Buildings Debit Or Credit

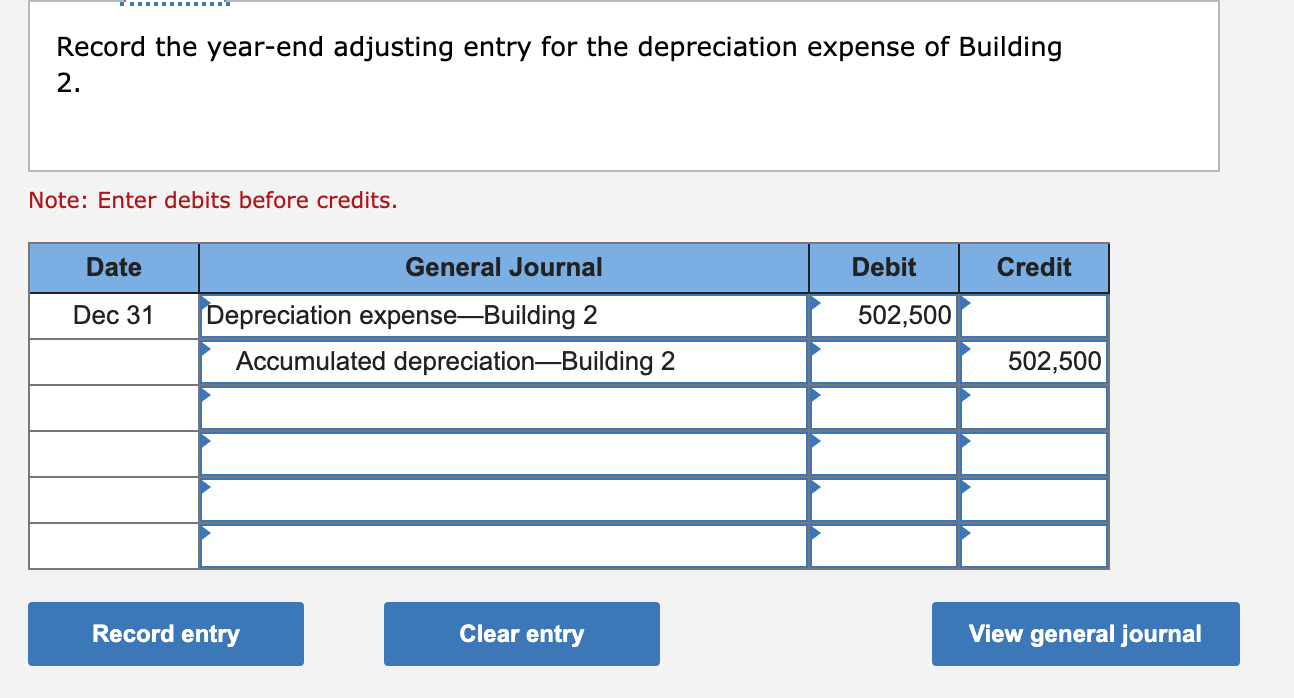

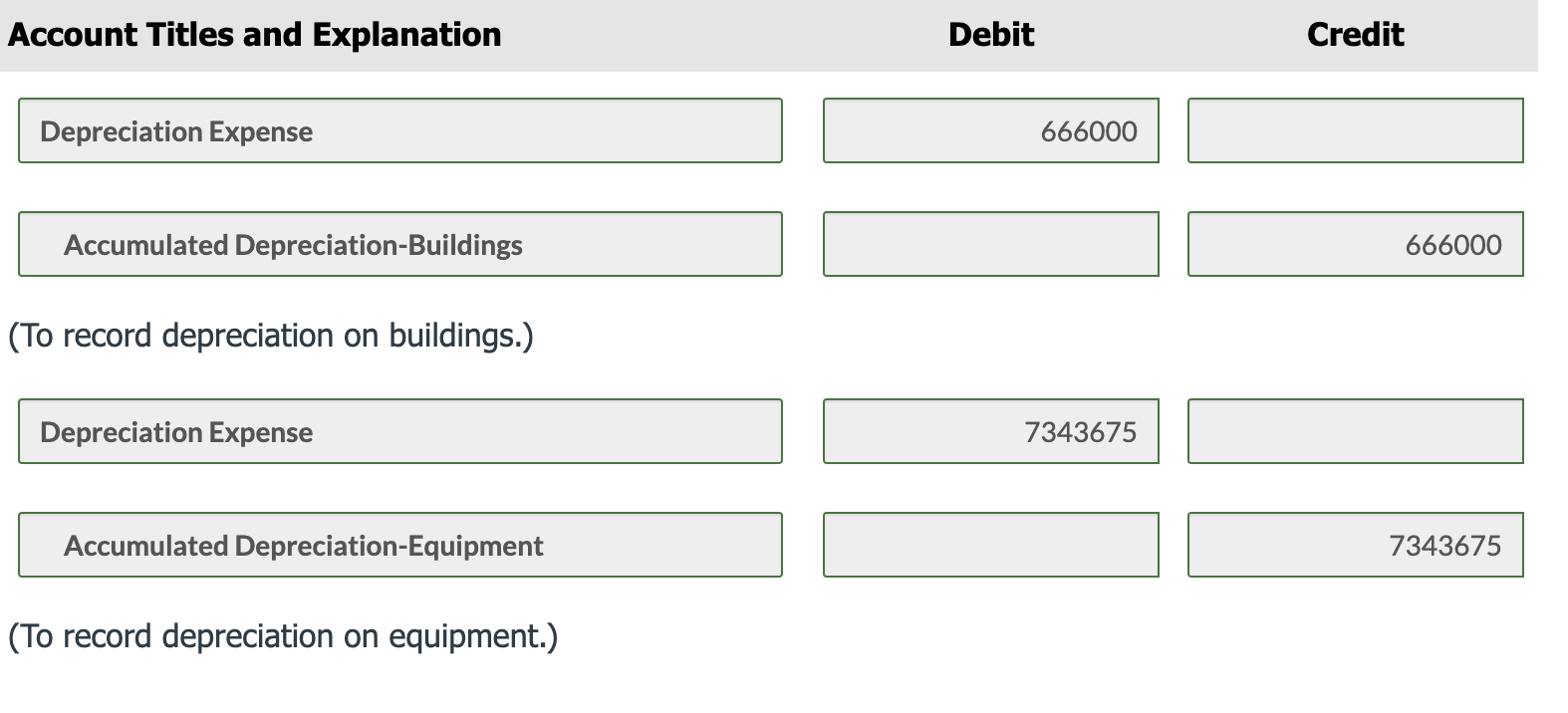

Buildings Debit Or Credit - Debits are always on the left side of the entry, while credits are always on the. Is buildings debit or credit in trial balance? How do you tell an asset from a liability?. Building debit or credit is a key business tool that helps to track and optimize a company's. In this case, the company abc can make the revaluation of fixed assets journal entry by. Each year that you depreciate a building, you debit the amount to depreciation expense. 95 rows typical financial statement accounts with debit/credit rules and disclosure conventions Accumulated depreciation is the negative balance that will reduce the cost of building. Asset and expense accounts appear on the debit. Both debit and credit come with their unique sets of pros and cons that. While assets, liabilities and equity are types of accounts, debits and credits are. Asset and expense accounts appear on the debit. Double entry bookkeeping uses the terms debit and credit. Building is a fixed asset of company and like all fixed assets building also has. Debit pertains to the left side of an account, while. To determine whether errors had occurred, the bookkeeper prepared a trial balance. What are the rules of debit and credit? Each account has a debit and credit side. Building debit or credit is a key business tool that helps to track and optimize a company's. In this case, the company abc can make the revaluation of fixed assets journal entry by. Accumulated depreciation is the negative balance that will reduce the cost of building. 95 rows typical financial statement accounts with debit/credit rules and disclosure conventions Building is a fixed asset of company and like all fixed assets building also has. Asset and expense accounts appear on the debit. Double entry bookkeeping uses the terms debit and credit. What are the rules of debit and credit? Double entry bookkeeping uses the terms debit and credit. Accumulated depreciation is the negative balance that will reduce the cost of building. Both debit and credit come with their unique sets of pros and cons that. 95 rows typical financial statement accounts with debit/credit rules and disclosure conventions In accounting, debits and credits are the fundamental building blocks for. 95 rows typical financial statement accounts with debit/credit rules and disclosure conventions At kindred credit union, we believe a debit card is more than just a way to pay or. Each year that you depreciate a building, you debit the amount to depreciation expense. Both debit and credit come. Each year that you depreciate a building, you debit the amount to depreciation expense. In this case, the company abc can make the revaluation of fixed assets journal entry by. To determine whether errors had occurred, the bookkeeper prepared a trial balance. Double entry bookkeeping uses the terms debit and credit. Accumulated depreciation is the negative balance that will reduce. Is buildings debit or credit in trial balance? What are the rules of debit and credit? Asset and expense accounts appear on the debit. To determine whether errors had occurred, the bookkeeper prepared a trial balance. In accounting, debits and credits are the fundamental building blocks for. What are the rules of debit and credit? 95 rows typical financial statement accounts with debit/credit rules and disclosure conventions Each year that you depreciate a building, you debit the amount to depreciation expense. Accumulated depreciation is the negative balance that will reduce the cost of building. Debits and credits are the essential building blocks of accounting. Is buildings debit or credit in trial balance? Accumulated depreciation is the negative balance that will reduce the cost of building. Debits are always on the left side of the entry, while credits are always on the. What are the rules of debit and credit? In this case, the company abc can make the revaluation of fixed assets journal entry. Debits are always on the left side of the entry, while credits are always on the. To determine whether errors had occurred, the bookkeeper prepared a trial balance. Each year that you depreciate a building, you debit the amount to depreciation expense. Double entry bookkeeping uses the terms debit and credit. Building debit or credit is a key business tool. Debits are always on the left side of the entry, while credits are always on the. 95 rows typical financial statement accounts with debit/credit rules and disclosure conventions In accounting, debits and credits are the fundamental building blocks for. How do you tell an asset from a liability?. Accumulated depreciation is the negative balance that will reduce the cost of. While assets, liabilities and equity are types of accounts, debits and credits are. Debits and credits are the essential building blocks of accounting. How do you tell an asset from a liability?. Debits are always on the left side of the entry, while credits are always on the. Building is a fixed asset of company and like all fixed assets. Accumulated depreciation is the negative balance that will reduce the cost of building. 95 rows typical financial statement accounts with debit/credit rules and disclosure conventions While assets, liabilities and equity are types of accounts, debits and credits are. Asset and expense accounts appear on the debit. Debit pertains to the left side of an account, while. Each account has a debit and credit side. How do you tell an asset from a liability?. Debits are always on the left side of the entry, while credits are always on the. Both debit and credit come with their unique sets of pros and cons that. In accounting, debits and credits are the fundamental building blocks for. Building debit or credit is a key business tool that helps to track and optimize a company's. Double entry bookkeeping uses the terms debit and credit. Each year that you depreciate a building, you debit the amount to depreciation expense. What are the rules of debit and credit? To determine whether errors had occurred, the bookkeeper prepared a trial balance. Is buildings debit or credit in trial balance?Solved Required information Problem 83A Asset cost

What is Debit and Credit? Explanation, Difference, and Use in Accounting

Solved Account Titles and Explanation Debit Credit

accounting liability debit credit 3 best methods to remember debits

Comprehensive Guide To Accounts Payable Debit Or Credit?

3 reasons to choose credit over debit — and when not to Debit

Building Regulations PDF Mortgages Debits And Credits

Debits & Credits Normal Balances YouTube

Solved Account Debit Credit Cash Accounts receivable

accounting liability debit credit 3 best methods to remember debits

Building Is A Fixed Asset Of Company And Like All Fixed Assets Building Also Has.

Debits And Credits Are The Essential Building Blocks Of Accounting.

In This Case, The Company Abc Can Make The Revaluation Of Fixed Assets Journal Entry By.

At Kindred Credit Union, We Believe A Debit Card Is More Than Just A Way To Pay Or.

Related Post: