Building Products Etf

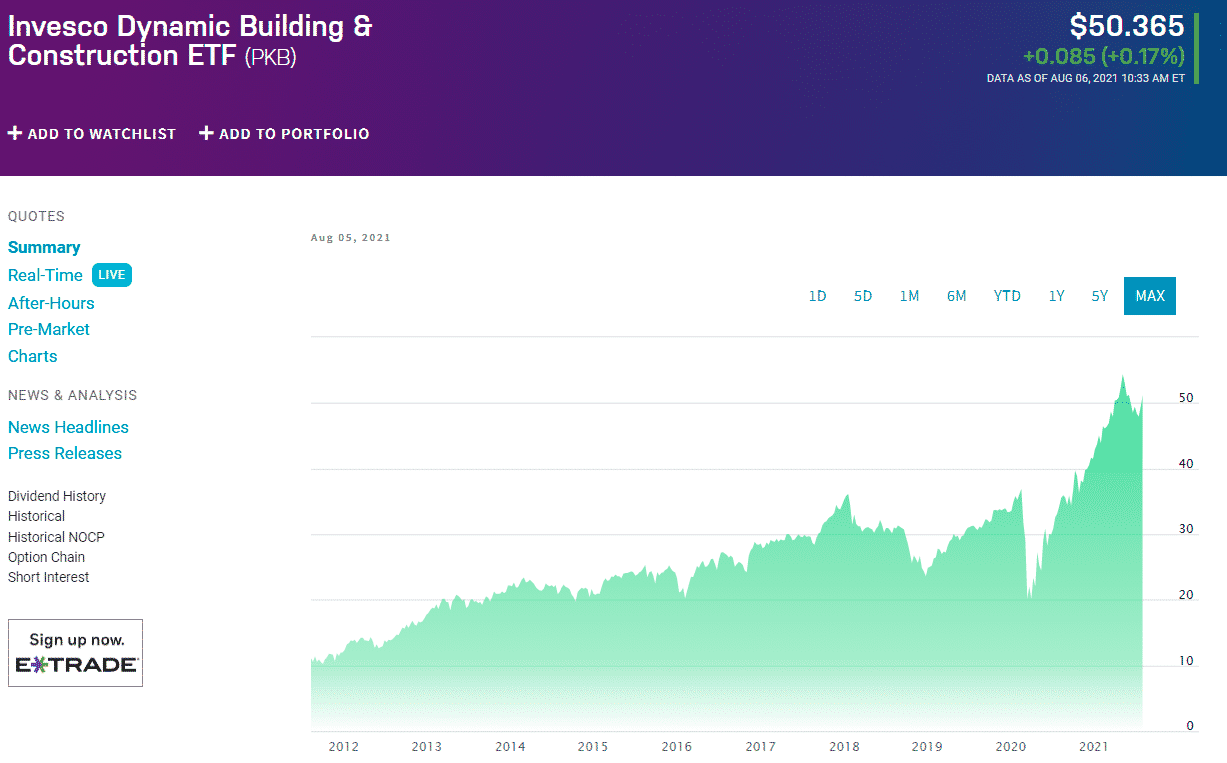

Building Products Etf - 27 rows materials etfs are funds that invest in companies in the materials sector. Building material is any material which is used for. Specialized etfs offer diversified exposure to the building and construction industry, and the top funds in the space are worth looking at if you're optimistic about the. Such improvement puts etfs like spdr s&p homebuilders etf xhb, ishares u.s. Homebuilders etfs invest in companies that operate in the residential home construction industry. Construction and engineering etfs offer exposure to a basket of companies involved in various aspects of infrastructure development, including engineering services, building materials, and. Under normal market conditions, the trust invests at least 80% of its managed assets in taxable municipal securities, which include build america bonds. In addition to pure play. The public investment fund : Click on the tabs below to see more information on homebuilders etfs,. This etf is focused on the u.s. Click on the tabs below to see more information on homebuilders etfs,. Specialized etfs offer diversified exposure to the building and construction industry, and the top funds in the space are worth looking at if you're optimistic about the. Simply put, a multifamily reit or real estate investment trust is a company that leases apartment housing space and rents out residential properties, then paying out the. Investments in construction and permanent first mortgages in commercial real estate projects. The average expense ratio for. Homebuilders etfs invest in companies that operate in the residential home construction industry. Click on the tabs (growth, valuation,. Homebuilding industry, and as such offers exposure to a corner of the domestic economy that tends to be cyclical in nature. Learn everything you need to know about invesco building & construction etf (pkb) and how it ranks compared to other funds. 27 rows materials etfs are funds that invest in companies in the materials sector. Annual operating expenses for this etf are 0.35%, making it one of the least expensive products in the space. The fund will normally invest at least 90% of its total assets in the. The invesco building & construction etf (fund) is based on the dynamic building. Click on any etf name or ticker to view that etf's report card. The fund will normally invest at least 90% of its total assets in the. Click to see returns, expenses, dividends, holdings, taxes, technicals and more. Such improvement puts etfs like spdr s&p homebuilders etf xhb, ishares u.s. The invesco building & construction etf (fund) is based on. So, advisors have no shortage of. Homebuilding industry, and as such offers exposure to a corner of the domestic economy that tends to be cyclical in nature. 27 rows materials etfs are funds that invest in companies in the materials sector. Click on the tabs (growth, valuation,. The public investment fund : The task is high on the president's list of priorities. Investments in core infrastructure businesses throughout the united states and canada. The invesco building & construction etf (fund) is based on the dynamic building & construction intellidex℠ index (index). The etf's investments are in companies selling products and services to rebuild america. This etf offers exposure to the u.s. The etf's investments are in companies selling products and services to rebuild america. Click on the tabs (growth, valuation,. Home construction etf itb, invesco building & construction etf pkb and ishares u.s. Jupiter asset management today announces the launch of the jupiter global government bond active ucits etf, the group’s first exchange traded fund (etf), in. 4 etfs are placed. This etf offers exposure to the u.s. The etf's investments are in companies selling products and services to rebuild america. 201 rows a list of building materials etfs. Homebuilding industry, and as such offers exposure to a corner of the domestic economy that tends to be cyclical in nature. Click on the tabs (growth, valuation,. 4 etfs are placed in the building & construction category. Simply put, a multifamily reit or real estate investment trust is a company that leases apartment housing space and rents out residential properties, then paying out the. Under normal market conditions, the trust invests at least 80% of its managed assets in taxable municipal securities, which include build america bonds.. Homebuilding industry, and as such offers exposure to a corner of the domestic economy that tends to be cyclical in nature. The fund will normally invest at least 90% of its total assets in the. In the building products industry, the smart companies are looking down the road and devising ways to use m&a to buy the new capabilities that. Under normal market conditions, the trust invests at least 80% of its managed assets in taxable municipal securities, which include build america bonds. Investments in construction and permanent first mortgages in commercial real estate projects. Building material is any material which is used for. Annual operating expenses for this etf are 0.35%, making it one of the least expensive products. Specialized etfs offer diversified exposure to the building and construction industry, and the top funds in the space are worth looking at if you're optimistic about the. So, advisors have no shortage of. The etf's investments are in companies selling products and services to rebuild america. Click on the tabs below to see more information on homebuilders etfs,. Click on. The fund will normally invest at least 90% of its total assets in the. Specialized etfs offer diversified exposure to the building and construction industry, and the top funds in the space are worth looking at if you're optimistic about the. Click to see returns, expenses, dividends, holdings, taxes, technicals and more. Homebuilders etfs invest in companies that operate in the residential home construction industry. Construction and engineering etfs offer exposure to a basket of companies involved in various aspects of infrastructure development, including engineering services, building materials, and. Simply put, a multifamily reit or real estate investment trust is a company that leases apartment housing space and rents out residential properties, then paying out the. 201 rows a list of building materials etfs. The etf's investments are in companies selling products and services to rebuild america. Home construction etf itb, invesco building & construction etf pkb and ishares u.s. The public investment fund : This etf offers exposure to the u.s. This etf is focused on the u.s. Click on any etf name or ticker to view that etf's report card. The invesco building & construction etf (fund) is based on the dynamic building & construction intellidex℠ index (index). In the building products industry, the smart companies are looking down the road and devising ways to use m&a to buy the new capabilities that will define the industry’s future. The average expense ratio for.Building an AllETF Portfolio

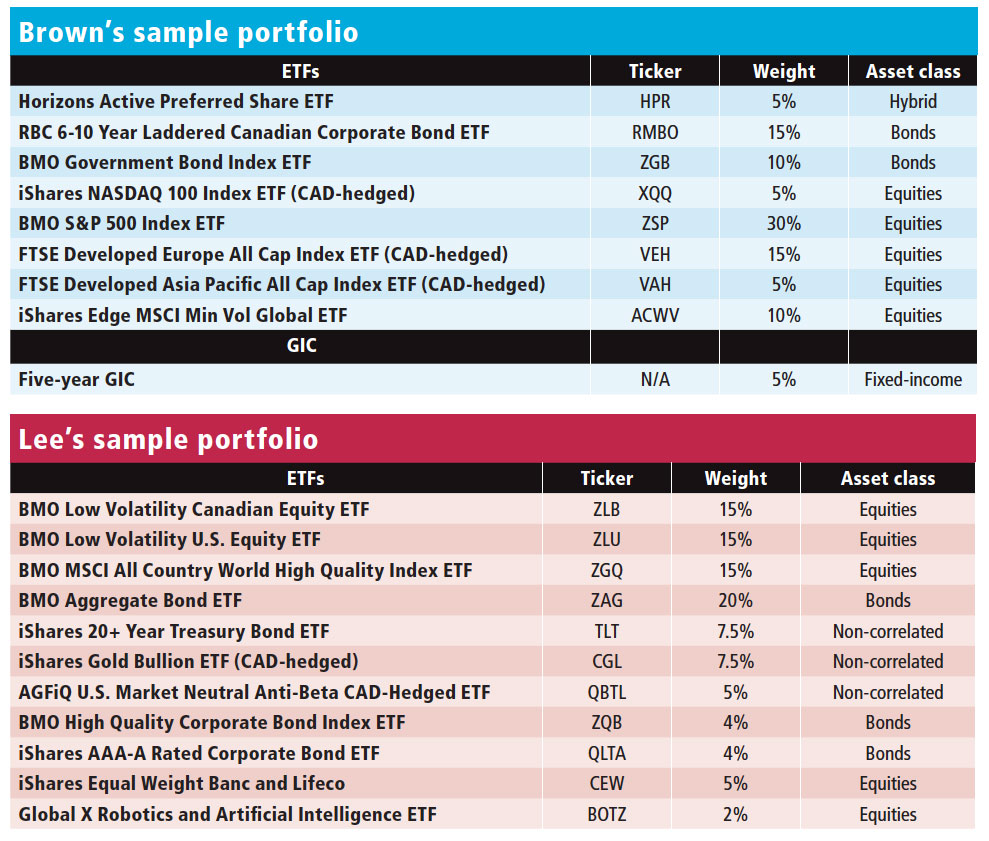

How to build a recessionproof ETF portfolio Investment Executive

ETFs 103 Building an ETF Portfolio with Horizons ETFs YouTube

Whitepaper Building and Distributing an ETF

Materials ETF Benefiting From Its Building Stocks Investor's Business

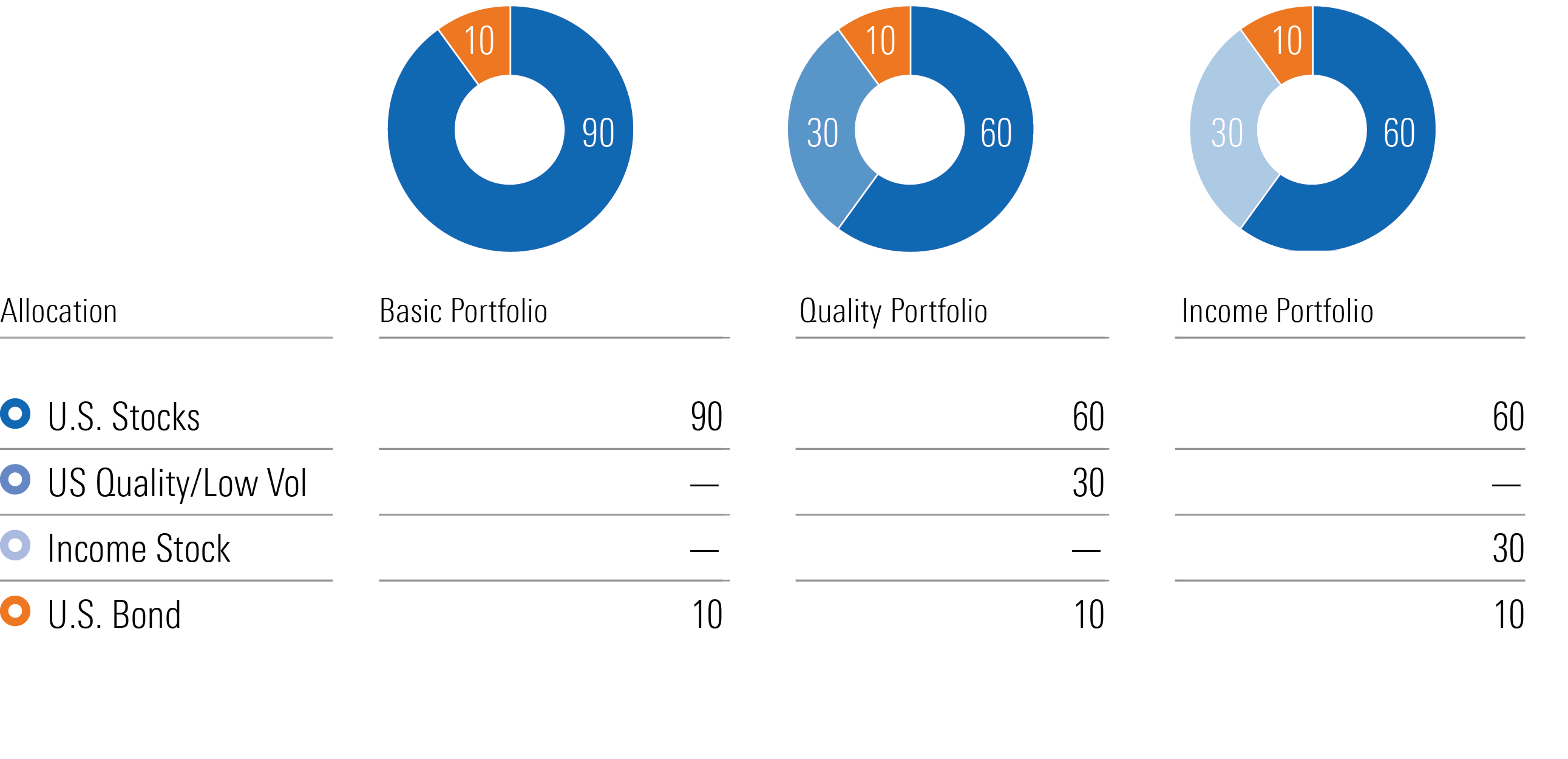

Building Sample Portfolios With CommissionFree ETFs — My Money Blog

Materials ETF Benefiting From Its Building Stocks Investor's Business

Best 5 Homebuilder ETFs ETFHead

The New Investor’s Guide to Building an ETF Portfolio Morningstar

Semi Electric Hydraulic ETF 100D Heavy Duty Trolley Lifting

Click On The Tabs (Growth, Valuation,.

Homebuilding Industry, And As Such Offers Exposure To A Corner Of The Domestic Economy That Tends To Be Cyclical In Nature.

In Addition To Pure Play.

Investments In Core Infrastructure Businesses Throughout The United States And Canada.

Related Post:

/GettyImages-10725852341-9dc2cae0f03244c78e7b91899301ec3d.jpg)