Can You Build Credit With Affirm

Can You Build Credit With Affirm - Here are some ways in which affirm can help you build credit: Plus, affirm is building adjacent revenue streams through innovation. Affirm is reinventing credit to make it more honest and friendly, giving consumers the flexibility to buy now and pay later without any hidden fees or compounding interest. There are no fees if you pay late, but late or partial payments could affect your credit score. Yes, affirm can help you build credit! Pay in 4 loans come with 0% apr but monthly installment loans charge an apr of 0% to 36%. Affirm is an installment payment. Affirm advertises on its own website the following: Affirm reports credit information to the three major credit bureaus (equifax, experian, and. At this time, only some affirm loan types are eligible to be reported to experian. Pay in 4 loans come with 0% apr but monthly installment loans charge an apr of 0% to 36%. There are no fees if you pay late, but late or partial payments could affect your credit score. Yes, affirm can help you build credit! Affirm reports credit information to the three major credit bureaus (equifax, experian, and. Affirm is an installment payment. Pay in 4 and monthly installments. Affirm generally leaves it up to merchants to set minimum or maximum credit limits. Yes, using affirm can build credit. Here are some ways in which affirm can help you build credit: Learn how it works and whether you should use it. Affirm does a soft credit check, which won’t impact your credit. Pay bills on time consistently (using reminders if necessary), maintain credit card utilization at 30% or less, and. If building credit is a priority for you, it. Here are some ways in which affirm can help you build credit: Creating an affirm account and checking your purchasing power will. Though there is an upper limit of $17,500 on purchases, your individual credit limit is. At this time, only some affirm loan types are eligible to be reported to experian. Pay in 4 loans come with 0% apr but monthly installment loans charge an apr of 0% to 36%. This means that affirm does not affect. Building good credit takes. Yes, using affirm can build credit. Plus, affirm is building adjacent revenue streams through innovation. Pay bills on time consistently (using reminders if necessary), maintain credit card utilization at 30% or less, and. Affirm generally leaves it up to merchants to set minimum or maximum credit limits. Affirm reports credit information to the three major credit bureaus (equifax, experian, and. This can help you build credit with the credit bureaus as long as. “paying on time can help you build positive credit history.” i have used affirm five times with that attractive proposition in mind and it has. Yes, using affirm can build credit. Pay bills on time consistently (using reminders if necessary), maintain credit card utilization at 30% or. Though there is an upper limit of $17,500 on purchases, your individual credit limit is. He offers three key recommendations for building credit: There are no fees if you pay late, but late or partial payments could affect your credit score. One is its affirm card, a physical payment card that has ramped up to 1.7 million users and gives. Yes, using affirm can build credit. Yes, affirm can help you build credit! The answer is yes, affirm can help your credit in several ways: Affirm reports credit information to the three major credit bureaus (equifax, experian, and. Affirm is reinventing credit to make it more honest and friendly, giving consumers the flexibility to buy now and pay later without. Affirm offers two types of loans: Here are some reasons why: About affirm affirm’s mission is to deliver honest financial products that improve lives. Creating an affirm account and checking your purchasing power will not affect your credit score. “paying on time can help you build positive credit history.” i have used affirm five times with that attractive proposition in. Pay in 4 and monthly installments. Affirm reports your payment history to three major credit bureaus (transunion, equifax, and. About affirm affirm’s mission is to deliver honest financial products that improve lives. There are no fees if you pay late, but late or partial payments could affect your credit score. This means that affirm does not affect. One is its affirm card, a physical payment card that has ramped up to 1.7 million users and gives affirm a. When you borrow with affirm, your positive payment history and credit use may be reported to the credit bureaus. Affirm advertises on its own website the following: This means that affirm does not affect. Affirm reports credit information to. If building credit is a priority for you, it. Affirm offers two types of loans: Affirm generally leaves it up to merchants to set minimum or maximum credit limits. Yes, affirm can help you build credit! The answer is yes, affirm can help your credit in several ways: There are no fees if you pay late, but late or partial payments could affect your credit score. Creating an affirm account and checking your purchasing power will not affect your credit score. If building credit is a priority for you, it. Affirm offers two types of loans: Affirm is reinventing credit to make it more honest and friendly, giving consumers the flexibility to buy now and pay later without any hidden fees or compounding interest. Plus, affirm is building adjacent revenue streams through innovation. Affirm reports payment history to experian for some larger loans that have multimonth terms, but it isn’t guaranteed. Affirm generally leaves it up to merchants to set minimum or maximum credit limits. “paying on time can help you build positive credit history.” i have used affirm five times with that attractive proposition in mind and it has. Though there is an upper limit of $17,500 on purchases, your individual credit limit is. One is its affirm card, a physical payment card that has ramped up to 1.7 million users and gives affirm a. Yes, affirm can help you build credit! Affirm does a soft credit check, which won’t impact your credit. Pay bills on time consistently (using reminders if necessary), maintain credit card utilization at 30% or less, and. This can help you build credit with the credit bureaus as long as. Yes, using affirm can build credit.Does Affirm payments build credit? Leia aqui Does Affirm monthly

How does Affirm work with credit card? Leia aqui Does Affirm let you

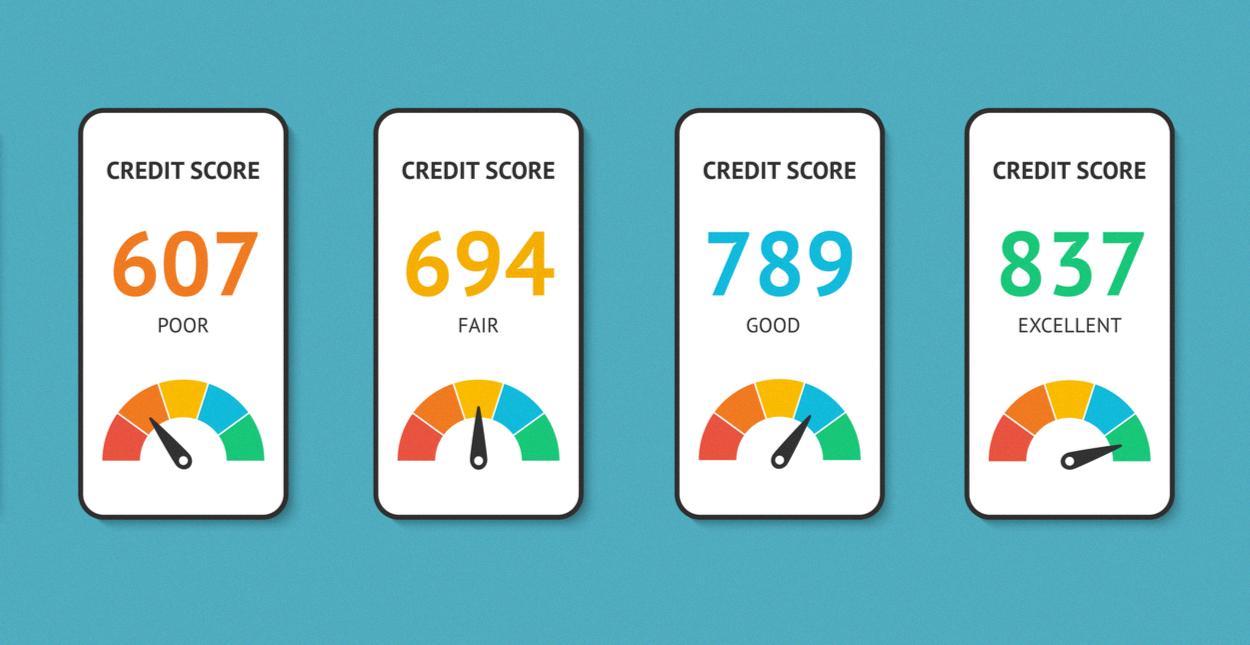

Is Affirm easy to get approved? Leia aqui What credit score do I need

What credit do you need to get approved by Affirm? Leia aqui What is

Affirm Everything you need to know! iMore

Get Approved Credit Score Needed For Affirm

Can I pay Affirm off early? Leia aqui Can Affirm build credit Fabalabse

Can you have 2 Affirm loans? Leia aqui What is the maximum loan amount

What is the Minimum Credit Score for Affirm in 2024? DebtHammer

How to get approval for an Affirm Loan

Here Are Some Reasons Why:

When You Borrow With Affirm, Your Positive Payment History And Credit Use May Be Reported To The Credit Bureaus.

By Making Regular Payments On Affirm, You’re Building A Positive Credit History.

Pay In 4 And Monthly Installments.

Related Post: