Can You Build A House With Fha Loan

Can You Build A House With Fha Loan - You can either buy a home from a builder with a traditional fha loan or you can use. Buyers in the city need an average of £510 a month to meet mortgage payments for a one or two bedroom home, which cost an average of £119,350, it said. An fha construction loan offers a pathway to turn those dreams into reality, with easier. There are two programs available: Building a dream home can be daunting, especially when it comes to financing. Not eligible for fha financing: To qualify for an fha construction loan, you’ll need a credit score of at least 580. In typical cases, you can technically only have an fha loan for one primary residence at a time. The borrower should have no delinquencies or defaults on an fha loan product in the last 3 years. While there are exceptions, such as fha loans for those who need to. The borrower should have no delinquencies or defaults on an fha loan product in the last 3 years. An fha construction loan offers a pathway to turn those dreams into reality, with easier. Buyers in the city need an average of £510 a month to meet mortgage payments for a one or two bedroom home, which cost an average of £119,350, it said. Backed by the federal housing administration, fha loans are popular for their flexible eligibility criteria and lower down payment requirements. “with a bridge loan in hand, you can make a home purchase offer that’s not contingent on selling your current home,” says sean simon, mortgage loan originator at planet. When you buy a home, you can usually rely on a standard mortgage to pay for it. But what if you want to. Building a dream home can be daunting, especially when it comes to financing. With this option, you can purchase land, pay for. Yes, fha loans are commonly leveraged by those who are looking to buy an existing home. Buyers in the city need an average of £510 a month to meet mortgage payments for a one or two bedroom home, which cost an average of £119,350, it said. The borrower should have no delinquencies or defaults on an fha loan product in the last 3 years. Building a dream home can be daunting, especially when it comes to. Yes, a new home can be purchased with an fha loan. But what if you want to. A prefabricated house built before june 15, 1976, can be moved and used as a permanent home. Buyers in the city need an average of £510 a month to meet mortgage payments for a one or two bedroom home, which cost an average. If you want to build your dream home but you're having a hard time meeting the. Find out how you can use an fha construction loan to buy land and build a custom home. “with a bridge loan in hand, you can make a home purchase offer that’s not contingent on selling your current home,” says sean simon, mortgage loan. To qualify for an fha construction loan, you’ll need a credit score of at least 580. There are two programs available: If you want to build your dream home but you're having a hard time meeting the. A prefabricated house built before june 15, 1976, can be moved and used as a permanent home. While there are exceptions, such as. An fha construction loan offers a pathway to turn those dreams into reality, with easier. If you want to build your dream home but you're having a hard time meeting the. With this option, you can purchase land, pay for. However, there are also fha loans out there that can assist you if you’re. A prefabricated house built before june. To qualify for an fha construction loan, you’ll need a credit score of at least 580. Building a dream home can be daunting, especially when it comes to financing. An fha construction loan offers a pathway to turn those dreams into reality, with easier. Additional principal payments also build home equity and help eliminate. In typical cases, you can technically. However, there are also fha loans out there that can assist you if you’re. And when you owe less interest, you can trim years off your loan term and pay off your mortgage early. Using a mortgage loan amount of $530k with a mortgage of 6.5%, your monthly principal and interest rate payment would be approximately $3,350. Loans for up. You can either buy a home from a builder with a traditional fha loan or you can use. There are two programs available: When you buy a home, you can usually rely on a standard mortgage to pay for it. In typical cases, you can technically only have an fha loan for one primary residence at a time. Fortunately, the. In typical cases, you can technically only have an fha loan for one primary residence at a time. However, there are also fha loans out there that can assist you if you’re. Loans for up to $7,500 are available for all eligible properties with only your signature, meaning you won’t need to put up any property as. But what if. The borrower should have no delinquencies or defaults on an fha loan product in the last 3 years. Backed by the federal housing administration, fha loans are popular for their flexible eligibility criteria and lower down payment requirements. With this option, you can purchase land, pay for. Buyers in the city need an average of £510 a month to meet. While there are exceptions, such as fha loans for those who need to. But when you build your home from the ground up, a regular mortgage may not suffice. “with a bridge loan in hand, you can make a home purchase offer that’s not contingent on selling your current home,” says sean simon, mortgage loan originator at planet. To qualify for an fha construction loan, you’ll need a credit score of at least 580. A prefabricated house built before june 15, 1976, can be moved and used as a permanent home. And when you owe less interest, you can trim years off your loan term and pay off your mortgage early. Yes, fha loans are commonly leveraged by those who are looking to buy an existing home. Loans for up to $7,500 are available for all eligible properties with only your signature, meaning you won’t need to put up any property as. The borrower should have no delinquencies or defaults on an fha loan product in the last 3 years. Using a mortgage loan amount of $530k with a mortgage of 6.5%, your monthly principal and interest rate payment would be approximately $3,350. When you buy a home, you can usually rely on a standard mortgage to pay for it. There are two programs available: Additional principal payments also build home equity and help eliminate. However, there are also fha loans out there that can assist you if you’re. Backed by the federal housing administration, fha loans are popular for their flexible eligibility criteria and lower down payment requirements. With this option, you can purchase land, pay for.Can I Buy a Manufactured Home with FHA Financing?

FHA Construction Loan for 2025 One Time Close FHA Lenders

Can I Buy Land And Build A House With An FHA Loan?

Can You Build a Home with an FHA Loan? Craig Sharp Homes

Build your dream home with FHA Construction to Permanent Loan Guide

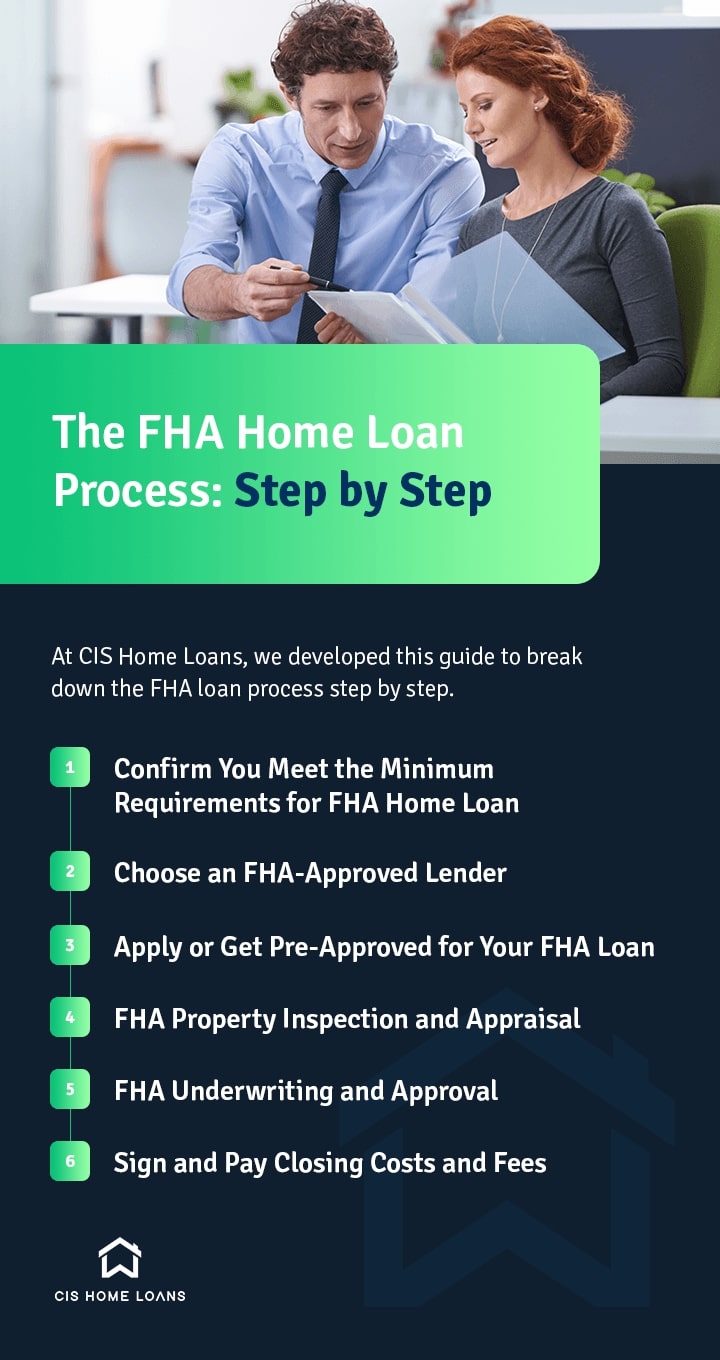

The FHA Home Loan Process Step by Step CIS Home Loans

FHA Construction to Permanent Loans Ultimate Guide Building Your Home

FHA Construction Loans Requirements and Process 2021 in 2021

Can You Get Fha Loan On Mobile Home Loan Walls

FHA and VA Construction Loans Construction loans, Construction, Fha

You Can Either Buy A Home From A Builder With A Traditional Fha Loan Or You Can Use.

An Fha Construction Loan Offers A Pathway To Turn Those Dreams Into Reality, With Easier.

Building A Dream Home Can Be Daunting, Especially When It Comes To Financing.

There Are Two Programs Available:

Related Post: