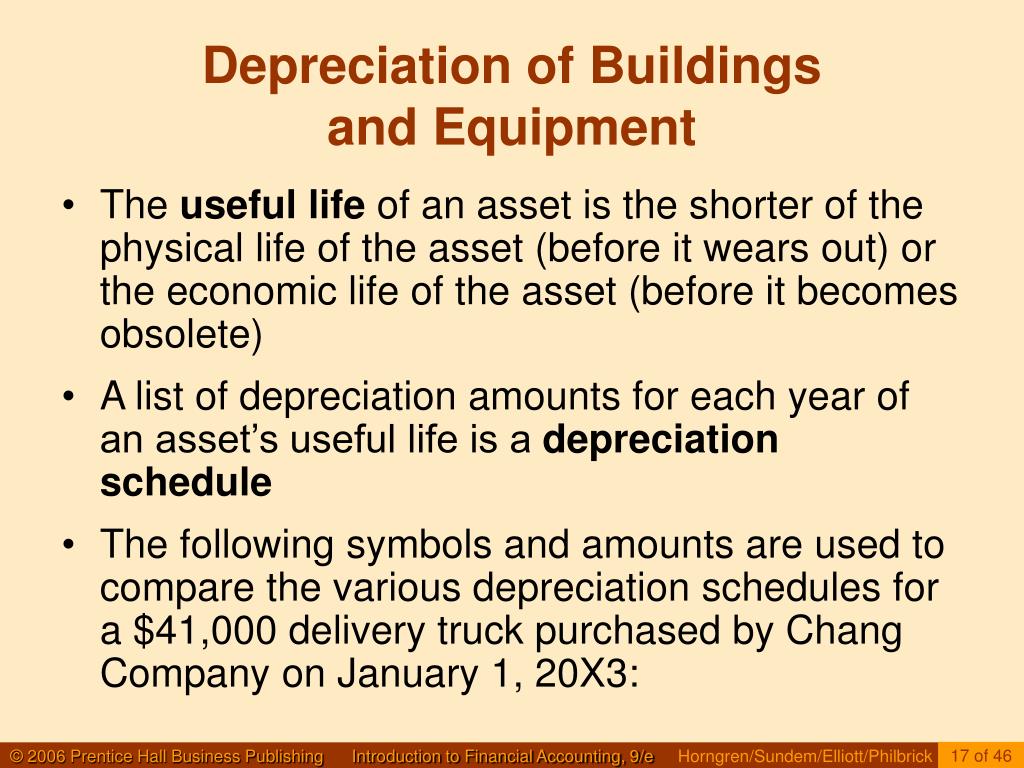

Building Life Depreciation - Building depreciation is a practice that enables a real estate owner to allocate the property's cost over many years, typically over its useful life. Calculating land and building values for tax purposes is a critical step toward maximizing your available tax deductions from depreciation. Useful life is the length of time the. Land can never be depreciated. There are three main methods of depreciation: There are several types of capital assets that can be depreciated when you use them in your business. Depreciation methods for commercial property vary, each offering a different approach to expense allocation over the asset’s useful life. This is because the law says you. For example, if a commercial building is completed in december but tenants. Asset depreciation is a major factor in capital planning and capital budgeting. Let's take a look at. For example, if a commercial building is completed in december but tenants. Asset depreciation is a major factor in capital planning and capital budgeting. If you own real estate, one of the big benefits is that it is a depreciable asset. Before rental property owners can calculate their depreciation for the year, they must determine an asset’s class life and recovery period, which are set by the irs. Depreciation of a building is the. Whole building life cycle assessments. Building life cycle assessment is a scientific methodology. Whether you’re investing in office space, apartment buildings, or retail properties, depreciation. This is because the law says you. For example, if a commercial building is completed in december but tenants. Depreciation methods for commercial property vary, each offering a different approach to expense allocation over the asset’s useful life. These methods are crucial for. Understanding the concept of building depreciation and its useful life is pivotal in the realm of real estate, accounting, and asset management. Useful life. Building research establishment environmental assessment method (breeam) u.s. These methods are crucial for. Land can never be depreciated. Depreciation methods for commercial property vary, each offering a different approach to expense allocation over the asset’s useful life. Useful life is the length of time the. Capital asset costs are depreciated over their estimated useful lives. For example, if a commercial building is completed in december but tenants. The company can choose which method it wants to use for depreciating. This means that you can record an expense each year for the wear and tear on your building. If you own real estate, one of the. Depreciation methods for commercial property vary, each offering a different approach to expense allocation over the asset’s useful life. If you own real estate, one of the big benefits is that it is a depreciable asset. Before rental property owners can calculate their depreciation for the year, they must determine an asset’s class life and recovery period, which are set. Building research establishment environmental assessment method (breeam) u.s. Learn how to manage building assets effectively, covering depreciation, financial reporting, and tax implications. Depreciation begins when the property is placed in service—when it is ready and available for use. Whole building life cycle assessments. Depreciation of a building is the. This is because the law says you. Depreciation methods for commercial property vary, each offering a different approach to expense allocation over the asset’s useful life. Financial professionals use depreciation schedules to forecast. Understanding the concept of building depreciation and its useful life is pivotal in the realm of real estate, accounting, and asset management. If you own real estate,. There are several types of capital assets that can be depreciated when you use them in your business. Depreciation of a building is the. Commercial real estate depreciation is a major tax benefit that every investor should understand. Understanding the concept of building depreciation and its useful life is pivotal in the realm of real estate, accounting, and asset management.. Before rental property owners can calculate their depreciation for the year, they must determine an asset’s class life and recovery period, which are set by the irs. This means that you can record an expense each year for the wear and tear on your building. If you own real estate, one of the big benefits is that it is a. [3] can i depreciate the cost of land? For example, if a commercial building is completed in december but tenants. Understanding the concept of building depreciation and its useful life is pivotal in the realm of real estate, accounting, and asset management. Before rental property owners can calculate their depreciation for the year, they must determine an asset’s class life. There are three main methods of depreciation: Building life cycle assessment is a scientific methodology. It requires making a prediction on how long we expect an asset would add to revenue generation and based on. Whole building life cycle assessments. These methods are crucial for. Asset depreciation is a major factor in capital planning and capital budgeting. The company can choose which method it wants to use for depreciating. These methods are crucial for. Charging depreciation expense should stop when the asset's useful life is over. Building life cycle assessment is a scientific methodology. This means that you can record an expense each year for the wear and tear on your building. Understanding the concept of building depreciation and its useful life is pivotal in the realm of real estate, accounting, and asset management. Building research establishment environmental assessment method (breeam) u.s. Let's take a look at. [3] can i depreciate the cost of land? This is because the law says you. There are three main methods of depreciation: Financial professionals use depreciation schedules to forecast. Whether you’re investing in office space, apartment buildings, or retail properties, depreciation. Useful life is the length of time the. Learn how to manage building assets effectively, covering depreciation, financial reporting, and tax implications.MACRS Depreciation Calculator

Leasehold Improvement GAAP, Accounting, Depreciation, Write Off eFM

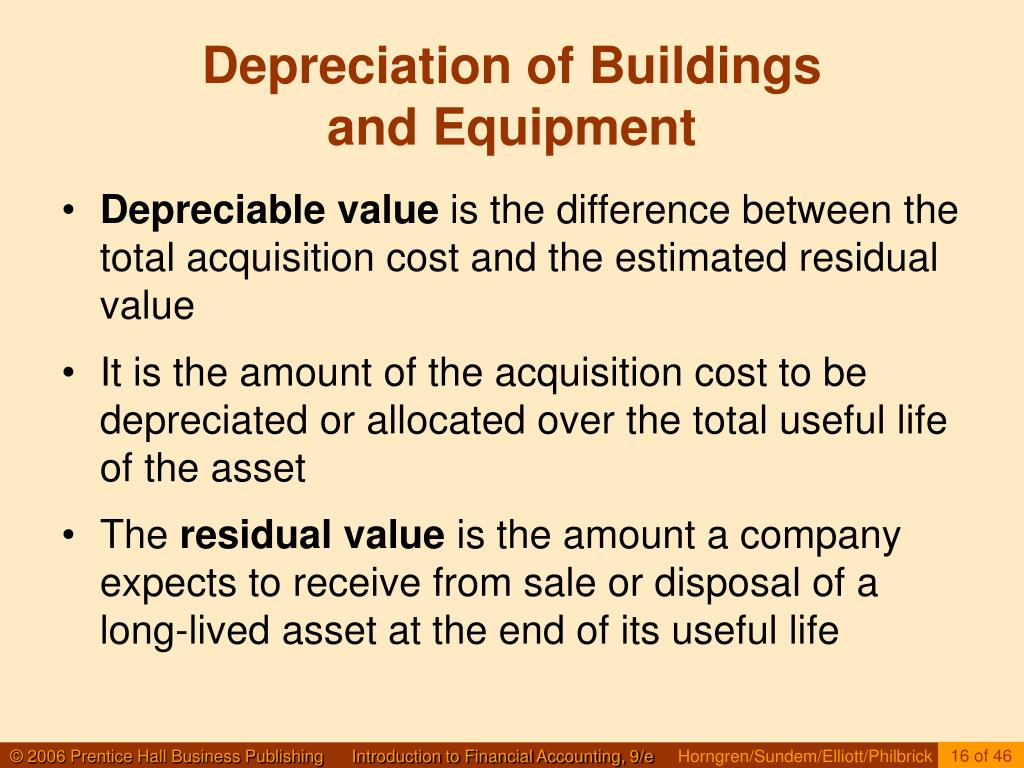

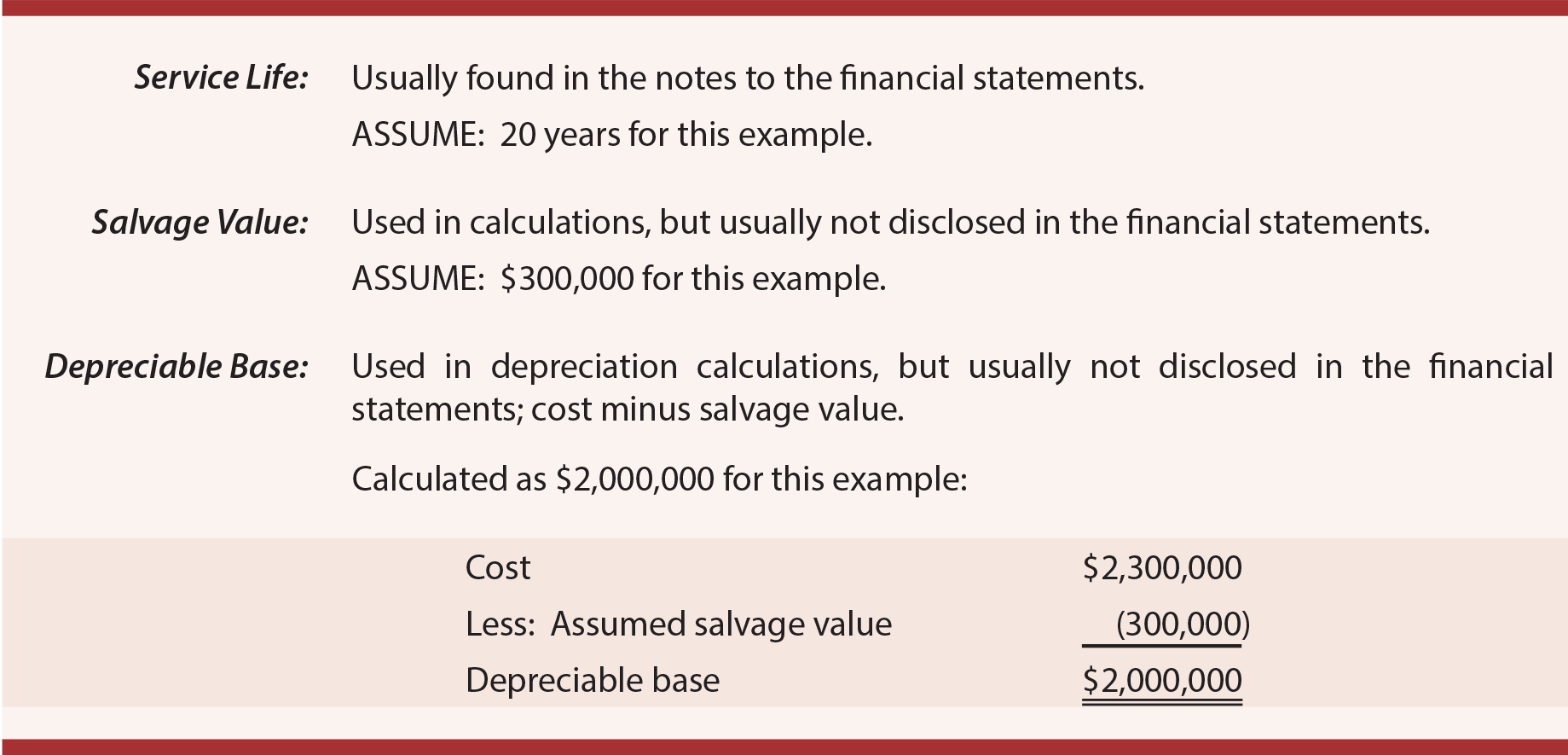

Depreciation for Building Definition, Formula, and Excel Examples

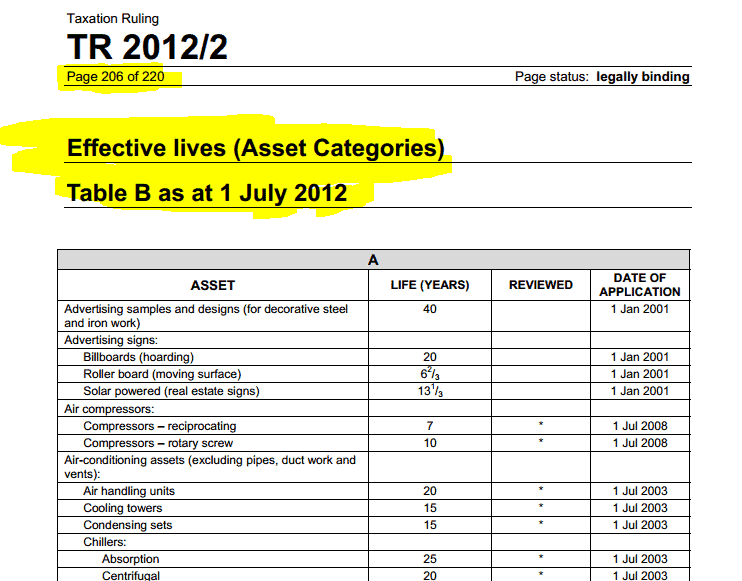

ATO depreciation rates and depreciation schedules AtoTaxRates.info

PPT LongLived Assets and Depreciation PowerPoint Presentation, free

Methods of Depreciation Formulas, Problems, and Solutions Owlcation

Depreciation for Building Definition, Formula, and Excel Examples

Solved Depreciation methods and useful lives Buildings—150

Depreciation Concepts

PPT LongLived Assets and Depreciation PowerPoint Presentation ID

There Are Several Types Of Capital Assets That Can Be Depreciated When You Use Them In Your Business.

Commercial Real Estate Depreciation Is A Major Tax Benefit That Every Investor Should Understand.

Before Rental Property Owners Can Calculate Their Depreciation For The Year, They Must Determine An Asset’s Class Life And Recovery Period, Which Are Set By The Irs.

If You Own Real Estate, One Of The Big Benefits Is That It Is A Depreciable Asset.

Related Post: