Can Buildings Be Depreciated

Can Buildings Be Depreciated - It’s an annual allowance for the wear and tear, deterioration or obsolescence of the property. The business stops depreciating property when they have fully recovered their cost or other basis or when they retire it from service, whichever. Depreciation accounts for the wear and tear, aging, and potential obsolescence of the asset. Properties that can be depreciated. Depreciation is a key accounting concept for managing the. Depreciation is a critical financial concept for owners and investors of commercial property. [3] can i depreciate the cost of land? Small businesses can depreciate property when they place it in service for use in their trade or business or to produce income. This includes assets used in a trade or business, such as buildings, equipment, and vehicles. Under gds, residential properties can be depreciated over a standard period of 27.5 years. Whether you own construction machinery, office equipment, or manufacturing tools, knowing how depreciation works can save you money and optimize operations. Once recorded, buildings must be regularly assessed for depreciation. Real estate used for rental purposes can. According to the internal revenue. Small businesses can depreciate property when they place it in service for use in their trade or business or to produce income. Land can never be depreciated. This includes assets used in a trade or business, such as buildings, equipment, and vehicles. Alternative depreciation system (ads) the alternative depreciation system. It’s an annual allowance for the wear and tear, deterioration or obsolescence of the property. However, factors like the building’s age, maintenance, and overall condition can still affect this rate. Land can never be depreciated. Commercial and residential buildings can be depreciated over a certain number of years based on the type of property. The business stops depreciating property when they have fully recovered their cost or other basis or when they retire it from service, whichever. It allows for the allocation of the cost of an asset over its. In accounting, we do not depreciate. Under gds, residential properties can be depreciated over a standard period of 27.5 years. The irs allows you to depreciate properties that are owned, generate income, and have a useful life of more than one year. Explore various building depreciation methods to optimize asset management and financial planning effectively. It allows for the allocation. Once recorded, buildings must be regularly assessed for depreciation. Alternative depreciation system (ads) the alternative depreciation system. Real estate used for rental purposes can. [3] can i depreciate the cost of land? In accounting, we do not depreciate. Depreciation is a key accounting concept for managing the. This includes assets used in a trade or business, such as buildings, equipment, and vehicles. Depreciation is a critical financial concept for owners and investors of commercial property. Properties that can be depreciated. But, under irs cost segregation guidelines, a significant portion of a building’s cost can. Whether you own construction machinery, office equipment, or manufacturing tools, knowing how depreciation works can save you money and optimize operations. But, under irs cost segregation guidelines, a significant portion of a building’s cost can. Alternative depreciation system (ads) the alternative depreciation system. [3] can i depreciate the cost of land? Explore various building depreciation methods to optimize asset management. Small businesses can depreciate property when they place it in service for use in their trade or business or to produce income. Improvements to land, such as buildings or landscaping, can be depreciated, but the land itself remains unchanged on the balance sheet. But, under irs cost segregation guidelines, a significant portion of a building’s cost can. It allows for. Properties that can be depreciated. Under gds, residential properties can be depreciated over a standard period of 27.5 years. In accounting, we do not depreciate. Real estate used for rental purposes can. This includes assets used in a trade or business, such as buildings, equipment, and vehicles. Alternative depreciation system (ads) the alternative depreciation system. Depreciation is an accounting concept that allows a property owner to expense a portion of a property’s value each year to account for the deterioration in its physical condition. Depreciation is a type of deduction that allows recovering the cost of certain property. It’s an annual allowance for the wear and tear,. But, under irs cost segregation guidelines, a significant portion of a building’s cost can. This includes assets used in a trade or business, such as buildings, equipment, and vehicles. Depreciation is a key accounting concept for managing the. The irs allows you to depreciate properties that are owned, generate income, and have a useful life of more than one year.. This includes assets used in a trade or business, such as buildings, equipment, and vehicles. Depreciation accounts for the wear and tear, aging, and potential obsolescence of the asset. There are several types of capital assets that can be depreciated when you use them in your business. [3] can i depreciate the cost of land? Depreciable assets include all tangible. Depreciation is a key accounting concept for managing the. Small businesses can depreciate property when they place it in service for use in their trade or business or to produce income. Depreciation may seem like a complex accounting term, but its essence is straightforward and holds significant implications, particularly in commercial real estate. Explore various building depreciation methods to optimize asset management and financial planning effectively. This includes assets used in a trade or business, such as buildings, equipment, and vehicles. It applies to commercial buildings, residential. Whether you own construction machinery, office equipment, or manufacturing tools, knowing how depreciation works can save you money and optimize operations. It allows for the allocation of the cost of an asset over its useful life, providing tax. Alternative depreciation system (ads) the alternative depreciation system. It’s an annual allowance for the wear and tear, deterioration or obsolescence of the property. Commercial and residential buildings can be depreciated over a certain number of years based on the type of property. Under gds, residential properties can be depreciated over a standard period of 27.5 years. Depreciable assets include all tangible fixed assets of a business that can be seen and touched such as buildings, machinery, vehicles, and equipment. Commercial buildings commercial properties such as office buildings or retail. Depreciation is a type of deduction that allows recovering the cost of certain property. [3] can i depreciate the cost of land?Depreciation for Building Definition, Formula, and Excel Examples

Difference between Depreciation and Obsolescence Value of Building

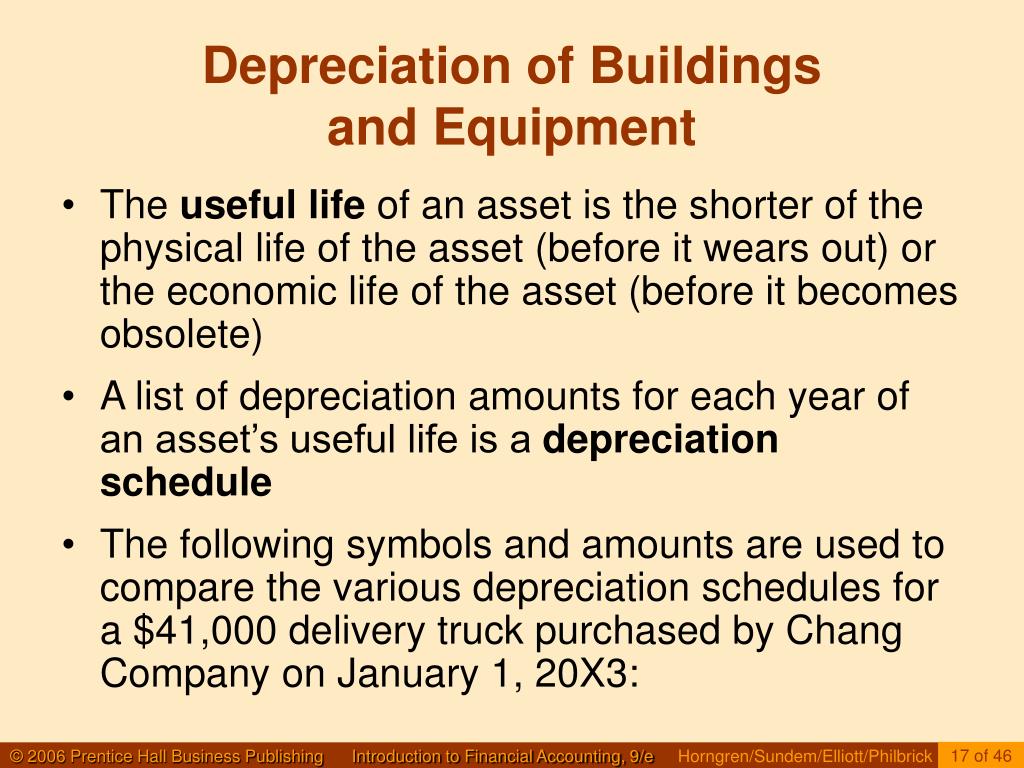

PPT LongLived Assets and Depreciation PowerPoint Presentation ID

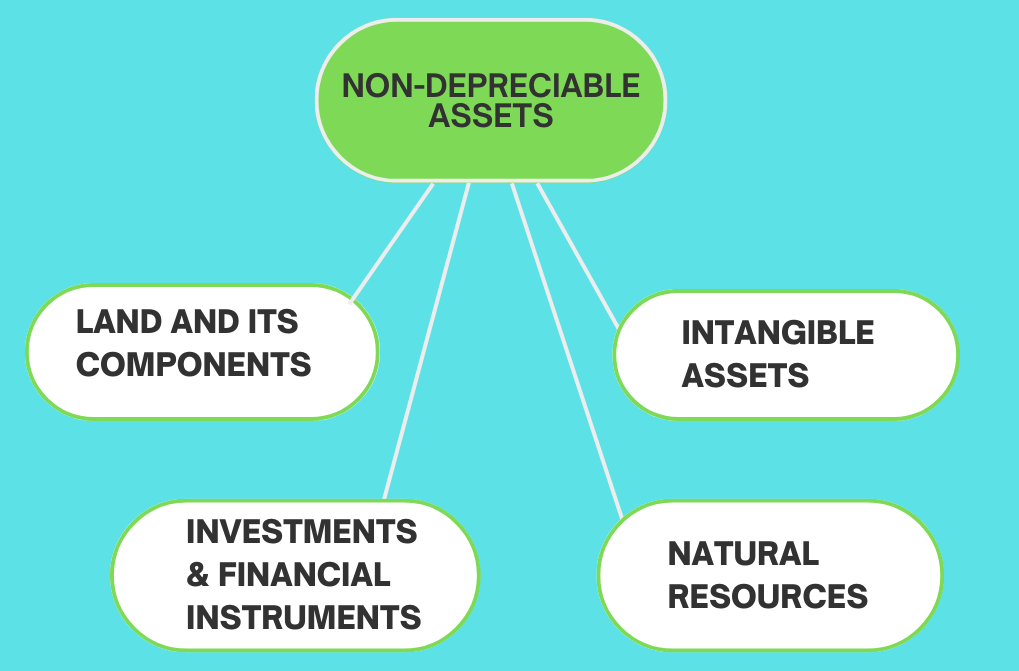

Depreciation of Assets What Asset Cannot Be Depreciated?

Understanding the Depreciation of a Commercial Building

Chapter 7 LongLived Assets and Depreciation. ppt download

Methods of Depreciation Formulas, Problems, and Solutions Owlcation

Depreciation for Building Definition, Formula, and Excel Examples

What is depreciation and how is it calculated? QuickBooks Global

Popular Depreciation Methods To Calculate Asset Value Over The Years

The Irs Allows You To Depreciate Properties That Are Owned, Generate Income, And Have A Useful Life Of More Than One Year.

The Business Stops Depreciating Property When They Have Fully Recovered Their Cost Or Other Basis Or When They Retire It From Service, Whichever.

Depreciation Is An Accounting Concept That Allows A Property Owner To Expense A Portion Of A Property’s Value Each Year To Account For The Deterioration In Its Physical Condition.

There Are Several Types Of Capital Assets That Can Be Depreciated When You Use Them In Your Business.

Related Post: