Business Credit Builder Accounts

Business Credit Builder Accounts - Open an account online in just minutes. Build $5,000 to $50,000 of bank. See what the experts say. Chase sets a $15 monthly fee for its business complete banking account, which it waives when customers maintain $2,000 in balances, deposits, or chase ink business card spending. In general, good personal credit is all you need to qualify for a wide variety of business credit cards.yet, working to build your business credit history and a good business. Join over 250,000 small business owners who have managed credit, built. Establishing business credit for the first time can be fast and easy. Learn how to build business credit and access more business financing. Nav prime is the only membership that helps you build, manage, and leverage your business’s credit in one place. This guide explores companies that help build business credit to help you. Open an account online in just minutes. Business credit builder loans can be a great way to improve your business credit score, especially if you’re relatively new to small business ownership. Nav prime is the only membership that helps you build, manage, and leverage your business’s credit in one place. This guide explores companies that help build business credit to help you. Establish a credit profile for your company. Ein only business credit cards approve businesses based on their employer identification number, or ein, without requiring a social. Join over 250,000 small business owners who have managed credit, built. Explore top business credit builder accounts that can help establish and strengthen your business credit. Building business credit is one of the most important things you can do as an entrepreneur. Equifax business credit risk score: It typically takes about three years to build satisfactory credit; Business credit builder loans can be a great way to improve your business credit score, especially if you’re relatively new to small business ownership. Build $5,000 to $50,000 of bank. Chase sets a $15 monthly fee for its business complete banking account, which it waives when customers maintain $2,000 in. Enter your basic personal and company information. There is no hard pull on your personal or business credit. Ecredable business lift offers a simple, straightforward way for businesses to build credit by reporting business utility and telecom payments. In general, good personal credit is all you need to qualify for a wide variety of business credit cards.yet, working to build. Open an account online in just minutes. Strong business credit helps you secure funding, qualify for better loan terms,. Learn how to build business credit and access more business financing. You’ll need to register your business, apply online for two different identification numbers and then open a business. It typically takes about three years to build satisfactory credit; See what the experts say. Explore top business credit builder accounts that can help establish and strengthen your business credit. Whether you use our vendor accounts to build your initial business credit, or take advantage of our credit line hybrid program, you’ll get your initial business credit profiles and scores. Ein only business credit cards approve businesses based on their. Join over 250,000 small business owners who have managed credit, built. Strong business credit helps you secure funding, qualify for better loan terms,. In general, good personal credit is all you need to qualify for a wide variety of business credit cards.yet, working to build your business credit history and a good business. Nav prime is the only membership that. Building business credit is one of the most important things you can do as an entrepreneur. You’ll need to register your business, apply online for two different identification numbers and then open a business. Explore top business credit builder accounts that can help establish and strengthen your business credit. Dun & bradstreet paydex score: There is no hard pull on. Dun & bradstreet paydex score: Chase sets a $15 monthly fee for its business complete banking account, which it waives when customers maintain $2,000 in balances, deposits, or chase ink business card spending. Good business credit is essential when applying for financing, whether you're after a company credit. Business credit builder loans can be a great way to improve your. There is no hard pull on your personal or business credit. Chase sets a $15 monthly fee for its business complete banking account, which it waives when customers maintain $2,000 in balances, deposits, or chase ink business card spending. Learn how to build business credit and access more business financing. Nav prime is the only membership that helps you build,. It offers a variety of personal and business deposit accounts, loans and credit. Enter your basic personal and company information. It typically takes about three years to build satisfactory credit; Bank offers three primary business checking accounts, including a free option via its silver business checking account. Ecredable business lift offers a simple, straightforward way for businesses to build credit. Nav prime is the only membership that helps you build, manage, and leverage your business’s credit in one place. Strong business credit helps you secure funding, qualify for better loan terms,. Join over 250,000 small business owners who have managed credit, built. Select a credit builder account that fits your objective and budget. Building business credit is one of the. Join over 250,000 small business owners who have managed credit, built. Business credit builder loans can be a great way to improve your business credit score, especially if you’re relatively new to small business ownership. See what the experts say. Building business credit is one of the most important things you can do as an entrepreneur. Open an account online in just minutes. This account includes up to. You’ll need to register your business, apply online for two different identification numbers and then open a business. Learn how to build business credit and access more business financing. Dun & bradstreet paydex score: Select a credit builder account that fits your objective and budget. This guide explores companies that help build business credit to help you. Explore top business credit builder accounts that can help establish and strengthen your business credit. Maybe you’re a new business owner just. Strong business credit helps you secure funding, qualify for better loan terms,. Best cards for building credit find out which credit cards could help. Equifax business credit risk score:Business Credit Builder Avoid Credit Blunders

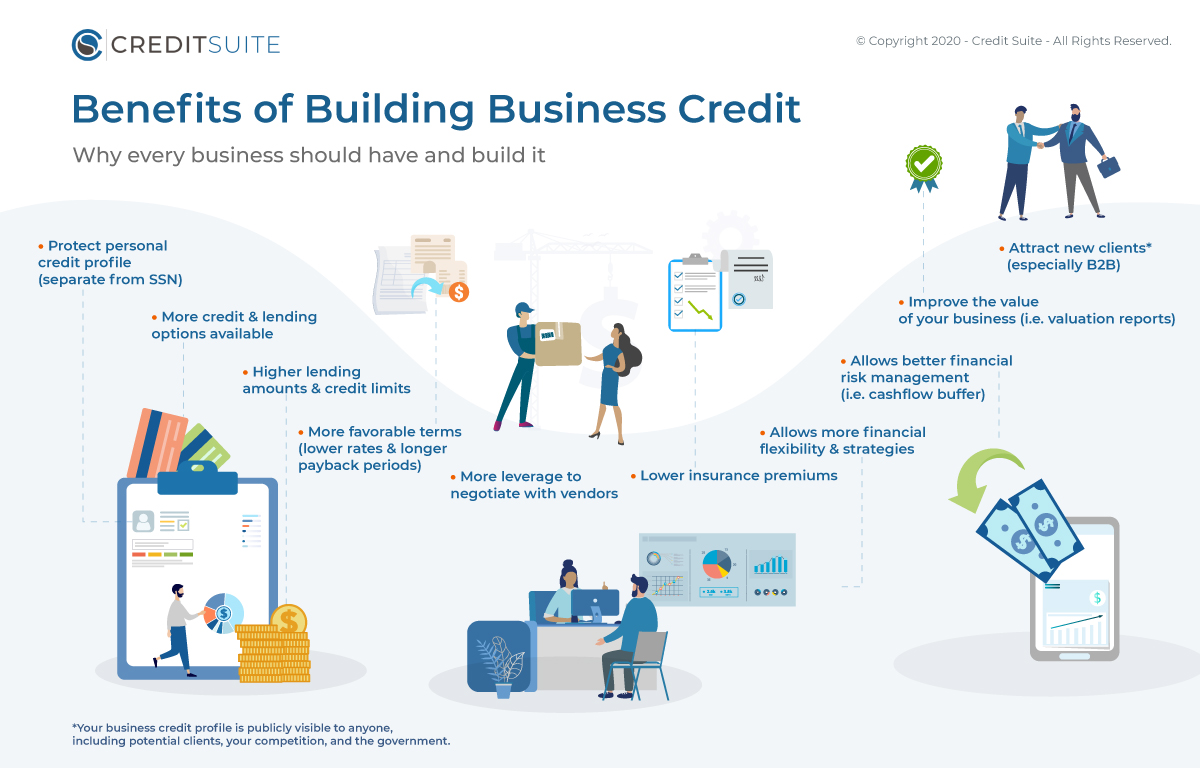

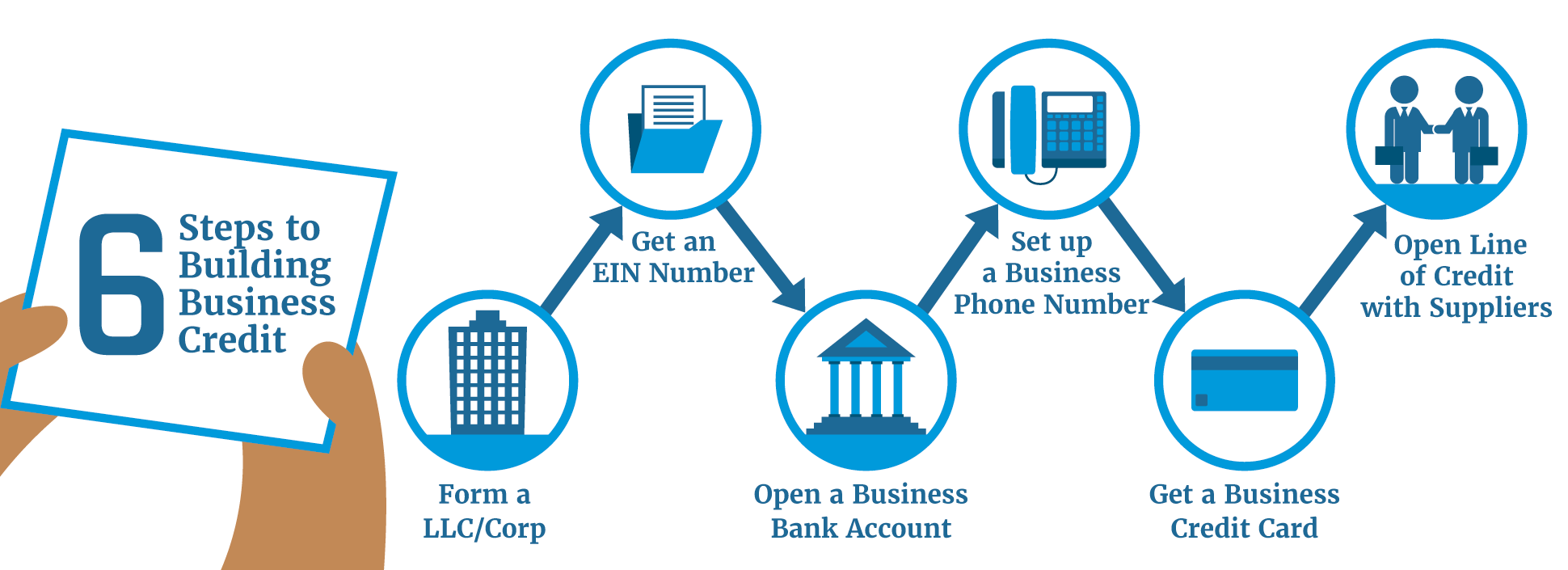

How to Build Business Credit for a Small Business

Top 5+ Best Business Credit Builder Programs And Services raymond

30 Best Net 30 Accounts to Build Your Business Credit [Latest]

How Credit Builder Accounts Work

Business Credit Builder Improve the Quality of Your Life

The 7 Best Business Credit Builder Programs in 2023 Digital Honey

Business Credit 101 Easy Net 30 Accounts for New Business to build

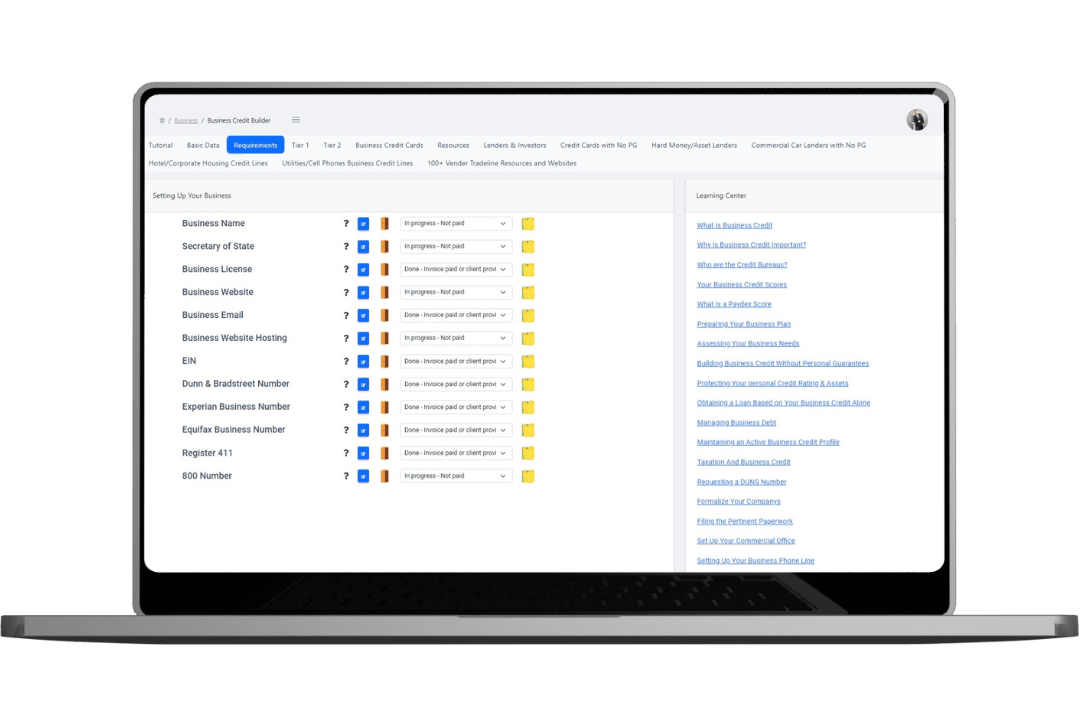

Business Credit Building System Business Credit Builders

The 7 Best Business Credit Builder Programs in 2023 Digital Honey

Enter Your Basic Personal And Company Information.

Whether You Use Our Vendor Accounts To Build Your Initial Business Credit, Or Take Advantage Of Our Credit Line Hybrid Program, You’ll Get Your Initial Business Credit Profiles And Scores.

Consistent Responsible Credit Use Is Key;

Ecredable Business Lift Offers A Simple, Straightforward Way For Businesses To Build Credit By Reporting Business Utility And Telecom Payments.

Related Post:

![30 Best Net 30 Accounts to Build Your Business Credit [Latest]](https://wisebusinessplans.com/wp-content/uploads/2022/03/approved-net-30-accounts-to-build-business-credit.jpg)