Can Renting An Apartment Build Your Credit

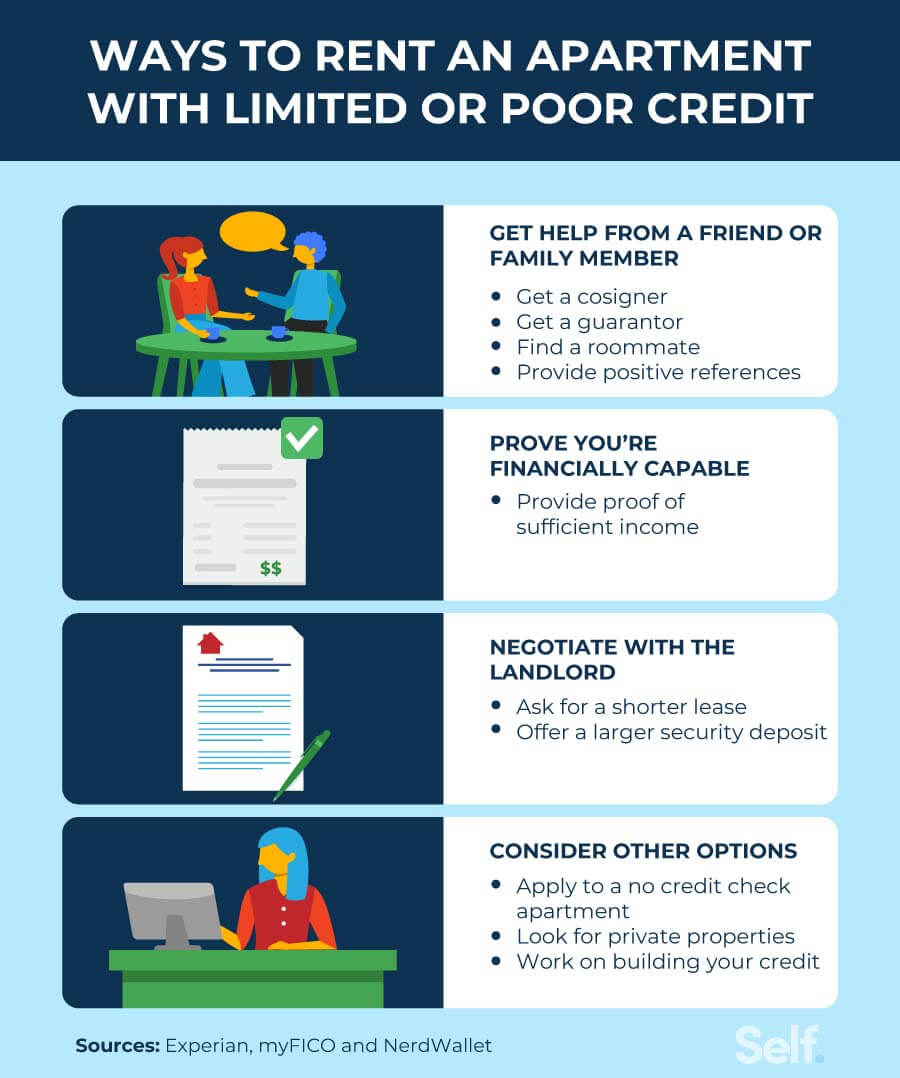

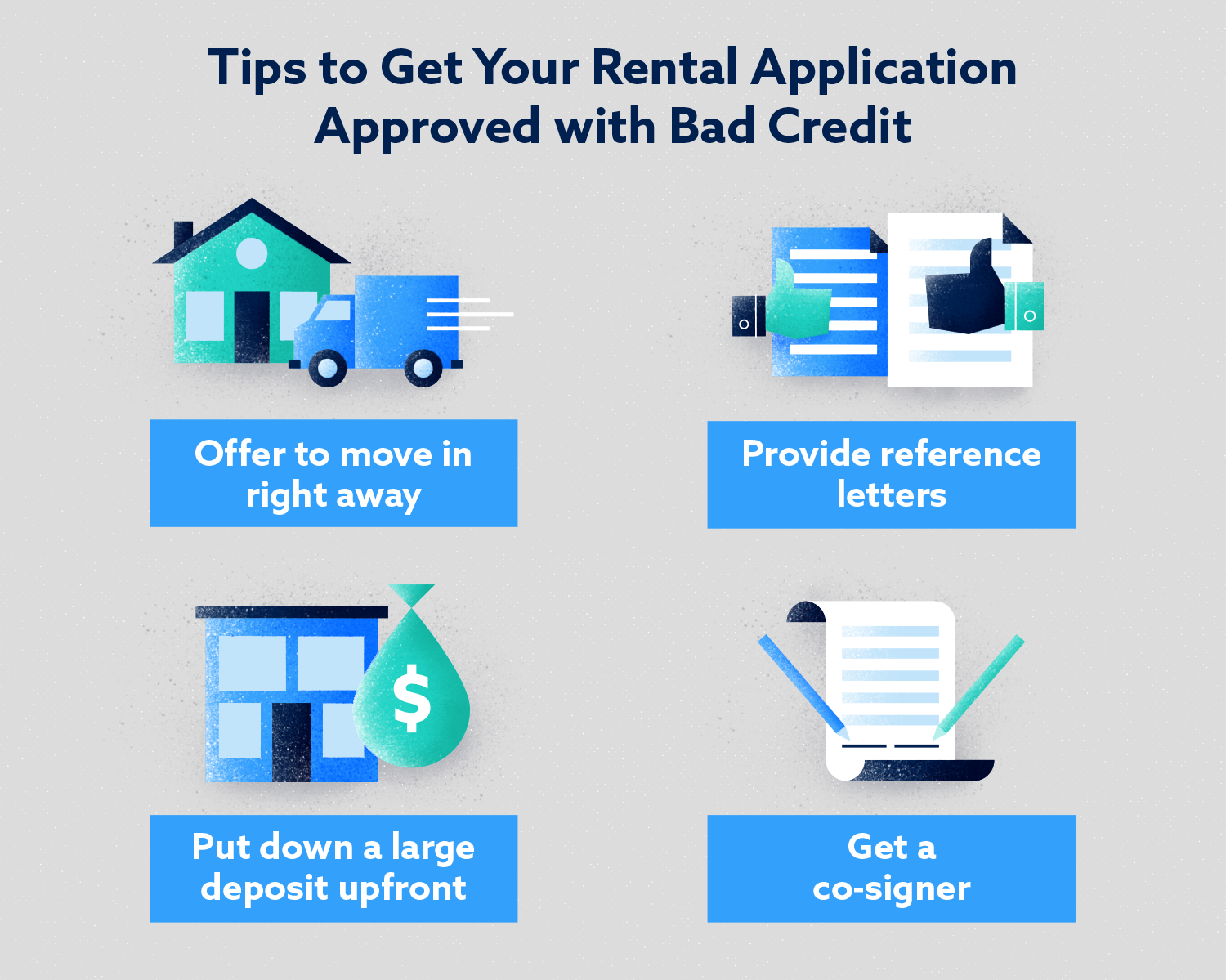

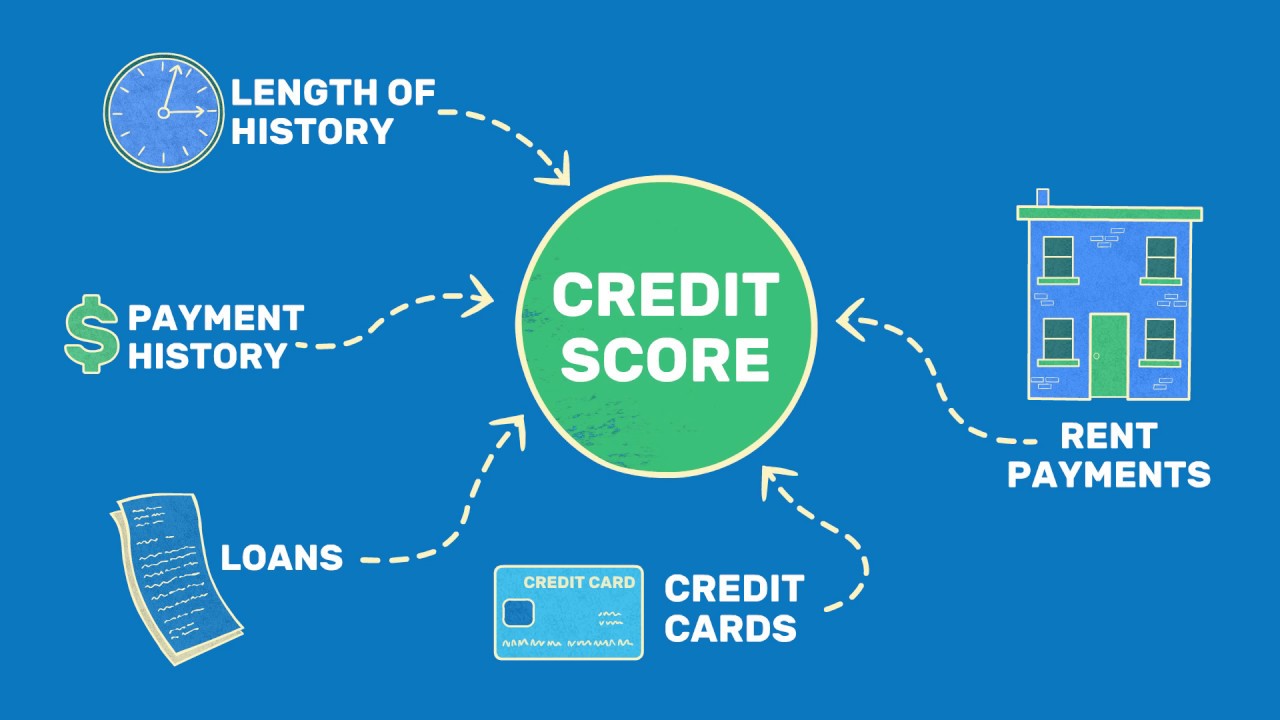

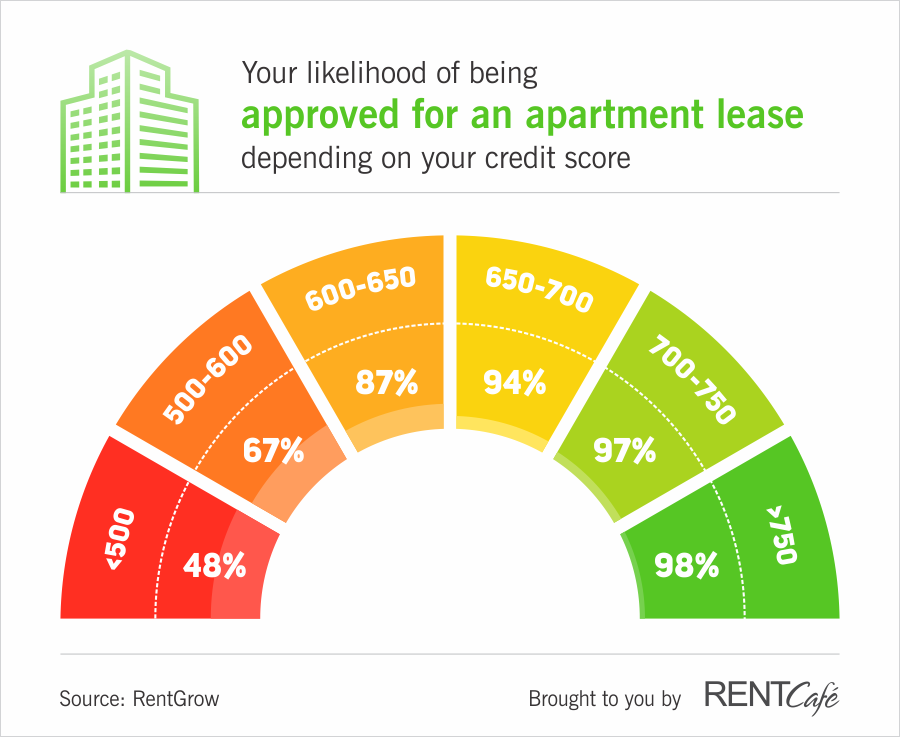

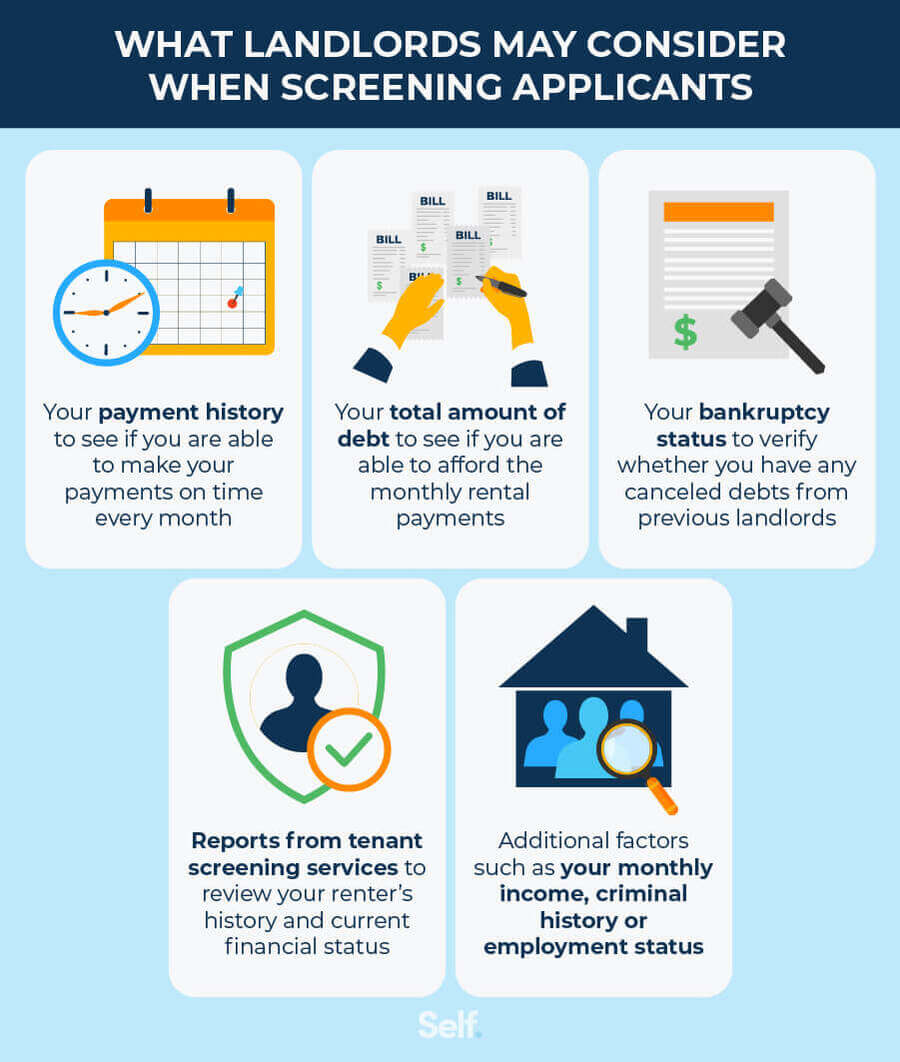

Can Renting An Apartment Build Your Credit - What is a credit score? However, no credit check apartments do exist, and the guide we have linked here can help you find them. While you do not necessarily need a high credit score (or a credit score at all) to rent an apartment, building your credit early in life can strengthen your rental applications and. Landlords may check credit reports, rent payment history, criminal history, conduct employment verification, and more. We found this article by the balance that. Most landlords will require credit history to rent an apartment. You may be able to build credit by paying your rent on time, but it’s not as common as you might think. The minimum credit score required to rent an apartment typically falls between 600 and 650, but this can vary depending on the landlord, location, and type of rental property. Property managers often check a. If you’d like to have rental payments reported to credit reporting agencies, ask your landlord if they participate in a rental. Most landlords will require credit history to rent an apartment. Answers what credit score you need to rent an apartment, we need to first. We’ll explore how rental payment history can influence your credit score, methods for reporting rent payments, and alternatives to building a good credit score as a renter. Positive rental payments can help build your credit. While your fico ® score may not be the no. Lots of questions happen when it comes to renting an apartment and whether or not it will help your credit, build your credit, or hurt your credit. Paying rent can build your credit — here’s how. The minimum credit score required to rent an apartment typically falls between 600 and 650, but this can vary depending on the landlord, location, and type of rental property. If you’d like to have rental payments reported to credit reporting agencies, ask your landlord if they participate in a rental. Before our property management company in washington, d.c. While your fico ® score may not be the no. Despite having a subpar credit score, there are still ways to improve your chances of being accepted for an apartment. Landlords may check credit reports, rent payment history, criminal history, conduct employment verification, and more. Make sure you’re following these three tips when you pay your rent each month. Does. Property managers often check a. If you’d like to have rental payments reported to credit reporting agencies, ask your landlord if they participate in a rental. There's no specific fico ® score that will determine whether or not you can move into a new apartment. Here’s how it works and how you can benefit. What is a bad credit score. While your fico ® score may not be the no. Answers what credit score you need to rent an apartment, we need to first. Renting an apartment can help you build your credit if your landlord reports your rent payments to one or more of the three main. Does renting an apartment build credit? Lots of questions happen when it. However, no credit check apartments do exist, and the guide we have linked here can help you find them. What is a credit score? You may be able to build credit by paying your rent on time, but it’s not as common as you might think. Positive rental payments can help build your credit. What is a bad credit score. Learn more about when your rent may be reported to credit bureaus. There's no specific fico ® score that will determine whether or not you can move into a new apartment. Does renting an apartment build credit? We’ll explore how rental payment history can influence your credit score, methods for reporting rent payments, and alternatives to building a good credit. Positive rental payments can help build your credit. When it comes to renting a house or apartment, your credit score can significantly impact your ability to qualify for the place you want. Lots of questions happen when it comes to renting an apartment and whether or not it will help your credit, build your credit, or hurt your credit. Make. Lots of questions happen when it comes to renting an apartment and whether or not it will help your credit, build your credit, or hurt your credit. When it comes to renting a house or apartment, your credit score can significantly impact your ability to qualify for the place you want. Renting an apartment can help you build your credit. Most landlords will require credit history to rent an apartment. Make sure you’re following these three tips when you pay your rent each month. If you’d like to have rental payments reported to credit reporting agencies, ask your landlord if they participate in a rental. Despite having a subpar credit score, there are still ways to improve your chances of. Can you rent an apartment with bad credit? Landlords may check credit reports, rent payment history, criminal history, conduct employment verification, and more. However, no credit check apartments do exist, and the guide we have linked here can help you find them. What is a credit score? Before our property management company in washington, d.c. Property managers often check a. If you’d like to have rental payments reported to credit reporting agencies, ask your landlord if they participate in a rental. Learn more about when your rent may be reported to credit bureaus. While you do not necessarily need a high credit score (or a credit score at all) to rent an apartment, building your. What is a credit score? Property managers often check a. The minimum credit score required to rent an apartment typically falls between 600 and 650, but this can vary depending on the landlord, location, and type of rental property. Before our property management company in washington, d.c. Landlords may check credit reports, rent payment history, criminal history, conduct employment verification, and more. Answers what credit score you need to rent an apartment, we need to first. There's no specific fico ® score that will determine whether or not you can move into a new apartment. When it comes to renting a house or apartment, your credit score can significantly impact your ability to qualify for the place you want. Make sure you’re following these three tips when you pay your rent each month. Does renting an apartment build credit? However, no credit check apartments do exist, and the guide we have linked here can help you find them. Here’s how it works and how you can benefit. If you’d like to have rental payments reported to credit reporting agencies, ask your landlord if they participate in a rental. Positive rental payments can help build your credit. While you do not necessarily need a high credit score (or a credit score at all) to rent an apartment, building your credit early in life can strengthen your rental applications and. We’ll explore how rental payment history can influence your credit score, methods for reporting rent payments, and alternatives to building a good credit score as a renter.10 Ways to Rent an Apartment with No Credit History Self. Credit Builder.

What Credit Score Is Needed for Renting an Apartment? Lexington Law

Do Rent to Own (RTO) Payments Help Build My Credit? The Renters Best

The Renters Journey Step 2 Your First Month in a New Rental The

How To Build Credit Quickly By Reporting Your Rent YouTube

What Credit Score Do You Need to Rent an Apartment? Insanely High, If

What credit score do you need to rent an apartment?

What Is the Minimum Credit Score to Rent an Apartment or House? Self

12 Tips to Rent an Apartment Without a Credit Check

Do you need to pass a credit check to rent? Leia aqui Is a credit

Paying Rent Can Build Your Credit — Here’s How.

Most Landlords Will Require Credit History To Rent An Apartment.

While Your Fico ® Score May Not Be The No.

Despite Having A Subpar Credit Score, There Are Still Ways To Improve Your Chances Of Being Accepted For An Apartment.

Related Post: