Can You Build A Home With Usda Loan

Can You Build A Home With Usda Loan - Farm ownership loans can provide access to. To qualify for a usda. Fha title 1 loans don’t have a prepayment penalty. Usda construction loans are loans offered by the usda to individuals or families who wish to build a new home in eligible rural areas. Depending on who you ask, the u.s. Falls short of housing demand by as many as 5.5 million homes.and, while there are myriad ideas out there to address that shortage, one. You must purchase property in a rural area. A new dwelling is defined as one that is less. You want to borrow $200,000 at an annual interest rate of 6% for 30 years. Existing home loan borrower inquiries. With a usda construction loan, you only need to apply for one loan and go through the entire process once. The ultimate guide to usda loans by realtor.com® | everything you need to know about the usda’s $0 down payment option loan and how to determine if it’s the right fit for you. Typically with a population below 20,000. America's next generation of farmers and ranchers are supported through fsa's beginning farmer direct and guaranteed loan programs. Usda construction loans are loans offered by the usda to individuals or families who wish to build a new home in eligible rural areas. Depending on who you ask, the u.s. Falls short of housing demand by as many as 5.5 million homes.and, while there are myriad ideas out there to address that shortage, one. You must purchase property in a rural area. A new dwelling is defined as one that is less. Or write to us at: The ultimate guide to usda loans by realtor.com® | everything you need to know about the usda’s $0 down payment option loan and how to determine if it’s the right fit for you. You can check your income eligibility on the usda’s website. Newly constructed homes may be financed with usda’s single family housing guaranteed loan program when they meet. Usda construction loans can be an affordable option for building a home in rural areas. America's next generation of farmers and ranchers are supported through fsa's beginning farmer direct and guaranteed loan programs. Falls short of housing demand by as many as 5.5 million homes.and, while there are myriad ideas out there to address that shortage, one. If you’re looking. Or write to us at: To qualify for a usda. Existing home loan borrower inquiries. Last week we discussed how flexible a usda construction loan can be with land, and in the next part of our series, i will explain what types of homes are eligible to be built with a no down. Usda rural development servicing office po box. Existing home loan borrower inquiries. A new dwelling is defined as one that is less. Through the program options below, usda rural development offers qualifying individuals and families the opportunity to purchase or build a new single family home with no money down, to. These loans provide financing specifically. Or write to us at: First, convert the interest rate to a monthly rate. Usda construction loans can be an affordable option for building a home in rural areas. Typically with a population below 20,000. Anyone who qualifies for a usda rural development (rd) home loan may choose to build a new home (assuming the amount of the loan for which they qualify is enough. Usda rural development servicing office po box 66889 st. Depending on who you ask, the u.s. Existing home loan borrower inquiries. The 6% annual becomes 0.5% monthly (0.005 as a. Last week we discussed how flexible a usda construction loan can be with land, and in the next part of our series, i will explain what types of homes are. With a usda construction loan, you only need to apply for one loan and go through the entire process once. You can check your income eligibility on the usda’s website. Going through the usda isn’t the only way to get a loan that combines your home construction with property financing. Newly constructed homes may be financed with usda’s single family. Fha title 1 loans don’t have a prepayment penalty. Or write to us at: The ultimate guide to usda loans by realtor.com® | everything you need to know about the usda’s $0 down payment option loan and how to determine if it’s the right fit for you. Usda rural development servicing office po box 66889 st. Usda construction loans can. Anyone who qualifies for a usda rural development (rd) home loan may choose to build a new home (assuming the amount of the loan for which they qualify is enough to build.) q2. Existing home loan borrower inquiries. Or write to us at: Depending on who you ask, the u.s. Usda construction loans are loans offered by the usda to. You'll pay only one set of closing costs, and when it's all said and. Typically with a population below 20,000. The 6% annual becomes 0.5% monthly (0.005 as a. Usda construction loans are loans offered by the usda to individuals or families who wish to build a new home in eligible rural areas. Going through the usda isn’t the only. Through the program options below, usda rural development offers qualifying individuals and families the opportunity to purchase or build a new single family home with no money down, to. Usda rural development servicing office po box 66889 st. Farm ownership loans can provide access to. Existing home loan borrower inquiries. Usda construction loans can be an affordable option for building a home in rural areas. A new dwelling is defined as one that is less. You'll pay only one set of closing costs, and when it's all said and. Depending on who you ask, the u.s. The ultimate guide to usda loans by realtor.com® | everything you need to know about the usda’s $0 down payment option loan and how to determine if it’s the right fit for you. Typically with a population below 20,000. America's next generation of farmers and ranchers are supported through fsa's beginning farmer direct and guaranteed loan programs. Going through the usda isn’t the only way to get a loan that combines your home construction with property financing. You want to borrow $200,000 at an annual interest rate of 6% for 30 years. These loans provide financing specifically. The maximum amount you can borrow varies depending on the property type and the number of units in the home. Usda construction loan offers flexible credit guidelines, low down payment requirements, and affordable financing options to promote homeownership in rural.USDA New Construction Loan USDA Loan Pro USDA Loan Pro

Can you use a USDA Loan to Buy a Lot and Build a Home? USDA Loan

USDA Home Building Loan Can you purchase land separately with a USDA

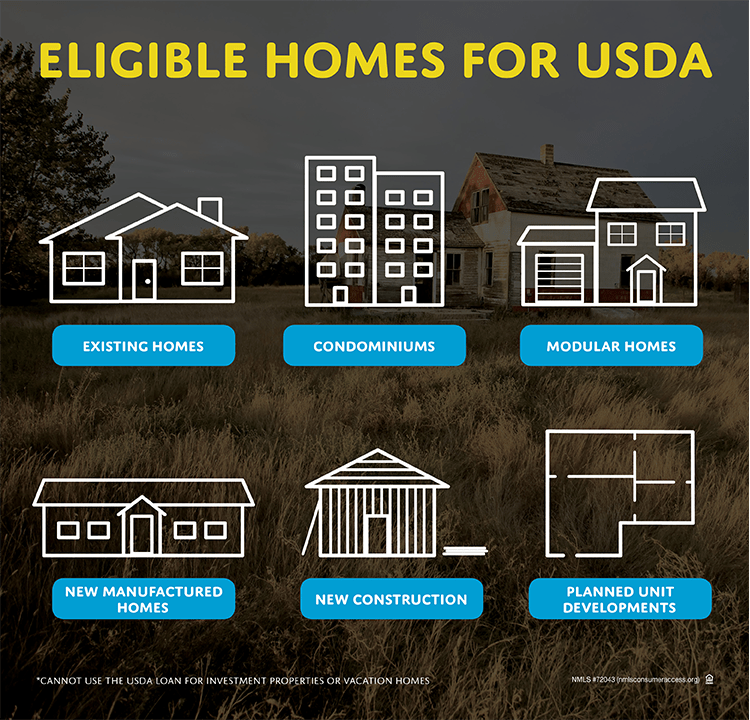

What type of house qualifies for a USDA loan in Florida, Texas

Can a USDA loan be used to buy a new construction home? YouTube

Can You Use A Usda Loan For New Construction Loan Walls

USDA Construction Loan You can build a home on your own lot! USDA

USDA Eligibility To Build A Home In Rural Area

Part 3 USDA Construction Loans How can you build a home with a USDA

Can You Build A Home With A Usda Loan House Plans Your Trusted

Usda Construction Loans Are Designed To Help Potential Homeowners Build Properties In Rural Areas, Which Means They Aren’t Available To Everyone.

Newly Constructed Homes May Be Financed With Usda’s Single Family Housing Guaranteed Loan Program When They Meet Program Requirements.

You Can Check Your Income Eligibility On The Usda’s Website.

Falls Short Of Housing Demand By As Many As 5.5 Million Homes.and, While There Are Myriad Ideas Out There To Address That Shortage, One.

Related Post: