Can You Build Credit At 17

Can You Build Credit At 17 - But anyone can potentially start building credit before 18 if they're an. The short answer is that 18 is the minimum age for financial products such as loans and credit cards. But young people often find it hard to build a credit history, which is a major contributor to your credit score. The simplest way may be to add him or her as an authorized user on your credit card today. Here are eight ways to get started building a credit history. You can build credit at 17 by being an authorized user or by opening a secured card/secured loan with a lender who offers these products. Your child does not need to be 18 to start building credit. There are many of benefits to. But those approvals may also look at your credit and income, which could make it hard to get approved before turning 18. Learn how to build credit as a teenager with these tips from tdecu that include becoming an authorized user on someone else's credit card, and more. Working towards building a superior credit history in. You can become an authorized user on a parent’s. Contrary to popular misconceptions, you can't build credit with a regular bank. The types of credit in use and recent credit. The simplest way may be to add him or her as an authorized user on your credit card today. But young people often find it hard to build a credit history, which is a major contributor to your credit score. Your child does not need to be 18 to start building credit. But that doesn’t mean you can’t get a head start on credit building at 17. You can build credit at 17 by being an authorized user or by opening a secured card/secured loan with a lender who offers these products. But anyone can potentially start building credit before 18 if they're an. If you're a student, you cannot count financial aid as part of your income on a credit card application, but you can include money someone else regularly deposits into your. Building credit in your teen years, while it takes some time and effort to earn a score that will be favorable when the need for borrowing comes up, can pay. You need to be 18 to open your own credit card, but that doesn’t mean you have to wait until then to start building your credit. Here are eight ways to get started building a credit history. Starting early with a secured credit card or becoming an authorized user on a parent’s account helps establish a credit history. Can a. The options outlined above are. Your child does not need to be 18 to start building credit. Contrary to popular misconceptions, you can't build credit with a regular bank. Credit is a measure of financial trustworthiness that. You can build credit at 17 by being an authorized user or by opening a secured card/secured loan with a lender who offers. Well, although you need to be at least 18 to legally open credit accounts, you can still start building credit at 17. Starting early with a secured credit card or becoming an authorized user on a parent’s account helps establish a credit history. Credit is a measure of financial trustworthiness that. Building credit in your teen years, while it takes. Well, although you need to be at least 18 to legally open credit accounts, you can still start building credit at 17. There are many of benefits to. If you're a student, you cannot count financial aid as part of your income on a credit card application, but you can include money someone else regularly deposits into your. Contrary to. But anyone can potentially start building credit before 18 if they're an. The short answer is that 18 is the minimum age for financial products such as loans and credit cards. You can build credit at 17 by being an authorized user or by opening a secured card/secured loan with a lender who offers these products. Here are eight ways. If you're a student, you cannot count financial aid as part of your income on a credit card application, but you can include money someone else regularly deposits into your. Learn how to build credit as a teenager with these tips from tdecu that include becoming an authorized user on someone else's credit card, and more. It’s never too early. The short answer is that 18 is the minimum age for financial products such as loans and credit cards. But anyone can potentially start building credit before 18 if they're an. Can a 17 year old build credit? Your child does not need to be 18 to start building credit. The types of credit in use and recent credit. You need to be 18 to open your own credit card, but that doesn’t mean you have to wait until then to start building your credit. Contrary to popular misconceptions, you can't build credit with a regular bank. Well, although you need to be at least 18 to legally open credit accounts, you can still start building credit at 17.. The short answer is that 18 is the minimum age for financial products such as loans and credit cards. It’s never too early to start. The types of credit in use and recent credit. But anyone can potentially start building credit before 18 if they're an. By learning the basics and working your way up, the simple answer is yes! Building credit in your teen years, while it takes some time and effort to earn a score that will be favorable when the need for borrowing comes up, can pay off in significant ways. Contrary to popular misconceptions, you can't build credit with a regular bank. The options outlined above are. By learning the basics and working your way up, the simple answer is yes! Your child does not need to be 18 to start building credit. But anyone can potentially start building credit before 18 if they're an. There are many of benefits to. The types of credit in use and recent credit. Here are eight ways to get started building a credit history. Starting early with a secured credit card or becoming an authorized user on a parent’s account helps establish a credit history. Well, although you need to be at least 18 to legally open credit accounts, you can still start building credit at 17. Working towards building a superior credit history in. You can become an authorized user on a parent’s. The short answer is that 18 is the minimum age for financial products such as loans and credit cards. Credit is a measure of financial trustworthiness that. You need to be 18 to open your own credit card, but that doesn’t mean you have to wait until then to start building your credit.Building Credit Worksheets

A Guide to Credit Cards for 17 Year Olds Self. Credit Builder.

What Age Can You Start Building Credit (Plus How to Do it)

can you start credit at 17 Ester Wynn

4 Fast Ways to Build Credit at 17 Credit Card Options & More

6 Savvy Tips On How To Build Credit at 17

7 Strategies to Build Credit with No Credit History

How can I build my credit at 17? Leia aqui Can a 17 year old build

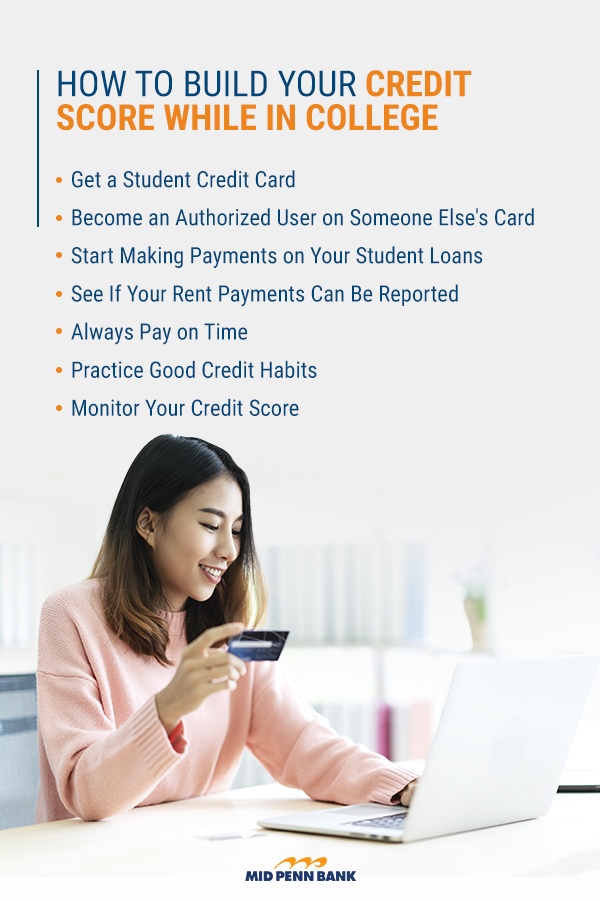

Building Credit in College Credit Score Tips Mid Penn Bank

How to Help Teens Build Credit 10 Tips Southern Savers

Most Of The Time, You Have To Be At Least 18 Years Old With An Income To Start Building Credit.

But Young People Often Find It Hard To Build A Credit History, Which Is A Major Contributor To Your Credit Score.

You Can Build Credit At 17 By Being An Authorized User Or By Opening A Secured Card/Secured Loan With A Lender Who Offers These Products.

Learn How To Build Credit As A Teenager With These Tips From Tdecu That Include Becoming An Authorized User On Someone Else's Credit Card, And More.

Related Post: