Building Loan Vs Home Loan

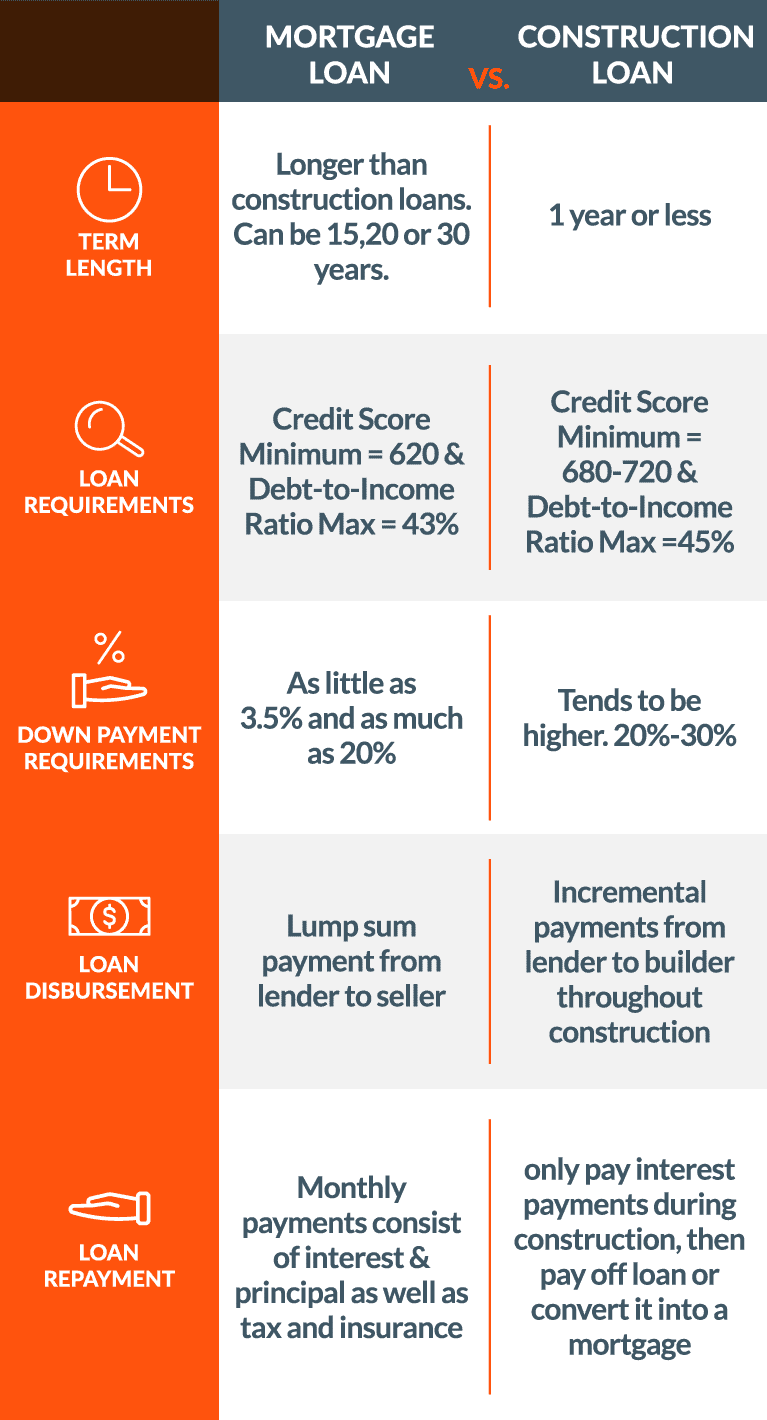

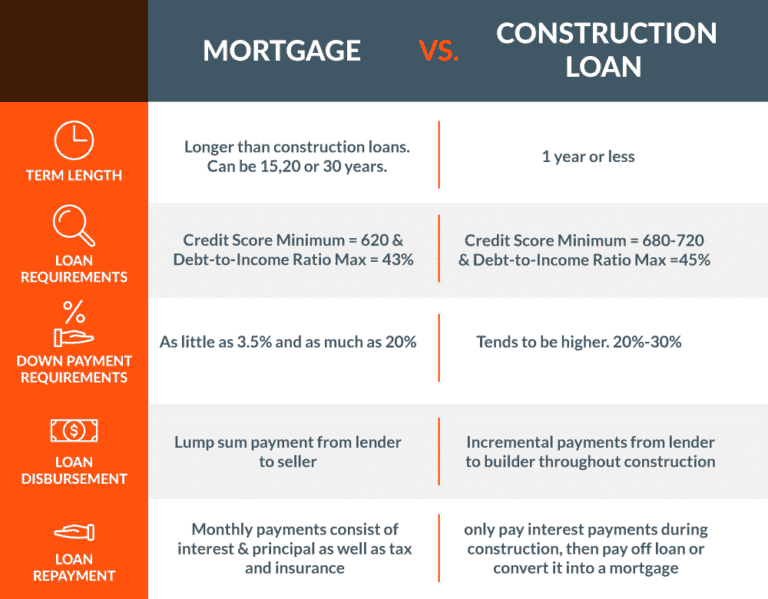

Building Loan Vs Home Loan - They can be anywhere from 6 months to a few years. They offer flexibility and control over the construction process. In a home loan, the entire loan amount is disbursed to the borrower in one go at the time of property purchase. Construction loans let you finance the materials and labor to build a house from scratch — as opposed to a traditional mortgage loan, which is only for completed homes. In a construction loan, the disbursement is done. However, if you’re looking to purchase an existing home or refinance your. Construction loans are intended to finance the building or renovation of a home, while mortgage loans are designed to purchase or refinance an existing property. But, there are quite a few differences between home loans and construction loans that you must know about. Construction loans offer borrowers the chance to. Ideal for building a new home or undertaking significant renovations. Construction loans let you finance the materials and labor to build a house from scratch — as opposed to a traditional mortgage loan, which is only for completed homes. Construction loans are intended to finance the building or renovation of a home, while mortgage loans are designed to purchase or refinance an existing property. Construction loans offer borrowers the chance to. But, there are quite a few differences between home loans and construction loans that you must know about. They offer flexibility and control over the construction process. In a home loan, the entire loan amount is disbursed to the borrower in one go at the time of property purchase. Mortgages can have lower interest rates than home equity loans, but that doesn’t mean they’re always a better choice. Explore the 6 key differences between a home loan and a home construction loan, like the interest rate, documents required, application process, and more. However, if you’re looking to purchase an existing home or refinance your. In a construction loan, the disbursement is done. There are a few specific differences between mortgages and construction loans. They can be anywhere from 6 months to a few years. But, there are quite a few differences between home loans and construction loans that you must know about. There are differences between applying for an ordinary home loan and a loan granted by the bank for construction or. When deciding which loan type is best. Ideal for building a new home or undertaking significant renovations. There are differences between applying for an ordinary home loan and a loan granted by the bank for construction or renovation of a property. Construction loans are intended to finance the building or renovation of a home, while mortgage loans are designed to. There are differences between applying for an ordinary home loan and a loan granted by the bank for construction or renovation of a property. However, if you’re looking to purchase an existing home or refinance your. Construction loans let you finance the materials and labor to build a house from scratch — as opposed to a traditional mortgage loan, which. Construction loans are a way for someone who wants to build a new construction home to finance their new home through the construction phase, without having to pay the. When deciding which loan type is best. Construction loans offer borrowers the chance to. Construction loans let you finance the materials and labor to build a house from scratch — as. Explore the 6 key differences between a home loan and a home construction loan, like the interest rate, documents required, application process, and more. In a home loan, the entire loan amount is disbursed to the borrower in one go at the time of property purchase. Construction loans let you finance the materials and labor to build a house from. Mortgages can have lower interest rates than home equity loans, but that doesn’t mean they’re always a better choice. They can be anywhere from 6 months to a few years. There are differences between applying for an ordinary home loan and a loan granted by the bank for construction or renovation of a property. These loans provide funding for all. Construction loans are a way for someone who wants to build a new construction home to finance their new home through the construction phase, without having to pay the. Construction loans let you finance the materials and labor to build a house from scratch — as opposed to a traditional mortgage loan, which is only for completed homes. Mortgages can. There are differences between applying for an ordinary home loan and a loan granted by the bank for construction or renovation of a property. Construction loans offer borrowers the chance to. When deciding which loan type is best. But, there are quite a few differences between home loans and construction loans that you must know about. They offer flexibility and. Ideal for building a new home or undertaking significant renovations. While home improvement loans typically cap at $50,000 to $100,000, you’re able to borrow up to 85% of your home's equity (primary mortgage and home equity loan combined). There are differences between applying for an ordinary home loan and a loan granted by the bank for construction or renovation of. If you’re planning to build a new home or undertake significant renovations, a construction loan is the right choice. Although some people use the terms “construction loan” and “construction mortgage” interchangeably, “construction loan” is. Construction loans are intended to finance the building or renovation of a home, while mortgage loans are designed to purchase or refinance an existing property. Construction. Mortgages can have lower interest rates than home equity loans, but that doesn’t mean they’re always a better choice. They can be anywhere from 6 months to a few years. There are differences between applying for an ordinary home loan and a loan granted by the bank for construction or renovation of a property. Explore the 6 key differences between a home loan and a home construction loan, like the interest rate, documents required, application process, and more. While home improvement loans typically cap at $50,000 to $100,000, you’re able to borrow up to 85% of your home's equity (primary mortgage and home equity loan combined). Construction loans offer borrowers the chance to. Construction loans are a way for someone who wants to build a new construction home to finance their new home through the construction phase, without having to pay the. They offer flexibility and control over the construction process. If you’re planning to build a new home or undertake significant renovations, a construction loan is the right choice. In a home loan, the entire loan amount is disbursed to the borrower in one go at the time of property purchase. These loans provide funding for all phases of construction, from purchasing the land to paying for materials and labor. Although some people use the terms “construction loan” and “construction mortgage” interchangeably, “construction loan” is. Ideal for building a new home or undertaking significant renovations. In a construction loan, the disbursement is done. When deciding which loan type is best. Let us look at the differences and understand which loan best suits your.Construction Loan vs Home Loan Know the Difference

Construction Loan Vs. Home Loan Understanding The Differences

Construction Loans vs Home Loans Key Differences You Should Know

Home Loan Vs Construction Loan Understanding The Difference Mahindra

2 Basic Financing Options Mortgages Vs. Construction Loans

2 Basic Financing Options Mortgages Vs. Construction Loans

Home Construction loan vs home loan what's the difference? Buildi

Difference Between Home Loan And Construction Loan Poonawalla Fincorp

Construction Loan Vs. Home Loan Understanding The Differences

Construction Loan vs Mortgage The Ultimate Comparison Guide

But, There Are Quite A Few Differences Between Home Loans And Construction Loans That You Must Know About.

Construction Loans Let You Finance The Materials And Labor To Build A House From Scratch — As Opposed To A Traditional Mortgage Loan, Which Is Only For Completed Homes.

Construction Loans Are Intended To Finance The Building Or Renovation Of A Home, While Mortgage Loans Are Designed To Purchase Or Refinance An Existing Property.

However, If You’re Looking To Purchase An Existing Home Or Refinance Your.

Related Post: