Can I Start Building My Credit At 17

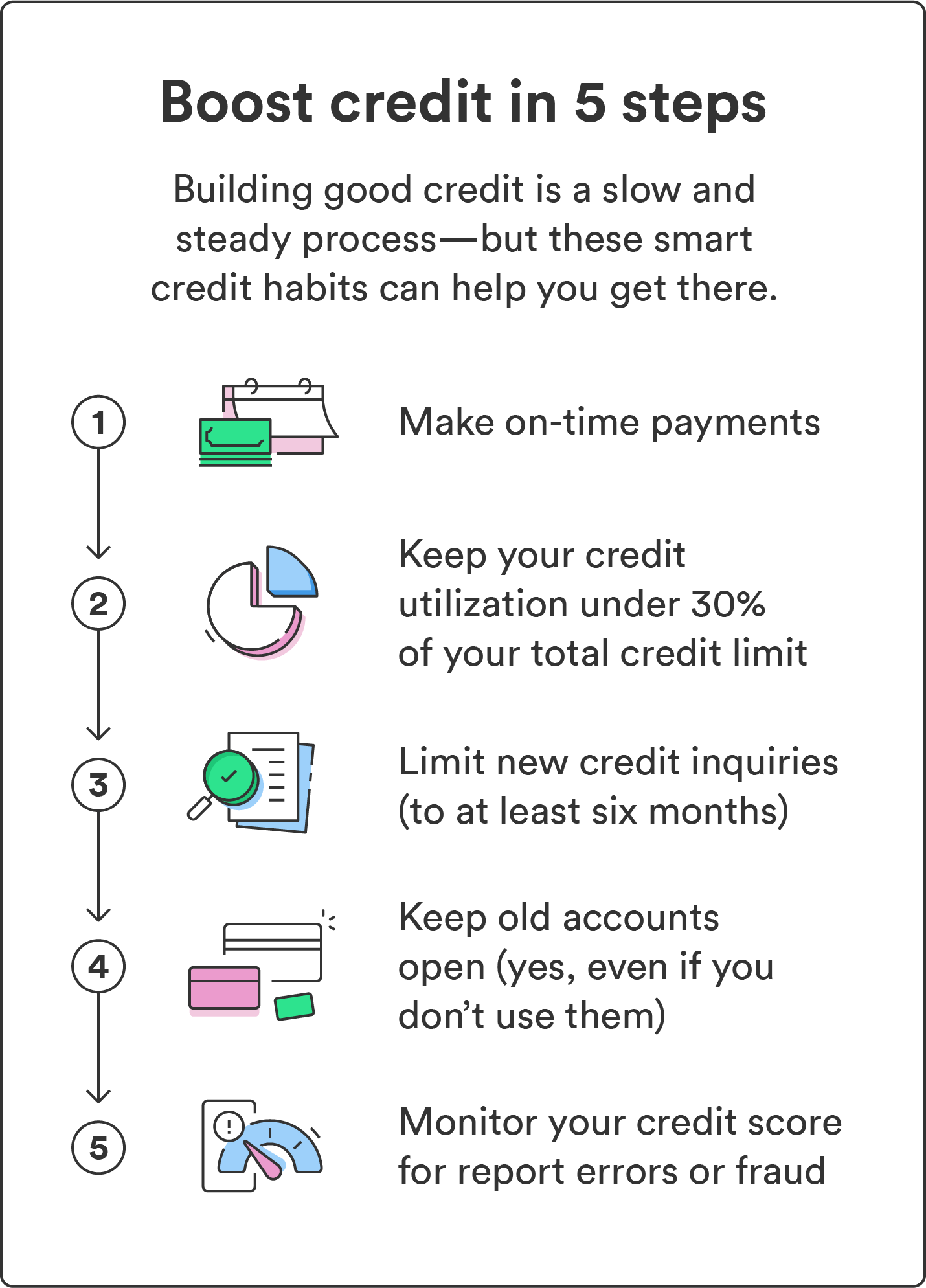

Can I Start Building My Credit At 17 - Learn how to build credit as a teenager with these tips from tdecu that include becoming an authorized user on someone else's credit card, and more. The short answer is that 18 is the minimum age for financial products such as loans and credit cards. One first step for teenagers to build credit involves riding on the coattails of their parents through becoming an authorized user on an existing credit card. There are many of benefits to. Well, although you need to be at least 18 to legally open credit accounts, you can still start building credit at 17. And, more specifically, at what age can you start building credit? If you’re able to help your child start building credit at 18, they will be better off than if they started at 24. Building a solid financial foundation is a journey that begins with small steps, and one of those significant steps is building your credit. You can become an authorized user on a parent’s. In this article, we will delve into the importance of. Credit is a measure of financial trustworthiness that. We’ll explore all your options, from becoming an authorized. It’s never too early to start. In this article, we will delve into the importance of. Learning how to build credit at 17 not only sets a strong financial foundation early on but could also help in saving significantly on interest and fees in the future. Contrary to popular misconceptions, you can't build credit with a regular bank. There are many of benefits to. Choose the right business structure. Obtaining a credit card at 17 has unique challenges, but options like becoming an authorized user, using secured cards, and parental involvement can help teenagers start. But that doesn’t mean you’re out of luck. Before you can start building credit, you need to set up your business the right way. By following a few simple steps, you can start building a solid credit foundation that will benefit you for years to come. The short answer is that 18 is the minimum age for financial products such as loans and credit cards. Obtaining a credit. Before you can start building credit, you need to set up your business the right way. By following a few simple steps, you can start building a solid credit foundation that will benefit you for years to come. In this article, we will delve into the importance of. They report to major business credit bureaus (d&b,. And, more specifically, at. Well, although you need to be at least 18 to legally open credit accounts, you can still start building credit at 17. Obtaining a credit card at 17 has unique challenges, but options like becoming an authorized user, using secured cards, and parental involvement can help teenagers start. Credit is a measure of financial trustworthiness that. You can become an. We’ll explore all your options, from becoming an authorized. One first step for teenagers to build credit involves riding on the coattails of their parents through becoming an authorized user on an existing credit card. There are many of benefits to. The short answer is that 18 is the minimum age for financial products such as loans and credit cards.. By following a few simple steps, you can start building a solid credit foundation that will benefit you for years to come. You can become an authorized user on a parent’s. But that doesn’t mean you’re out of luck. It’s never too early to start. Credit is a measure of financial trustworthiness that. In this article, we will delve into the importance of. You need to be 18 to open your own credit card, but that doesn’t mean you have to wait until then to start building your credit. But that doesn’t mean you’re out of luck. There are many of benefits to. Credit is a measure of financial trustworthiness that. You can’t technically get your own credit card until you’re 18. We’ll explore all your options, from becoming an authorized. By following a few simple steps, you can start building a solid credit foundation that will benefit you for years to come. They report to major business credit bureaus (d&b,. The earlier you start, the. Choose the right business structure. By following a few simple steps, you can start building a solid credit foundation that will benefit you for years to come. The earlier you start, the. And, more specifically, at what age can you start building credit? They report to major business credit bureaus (d&b,. By following a few simple steps, you can start building a solid credit foundation that will benefit you for years to come. Choose the right business structure. If you’re able to help your child start building credit at 18, they will be better off than if they started at 24. In this article, we will delve into the importance of.. The earlier you start, the. Obtaining a credit card at 17 has unique challenges, but options like becoming an authorized user, using secured cards, and parental involvement can help teenagers start. We’ll explore all your options, from becoming an authorized. If you’re able to help your child start building credit at 18, they will be better off than if they. It’s never too early to start. By following a few simple steps, you can start building a solid credit foundation that will benefit you for years to come. Traditionally, you can start building credit. Obtaining a credit card at 17 has unique challenges, but options like becoming an authorized user, using secured cards, and parental involvement can help teenagers start. You need to be 18 to open your own credit card, but that doesn’t mean you have to wait until then to start building your credit. Choose the right business structure. One first step for teenagers to build credit involves riding on the coattails of their parents through becoming an authorized user on an existing credit card. Well, although you need to be at least 18 to legally open credit accounts, you can still start building credit at 17. Credit is a measure of financial trustworthiness that. In this article, we will delve into the importance of. Learning how to build credit at 17 not only sets a strong financial foundation early on but could also help in saving significantly on interest and fees in the future. They report to major business credit bureaus (d&b,. If you’re able to help your child start building credit at 18, they will be better off than if they started at 24. And you might wonder, at what age can you start building credit? The earlier you start, the. The short answer is that 18 is the minimum age for financial products such as loans and credit cards.can you start credit at 17 Ester Wynn

What Age Can You Start Building Credit (Plus How to Do it)

How Quickly Can You Truly Build Great Credit

How can I build my credit at 17? Leia aqui Can a 17 year old build

How can I build my credit at 17? Leia aqui Can a 17 year old build

How can I build my credit at 17? Leia aqui Can a 17 year old build

can you start credit at 17 Ester Wynn

How to Build Credit The 7Step Guide Chime

Build Credit for Teens 5 Simple Ways to Get Started

How do you start building your credit score? Leia aqui How do I start

You Can Become An Authorized User On A Parent’s.

Before You Can Start Building Credit, You Need To Set Up Your Business The Right Way.

And, More Specifically, At What Age Can You Start Building Credit?

You Can’t Technically Get Your Own Credit Card Until You’re 18.

Related Post: