Building Tax Kerala

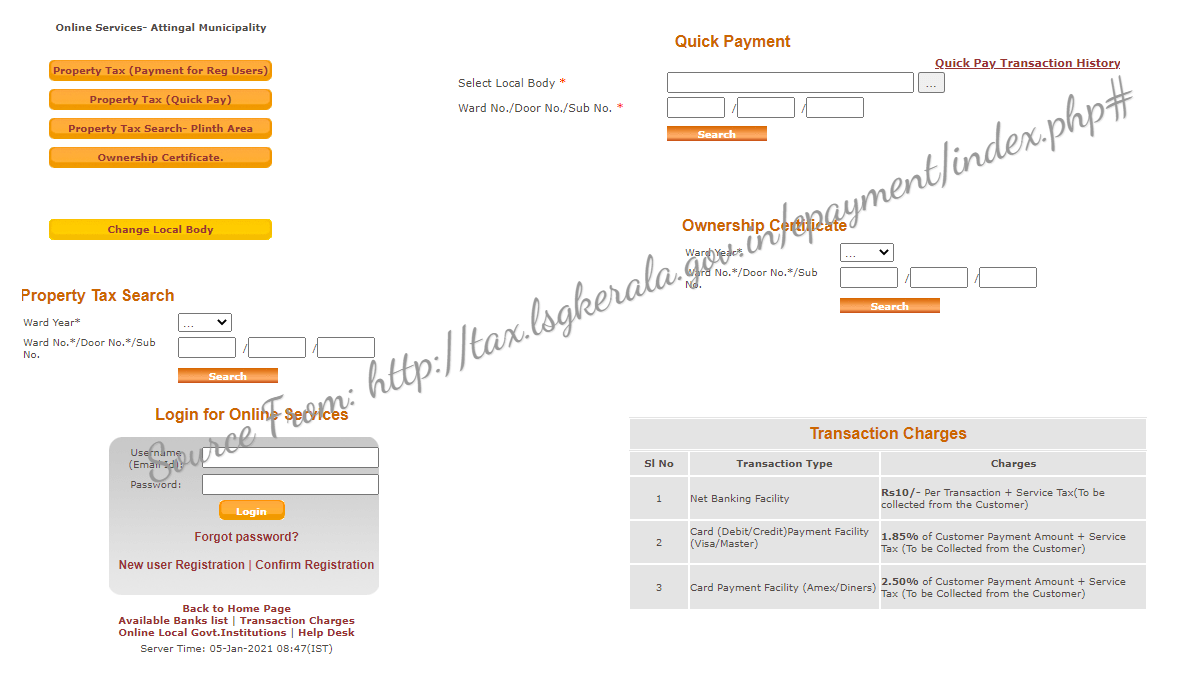

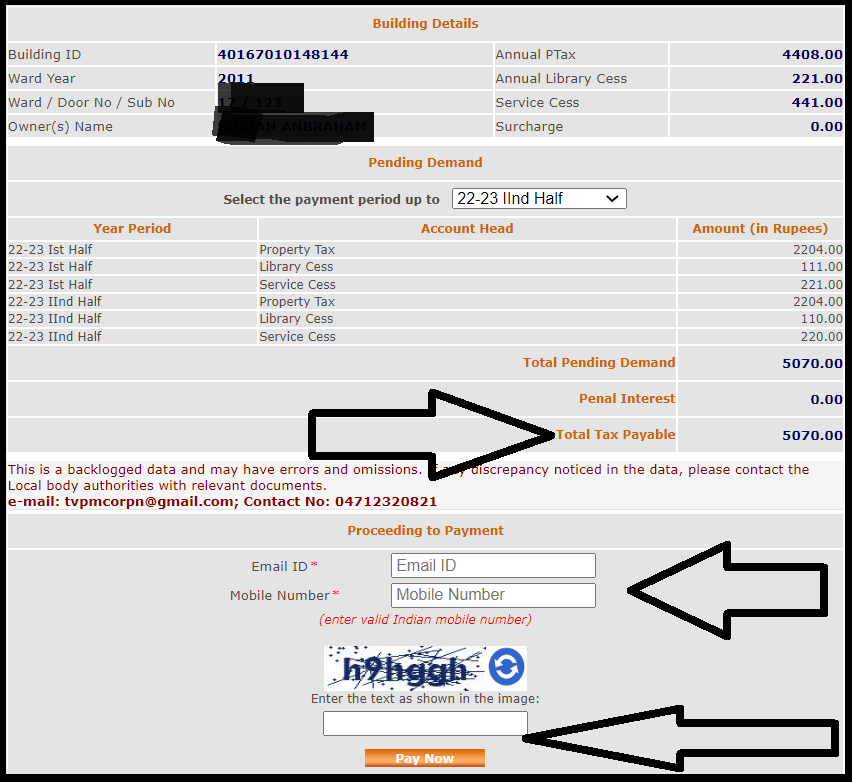

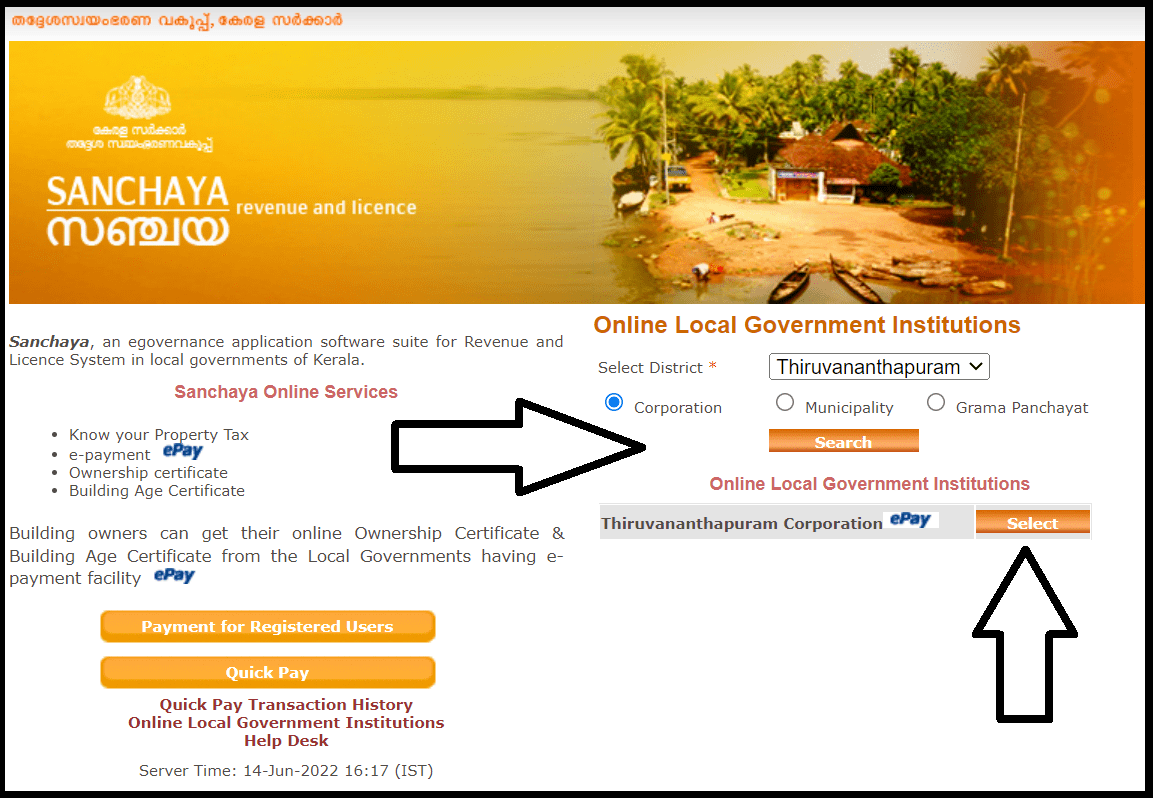

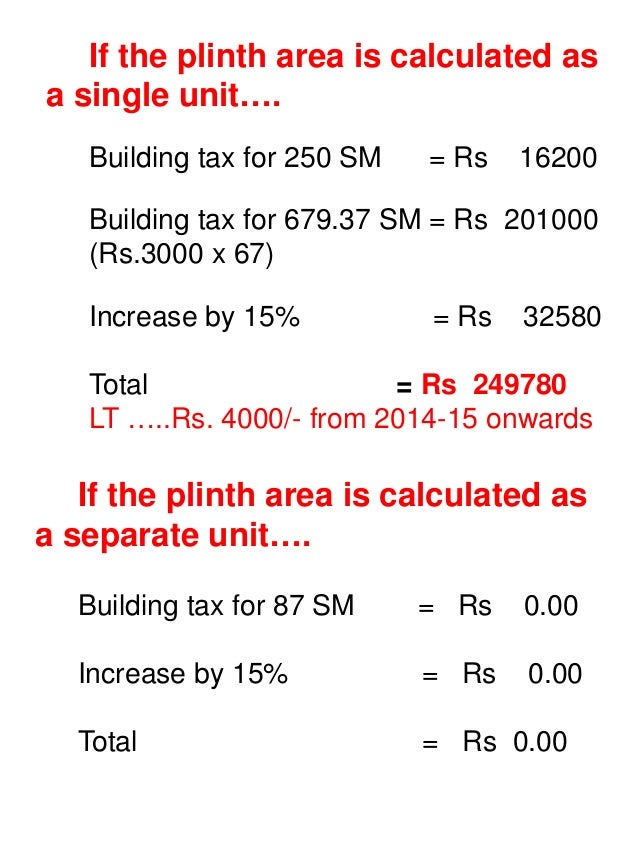

Building Tax Kerala - Property owners can conveniently settle their taxes online via the sanchaya tax portal, as mandated by these rules. Understand the importance of timely payment to avoid penalties and ensure. Failure to meet tax deadlines may result in penalties. Balagopal justifies the 50% hike in land tax, stating that land value and revenue potential have increased tenfold due to overall development. Learn about building tax in kerala, including rates, payment methods, calculation, and deadlines. In kerala, paying property and building taxes is a critical duty for property owners, directly impacting the ability of local governments to provide essential services and infrastructure. In kerala, you can make online payment of building tax using sanchaya online services. Learn rates for residential & commercial buildings, plus luxury tax details. Property or building owners can pay taxes online on the sanchaya tax portal. Sanchaya is an egovernance application software suite for revenue and licence system in local governments of kerala. Land tax is paid in the village office, building tax is is panchayath, municipality or corporation offices. In kerala, paying property and building taxes is a critical duty for property owners, directly impacting the ability of local governments to provide essential services and infrastructure. The minister stated that kerala was. Sanchaya, an egovernance application software suite for revenue and licence system in local governments of kerala. Sanchaya is an egovernance application software suite for revenue and licence system in local governments of kerala. Sanchaya is a project of information kerala mission for local self government institutions (lsgis) in kerala. It offers online payment, exemption, and allotment of various taxes. Find out the factors affecting tax rates, the payment. One can pay kerala property tax online for his/her property in any city of the state by following a simple process. Failure to meet tax deadlines may result in penalties. Learn how to calculate, pay, and benefit from building tax in kerala, a property tax levied by local municipal authorities. In kerala, you can make online payment of building tax using sanchaya online services. It offers online payment, exemption, and allotment of various taxes. Learn rates for residential & commercial buildings, plus luxury tax details. Sanchaya is a project of. Learn rates for residential & commercial buildings, plus luxury tax details. Sanchaya is an egovernance application software suite for revenue and licence system in local governments of kerala. Failure to meet tax deadlines may result in penalties. Understand kerala's building tax details as to who collects it, how it's calculated, exemptions and so on. When the building construction is completed. Any one who possess a building either for residential or business purpose should pay building tax to the local body like panchayat, municipality or corporation in which the building is. Find out the factors affecting tax rates, the payment. Sanchaya is an egovernance application software suite for revenue and licence system in local governments of kerala. Land tax is paid. It offers online payment, exemption, and allotment of various taxes. Property owners can conveniently settle their taxes online via the sanchaya tax portal, as mandated by these rules. Land tax is paid in the village office, building tax is is panchayath, municipality or corporation offices. Using this service you can pay your building tax, rent, professional tax, and license. Learn. Understand the importance of timely payment to avoid penalties and ensure. Using this service you can pay your building tax, rent, professional tax, and license. It is an annual tax that property owners have to pay. The minister stated that kerala was. Understand kerala's building tax details as to who collects it, how it's calculated, exemptions and so on. Sanchaya, an egovernance application software suite for revenue and licence system in local governments of kerala. Property or building owners can pay taxes online on the sanchaya tax portal. It is an annual tax that property owners have to pay. In kerala, paying property and building taxes is a critical duty for property owners, directly impacting the ability of local. In kerala, paying property and building taxes is a critical duty for property owners, directly impacting the ability of local governments to provide essential services and infrastructure. Sanchaya is a project of information kerala mission for local self government institutions (lsgis) in kerala. The minister stated that kerala was. Understand the importance of timely payment to avoid penalties and ensure.. The minister stated that kerala was. Property owners can conveniently settle their taxes online via the sanchaya tax portal, as mandated by these rules. Learn how to register, login, search, pay and check sanchaya tax. It offers online payment, exemption, and allotment of various taxes. Sanchaya portal is a website by the kerala government for building employees to download ownership. Any one who possess a building either for residential or business purpose should pay building tax to the local body like panchayat, municipality or corporation in which the building is. Learn how to register, login, search, pay and check sanchaya tax. Understand the importance of timely payment to avoid penalties and ensure. It offers online payment, exemption, and allotment of. Land tax is paid in the village office, building tax is is panchayath, municipality or corporation offices. Find out the factors affecting tax rates, the payment. Understand kerala's building tax details as to who collects it, how it's calculated, exemptions and so on. Learn how to login, register, and. Sanchaya portal is a website by the kerala government for building. Balagopal justifies the 50% hike in land tax, stating that land value and revenue potential have increased tenfold due to overall development. Find out the factors affecting tax rates, the payment. Learn how to login, register, and. Property or building owners can pay taxes online on the sanchaya tax portal. According to the kerala building tax rules, property taxes are calculated annually. In kerala, you can make online payment of building tax using sanchaya online services. Land tax is paid in the village office, building tax is is panchayath, municipality or corporation offices. Learn rates for residential & commercial buildings, plus luxury tax details. The minister stated that kerala was. Sanchaya portal is a website by the kerala government for building employees to download ownership certificate, pay taxes, and access other services. Sanchaya is an egovernance application software suite for revenue and licence system in local governments of kerala. Any one who possess a building either for residential or business purpose should pay building tax to the local body like panchayat, municipality or corporation in which the building is. Failure to meet tax deadlines may result in penalties. In kerala, paying property and building taxes is a critical duty for property owners, directly impacting the ability of local governments to provide essential services and infrastructure. Understand the importance of timely payment to avoid penalties and ensure. Understand kerala's building tax details as to who collects it, how it's calculated, exemptions and so on.Kerala Property Tax Online epayment at tax.lsgkerala.gov.in

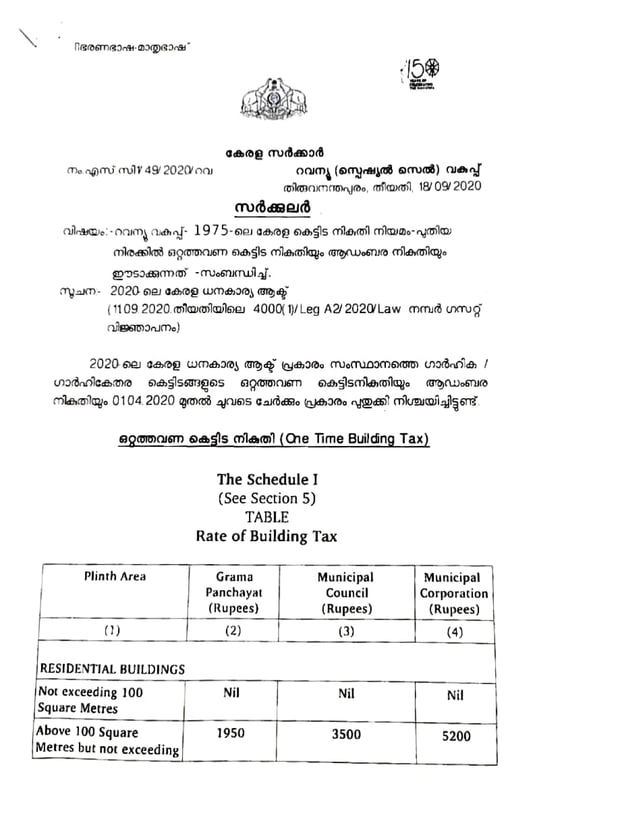

Kerala Building Tax and Luxury tax rates 2021 James adhikaram PDF

Sanchaya Tax 2023 Online Property Tax Payment in Kerala

Building Tax Online Payment Kerala വീട്ടു നികുതി, കെട്ടിട നികുതി

Sanchaya Tax 2023 Online Property Tax Payment in Kerala

Building tax online payment property tax malayalam കെട്ടിട നികുതി ഓ

How to Pay Property Tax Online EPayment Sanchaya Revenue Quick

Kerala Building Tax Online Payment Property tax Online payment

The kerala building tax 1975 short notes

Kerala Building tax online payment വീട്ടുനികുതി കെട്ടിടനികുതി ഓ

Learn About Building Tax In Kerala, Including Rates, Payment Methods, Calculation, And Deadlines.

Property Owners Can Conveniently Settle Their Taxes Online Via The Sanchaya Tax Portal, As Mandated By These Rules.

Using This Service You Can Pay Your Building Tax, Rent, Professional Tax, And License.

It Is An Annual Tax That Property Owners Have To Pay.

Related Post: