Can You Build A House On Heir Property

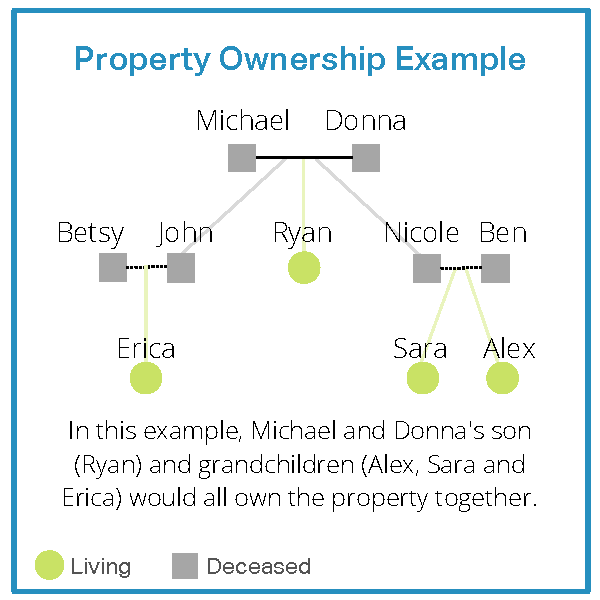

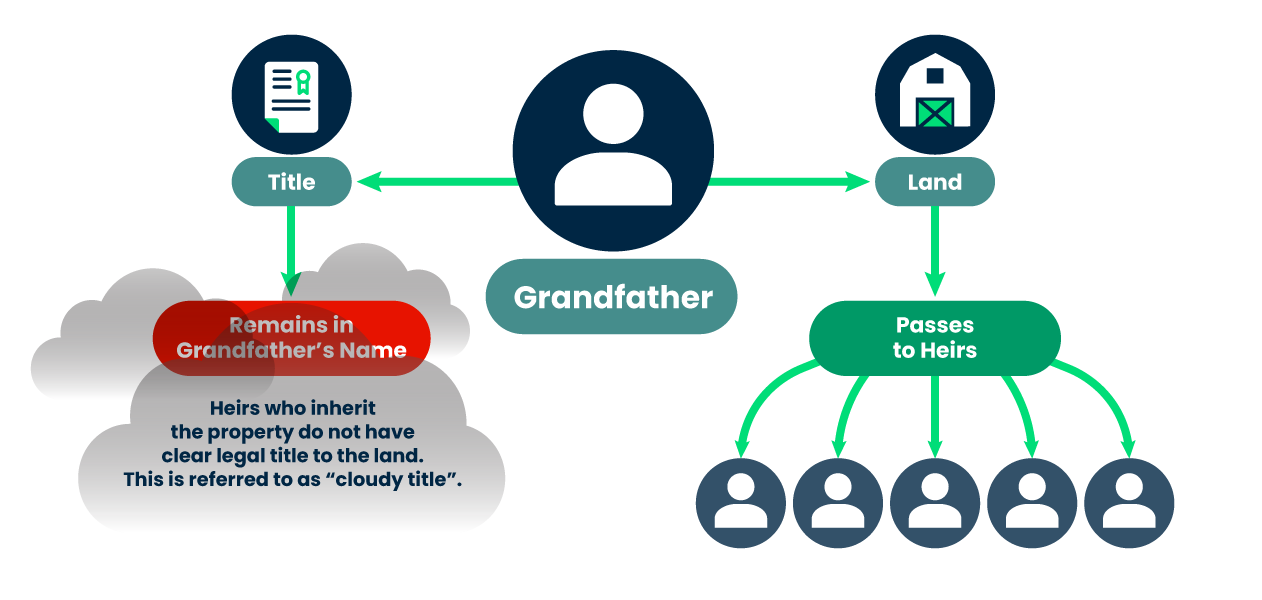

Can You Build A House On Heir Property - The probate court will confirm that there are no eligible heirs or beneficiaries before the state can claim the property. Heir property is an informal transferring of ownership of land from one person to another or from one generation to another generation. When it comes to passing down property, you have a few different options. Based on state law, a deceased property owner can have many heirs. How can you inherit a house from your parents after death? You can sell it, gift it to your children, establish a trust or form some sort of legal entity like an llc. Yes you can build a house on the property on the joint property. The federal government doesn’t levy inheritance taxes on when you inherit a property and only six states levy any sort of inheritance taxes on their citizens. This is called tenancy in. But in your portion of land only. Once confirmed, the state takes ownership of the house and. Inheriting property and taxes on inherited property also depend on the. Yes you can build a house on the property on the joint property. (1) the improvements that become part of the real property are owned by all heirs,. That means that you don’t have to worry about paying capital gains taxes on your inherited property until you sell it. How can you keep your property safe in the event of a tragedy? Land is one of the most valuable assets a person can pass down to future generations. Usda can help you gain access to programs and services. Dividing heir property, whether through a sale or partition, can have significant tax consequences. One major concern is capital gains taxes, which may arise when the property. You can establish ownership of the property by bringing an action to quiet title. When you build the house, it will be owned by whoever owns the land on which it is built. If it doesn’t fall into one of these exceptions, the general rule is that if someone dies and owns real estate, any property they own is headed. But whatever you build on the land belongs to them, which means they’re the owner of the house. You can establish ownership of the property by bringing an action to quiet title. You can inherit a property at fair market value and only pay capital gains tax from inheritance to sale. Are you an heirs’ property landowner who inherited land. How can you inherit a house from your parents after death? You can sell it, gift it to your children, establish a trust or form some sort of legal entity like an llc. It’s informal in such a way that the. The federal government doesn’t levy inheritance taxes on when you inherit a property and only six states levy any. How can you inherit a house from your parents after death? You need to go for partition deed and divide the property first then post that you can. Heir property is an informal transferring of ownership of land from one person to another or from one generation to another generation. It’s informal in such a way that the. I would. You can inherit a property at fair market value and only pay capital gains tax from inheritance to sale. That means that you don’t have to worry about paying capital gains taxes on your inherited property until you sell it. Inheriting property and taxes on inherited property also depend on the. Based on state law, a deceased property owner can. This is called tenancy in. However, inheriting land isn’t always a straightforward process. Heir property is an informal transferring of ownership of land from one person to another or from one generation to another generation. When you build the house, it will be owned by whoever owns the land on which it is built. When it comes to passing down. This is called tenancy in. You can establish ownership of the property by bringing an action to quiet title. The key thing to understand is that while you can erect buildings, dwellings or other improvements to the real property without a deed or without express consent by the other heirs, two things remain true: How can you inherit a house. The probate court will confirm that there are no eligible heirs or beneficiaries before the state can claim the property. Each heir has rights and responsibilities related to their fractional interest in the property. But in your portion of land only. If no succession then one heir could allow trailer or building but anything affixed to. When you build the. How can you inherit a house from your parents after death? There are many ways you can inherit a home. You can inherit a property at fair market value and only pay capital gains tax from inheritance to sale. One major concern is capital gains taxes, which may arise when the property. If the succession has been completed and property. You can sell it, gift it to your children, establish a trust or form some sort of legal entity like an llc. That means that you don’t have to worry about paying capital gains taxes on your inherited property until you sell it. There are many ways you can inherit a home. It examines state laws that are relevant to. Yes, under law, heirs are seized of their rights upon the passing of the decedent. If it doesn’t fall into one of these exceptions, the general rule is that if someone dies and owns real estate, any property they own is headed for some kind of probate process. Inheriting property and taxes on inherited property also depend on the. Heir property is an informal transferring of ownership of land from one person to another or from one generation to another generation. When it comes to passing down property, you have a few different options. You can inherit a property at fair market value and only pay capital gains tax from inheritance to sale. The purpose of this factsheet is to prevent the loss of land owned as heirs’ property in south carolina. Each heir has rights and responsibilities related to their fractional interest in the property. Based on state law, a deceased property owner can have many heirs. I would not recommend building a house or immobilizing the mobile home, but putting it on the. The probate court will confirm that there are no eligible heirs or beneficiaries before the state can claim the property. Once confirmed, the state takes ownership of the house and. You need to go for partition deed and divide the property first then post that you can. Yes you can build a house on the property on the joint property. You can build on your parents’ land. There are many ways you can inherit a home.Partition of Heirs Property Act Uniform Law Commission

What Is an Heirs' Property Partition in Texas Attorney Philip Hundl

Property ownership, heir property, and estate planning Legal Aid of

Heirs’ Property Farmland Access Legal Toolkit

I Inherited a House and Want to Sell It Now What? The Pinnacle List

"Guide to 'Rights of Heirs to Property' Legal Insights"

What To Do With An Inherited House With Multiple Heirs? Real estate

Alabama Heir Property Laws Wealth Legacy Expertise by KPT

Can you build a house on heir property Updated, November 2023

What is heirs’ property? A huge contributor to Black land loss you

The Key Thing To Understand Is That While You Can Erect Buildings, Dwellings Or Other Improvements To The Real Property Without A Deed Or Without Express Consent By The Other Heirs, Two Things Remain True:

Land Is One Of The Most Valuable Assets A Person Can Pass Down To Future Generations.

That Means That You Don’t Have To Worry About Paying Capital Gains Taxes On Your Inherited Property Until You Sell It.

The Federal Government Doesn’t Levy Inheritance Taxes On When You Inherit A Property And Only Six States Levy Any Sort Of Inheritance Taxes On Their Citizens.

Related Post: