Can Credit Unions Help Build Credit

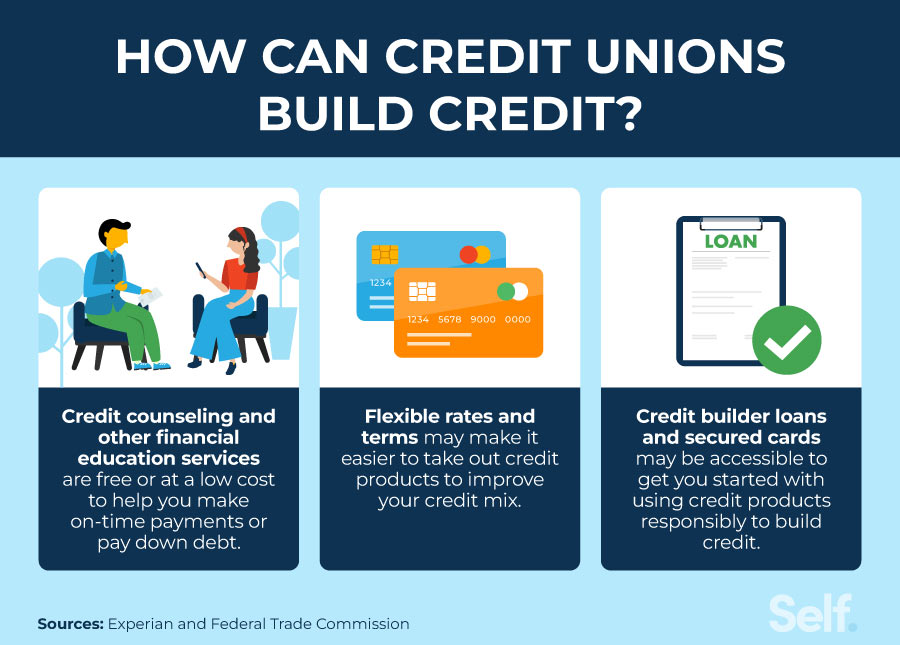

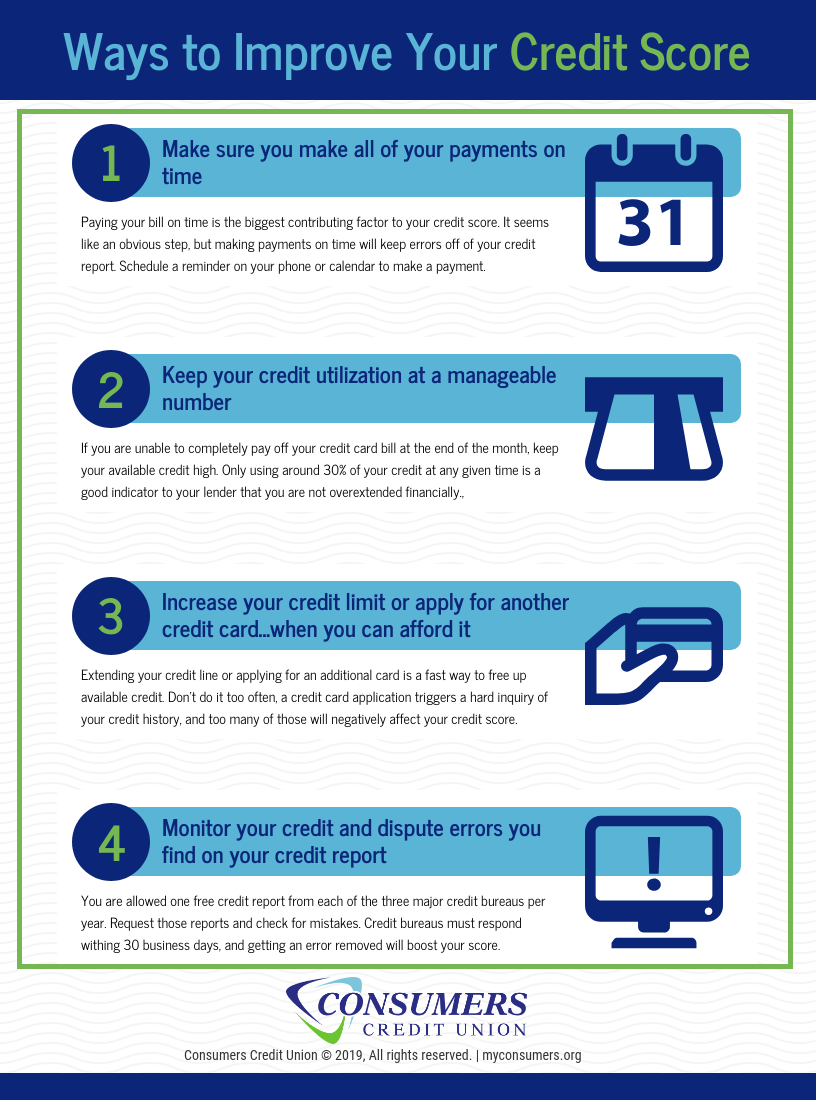

Can Credit Unions Help Build Credit - Good credit will help you save money over time, so it’s important to build strong credit from the beginning. Understand the benefits of membership that help ensure credit unions remain essential, adaptable and thriving. The money basics guides are a series of learning. About the money basics guide serieswelcome to the ncua’s money basics guide to building and maintaining credit! If your credit card has a $1,000 credit limit, use no more than $300 each statement period and. Creditors don't know if they can trust you with a line of credit yet. The competition may seem a bit. We can protect, empower, and advance credit unions when we leverage our collective influence and make it easier than ever for credit union staff and members to get. Marine credit union can help you build your credit score with get credit. You pick the amount to save, and we’ll set you up for success. Don’t let your credit score get in the way of where you want to go. We can protect, empower, and advance credit unions when we leverage our collective influence and make it easier than ever for credit union staff and members to get. By understanding the unique offerings of credit. Understand the benefits of membership that help ensure credit unions remain essential, adaptable and thriving. Marine credit union can help you build your credit score with get credit. Additionally, encouraging the use of a. With a high credit score and good credit history you can qualify for all kinds of perks, including better terms on loans and increased borrowing. You pick the amount to save, and we’ll set you up for success. “credit builder loans” are given out to qualifying members as a way for them to build. You must build credit by getting credit, so we’ve provided three ways to do this. So you basically offer to make it safer for them. When banks can evaluate your credit history to develop a sense of your fiscal responsibility, they can provide quicker decisions when you want to make an offer on that. Good credit will help you save money over time, so it’s important to build strong credit from the beginning. To help. In 2019 marine credit union launched an exclusively digital get credit. About the money basics guide serieswelcome to the ncua’s money basics guide to building and maintaining credit! “credit builder loans” are given out to qualifying members as a way for them to build. Marine credit union has been helping people do just that with a new program starting two. Additionally, encouraging the use of a. Use 30% or less credit: Here's how you can build it with these three smart money strategies. With a high credit score and good credit history you can qualify for all kinds of perks, including better terms on loans and increased borrowing. If your credit card has a $1,000 credit limit, use no more. You pick the amount to save, and we’ll set you up for success. By understanding the unique offerings of credit. Good credit is something that pays off every day. This is the sba’s flagship loan program, offering borrowing amounts of $500,000 to $5,000,000 and a 75% loan guarantee. Don’t let your credit score get in the way of where you. Perhaps they should only use their credit card for essentials like groceries or gas. You pick the amount to save, and we’ll set you up for success. With a high credit score and good credit history you can qualify for all kinds of perks, including better terms on loans and increased borrowing. When you join a credit. The money borrowed. Use 30% or less credit: The competition may seem a bit. Credit unions often have programs meant to help those with nonexistent or poor credit. Creditors don't know if they can trust you with a line of credit yet. Here's how you can build it with these three smart money strategies. In this article, we will explore how credit unions can help you build credit and provide tips for maximizing their benefits. Understand the benefits of membership that help ensure credit unions remain essential, adaptable and thriving. Building strong relationships enhances trust and communication, making it. When banks can evaluate your credit history to develop a sense of your fiscal responsibility,. Don’t let your credit score get in the way of where you want to go. Additionally, encouraging the use of a. When you join a credit. About the money basics guide serieswelcome to the ncua’s money basics guide to building and maintaining credit! Perhaps they should only use their credit card for essentials like groceries or gas. Additionally, encouraging the use of a. Creditors don't know if they can trust you with a line of credit yet. Perhaps they should only use their credit card for essentials like groceries or gas. The money borrowed is secured in the. Use 30% or less credit: Understand the benefits of membership that help ensure credit unions remain essential, adaptable and thriving. To help avoid this scenario, set some ground rules. In 2019 marine credit union launched an exclusively digital get credit. Here's how you can build it with these three smart money strategies. Marine credit union can help you build your credit score with get credit. With a high credit score and good credit history you can qualify for all kinds of perks, including better terms on loans and increased borrowing. “credit builder loans” are given out to qualifying members as a way for them to build. Credit unions often have programs meant to help those with nonexistent or poor credit. By understanding the unique offerings of credit. The money basics guides are a series of learning. Additionally, encouraging the use of a. You must build credit by getting credit, so we’ve provided three ways to do this. Good credit is something that pays off every day. This is the sba’s flagship loan program, offering borrowing amounts of $500,000 to $5,000,000 and a 75% loan guarantee. Perhaps they should only use their credit card for essentials like groceries or gas. You pick the amount to save, and we’ll set you up for success. Use 30% or less credit: Building strong relationships enhances trust and communication, making it. Understand the benefits of membership that help ensure credit unions remain essential, adaptable and thriving. A credit builder loan is a loan designed to assist members with no credit or past credit problems as they strive to establish a better credit history. Don’t let your credit score get in the way of where you want to go.Do Credit Unions Help You Build Your Credit? SoFi

Articles About Building Credit From Scratch Self. Page 2

Do credit unions help build credit? Leia aqui Can you build a credit

How Can I Start Building Credit RBFCU Credit Union

How to Build Credit Without a Credit Card PenFed Credit Union

Does credit union build your credit? Leia aqui Do credit unions help

Does credit union build credit? Leia aqui Will joining a credit union

Do credit unions help build credit? Leia aqui Can you build a credit

Do credit unions help build credit? Leia aqui Can you build a credit

Do Credit Unions Help Build Credit? Self. Credit Builder.

Creditors Don't Know If They Can Trust You With A Line Of Credit Yet.

About The Money Basics Guide Serieswelcome To The Ncua’s Money Basics Guide To Building And Maintaining Credit!

We Can Protect, Empower, And Advance Credit Unions When We Leverage Our Collective Influence And Make It Easier Than Ever For Credit Union Staff And Members To Get.

Using Your Credit Card Will Help You Build Your Credit, But Don’t Overuse It.

Related Post:

.png?width=752&name=alt lending comparison infographic (1).png)