Can Klarna Build Credit

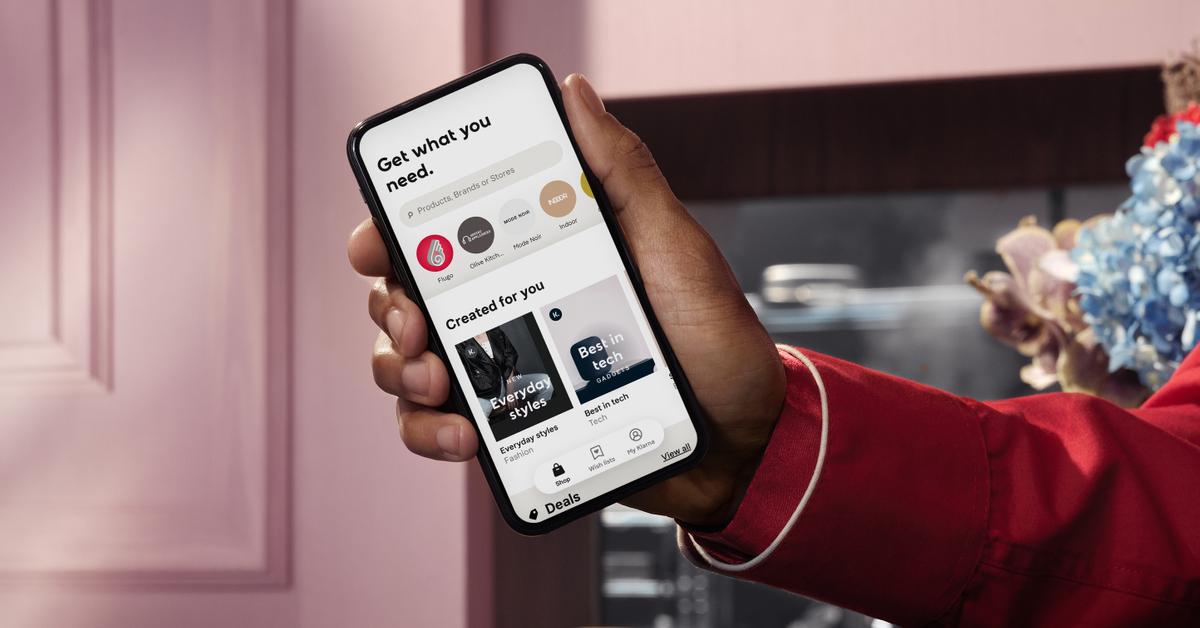

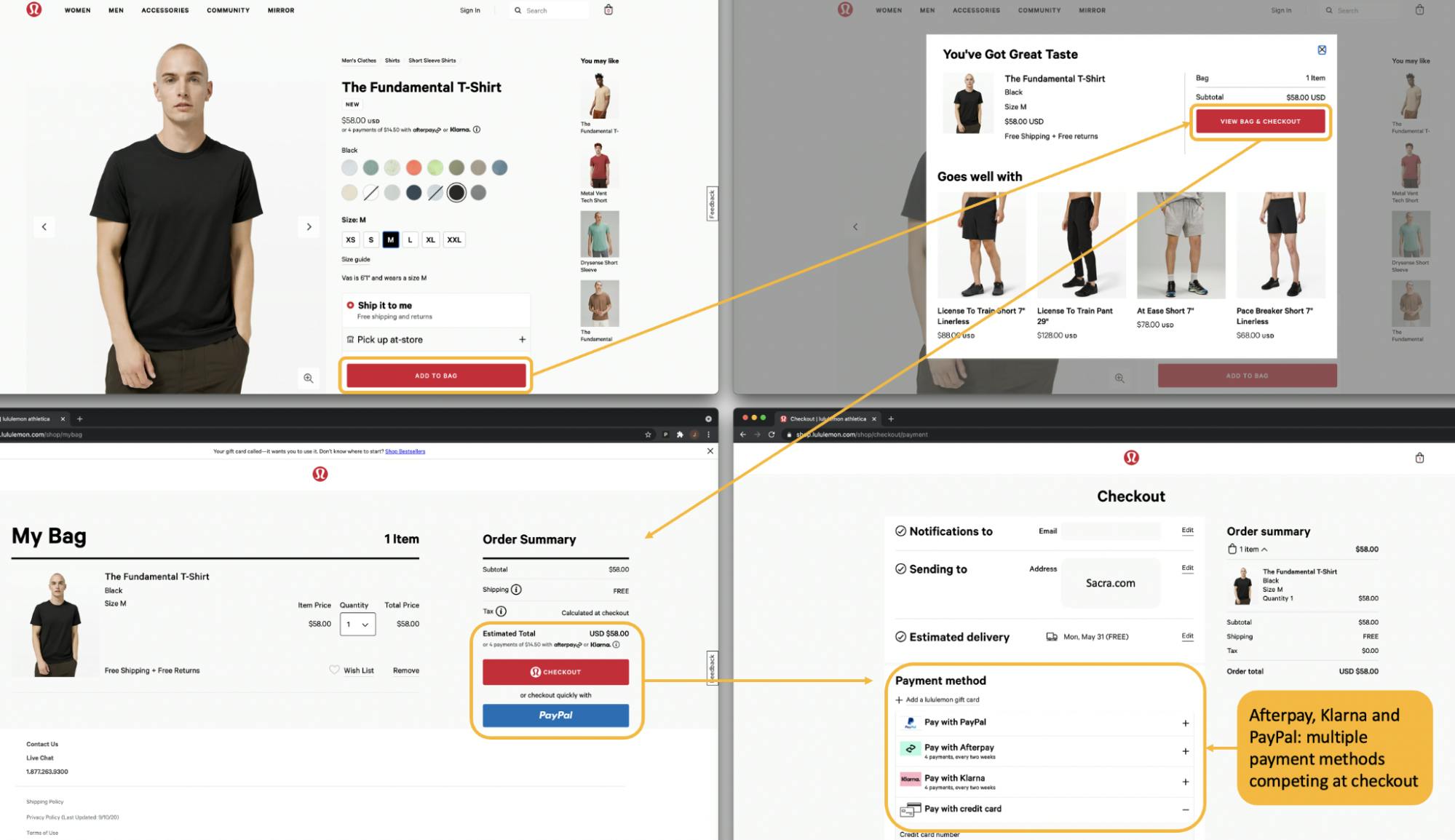

Can Klarna Build Credit - Klarna doesn’t set a minimum credit score to qualify for its finance products. Klarna offers four payment options: With good credit (typically, credit scores of at least 690), you could qualify for a credit card that offers a 0% introductory apr for 12, 15 or 18 months, sometimes longer. As with any form of credit or financing, how. While it doesn't build credit, it can harm a person's score. Credit card number, address, and password over and over again. Let’s dig a bit deeper into the klarna. Referrals to build trust, drive traffic, and increase conversion, with yotpo in place. Klarna accepts major credit cards, including visa, discover, mastercard, and maestro, but not prepaid cards. However, lenders you apply to for credit in the future could see. Using klarna’s payment options won’t affect your credit score in itself. Klarna performs credit checks through transunion and experian, which can temporarily affect your score. As with any form of credit or financing, how. Although your credit score won’t automatically be affected if you use klarna, the payment method you choose can have an impact. Klarna accepts major credit cards, including visa, discover, mastercard, and maestro, but not prepaid cards. Let’s dig a bit deeper into the klarna. 31% of global consumers switched brands because they felt that the company was lying about product performance. However, klarna may look at your credit report as a whole before making a decision. Will missed klarna payments lower my credit score? Yes, using klarna responsibly by making timely payments can help build a positive credit history. Yes, using klarna responsibly by making timely payments can help build a positive credit history. However, lenders you apply to for credit in the future could see. While it doesn't build credit, it can harm a person's score. Klarna checks your credit each time you use the service to make a purchase, but the kind of credit check depends on. Using klarna’s payment options won’t affect your credit score in itself. If you sign up for klarna in the u.s. Let’s dig a bit deeper into the klarna. However, klarna may look at your credit report as a whole before making a decision. While it doesn't build credit, it can harm a person's score. Klarna performs credit checks through transunion and experian, which can temporarily affect your score. 31% of global consumers switched brands because they felt that the company was lying about product performance. Klarna doesn’t set a minimum credit score to qualify for its finance products. Klarna can help build credit if used responsibly by maintaining a positive payment history. Klarna checks. As with any form of credit or financing, how. Timely payments with klarna are reported to credit bureaus and positively. Credit card number, address, and password over and over again. Using klarna’s payment options won’t affect your credit score in itself. Klarna doesn’t set a minimum credit score to qualify for its finance products. Klarna accepts major credit cards, including visa, discover, mastercard, and maestro, but not prepaid cards. Referrals to build trust, drive traffic, and increase conversion, with yotpo in place. Using klarna’s payment options won’t affect your credit score in itself. Klarna is a buy now, pay later (bnpl) service, which you can download on app stores or access via their website,. Timely payments with klarna are reported to credit bureaus and positively. However, klarna may look at your credit report as a whole before making a decision. Using klarna’s payment options won’t affect your credit score in itself. Although your credit score won’t automatically be affected if you use klarna, the payment method you choose can have an impact. With good. Klarna offers four payment options: 31% of global consumers switched brands because they felt that the company was lying about product performance. With good credit (typically, credit scores of at least 690), you could qualify for a credit card that offers a 0% introductory apr for 12, 15 or 18 months, sometimes longer. Klarna accepts major credit cards, including visa,. However, lenders you apply to for credit in the future could see. The finance/credit industry in the us has. However, klarna may look at your credit report as a whole before making a decision. Before june 1, 2022, klarna didn’t directly report your payment history to credit reference agencies (cras) in the uk (like experian and transunion). As with any. However, klarna may look at your credit report as a whole before making a decision. Credit card number, address, and password over and over again. Klarna doesn’t set a minimum credit score to qualify for its finance products. Timely payments with klarna are reported to credit bureaus and positively. Before june 1, 2022, klarna didn’t directly report your payment history. Will missed klarna payments lower my credit score? Credit card number, address, and password over and over again. As with any form of credit or financing, how. Klarna can help build credit if used responsibly by maintaining a positive payment history. That means there would be no impact to. Klarna offers four payment options: Credit card number, address, and password over and over again. However, lenders you apply to for credit in the future could see. Will missed klarna payments lower my credit score? Timely payments with klarna are reported to credit bureaus and positively. Before june 1, 2022, klarna didn’t directly report your payment history to credit reference agencies (cras) in the uk (like experian and transunion). The finance/credit industry in the us has. Klarna doesn’t set a minimum credit score to qualify for its finance products. Klarna can help build credit if used responsibly by maintaining a positive payment history. With good credit (typically, credit scores of at least 690), you could qualify for a credit card that offers a 0% introductory apr for 12, 15 or 18 months, sometimes longer. Referrals to build trust, drive traffic, and increase conversion, with yotpo in place. Let’s dig a bit deeper into the klarna. If you sign up for klarna in the u.s. While it doesn't build credit, it can harm a person's score. Klarna performs credit checks through transunion and experian, which can temporarily affect your score. That means there would be no impact to.Does Klarna Build Credit? Cleo

Why does Klarna not show on my credit report? Leia aqui Does Klarna

Does Klarna affect your credit score? Leia aqui Is Klarna going to

Does the Klarna Shopping Platform Help Build Your Credit?

Does Klarna build my credit? Leia aqui Is Klarna good for building

Can Klarna Help Build Credit? DollarSlate

Can Klarna improve credit? Leia aqui Does Klarna boost your credit

Can you pay Klarna with a credit card? Leia aqui Why can’t i pay

Did Klarna help build credit? Leia aqui Is Klarna good for building

Does BuyNowPayLater Solution Klarna Build Credit?

As With Any Form Of Credit Or Financing, How.

Using Klarna’s Payment Options Won’t Affect Your Credit Score In Itself.

Yes, Using Klarna Responsibly By Making Timely Payments Can Help Build A Positive Credit History.

31% Of Global Consumers Switched Brands Because They Felt That The Company Was Lying About Product Performance.

Related Post:

.png)