Buildings On Balance Sheet

Buildings On Balance Sheet - Balance sheets provide the basis for computing rates of return for investors and evaluating a company's capital structure. The following are the general list. Normally, assets are categorized into different categories based on types of assets and their usage. Accounting for building assets is a critical aspect of financial. It is unlike a budget or cash flow. On the “buildings” line in the “property, plant & equipment” section, write the original cost of the building. A personal balance sheet or personal net worth statement is a snapshot of your financial life. Just like land, buildings are long. The first is to purchase the material, engage the necessary workmen and. Having acquired the land upon which to place the building, the concern may proceed in one of three ways. Fill in your balance sheet. Buildings are not classified as current assets on the balance sheet. A personal balance sheet or personal net worth statement is a snapshot of your financial life. Entity reports fixed assets in the balance sheet; Company abc owns a building that cost $ 500,000 and accumulated depreciation of $ 200,000 on the balance sheet date. Learn how to manage building assets effectively, covering depreciation, financial reporting, and tax implications. The purpose of a balance sheet is to. Unlike land, buildings are depreciable. Like a photo, it represents one point in time. Our explanation of the balance sheet provides you with a basic understanding of a corporation's balance sheet (or statement of financial position). You will gain insights regarding the assets,. A balance sheet is a financial statement that provides an overall snapshot of a company’s financial health at a specific point in time. Buildings will be depreciated over their useful lives by debiting the. On the “buildings” line in the “property, plant & equipment” section, write the original cost of the building. Normally,. Our explanation of the balance sheet provides you with a basic understanding of a corporation's balance sheet (or statement of financial position). You will gain insights regarding the assets,. The first is to purchase the material, engage the necessary workmen and. Also, when preparing a balance sheet for your intermediate accounting class, make sure you. Fixed assets can be recorded. Company abc owns a building that cost $ 500,000 and accumulated depreciation of $ 200,000 on the balance sheet date. The following are the general list. Learn how to manage building assets effectively, covering depreciation, financial reporting, and tax implications. The balance sheet, also called the statement of financial position, is the third general purpose financial statement prepared during the. A personal balance sheet or personal net worth statement is a snapshot of your financial life. Just like land, buildings are long. Like a photo, it represents one point in time. When you acquire a building, you record it on your balance sheet at its purchase price plus any costs related to the acquisition and preparation for use. Learn how. Normally, assets are categorized into different categories based on types of assets and their usage. The balance sheet, also called the statement of financial position, is the third general purpose financial statement prepared during the accounting cycle. Under ifrs, specifically ias 16, auc are initially recognized at cost, which includes expenditures directly attributable to bringing the asset to its intended. Learn how to manage building assets effectively, covering depreciation, financial reporting, and tax implications. The purpose of a balance sheet is to. Fill in your balance sheet. It is unlike a budget or cash flow. Having acquired the land upon which to place the building, the concern may proceed in one of three ways. Also, when preparing a balance sheet for your intermediate accounting class, make sure you. Fixed assets can be recorded within a number of classifications, including buildings, computer equipment, furniture and fixtures, and office equipment. When you acquire a building, you record it on your balance sheet at its purchase price plus any costs related to the acquisition and preparation for. The first is to purchase the material, engage the necessary workmen and. Fill in your balance sheet. Like land, buildings are also known as real property assets. A personal balance sheet or personal net worth statement is a snapshot of your financial life. When you acquire a building, you record it on your balance sheet at its purchase price plus. In short, the balance sheet is a financial statement. Unlike land, buildings are depreciable. Fixed assets can be recorded within a number of classifications, including buildings, computer equipment, furniture and fixtures, and office equipment. Buildings will be depreciated over their useful lives by debiting the. Learn how to manage building assets effectively, covering depreciation, financial reporting, and tax implications. The purpose of a balance sheet is to. When you acquire a building, you record it on your balance sheet at its purchase price plus any costs related to the acquisition and preparation for use. Learn how to manage building assets effectively, covering depreciation, financial reporting, and tax implications. Balance sheets provide the basis for computing rates of return for. Normally, assets are categorized into different categories based on types of assets and their usage. Under ifrs, specifically ias 16, auc are initially recognized at cost, which includes expenditures directly attributable to bringing the asset to its intended use, such as materials,. You then depreciate the building's cost. Learn how to manage building assets effectively, covering depreciation, financial reporting, and tax implications. The first is to purchase the material, engage the necessary workmen and. Having acquired the land upon which to place the building, the concern may proceed in one of three ways. What is a balance sheet? A balance sheet reports the assets, liabilities & owner’s equity of a business. Balance sheets provide the basis for computing rates of return for investors and evaluating a company's capital structure. Buildings will be depreciated over their useful lives by debiting the. On the “buildings” line in the “property, plant & equipment” section, write the original cost of the building. Company abc owns a building that cost $ 500,000 and accumulated depreciation of $ 200,000 on the balance sheet date. When you acquire a building, you record it on your balance sheet at its purchase price plus any costs related to the acquisition and preparation for use. Buildings are not classified as current assets on the balance sheet. The purpose of a balance sheet is to. Just like land, buildings are long.PPT Chapter 2 PowerPoint Presentation, free download ID5765313

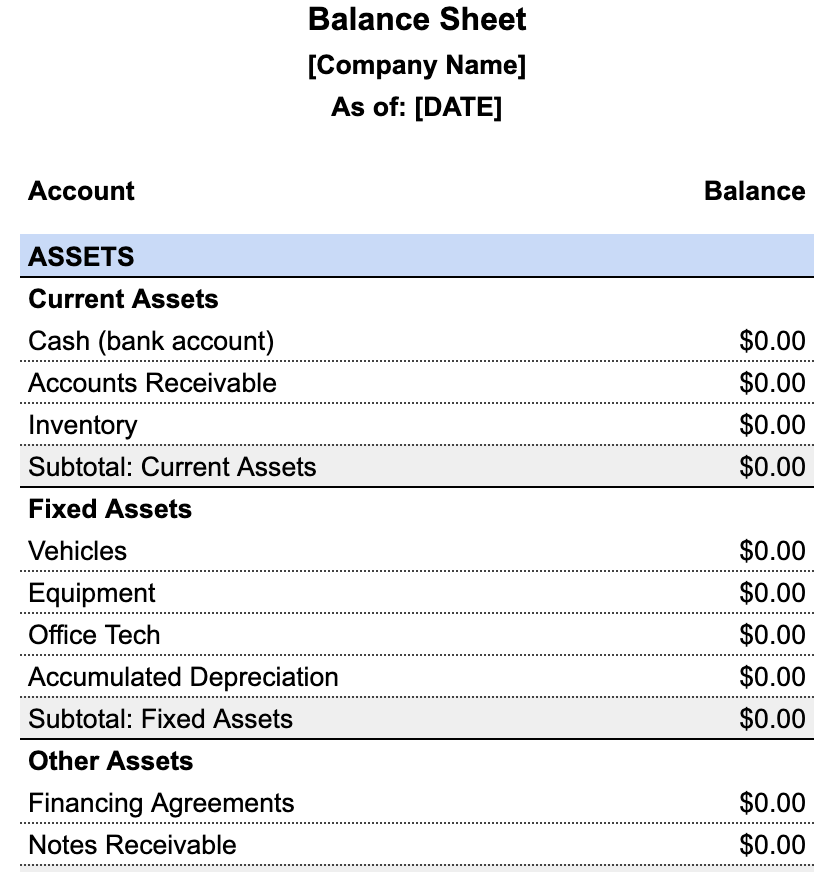

The Balance Sheet A Howto Guide for Businesses

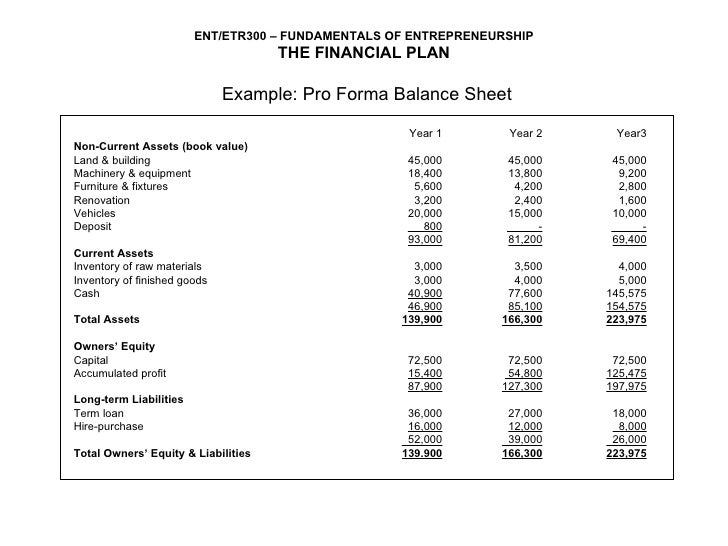

Ent300 Module11

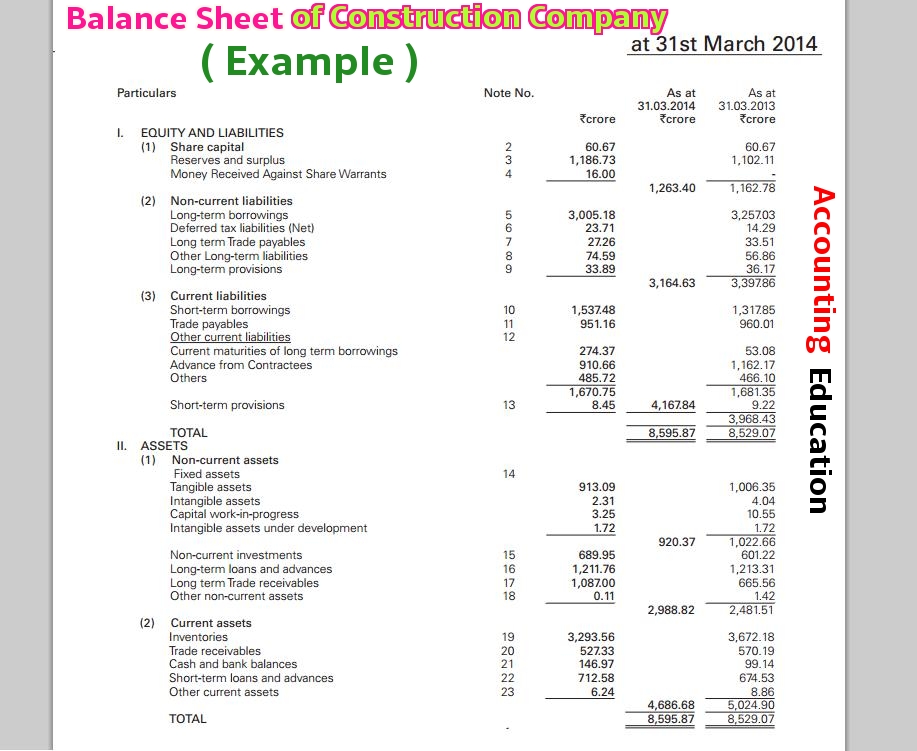

How to Make Balance Sheet of Construction Company Accounting Education

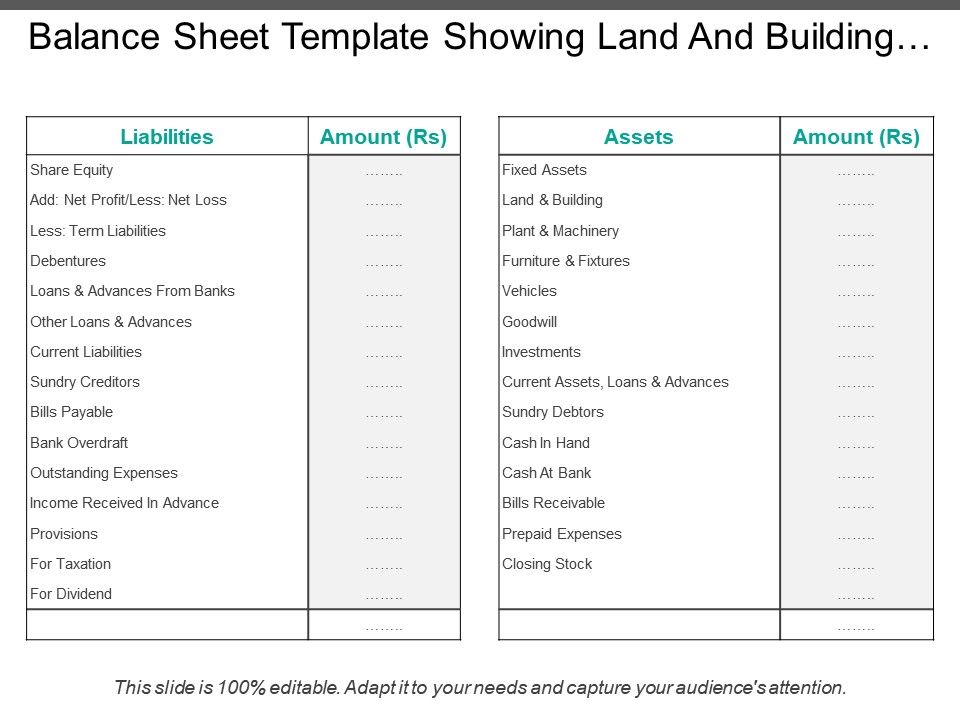

Balance Sheet Template Showing Land And Building Loans Advances

Balance Sheet Format for Construction Company in Excel

Solved ROJAS CORPORATION Comparative Balance Sheets December

Is my Building an Asset or Liability?

Building a balance sheet Building Dashboards with Microsoft Dynamics

AnalyzingaCondoorCoopBuildingsBalanceSheet Hauseit Balance

Accounting For Building Assets Is A Critical Aspect Of Financial.

Like A Photo, It Represents One Point In Time.

You Will Gain Insights Regarding The Assets,.

A Personal Balance Sheet Or Personal Net Worth Statement Is A Snapshot Of Your Financial Life.

Related Post: