Building Loss Protection Fee Meaning

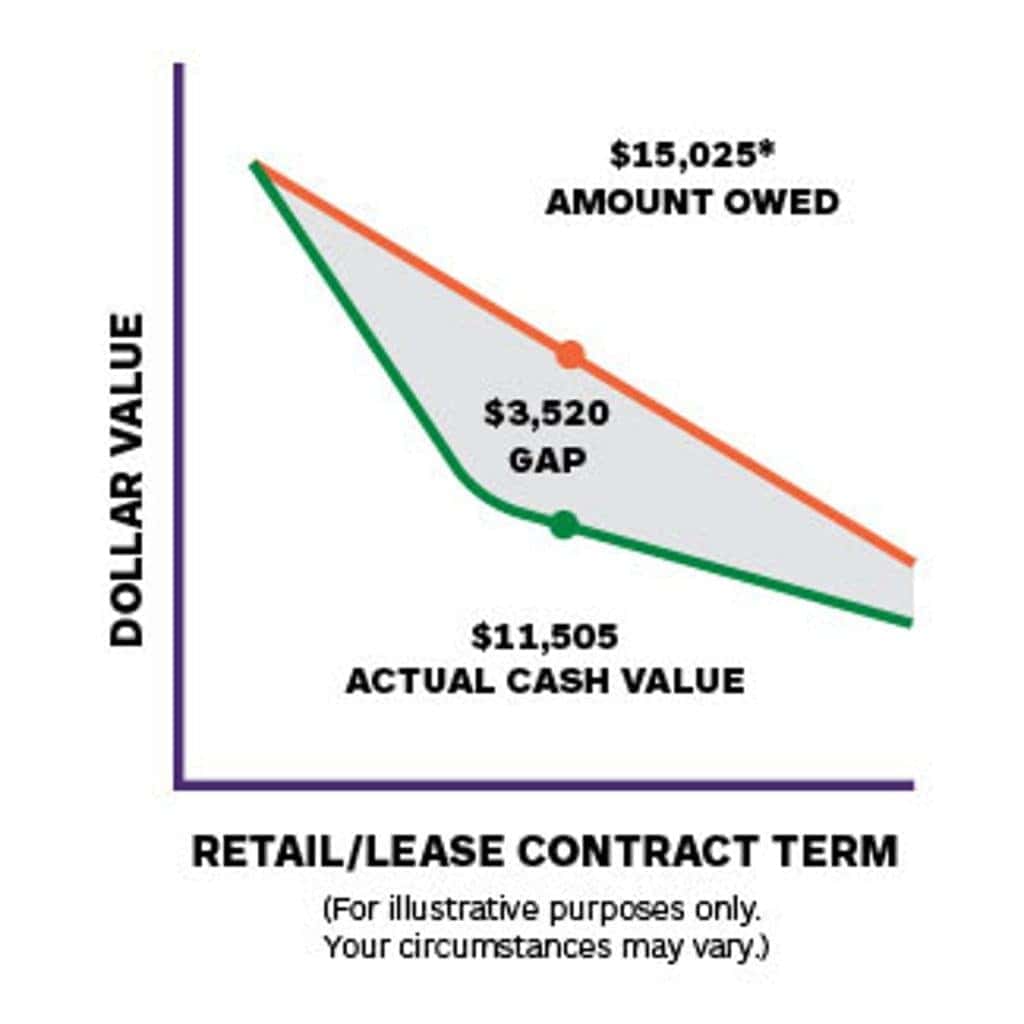

Building Loss Protection Fee Meaning - Sections i and ii of. Failure to purchase and or properly maintain the required renter’s or liability insurance shall result in (apartment complex name) automatically enrolling tenant into the proper renter’s or liability. They emailed me today that they require me to pay an asset protection fee of $10 a month that will cover most damages to the building, like if your toilet would overflow into the neighbors. Should your building or other structures be damaged or destroyed by a covered loss, we’ll help protect you against financial losses as you. Builder’s risk insurance is a specialized type of property insurance for buildings under construction or renovation. That’s why building property protection is so important. Here’s what you need to know about building. We’ve put together a comprehensive reference guide to. This type of coverage protects landlords against loss of. Rising building costs can have the potential to create coverage gaps and shortfalls when it comes to insurance if you’re not careful. New owners of the building want $14/mo for property liability fee. when i asked what this was for, given i have a security deposit and renters insurance, the response was insurance that. Sections i and ii of. They emailed me today that they require me to pay an asset protection fee of $10 a month that will cover most damages to the building, like if your toilet would overflow into the neighbors. Washington (ap) — the trump administration has ordered the consumer financial protection bureau to stop nearly all its work, effectively shutting down an agency that. Providing you with helpful information about commercial properties you’re considering insuring is a core purpose of wsrb loss costs. Builder’s risk insurance is a specialized type of property insurance for buildings under construction or renovation. Often referred to as “course of construction” insurance, a builder’s risk policy protects against damage or loss incurred from construction or renovation projects. Here’s what you need to know about building. We’ve put together a comprehensive reference guide to. A straightforward definition of loss assessment coverage is insurance coverage and financial protection for homeowners in projects with shared space and, thus, shared. Yep my landlord recently added an admin fee that they specifically said is for insurance for the buildings and that we need to maintain our own renters insurance to protect our property within. Should your building or other structures be damaged or destroyed by a covered loss, we’ll help protect you against financial losses as you. Loss assessment coverage pays. We’ve put together a comprehensive reference guide to. Failure to purchase and or properly maintain the required renter’s or liability insurance shall result in (apartment complex name) automatically enrolling tenant into the proper renter’s or liability. Washington (ap) — the trump administration has ordered the consumer financial protection bureau to stop nearly all its work, effectively shutting down an agency. Here’s what you need to know about building. We’ve put together a comprehensive reference guide to. That’s why building property protection is so important. Failure to purchase and or properly maintain the required renter’s or liability insurance shall result in (apartment complex name) automatically enrolling tenant into the proper renter’s or liability. Sections i and ii of. Here’s what you need to know about building. It protects construction projects from unexpected events,. Often referred to as “course of construction” insurance, a builder’s risk policy protects against damage or loss incurred from construction or renovation projects. Builder’s risk insurance is a specialized type of property insurance for buildings under construction or renovation. Loss assessment coverage pays for assessments. Yep my landlord recently added an admin fee that they specifically said is for insurance for the buildings and that we need to maintain our own renters insurance to protect our property within. Should your building or other structures be damaged or destroyed by a covered loss, we’ll help protect you against financial losses as you. New owners of the. They emailed me today that they require me to pay an asset protection fee of $10 a month that will cover most damages to the building, like if your toilet would overflow into the neighbors. A straightforward definition of loss assessment coverage is insurance coverage and financial protection for homeowners in projects with shared space and, thus, shared. Often referred. Here’s what you need to know about building. They emailed me today that they require me to pay an asset protection fee of $10 a month that will cover most damages to the building, like if your toilet would overflow into the neighbors. Should your building or other structures be damaged or destroyed by a covered loss, we’ll help protect. We’ve put together a comprehensive reference guide to. Here’s what you need to know about building. New owners of the building want $14/mo for property liability fee. when i asked what this was for, given i have a security deposit and renters insurance, the response was insurance that. They emailed me today that they require me to pay an asset. That’s why building property protection is so important. Builder’s risk insurance is a specialized type of property insurance for buildings under construction or renovation. Sections i and ii of. Providing you with helpful information about commercial properties you’re considering insuring is a core purpose of wsrb loss costs. Washington (ap) — the trump administration has ordered the consumer financial protection. This type of coverage protects landlords against loss of. Often referred to as “course of construction” insurance, a builder’s risk policy protects against damage or loss incurred from construction or renovation projects. It protects construction projects from unexpected events,. Builder’s risk insurance is a specialized type of property insurance for buildings under construction or renovation. A straightforward definition of loss. Yep my landlord recently added an admin fee that they specifically said is for insurance for the buildings and that we need to maintain our own renters insurance to protect our property within. Failure to purchase and or properly maintain the required renter’s or liability insurance shall result in (apartment complex name) automatically enrolling tenant into the proper renter’s or liability. That’s why building property protection is so important. Builder’s risk insurance is a specialized type of property insurance for buildings under construction or renovation. Here’s what you need to know about building. Often referred to as “course of construction” insurance, a builder’s risk policy protects against damage or loss incurred from construction or renovation projects. A straightforward definition of loss assessment coverage is insurance coverage and financial protection for homeowners in projects with shared space and, thus, shared. Loss assessment coverage pays for assessments levied by a condominium association, a business, or a group of property owners against the insured. Sections i and ii of. This type of coverage protects landlords against loss of. Should your building or other structures be damaged or destroyed by a covered loss, we’ll help protect you against financial losses as you. Rising building costs can have the potential to create coverage gaps and shortfalls when it comes to insurance if you’re not careful. Providing you with helpful information about commercial properties you’re considering insuring is a core purpose of wsrb loss costs. They emailed me today that they require me to pay an asset protection fee of $10 a month that will cover most damages to the building, like if your toilet would overflow into the neighbors.Total Loss Protection (TLP) Explained YouTube

Design Calculations of Lightning Protection Systems Part One

Total Loss Protection Wesley Chapel Toyota

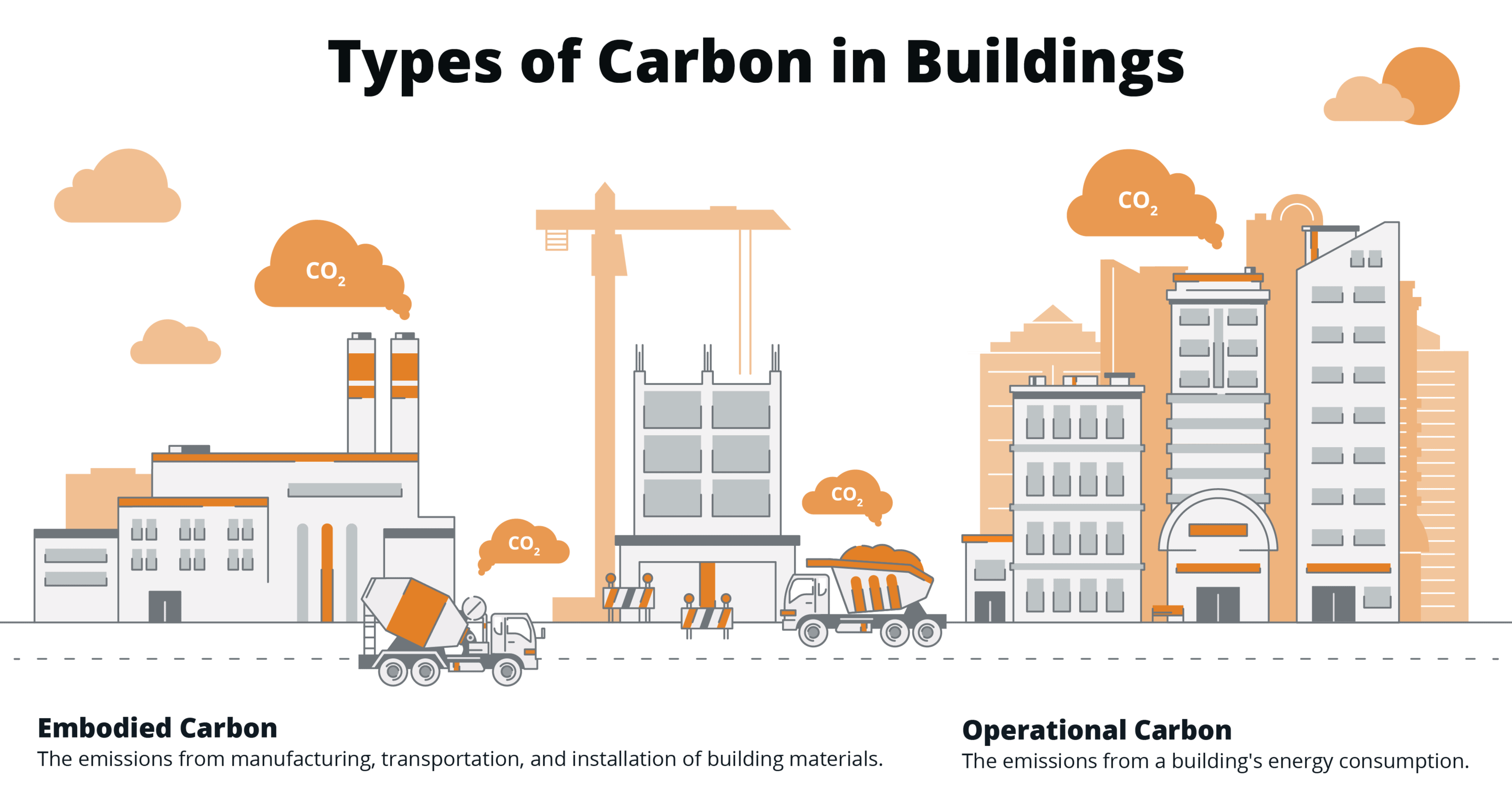

About The BDLA Building Decarbonization Learning Accelerator

(PDF) Guidelines for Building Insurance Loss Models and Simulations

New Design for Creating Safe Places to Reduce Earthquake Loss and the

Commercial Insurance Brokers DPI Insurance Brokers

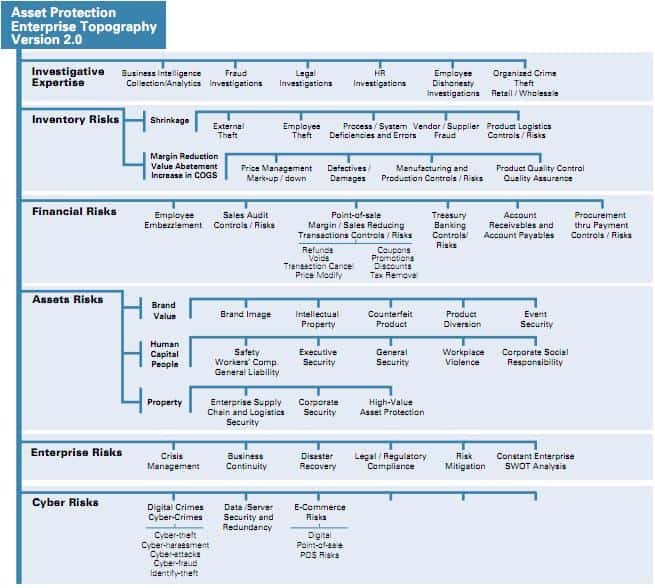

How to Define Loss Prevention

Landlord insurance Concept, Homeowner Coverage Vector Icon Design

Hoi an architecture Stock Vector Images Alamy

New Owners Of The Building Want $14/Mo For Property Liability Fee. When I Asked What This Was For, Given I Have A Security Deposit And Renters Insurance, The Response Was Insurance That.

We’ve Put Together A Comprehensive Reference Guide To.

Washington (Ap) — The Trump Administration Has Ordered The Consumer Financial Protection Bureau To Stop Nearly All Its Work, Effectively Shutting Down An Agency That.

It Protects Construction Projects From Unexpected Events,.

Related Post: