Building Materials Tax Deduction

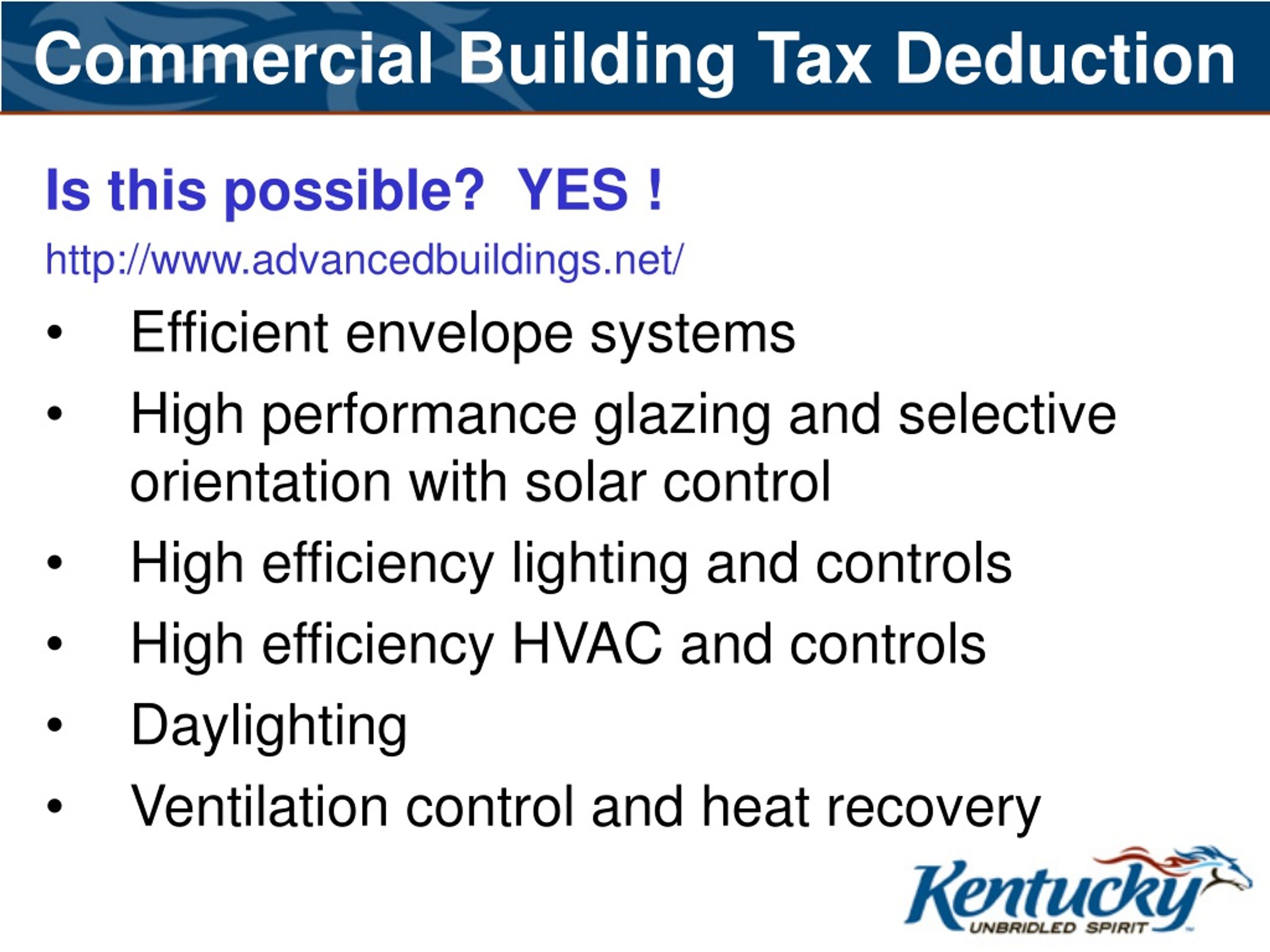

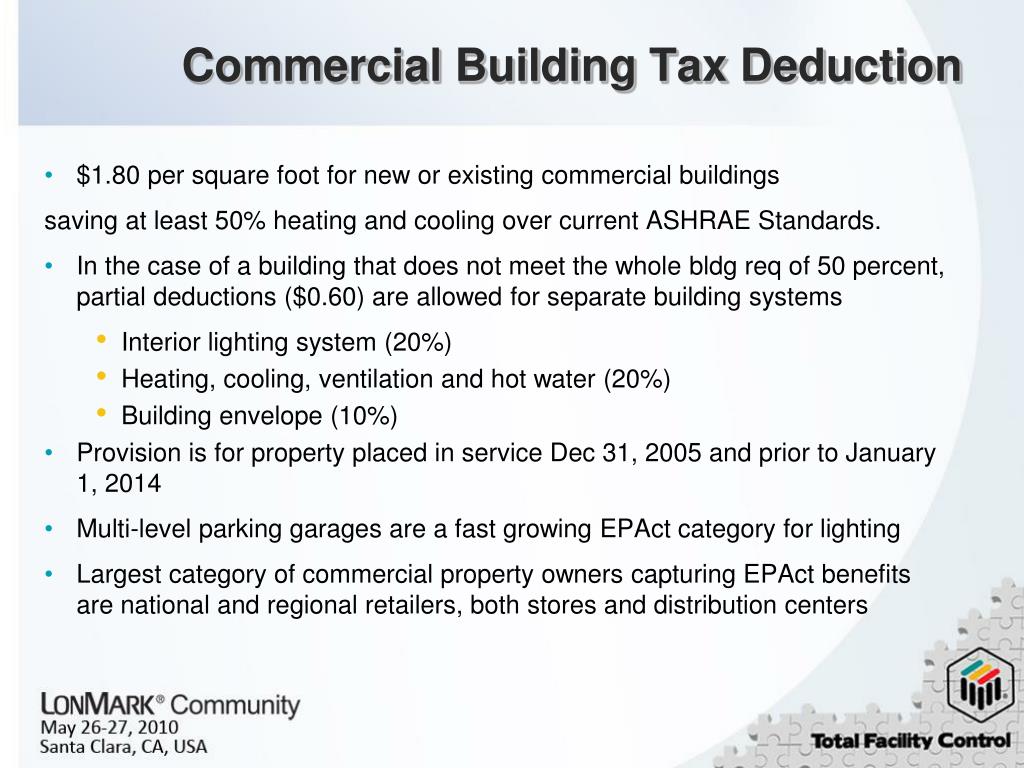

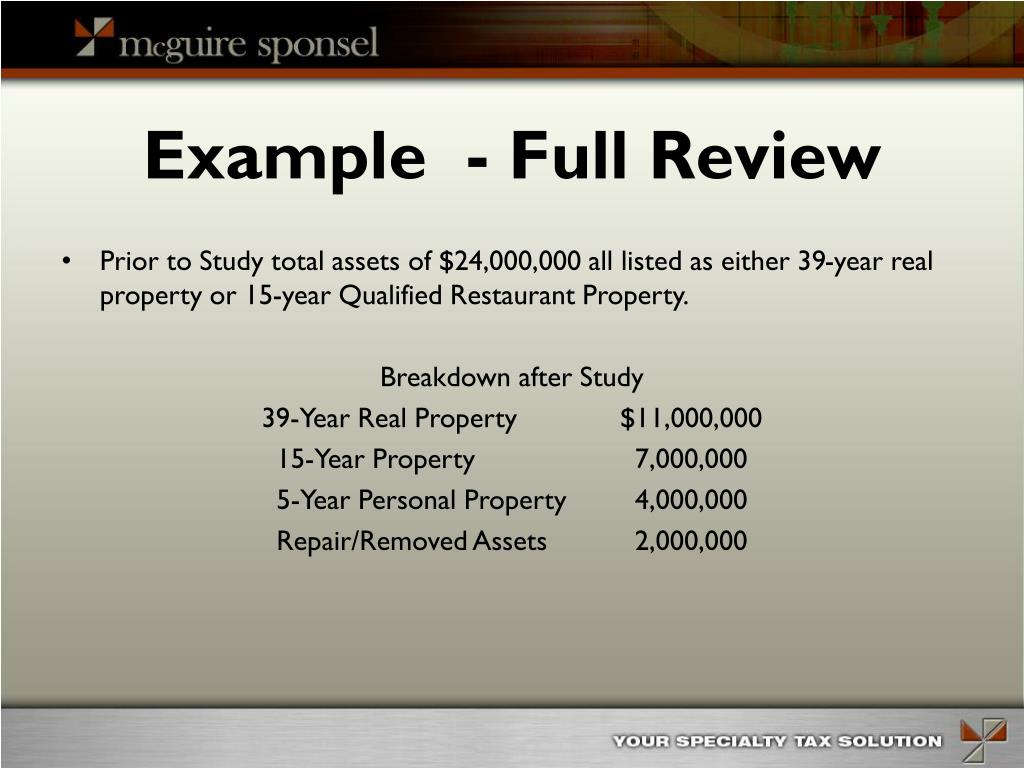

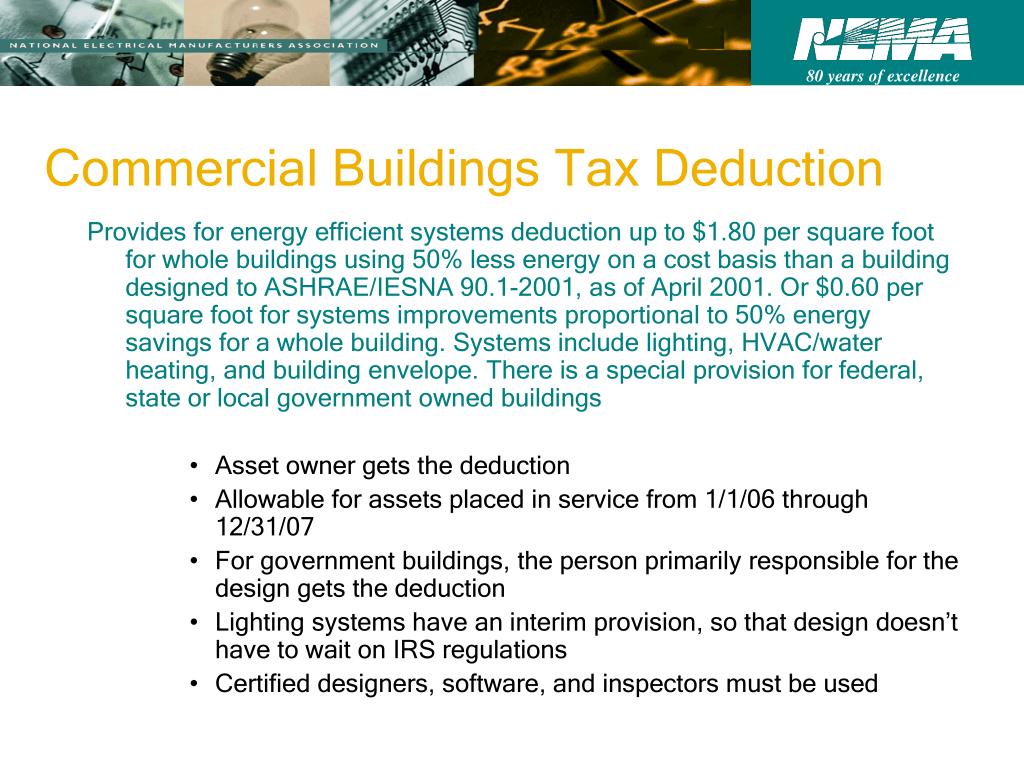

Building Materials Tax Deduction - How do i apply for a building materials exemption certificate (bmec)?. Building materials may be reported on the business portion of your tax return in more than one area. What is considered building material for sales tax from a home remodel? Up to 8% cash back you may qualify for a home renovation tax deduction on the sales tax for the materials you purchased. The taxes must be based on your property's assessed value, and all of the property in. Yes, ropes and chains and the other items permanently affixed (or not meant to be removed and used elsewhere) would be considered building materials and could be used for. Tax deductions for building materials refer to the allowable expenses associated with the purchase, installation, and use of qualifying building materials. Almost any items used for home renovation or construction that you paid sales tax on are considered. You're taking the sales tax deduction, as opposed to. Individual tax return form 1040 instructions; The law requires reports to be filed with idor on or before. Building materials for a major renovation or substantial addition to a home, if you paid the general sales tax rate yourself or your contractor was authorized to, may qualify for a. Almost any items used for home renovation or construction that you paid sales tax on are considered. You're taking the sales tax deduction, as opposed to the state/local income tax deduction; Unfortunately no, you can not deduction home improvement costs on a personal residence. However, if these are capital improvements and they increase the value of the. However, all of the following must apply: If you are in the business of selling building materials, the concrete. A taxpayer claiming the credit for exterior windows or skylights, exterior doors, and. What is considered building material for sales tax from a home remodel? Tax deductions for building materials refer to the allowable expenses associated with the purchase, installation, and use of qualifying building materials. You must report the value of all tax exempt building materials purchased between january 1, 2024, and december 31, 2024. Up to 8% cash back you may qualify for a home renovation tax deduction on the sales tax for. You're taking the sales tax deduction, as opposed to. Building materials may be reported on the business portion of your tax return in more than one area. You must report the value of all tax exempt building materials purchased between january 1, 2024, and december 31, 2024. You can deduct the rent you paid to occupy a building for the. The irs allows you to deduct the amount you paid for real estate taxes when building your new home. How do i apply for a building materials exemption certificate (bmec)?. Up to 8% cash back you may qualify for a home renovation tax deduction on the sales tax for the materials you purchased. You must report the value of all. Tax deductions for building materials refer to the allowable expenses associated with the purchase, installation, and use of qualifying building materials. Almost any items used for home renovation or construction that you paid sales tax on are considered. Who is eligible to obtain an illinois department of revenue building materials exemption certificate (bmec)? You're taking the sales tax deduction, as. Building materials for a major renovation or substantial addition to a home, if you paid the general sales tax rate yourself or your contractor was authorized to, may qualify for a. You must report the value of all tax exempt building materials purchased between january 1, 2024, and december 31, 2024. You're taking the sales tax deduction, as opposed to. You can deduct the sales tax on your home renovation or construction if all of these conditions apply: Building materials may be reported on the business portion of your tax return in more than one area. However, if these are capital improvements and they increase the value of the. Almost any items used for home renovation or construction that you. The irs allows you to deduct the amount you paid for real estate taxes when building your new home. A taxpayer claiming the credit for exterior windows or skylights, exterior doors, and. Understanding the tax implications of. Unlocking tax savings on building materials? Building materials for a major renovation or substantial addition to a home, if you paid the general. If you paid state sales tax when purchasing building materials and that total was greater than your state and local income tax, you may be able to deduct from your federal. Tax deductions for building materials refer to the allowable expenses associated with the purchase, installation, and use of qualifying building materials. You must report the value of all tax. Understanding the tax implications of. What is considered building material for sales tax from a home remodel? The law requires reports to be filed with idor on or before. You can deduct the sales tax on your home renovation or construction if all of these conditions apply: You're taking the sales tax deduction, as opposed to the state/local income tax. Unfortunately no, you can not deduction home improvement costs on a personal residence. Tax deductions for building materials refer to the allowable expenses associated with the purchase, installation, and use of qualifying building materials. If you paid state sales tax when purchasing building materials and that total was greater than your state and local income tax, you may be able. Understanding the tax implications of. Up to 8% cash back you may qualify for a home renovation tax deduction on the sales tax for the materials you purchased. Individual tax return form 1040 instructions; Almost any items used for home renovation or construction that you paid sales tax on are considered. You can deduct the rent you paid to occupy a building for the tax year. You're taking the sales tax deduction, as opposed to. Tax deductions for building materials refer to the allowable expenses associated with the purchase, installation, and use of qualifying building materials. Yes, ropes and chains and the other items permanently affixed (or not meant to be removed and used elsewhere) would be considered building materials and could be used for. The irs allows you to deduct the amount you paid for real estate taxes when building your new home. The taxes must be based on your property's assessed value, and all of the property in. Building materials may be reported on the business portion of your tax return in more than one area. Who is eligible to obtain an illinois department of revenue building materials exemption certificate (bmec)? You're taking the sales tax deduction, as opposed to the state/local income tax deduction; Discover how to navigate tax deductions for building materials, distinguishing between repairs, improvements, and business use. However, all of the following must apply: Unfortunately no, you can not deduction home improvement costs on a personal residence.PPT 179D Energy Efficient Commercial Building Tax Deduction

Tax Deductions for Building Materials the ins and outs of the process

Recycle building materials and get a tax deduction Phoenix Business

PPT Overview PowerPoint Presentation, free download ID9092914

Most Common Tax Deductions for Construction Contractors

PPT Government Rebates and Incentives PowerPoint Presentation, free

How Does Section 179d (aka the "Green Building Tax Deduction") Work

PPT 179D Energy Efficient Commercial Building Tax Deduction

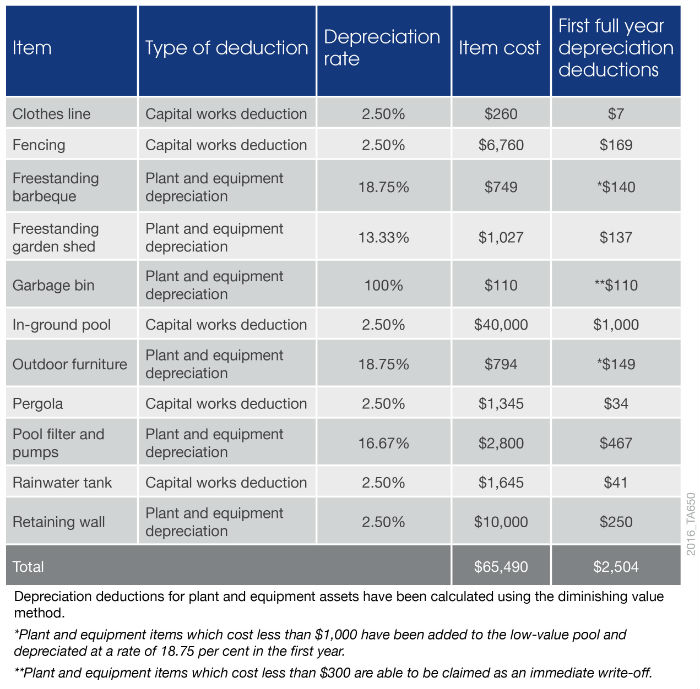

Three Rules to Claiming Outdoor Depreciation Deductions Correctly

PPT New Homes Tax Credit PowerPoint Presentation, free download ID

Building Materials For A Major Renovation Or Substantial Addition To A Home, If You Paid The General Sales Tax Rate Yourself Or Your Contractor Was Authorized To, May Qualify For A.

However, If These Are Capital Improvements And They Increase The Value Of The.

You Must Report The Value Of All Tax Exempt Building Materials Purchased Between January 1, 2024, And December 31, 2024.

What Is Considered Building Material For Sales Tax From A Home Remodel?

Related Post: