Can I Use My Credit Builder Card At The Atm

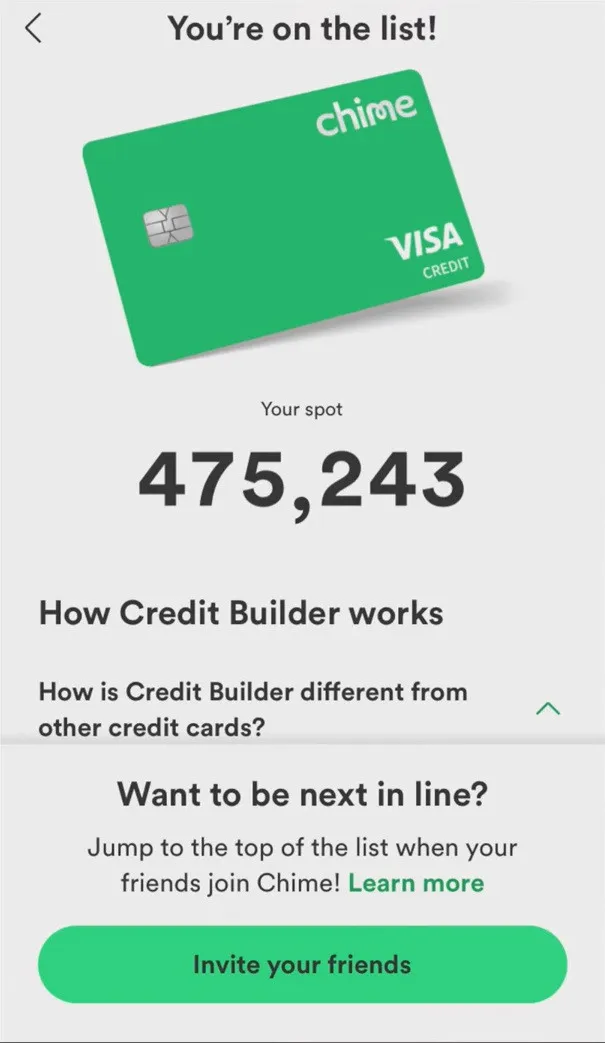

Can I Use My Credit Builder Card At The Atm - You can use your credit builder card to withdraw 90% of your credit limit from an atm (plus some fees) in the form of a “card cash advance,” or you can transfer funds with cashapp. When it comes to accessing your credit limit on your card, you can only ever withdraw 90% of it at a time from an. When used responsibly, they can help you build a strong credit history,. Credit cards can be a great financial tool, offering convenience, rewards, and enhanced security. How do i get funds off of my credit builder card's credit limit? This means that you can withdraw up to $500 in cash from an atm using your chime credit builder account in a 24. The card cash advance is a feature unique to the credit builder card and allows you to advance cash at an atm. Can i add cash to my builder card's security deposit outside of the cleo app? Activating your chime credit builder card is a straightforward process, whether done via the chime app, phone, or online. Or stride bank, n.a., pursuant to licenses from visa u.s.a. Credit builder atm withdrawals don’t affect the withdrawal limits on your debit card. The card cash advance is subject to a $2.50 fee per transaction plus any fee. You can use your chime card wherever visa is accepted, including to. The chime credit builder atm withdrawal limit is set at $500 per day. Credit cards can be a great financial tool, offering convenience, rewards, and enhanced security. Or stride bank, n.a., pursuant to licenses from visa u.s.a. This fee can go up to $5 when using international atms. Also you can’t pull money out the atm from you. I am not sure on this. This means that you can withdraw up to $500 in cash from an atm using your chime credit builder account in a 24. Credit builder atm withdrawals don’t affect the withdrawal limits on your debit card. Credit cards can be a great financial tool, offering convenience, rewards, and enhanced security. If your credit builder available to spend is less than $1,015, you can withdraw up to that amount from atms. Can i add cash to my builder card's security deposit outside of the. Credit builder atm withdrawals don’t affect the withdrawal limits on your debit card. When used responsibly, they can help you build a strong credit history,. This means that you can withdraw up to $500 in cash from an atm using your chime credit builder account in a 24. There is no credit check to apply. You can use your chime. When it comes to accessing your credit limit on your card, you can only ever withdraw 90% of it at a time from an. Yes, you can use your chime credit builder card at atms! There is no credit check to apply. If you have insurance, file a claim as soon as possible and be. There is no minimum deposit. This means that you can withdraw up to $500 in cash from an atm using your chime credit builder account in a 24. However, it’s essential to note that the card functions more like a debit card than a traditional credit card. Also you can’t pull money out the atm from you. There is no minimum deposit required, and you. There is no credit check to apply. However, it’s essential to note that the card functions more like a debit card than a traditional credit card. When used responsibly, they can help you build a strong credit history,. If you have insurance, file a claim as soon as possible and be. Your secured credit builder card has an atm withdrawal. This means that you can withdraw up to $500 in cash from an atm using your chime credit builder account in a 24. Or stride bank, n.a., pursuant to licenses from visa u.s.a. However, it’s essential to note that the card functions more like a debit card than a traditional credit card. When it comes to accessing your credit limit. If your credit builder available to spend is less than $1,015, you can withdraw up to that amount from atms. Yes, you can definitely use your credit builder card at an atm to withdraw cash, just like a regular debit or credit card. Can i use my credit builder card at an atm? Credit cards can be a great financial. The chime visa® debit card and the secured chime credit builder visa® credit card are issued by the bancorp bank, n.a. There is no credit check to apply. Yes, you can definitely use your credit builder card at an atm to withdraw cash, just like a regular debit or credit card. This means that you can withdraw up to $500. Remember, strong credit scores are the keys that can open a lot of doors. Credit builder atm withdrawals don’t affect the withdrawal limits on your debit card. This means that you can withdraw up to $500 in cash from an atm using your chime credit builder account in a 24. Also you can’t pull money out the atm from you.. Credit cards can be a great financial tool, offering convenience, rewards, and enhanced security. Your secured credit builder card has an atm withdrawal limit of $1,015 per day. Remember, strong credit scores are the keys that can open a lot of doors. There is no minimum deposit required, and you set and control your own spending limit. The card cash. Remember, strong credit scores are the keys that can open a lot of doors. Yes, you can definitely use your credit builder card at an atm to withdraw cash, just like a regular debit or credit card. If your credit builder available to spend is less than $1,015, you can withdraw up to that amount from atms. This means that you can withdraw up to $500 in cash from an atm using your chime credit builder account in a 24. You can use your chime card wherever visa is accepted, including to. You can use your credit builder card to withdraw 90% of your credit limit from an atm (plus some fees) in the form of a “card cash advance,” or you can transfer funds with cashapp. Activating your chime credit builder card is a straightforward process, whether done via the chime app, phone, or online. The chime credit builder atm withdrawal limit is set at $500 per day. The chime visa® debit card and the secured chime credit builder visa® credit card are issued by the bancorp bank, n.a. How do i get funds off of my credit builder card's credit limit? From what i hear is when you out money in the credit builder account it can’t be moved/transferred. You can now use your secured chime visa® credit builder card to withdraw cash in the amount of either your available to spend or a max of $500 every 24 hours, whichever is lower. The chime credit builder visa ® credit card isn’t like traditional credit cards, and it’s even different from other secured credit cards. Credit cards can be a great financial tool, offering convenience, rewards, and enhanced security. The card cash advance is a feature unique to the credit builder card and allows you to advance cash at an atm. However, there are some important factors to consider, such as fees,.Can I Use My Chime Credit Builder Card With No Money Transfer Mone

How do I get cash off my Self card? Leia aqui Can I use self credit

Chime Card ATM, Credit & Debit Card Features

How Does Chime Credit Builder Card Help In Fulfilling My Requirements?

Credit Builder Card Chime

Can I withdraw money from an ATM with my Credit Builder card? Help

Can I use my Chime credit builder card at ATM? How to use it? UniTopTen

What a Credit Builder Card is, and Why You Need One — Grow Credit Blog

US challenger bank Chime launches Credit Builder, a credit card that

Can I Use My Chime Credit Builder Card At Atm Chime Bank Review

This Fee Can Go Up To $5 When Using International Atms.

Can I Use My Credit Builder Card At An Atm?

The Card Cash Advance Is Subject To A $2.50 Fee Per Transaction Plus Any Fee.

Yes, You Can Use Your Chime Credit Builder Card At Atms!

Related Post: