Building Tax In Kerala

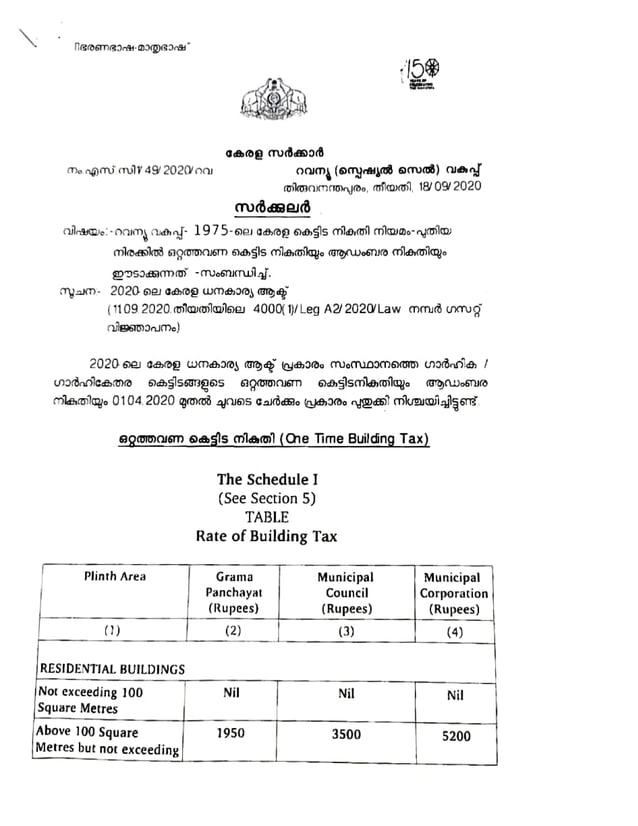

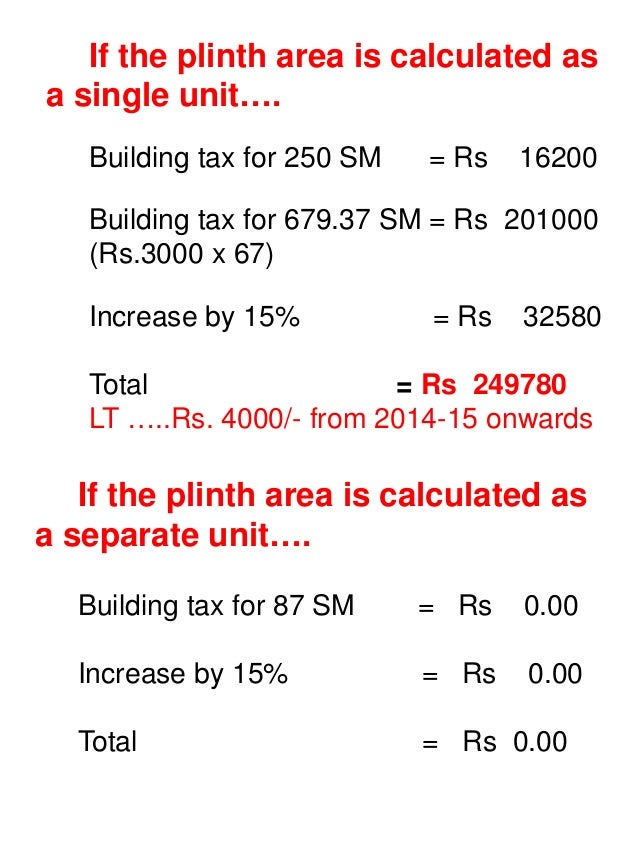

Building Tax In Kerala - Sanchaya's online services cater to the online payment of building and property taxes in kerala. Kerala finance minister kn balagopal, in his budget presentation, announced a revision in the life time road tax for electric vehicles (evs). Learn about building tax in kerala, including rates, payment methods, calculation, and deadlines. The ability to pay building and property taxes online in kerala is a significant step forward in using technology to enhance public service delivery. Sanchaya, an egovernance application software suite for revenue and licence system in local governments of kerala. The sanchaya online system allows for a seamless collection of fees, levies. The minister stated that kerala was. Using this service you can pay your building tax, rent, professional tax, and license. According to the kerala building tax plint area rules. In kerala, you can make online payment of building tax using sanchaya online services. In this article, let's look at how to pay online property tax in kerala using. Learn rates for residential & commercial buildings, plus luxury tax details. Learn about building tax in kerala, including rates, regulations, and exemptions. Land tax is paid in the village office, building tax is is panchayath, municipality or corporation offices. Balagopal justifies the 50% hike in land tax, stating that land value and revenue potential have increased tenfold due to overall development. Understand the importance of timely payment to avoid penalties and ensure. This system not only makes complying with tax. Understand kerala's building tax details as to who collects it, how it's calculated, exemptions and so on. Sanchaya, an egovernance application software suite for revenue and licence system in local governments of kerala. In kerala, you can make online payment of building tax using sanchaya online services. Profession tax, hall booking, entertainment tax (cinema) and d&o licence, etc. In kerala's budget presentation, finance minister balagopal. Sanchaya online services are also for collecting property tax and building taxes online in kerala. The sanchaya online system allows for a seamless collection of fees, levies. Kerala finance minister kn balagopal, in his budget presentation, announced a revision in the life. As sanchaya property tax (quick pay) services for municipalities and. According to the kerala building tax plint area rules. Understand kerala's building tax details as to who collects it, how it's calculated, exemptions and so on. Balagopal justifies the 50% hike in land tax, stating that land value and revenue potential have increased tenfold due to overall development. Sanchaya's online. Using this service you can pay your building tax, rent, professional tax, and license. When the building construction is completed for the residential purpose, if it is below. According to the kerala building tax plint area rules. The sanchaya online system allows for a seamless collection of fees, levies. Kerala finance minister kn balagopal, in his budget presentation, announced a. The minister stated that kerala was. The ability to pay building and property taxes online in kerala is a significant step forward in using technology to enhance public service delivery. Sanchaya, an egovernance application software suite for revenue and licence system in local governments of kerala. According to the kerala building tax plint area rules. Understand the importance of timely. In kerala, you can make online payment of building tax using sanchaya online services. Land tax is paid in the village office, building tax is is panchayath, municipality or corporation offices. This system not only makes complying with tax. Balagopal proposes 50 per cent hike in land tax, private vehicle road tax. The sanchaya online system allows for a seamless. The minister stated that kerala was. As sanchaya property tax (quick pay) services for municipalities and. Understand kerala's building tax details as to who collects it, how it's calculated, exemptions and so on. Understand the importance of timely payment to avoid penalties and ensure. This system not only makes complying with tax. Profession tax, hall booking, entertainment tax (cinema) and d&o licence, etc. Discover how to calculate your building tax and stay compliant with local laws. Using this service you can pay your building tax, rent, professional tax, and license. This system not only makes complying with tax. Any one who possess a building either for residential or business purpose should pay. Sanchaya online services are also for collecting property tax and building taxes online in kerala. Balagopal justifies the 50% hike in land tax, stating that land value and revenue potential have increased tenfold due to overall development. In kerala, you can make online payment of building tax using sanchaya online services. The minister stated that kerala was. In this article,. The minister stated that kerala was. When the building construction is completed for the residential purpose, if it is below. The ability to pay building and property taxes online in kerala is a significant step forward in using technology to enhance public service delivery. Learn about building tax in kerala, including rates, payment methods, calculation, and deadlines. The sanchaya online. When the building construction is completed for the residential purpose, if it is below. The ability to pay building and property taxes online in kerala is a significant step forward in using technology to enhance public service delivery. The sanchaya online system allows for a seamless collection of fees, levies. Learn about building tax in kerala, including rates, payment methods,. In kerala's budget presentation, finance minister balagopal. Discover how to calculate your building tax and stay compliant with local laws. Sanchaya, an egovernance application software suite for revenue and licence system in local governments of kerala. Annual average market price of building materials and labour wages 2022. Sanchaya, an egovernance application software suite for revenue and licence system in local governments of kerala. Sanchaya's online services cater to the online payment of building and property taxes in kerala. Using this service you can pay your building tax, rent, professional tax, and license. Profession tax, hall booking, entertainment tax (cinema) and d&o licence, etc. Understand kerala's building tax details as to who collects it, how it's calculated, exemptions and so on. The ability to pay building and property taxes online in kerala is a significant step forward in using technology to enhance public service delivery. Kerala finance minister kn balagopal, in his budget presentation, announced a revision in the life time road tax for electric vehicles (evs). As sanchaya property tax (quick pay) services for municipalities and. The sanchaya online system allows for a seamless collection of fees, levies. Land tax is paid in the village office, building tax is is panchayath, municipality or corporation offices. Understand the importance of timely payment to avoid penalties and ensure. This system not only makes complying with tax.Kerala Land Revenue Department .How to assess building tax. PPT

Sanchaya Building Tax Kerala Online Payment Quick and Secure

Kerala Building tax online payment വീട്ടുനികുതി കെട്ടിടനികുതി ഓ

Building tax online payment property tax malayalam കെട്ടിട നികുതി ഓ

Kerala Building tax online payment വീട്ടുനികുതി /കെട്ടിടനികുതി ഓ

How to Pay Property Tax Online EPayment Sanchaya Revenue Quick

Kerala Building Tax and Luxury tax rates 2021 James adhikaram PDF

Kerala Building Tax Online Payment Property tax Online payment

The kerala building tax 1975 short notes

Kerala building tax luxury tax revised rates 2019 A James Adhik…

Sanchaya Online Services Are Also For Collecting Property Tax And Building Taxes Online In Kerala.

Balagopal Proposes 50 Per Cent Hike In Land Tax, Private Vehicle Road Tax.

Learn About Building Tax In Kerala, Including Rates, Regulations, And Exemptions.

Balagopal Justifies The 50% Hike In Land Tax, Stating That Land Value And Revenue Potential Have Increased Tenfold Due To Overall Development.

Related Post: