Can A Credit Union Build Credit

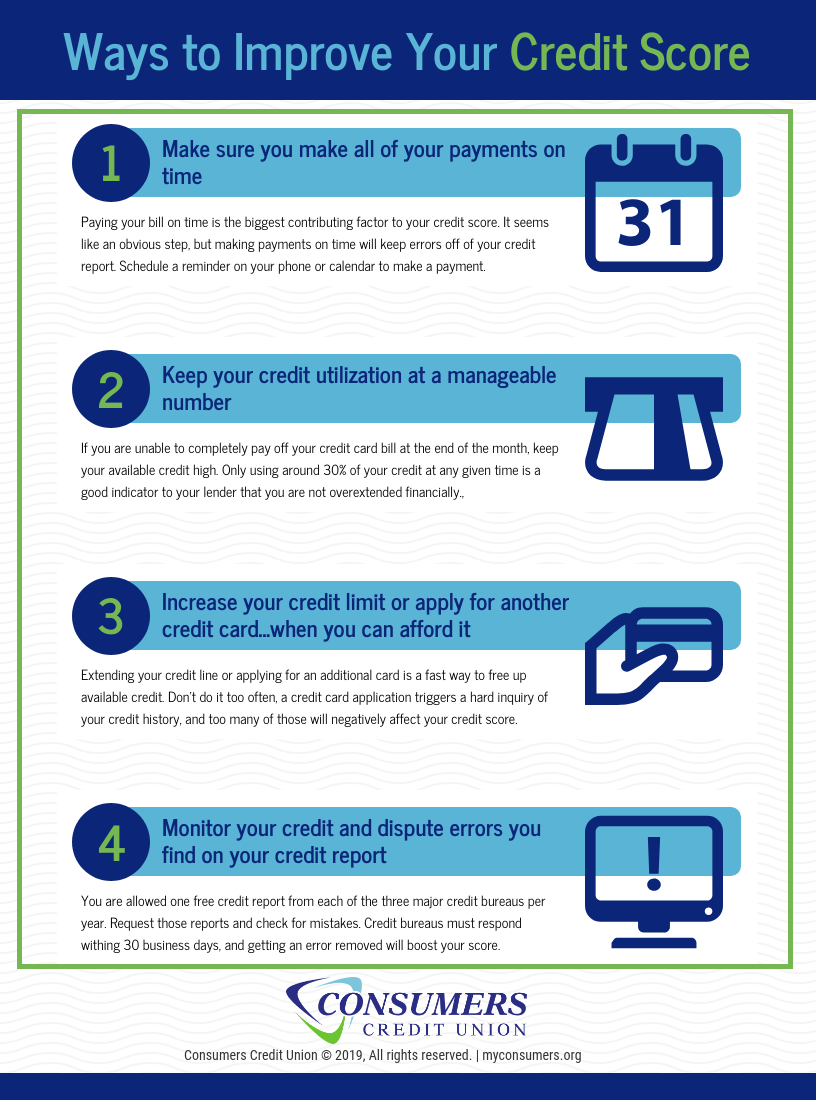

Can A Credit Union Build Credit - That money is held in a savings account and it serves as your line of credit. Whether you are looking for a place to save, borrow, or plan for the future, credit unions in chicago provide a welcoming and inclusive environment for all members. First, check your credit score. Get credit is a simple way to build or rebuild your credit and build up a stack of cash along the way. By mastering these skills, credit union business lenders can make sound lending decisions, foster strong member relationships, and ensure the financial stability and growth of their credit unions. According to consumer financial protection bureau, a credit score is a number assigned to a person that predicts how likely you are to pay back a loan on time. Economic wellness organizations can assist with acquiring the proper tax documentation to obtain a credit score. It's like the chicken or the egg dilemma—if you don’t have a credit history, it’s hard to get a credit card or loan. Follow these eight tips to establish credit and set yourself up for future financial success: The competition may seem a bit skewed in favor of the. The standard share insurance amount is $250,000 per share owner, per insured credit union, for each account ownership category. These deals can have a substantial impact on local economies. Building strong relationships enhances trust and communication, making it easier to identify and manage risks effectively. If you are building your credit score from scratch, you’ll likely need to apply for a secured credit card. We’ve designed each account to suit different member needs and goals. Other examples include utility charges. Get credit is a simple way to build or rebuild your credit and build up a stack of cash along the way. So you basically offer to make it safer for them. Credit unions require membership to open a bank account or utilize services. Marine credit union can help you build your credit score with get credit. We’ve designed each account to suit different member needs and goals. It's like the chicken or the egg dilemma—if you don’t have a credit history, it’s hard to get a credit card or loan. Building and maintaining good credit takes time, so be patient, persistent and diligent. Get credit is a simple way to build or rebuild your credit and. United federal credit union’s u first visa ® credit card is ideal for people who want to start building their credit with a credit card. Wallethub makes it easy to find the best credit unions online. Please find below 2025's best credit unions in illinois. Building and maintaining good credit takes time, so be patient, persistent and diligent. No matter. How do credit score companies determine your credit score? Here's how you can build it with these three smart money strategies. You can use it the same way you use any other credit card. United federal credit union’s u first visa ® credit card is ideal for people who want to start building their credit with a credit card. What. Other examples include utility charges. Building and maintaining good credit takes time, so be patient, persistent and diligent. Building strong relationships enhances trust and communication, making it easier to identify and manage risks effectively. You must build credit by getting credit, so we’ve provided three ways to do this. Get credit is a simple way to build or rebuild your. The competition may seem a bit skewed in favor of the. It's like the chicken or the egg dilemma—if you don’t have a credit history, it’s hard to get a credit card or loan. Other examples include utility charges. Creditors don't know if they can trust you with a line of credit yet. By mastering these skills, credit union business. That money is held in a savings account and it serves as your line of credit. Whether you are looking for a place to save, borrow, or plan for the future, credit unions in chicago provide a welcoming and inclusive environment for all members. One of the easiest ways to increase your credit is to open a credit card. Here's. Please find below 2025's best credit unions in illinois. Follow these eight tips to establish credit and set yourself up for future financial success: Some providers of service credit, especially utilities, report delinquencies to the credit bureaus and can thus affect your score. One of the easiest ways to increase your credit is to open a credit card. You can. Usually, you'll have to work for a select employer or live in a specific city or county. One of the easiest ways to increase your credit is to open a credit card. Please find below 2025's best credit unions in illinois. This year, credit union leaders face a pivotal moment—one that could shape the future of our industry for decades. These deals can have a substantial impact on local economies. Wallethub makes it easy to find the best credit unions online. According to consumer financial protection bureau, a credit score is a number assigned to a person that predicts how likely you are to pay back a loan on time. That money is held in a savings account and it. Some providers of service credit, especially utilities, report delinquencies to the credit bureaus and can thus affect your score. These deals can have a substantial impact on local economies. According to consumer financial protection bureau, a credit score is a number assigned to a person that predicts how likely you are to pay back a loan on time. What does. Here's how you can build it with these three smart money strategies. Don’t skip this step if. Marine credit union can help you build your credit score with get credit. You can use it the same way you use any other credit card. United federal credit union’s u first visa ® credit card is ideal for people who want to start building their credit with a credit card. Economic wellness organizations can assist with acquiring the proper tax documentation to obtain a credit score. Creditors don't know if they can trust you with a line of credit yet. From convenient online banking to competitive loan options, these institutions are committed to helping their members achieve financial success. Usually, you'll have to work for a select employer or live in a specific city or county. How do credit score companies determine your credit score? Some providers of service credit, especially utilities, report delinquencies to the credit bureaus and can thus affect your score. These deals can have a substantial impact on local economies. We’ve designed each account to suit different member needs and goals. One of the easiest ways to increase your credit is to open a credit card. Whether you are looking for a place to save, borrow, or plan for the future, credit unions in chicago provide a welcoming and inclusive environment for all members. This year, credit union leaders face a pivotal moment—one that could shape the future of our industry for decades to come.How to Build Credit • Beacon Credit Union

Does credit union build your credit? Leia aqui Do credit unions help

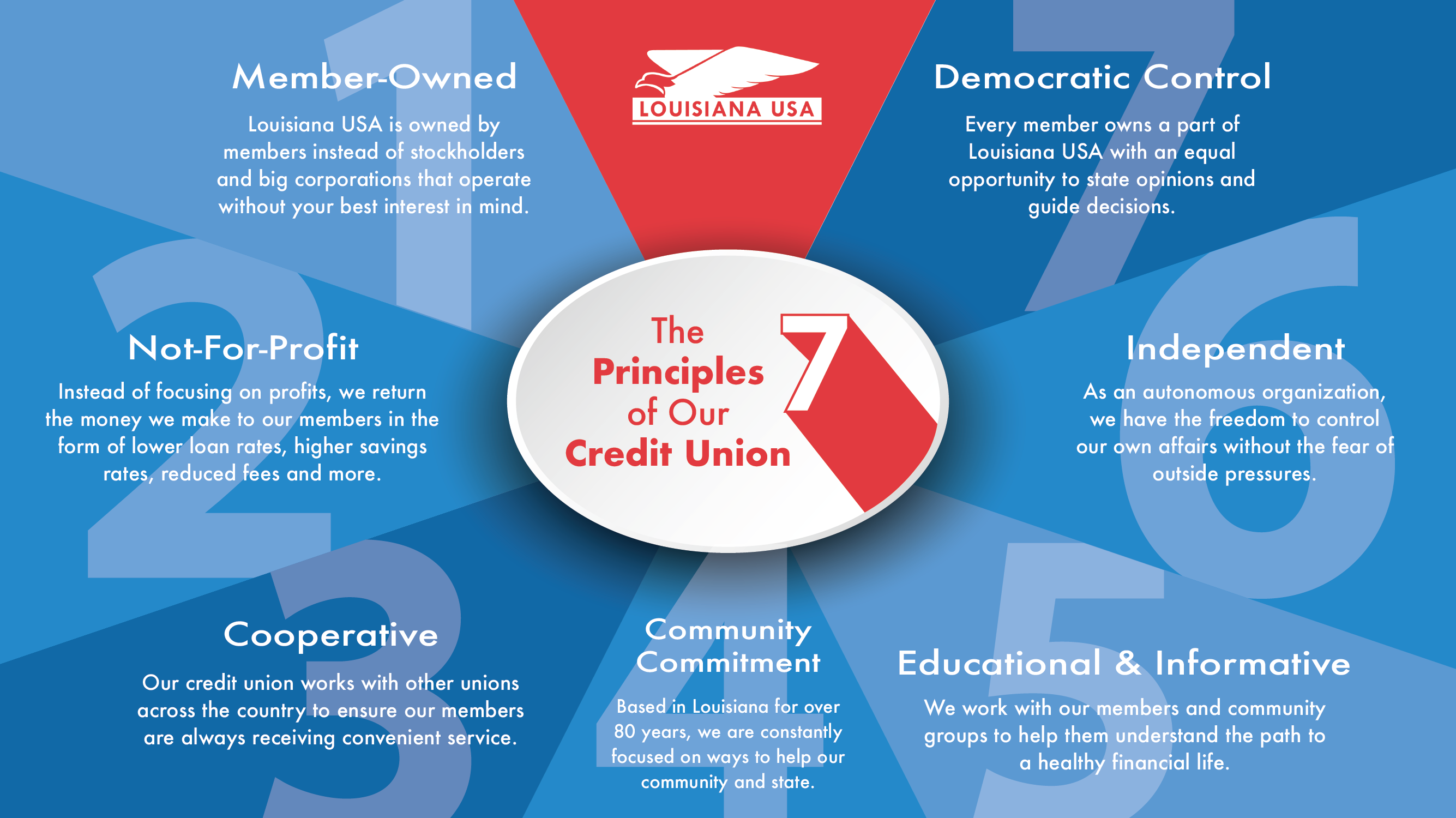

How do credit unions work? Leia aqui Why use a credit union instead of

Articles About Building Credit From Scratch Self. Page 2

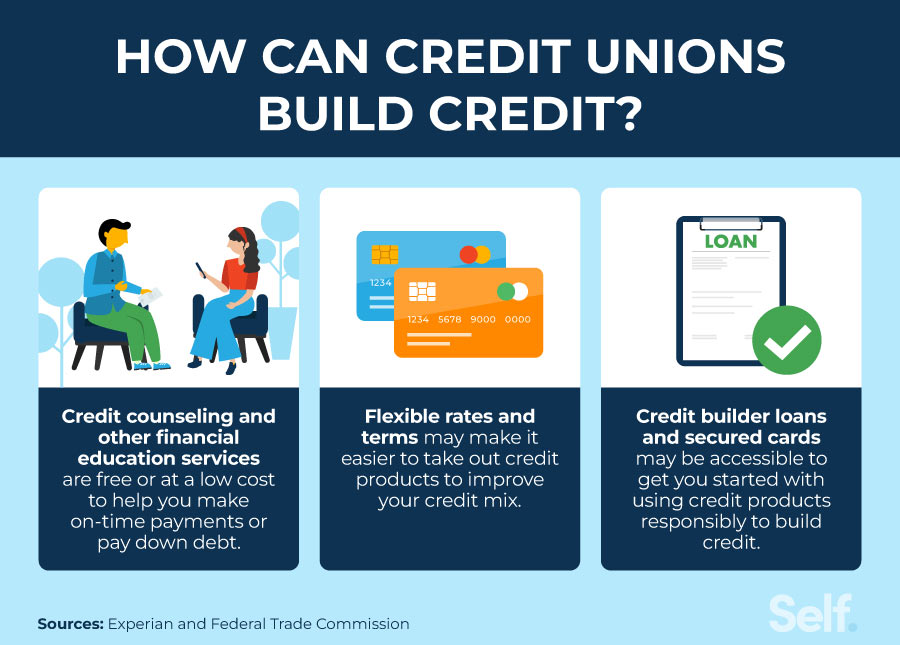

Do Credit Unions Help Build Credit? Self. Credit Builder.

Do credit unions help build credit? Leia aqui Can you build a credit

5 Ways Joining a Credit Union Can Help Build Your Credit

Do credit unions help build credit? Leia aqui Can you build a credit

Do credit unions help build credit? Leia aqui Can you build a credit

How Can I Start Building Credit RBFCU Credit Union

Get Credit Is A Simple Way To Build Or Rebuild Your Credit And Build Up A Stack Of Cash Along The Way.

Follow These Eight Tips To Establish Credit And Set Yourself Up For Future Financial Success:

Building And Maintaining Good Credit Takes Time, So Be Patient, Persistent And Diligent.

First, Check Your Credit Score.

Related Post:

.png?width=752&name=alt lending comparison infographic (1).png)