Can Prepaid Credit Cards Build Credit

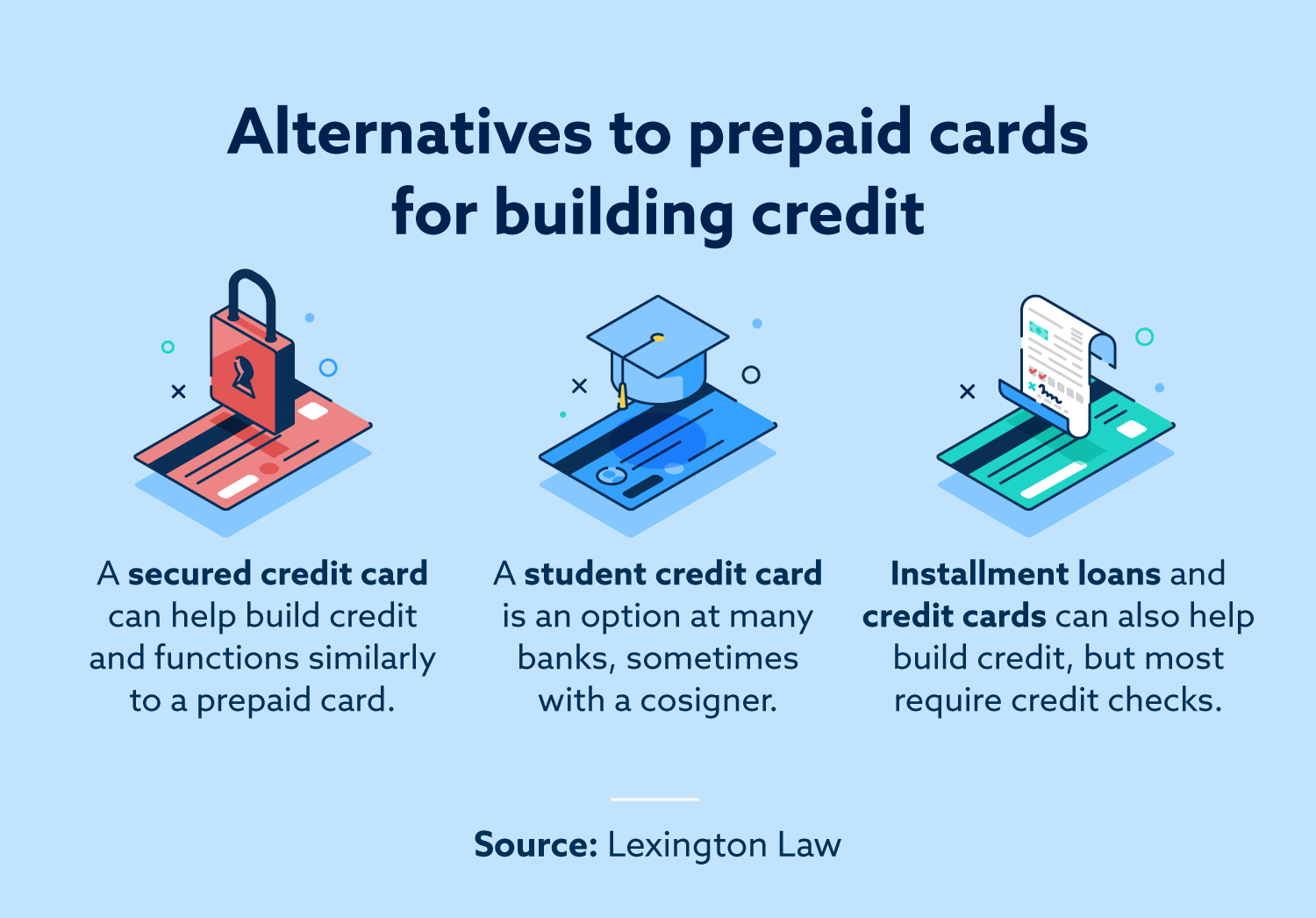

Can Prepaid Credit Cards Build Credit - Prepaid cards don’t build credit and shouldn’t be confused with secured credit cards. To build good credit, you need to make sure that you’re paying a bill that gets reported to each major credit bureau — experian,. If you pay off your credit card monthly, you can use your credit. This can open the door to better credit deals in the future. Lenders have touted bnpl as a safer alternative to traditional credit card debt, along with its ability to serve consumers with limited or subprime credit histories. Reloadable credit cards, also known as prepaid cards, allow you to load funds and spend money without needing to apply for credit or open a bank account. Neither prepaid cards nor debit cards report usage information to the major credit bureaus, which means they have absolutely no impact on your credit standing. Make sure you read all the t&cs. If you currently use a prepaid card to manage your finances, some. If you have a poor credit history, you can use a prepaid card to build credit—peek into when it’s best to use one and other ways to develop your score. Prepaid credit cards will not show up on your credit report , and they won't be. Prepaid cards look like credit cards and spend like credit cards, but there’s no credit behind them. What is a prepaid credit card? Prepaid credit cards cannot help you build credit. Prepaid credit cards do not help to build credit because the issuers do not report to credit bureaus. The loan providers or credit lenders use credit scores as the primary factor to approve customers’ loan applications. However, when it comes to building credit, prepaid credit cards are no substitute for the real thing. This can open the door to better credit deals in the future. If you're using a card for every. Neither prepaid cards nor debit cards report usage information to the major credit bureaus, which means they have absolutely no impact on your credit standing. This can open the door to better credit deals in the future. Both options provide a completely different solution. Lenders have touted bnpl as a safer alternative to traditional credit card debt, along with its ability to serve consumers with limited or subprime credit histories. The perpay credit card, issued by celtic bank, is designed to help cardholders who want. If you pay off your credit card monthly, you can use your credit. The loan providers or credit lenders use credit scores as the primary factor to approve customers’ loan applications. Most credit cards offer some type of rewards, whether it's cash back, points, or travel miles. Prepaid cards let you make purchases with money you’ve loaded onto the card,. There’s no such thing as a prepaid credit card that builds credit. Most credit cards offer some type of rewards, whether it's cash back, points, or travel miles. If you're using a card for every. Both options provide a completely different solution. You can earn rewards on everything. Reloadable credit cards, also known as prepaid cards, allow you to load funds and spend money without needing to apply for credit or open a bank account. The perpay credit card, issued by celtic bank, is designed to help cardholders who want to build credit, but are seeking an alternative to secured credit cards.instead of requiring. Make sure you read. Keep paying your card on time and you can build up a positive credit history. Prepaid credit cards cannot help you build credit. If you currently use a prepaid card to manage your finances, some. Prepaid credit cards do not help to build credit because the issuers do not report to credit bureaus. The perpay credit card, issued by celtic. If you have a poor credit history, you can use a prepaid card to build credit—peek into when it’s best to use one and other ways to develop your score. To build good credit, you need to make sure that you’re paying a bill that gets reported to each major credit bureau — experian,. You can get a prepaid card. Keep paying your card on time and you can build up a positive credit history. Some services like cred.ai can let you use a debit card and build credit at the same time. Most credit cards offer some type of rewards, whether it's cash back, points, or travel miles. Reloadable credit cards, also known as prepaid cards, allow you to. The cards that come closest to prepaid cards are secured cards that require a deposit which sets your spending limit. Most credit cards offer some type of rewards, whether it's cash back, points, or travel miles. There are two different products it could be. Make sure you read all the t&cs. Neither prepaid cards nor debit cards report usage information. You can get a prepaid card without a. You can earn rewards on everything. There’s no such thing as a prepaid credit card that builds credit. To build good credit, you need to make sure that you’re paying a bill that gets reported to each major credit bureau — experian,. If you have a poor credit history, you can use. Some services like cred.ai can let you use a debit card and build credit at the same time. Prepaid credit cards do not help to build credit because the issuers do not report to credit bureaus. Prepaid cards let you make purchases with money you’ve loaded onto the card, instead of drawing from a bank account or line of credit.. Prepaid credit cards will not show up on your credit report , and they won't be. Some services like cred.ai can let you use a debit card and build credit at the same time. You can get a prepaid card without a. In fact, the term “prepaid credit card” itself is a misnomer. The perpay credit card, issued by celtic bank, is designed to help cardholders who want to build credit, but are seeking an alternative to secured credit cards.instead of requiring. Keep paying your card on time and you can build up a positive credit history. What is a prepaid credit card? Lenders have touted bnpl as a safer alternative to traditional credit card debt, along with its ability to serve consumers with limited or subprime credit histories. There are two different products it could be. There’s no such thing as a prepaid credit card that builds credit. Both options provide a completely different solution. This can open the door to better credit deals in the future. Reloadable credit cards, also known as prepaid cards, allow you to load funds and spend money without needing to apply for credit or open a bank account. If you pay off your credit card monthly, you can use your credit. Make sure you read all the t&cs. Neither prepaid cards nor debit cards report usage information to the major credit bureaus, which means they have absolutely no impact on your credit standing.What is a prepaid card? Prepaid, debit + credit cards Lexington Law

Can Prepaid Cards Help Build Credit? (November 2024) Scholaroo

5 Best Prepaid Credit Cards To Build Credit by Christinathomas Aug

Do Prepaid Credit Cards Help Build Your Credit? SoFi

Does A Prepaid Credit Card Help To Build a Credit Score? Credello

Best Prepaid Credit Cards to Build Credit 2019 Every Buck Counts

Top 5 Best Prepaid Credit Cards To Build Credit AquilaResources

5 Prepaid Cards That Build Credit (2025)

Top 5 Best Prepaid Credit Cards To Build Credit AquilaResources

Top 5 Best Prepaid Credit Cards To Build Credit AquilaResources

Prepaid Credit Cards Do Not Help To Build Credit Because The Issuers Do Not Report To Credit Bureaus.

The Loan Providers Or Credit Lenders Use Credit Scores As The Primary Factor To Approve Customers’ Loan Applications.

Prepaid Cards Don’t Build Credit And Shouldn’t Be Confused With Secured Credit Cards.

People With Low Credit Scores Prefer Prepaid Credit Cards.

Related Post: