Can You Build A House With A Usda Loan

Can You Build A House With A Usda Loan - Going through the usda isn’t the only way to get a loan that combines your home construction with property financing. While a typical usda loan allows a borrower to buy an existing home, a usda construction loan allows borrowers to finance a home build. And if you do meet the given requirements, it can be an. With no down payment requirement and a seamless transition from a construction loan to a permanent loan, a usda construction loan is a great way to finance your dream. The balance of the purchase price not covered by the down payment loan and the loan applicant's down payment may be financed by a commercial lender (xls, 275kb), private lender, a. A usda construction loan can help, but only if you meet its requirements. Usda construction loans combine the purchase of land — usually five acres or more — with the cost of constructing a house on that land in a designated area. Usda construction loans allow you to build rural homes with 100% financing. The ultimate guide to usda loans by realtor.com® | everything you need to know about the usda’s $0 down payment option loan and how to determine if it’s the right fit for you. Usda construction loans are loans offered by the usda to individuals or families who wish to build a new home in eligible rural areas. While a typical usda loan allows a borrower to buy an existing home, a usda construction loan allows borrowers to finance a home build. Usda construction loans can be used to purchase land, build a home, rehabilitate existing homes, and improve upon or relocate homes in certain eligible areas. Unlike a traditional construction loan, which. The catch is only certain regions qualify and you must fall below income requirements. Usda construction loans combine the purchase of land — usually five acres or more — with the cost of constructing a house on that land in a designated area. Borrowers usually need to have a minimum fico® score of 500 and pay a 10% down. The balance of the purchase price not covered by the down payment loan and the loan applicant's down payment may be financed by a commercial lender (xls, 275kb), private lender, a. The usda mortgage program is designed to make. A new dwelling is defined as one that is less. And if you do meet the given requirements, it can be an. And if you do meet the given requirements, it can be an. The ultimate guide to usda loans by realtor.com® | everything you need to know about the usda’s $0 down payment option loan and how to determine if it’s the right fit for you. Borrowers usually need to have a minimum fico® score of 500 and pay a 10%. A new dwelling is defined as one that is less. How do you buy a house that doesn’t exist? Newly constructed homes may be financed with usda’s single family housing guaranteed loan program when they meet program requirements. Through the program options below, usda rural development offers qualifying individuals and families the opportunity to purchase or build a new single. Usda considers a property new. Usda construction loans can be used to purchase land, build a home, rehabilitate existing homes, and improve upon or relocate homes in certain eligible areas. A usda construction loan can help, but only if you meet its requirements. Through the program options below, usda rural development offers qualifying individuals and families the opportunity to purchase. Borrowers usually need to have a minimum fico® score of 500 and pay a 10% down. If you’re looking for a single loan to help you buy land and. The first thing you want to do is make sure you qualify for an fha construction loan. Newly constructed homes may be financed with usda’s single family housing guaranteed loan program. The ultimate guide to usda loans by realtor.com® | everything you need to know about the usda’s $0 down payment option loan and how to determine if it’s the right fit for you. Q1.who qualifies for new construction? Unlike a traditional construction loan, which. Borrowers usually need to have a minimum fico® score of 500 and pay a 10% down.. Usda is an equal opportunity provider, employer and lender. These loans provide financing specifically. And if you do meet the given requirements, it can be an. If you’re looking for a single loan to help you buy land and. Through the program options below, usda rural development offers qualifying individuals and families the opportunity to purchase or build a new. Through the program options below, usda rural development offers qualifying individuals and families the opportunity to purchase or build a new single family home with no money down, to. Usda considers a property new. Unlike a traditional construction loan, which. Newly constructed homes may be financed with usda’s single family housing guaranteed loan program when they meet program requirements. And. Usda construction loans can be used to purchase land, build a home, rehabilitate existing homes, and improve upon or relocate homes in certain eligible areas. A usda construction loan can help, but only if you meet its requirements. How do you buy a house that doesn’t exist? Newly constructed homes may be financed with usda’s single family housing guaranteed loan. The first thing you want to do is make sure you qualify for an fha construction loan. Borrowers usually need to have a minimum fico® score of 500 and pay a 10% down. How do you buy a house that doesn’t exist? With no down payment requirement and a seamless transition from a construction loan to a permanent loan, a. While a typical usda loan allows a borrower to buy an existing home, a usda construction loan allows borrowers to finance a home build. The balance of the purchase price not covered by the down payment loan and the loan applicant's down payment may be financed by a commercial lender (xls, 275kb), private lender, a. Going through the usda isn’t. Usda construction loans are loans offered by the usda to individuals or families who wish to build a new home in eligible rural areas. Through the program options below, usda rural development offers qualifying individuals and families the opportunity to purchase or build a new single family home with no money down, to. The balance of the purchase price not covered by the down payment loan and the loan applicant's down payment may be financed by a commercial lender (xls, 275kb), private lender, a. A usda construction loan can help, but only if you meet its requirements. Usda is an equal opportunity provider, employer and lender. Anyone who qualifies for a usda rural development (rd) home loan may. Usda construction loans combine the purchase of land — usually five acres or more — with the cost of constructing a house on that land in a designated area. How do you buy a house that doesn’t exist? Q1.who qualifies for new construction? A new dwelling is defined as one that is less. The ultimate guide to usda loans by realtor.com® | everything you need to know about the usda’s $0 down payment option loan and how to determine if it’s the right fit for you. Borrowers usually need to have a minimum fico® score of 500 and pay a 10% down. These loans provide financing specifically. The first thing you want to do is make sure you qualify for an fha construction loan. Usda construction loans can be used to purchase land, build a home, rehabilitate existing homes, and improve upon or relocate homes in certain eligible areas. While a regular usda loan lets you buy a house that’s already built, a usda construction loan lets you build a new one instead.USDA Construction Loans for New Homes Construction loans, Usda, Usda loan

Homepage USDA Loan Pro USDA Loan Pro

USDA Eligibility To Build A Home In Rural Area

USDA Home Building Loan Can you purchase land separately with a USDA

USDA Construction Loan You can build a home on your own lot! USDA

Part 3 USDA Construction Loans How can you build a home with a USDA

Can You Use A Usda Loan For New Construction Loan Walls

Can you use a USDA Loan to Buy a Lot and Build a Home? USDA Loan

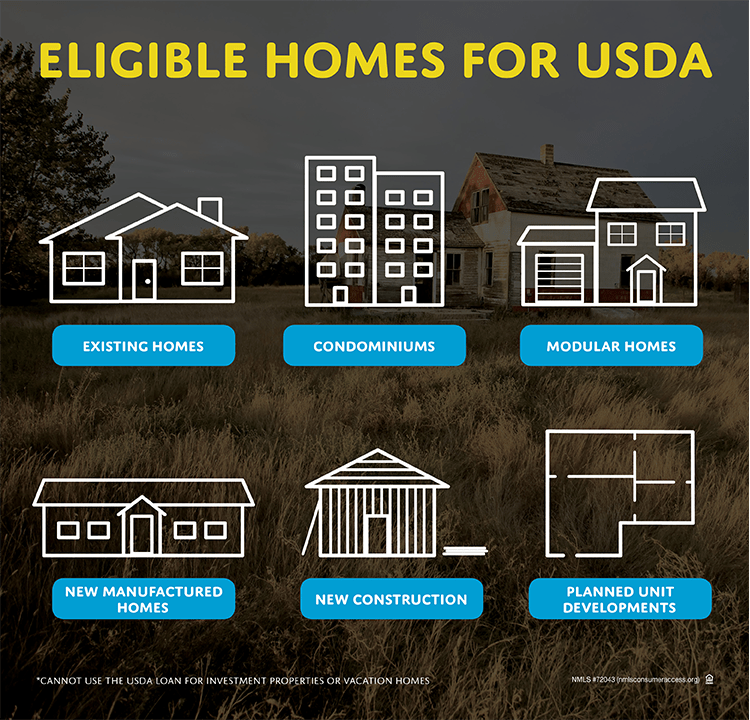

What type of house qualifies for a USDA loan in Florida, Texas

Can You Build A Home With A Usda Loan House Plans Your Trusted

And If You Do Meet The Given Requirements, It Can Be An.

With No Down Payment Requirement And A Seamless Transition From A Construction Loan To A Permanent Loan, A Usda Construction Loan Is A Great Way To Finance Your Dream.

Newly Constructed Homes May Be Financed With Usda’s Single Family Housing Guaranteed Loan Program When They Meet Program Requirements.

While A Typical Usda Loan Allows A Borrower To Buy An Existing Home, A Usda Construction Loan Allows Borrowers To Finance A Home Build.

Related Post: