Building Loss Protection Fee

Building Loss Protection Fee - A builders risk insurance policy can insure a building that is under construction along with the materials and equipment used to make it against sudden perils like fire, theft. While the cost of builder’s risk insurance varies, most businesses pay between 1% and 5% of the total cost of the construction project. They emailed me today that they require me to pay an asset protection fee of $10 a month that will cover most damages to the building, like if your toilet would overflow into the neighbors. It protects construction projects from unexpected events,. For example, if your budget for a. Builders risk typically only offers coverage for the home. That’s why building property protection is so important. However, policy forms should be carefully. These soft costs would include. Covers additional expenses caused by a covered claim that are not related to building materials, equipment, or other hard costs. They emailed me today that they require me to pay an asset protection fee of $10 a month that will cover most damages to the building, like if your toilet would overflow into the neighbors. Builder’s risk insurance is a specialized type of property insurance for buildings under construction or renovation. However, policy forms should be carefully. These soft costs would include. Should your building or other structures be damaged or destroyed by a covered loss, we’ll help protect you against financial losses as you. That’s why building property protection is so important. Builders risk typically only offers coverage for the home. Most builders risk insurers will not provide coverage for the cost of making good defective design, workmanship, or materials. Many builders risk policies insure against loss of revenue and/or soft costs that result from a project delay due to insured physical damage to the project. Builders risk insurance is a form of property insurance that covers property that is being constructed or renovated, against physical loss or damage from a covered cause. Builders risk insurance is a form of property insurance that covers property that is being constructed or renovated, against physical loss or damage from a covered cause. Most builders risk insurers will not provide coverage for the cost of making good defective design, workmanship, or materials. Many builders risk policies insure against loss of revenue and/or soft costs that result. Builders risk insurance is a form of property insurance that covers property that is being constructed or renovated, against physical loss or damage from a covered cause. Homeowners insurance provides coverage for the home itself, personal belongings, loss of use, and personal liability. Most builders risk insurers will not provide coverage for the cost of making good defective design, workmanship,. Builders risk typically only offers coverage for the home. While the cost of builder’s risk insurance varies, most businesses pay between 1% and 5% of the total cost of the construction project. Homeowners insurance provides coverage for the home itself, personal belongings, loss of use, and personal liability. However, policy forms should be carefully. Covers additional expenses caused by a. They emailed me today that they require me to pay an asset protection fee of $10 a month that will cover most damages to the building, like if your toilet would overflow into the neighbors. Builders risk insurance is a form of property insurance that covers property that is being constructed or renovated, against physical loss or damage from a. It protects construction projects from unexpected events,. They emailed me today that they require me to pay an asset protection fee of $10 a month that will cover most damages to the building, like if your toilet would overflow into the neighbors. However, policy forms should be carefully. Homeowners insurance provides coverage for the home itself, personal belongings, loss of. A builders risk insurance policy can insure a building that is under construction along with the materials and equipment used to make it against sudden perils like fire, theft. While the cost of builder’s risk insurance varies, most businesses pay between 1% and 5% of the total cost of the construction project. Builders risk insurance is a form of property. It protects construction projects from unexpected events,. While the cost of builder’s risk insurance varies, most businesses pay between 1% and 5% of the total cost of the construction project. These soft costs would include. Homeowners insurance provides coverage for the home itself, personal belongings, loss of use, and personal liability. For example, if your budget for a. It protects construction projects from unexpected events,. Builders risk typically only offers coverage for the home. However, policy forms should be carefully. These soft costs would include. Builder’s risk insurance is a specialized type of property insurance for buildings under construction or renovation. Most builders risk insurers will not provide coverage for the cost of making good defective design, workmanship, or materials. Builders risk typically only offers coverage for the home. That’s why building property protection is so important. These soft costs would include. For example, if your budget for a. For example, if your budget for a. It protects construction projects from unexpected events,. That’s why building property protection is so important. However, policy forms should be carefully. Covers additional expenses caused by a covered claim that are not related to building materials, equipment, or other hard costs. However, policy forms should be carefully. Builders risk insurance is a form of property insurance that covers property that is being constructed or renovated, against physical loss or damage from a covered cause. Many builders risk policies insure against loss of revenue and/or soft costs that result from a project delay due to insured physical damage to the project. They emailed me today that they require me to pay an asset protection fee of $10 a month that will cover most damages to the building, like if your toilet would overflow into the neighbors. Builder’s risk insurance is a specialized type of property insurance for buildings under construction or renovation. Most builders risk insurers will not provide coverage for the cost of making good defective design, workmanship, or materials. A builders risk insurance policy can insure a building that is under construction along with the materials and equipment used to make it against sudden perils like fire, theft. Covers additional expenses caused by a covered claim that are not related to building materials, equipment, or other hard costs. For example, if your budget for a. These soft costs would include. Homeowners insurance provides coverage for the home itself, personal belongings, loss of use, and personal liability. It protects construction projects from unexpected events,.Apartment Buildings Avoid Fire Loss Business Resource Center

Landlord insurance Concept, Homeowner Coverage Vector Icon Design

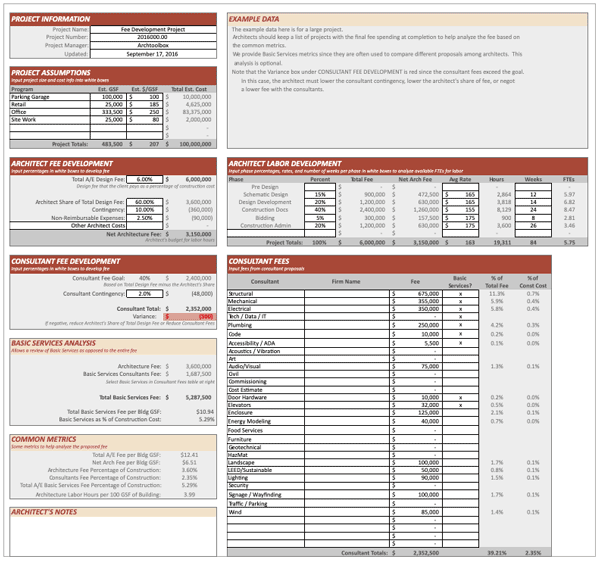

Calculating an Architectural Fee for Services Archtoolbox

Hoi an architecture Stock Vector Images Alamy

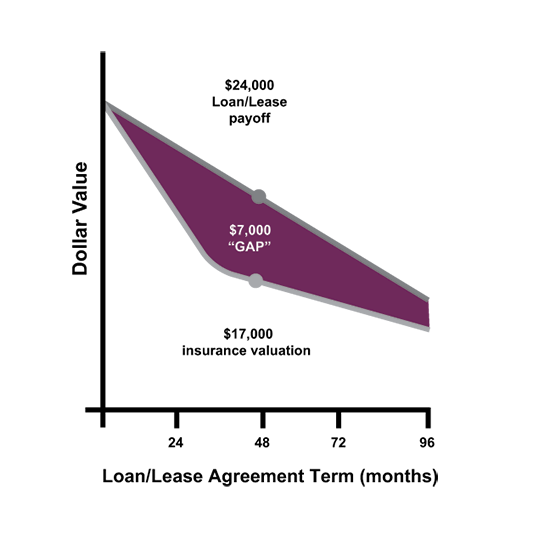

Total Loss Protection (GAP)® SymTech Dealer Services

Design Calculations of Lightning Protection Systems Part One

Premium Vector Landlord insurance isometric concept homeowner

(PDF) Building Loss Estimation for Earthquake Insurance Pricing

New Design for Creating Safe Places to Reduce Earthquake Loss and the

Building Construction Risk Insurance Concept Contractor Coverage Stock

Should Your Building Or Other Structures Be Damaged Or Destroyed By A Covered Loss, We’ll Help Protect You Against Financial Losses As You.

That’s Why Building Property Protection Is So Important.

Builders Risk Typically Only Offers Coverage For The Home.

While The Cost Of Builder’s Risk Insurance Varies, Most Businesses Pay Between 1% And 5% Of The Total Cost Of The Construction Project.

Related Post: