Can Afterpay Build Credit

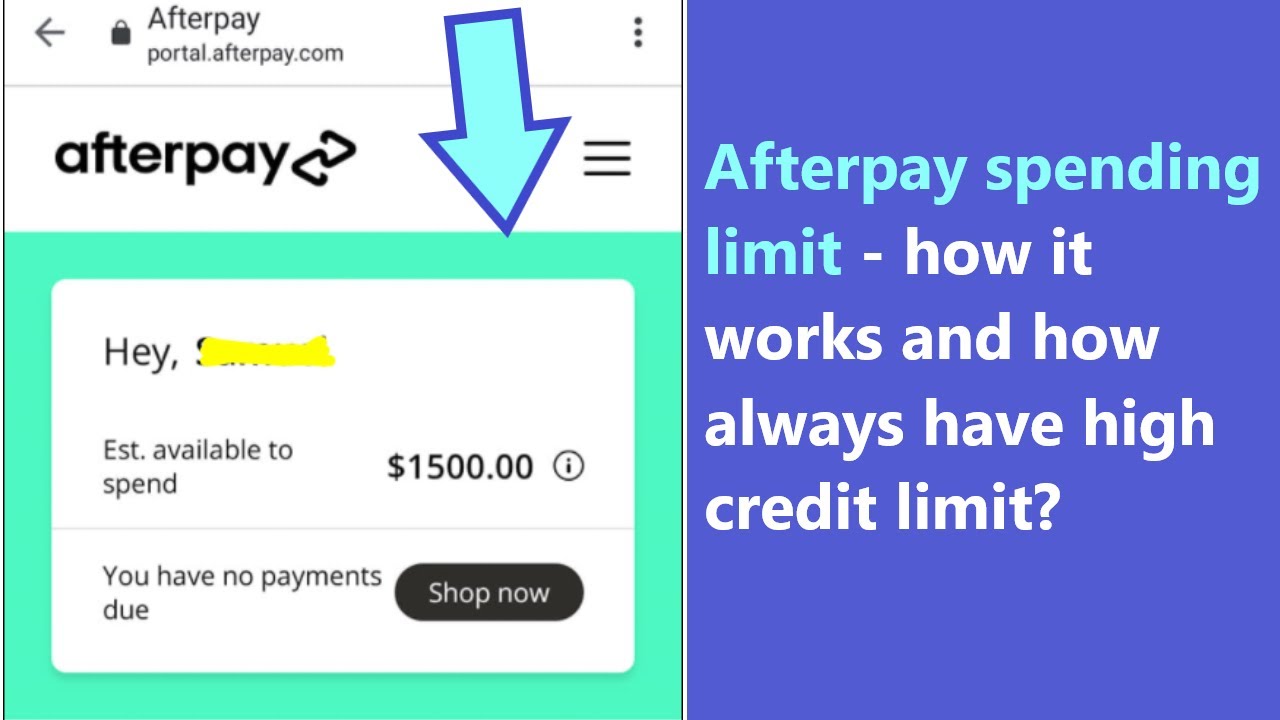

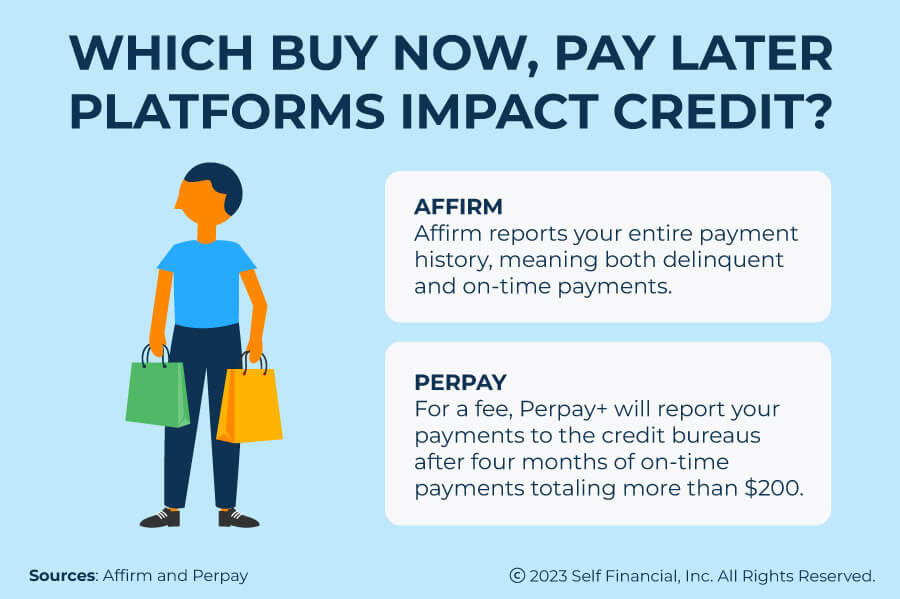

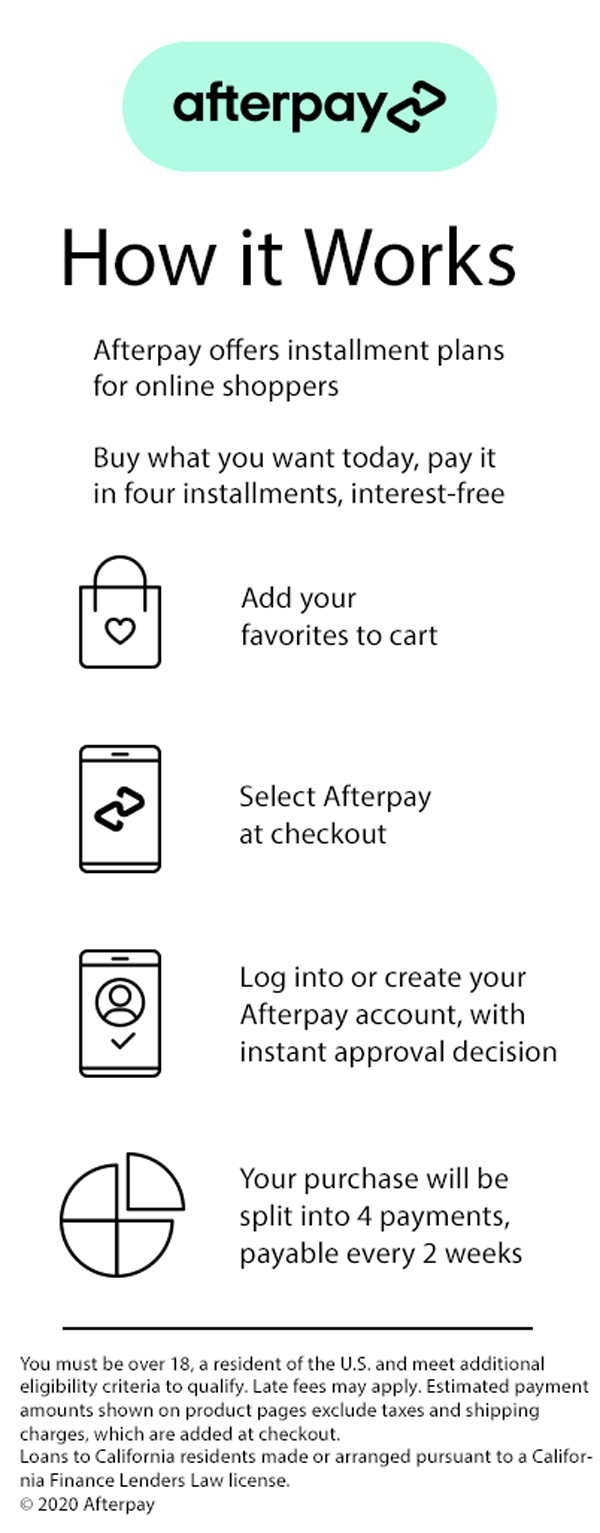

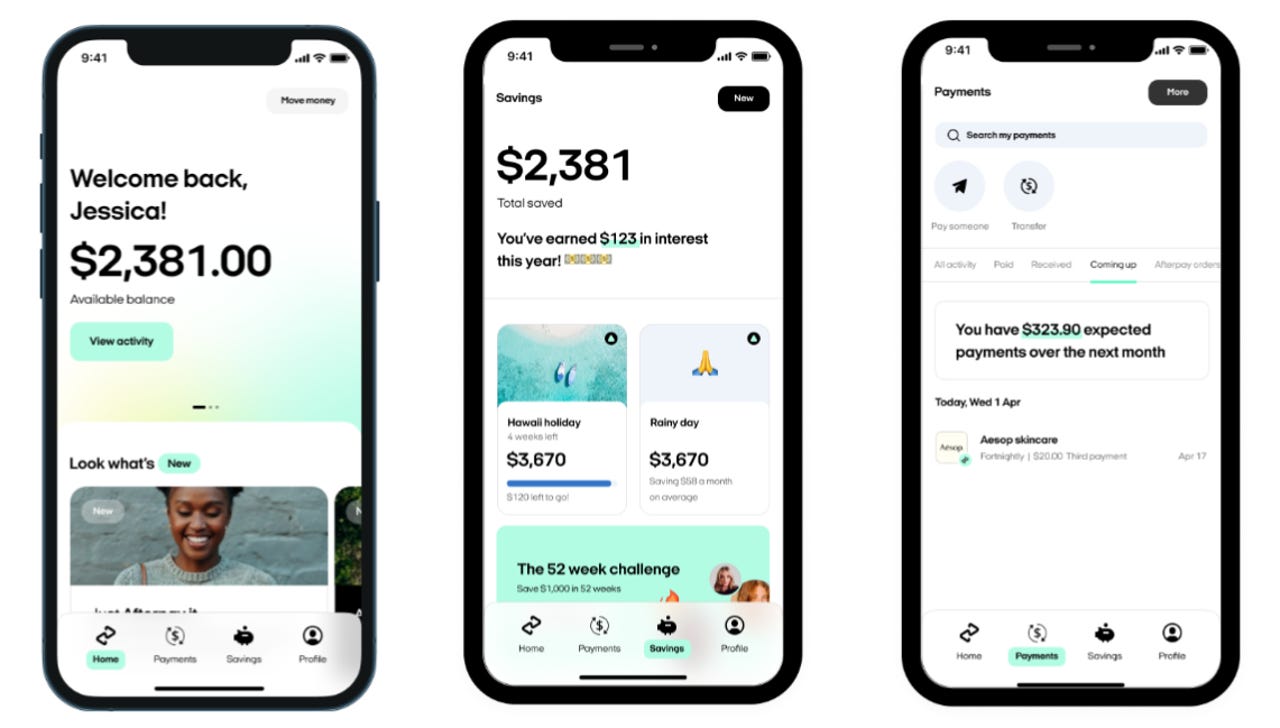

Can Afterpay Build Credit - Bnpl credit is a type of. The short answer is no, afterpay itself does not build your credit. Unpaid loans may go to collections,. A soft credit check allows a lender to see your credit history without impacting your credit score. Afterpay’s financing arrangements aren’t loans that get reported to the credit bureaus. Afterpay doesn’t check your credit score or credit history to get approved and it. Credit card options can be limited if you have no credit or bad credit (fico scores of 629 or lower). A common choice is a secured card, which requires an upfront security. No matter how you want to split up your payments, afterpay only runs a soft credit check. You can pay afterpay using a debit or credit card, either. Afterpay’s financing arrangements aren’t loans that get reported to the credit bureaus. No matter how you want to split up your payments, afterpay only runs a soft credit check. A soft credit check allows a lender to see your credit history without impacting your credit score. When you open a new account on afterpay, the afterpay credit limit can be as low as $500 but if you keep repaying on time, the maximum limit can go up to $1,500 with an. With afterpay, payment history isn’t reported, so you can’t build credit. Credit card options can be limited if you have no credit or bad credit (fico scores of 629 or lower). “at afterpay, we never do credit checks or report late payments,”. Unpaid loans may go to collections,. Building credit is important because the better your credit score, the more likely you can qualify for other. A common choice is a secured card, which requires an upfront security. With afterpay, payment history isn’t reported, so you can’t build credit. Credit card options can be limited if you have no credit or bad credit (fico scores of 629 or lower). You have to create a digital credit card and add it to your. Here’s what you’ll need to create an account: A common choice is a secured card, which. The short answer is no, afterpay itself does not build your credit. You can pay afterpay using a debit or credit card, either. A soft credit check allows a lender to see your credit history without impacting your credit score. Building credit is important because the better your credit score, the more likely you can qualify for other. Afterpay may. Since it doesn’t report information to credit bureaus*, it’s not possible for afterpay usage to help you build credit. While it offers a convenient way to make purchases and manage payments, afterpay doesn’t report payment. Afterpay may conduct a soft credit check when you sign up for the platform. Unpaid loans may go to collections,. It can help you get. Signing up for afterpay is simple and fast. A common choice is a secured card, which requires an upfront security. You have to create a digital credit card and add it to your. Here’s what you’ll need to create an account: It can help you get into the habit of regularly repaying debts off,. Today’s study helps fill the data gap by pairing a matched sample of bnpl applications from six large firms with deidentified credit records. When you open a new account on afterpay, the afterpay credit limit can be as low as $500 but if you keep repaying on time, the maximum limit can go up to $1,500 with an. Signing up. In its support website, afterpay clarifies that the service does not affect customers’ credit score or credit rating. Since it doesn’t report information to credit bureaus*, it’s not possible for afterpay usage to help you build credit. When you open a new account on afterpay, the afterpay credit limit can be as low as $500 but if you keep repaying. Today’s study helps fill the data gap by pairing a matched sample of bnpl applications from six large firms with deidentified credit records. Afterpay may conduct a soft credit check when you sign up for the platform. After you make a purchase, you can log into the afterpay app to see when your next payment is due and in what. Building credit is important because the better your credit score, the more likely you can qualify for other. You have to create a digital credit card and add it to your. Afterpay’s financing arrangements aren’t loans that get reported to the credit bureaus. While afterpay doesn’t directly build credit, as it performs soft checks and doesn’t report to major bureaus,. Afterpay doesn’t check your credit score or credit history to get approved and it. Since it doesn’t report information to credit bureaus*, it’s not possible for afterpay usage to help you build credit. You can pay afterpay using a debit or credit card, either. Afterpay may conduct a soft credit check when you sign up for the platform. Here’s what. With afterpay, payment history isn’t reported, so you can’t build credit. You have to create a digital credit card and add it to your. Building credit is important because the better your credit score, the more likely you can qualify for other. The account even comes with a card to help you build credit with everyday purchases and earn points. You have to create a digital credit card and add it to your. When you open a new account on afterpay, the afterpay credit limit can be as low as $500 but if you keep repaying on time, the maximum limit can go up to $1,500 with an. Buy now, pay later (bnpl) services from companies like affirm, klarna and afterpay are the latest online shopping innovation to go mainstream, and they’re only growing in. “at afterpay, we never do credit checks or report late payments,”. While it offers a convenient way to make purchases and manage payments, afterpay doesn’t report payment. It can help you get into the habit of regularly repaying debts off,. A soft credit check allows a lender to see your credit history without impacting your credit score. No matter how you want to split up your payments, afterpay only runs a soft credit check. The short answer is no, afterpay itself does not build your credit. You can pay afterpay using a debit or credit card, either. In its support website, afterpay clarifies that the service does not affect customers’ credit score or credit rating. Today’s study helps fill the data gap by pairing a matched sample of bnpl applications from six large firms with deidentified credit records. A common choice is a secured card, which requires an upfront security. While afterpay doesn’t directly build credit, as it performs soft checks and doesn’t report to major bureaus, using it responsibly can indirectly benefit your score by reducing hard. Credit card options can be limited if you have no credit or bad credit (fico scores of 629 or lower). Since it doesn’t report information to credit bureaus*, it’s not possible for afterpay usage to help you build credit.What is the highest Afterpay level? Leia aqui Can you get more than

Do Afterpay build your credit? Leia aqui How much credit does Afterpay

Does Afterpay Build Credit? Understanding Buy Now, Pay Later Self

What is the max Afterpay credit? Leia aqui Can you get more than 600

Can I build credit with Afterpay? Leia aqui Can Afterpay contribute to

Can I build credit with Afterpay? Leia aqui Can Afterpay contribute to

Can banks see your Afterpay? Leia aqui Can banks see if you have Afterpay

Do Afterpay build your credit? Leia aqui How much credit does Afterpay

Does Afterpay build credit? YouTube

Do Afterpay build your credit? Leia aqui How much credit does Afterpay

Unpaid Loans May Go To Collections,.

If You Use The Loans, You Won’t Build Your Credit History.

The Account Even Comes With A Card To Help You Build Credit With Everyday Purchases And Earn Points On Swipes For Cash Back.

Afterpay’s Financing Arrangements Aren’t Loans That Get Reported To The Credit Bureaus.

Related Post: