Can You Build Credit With Afterpay

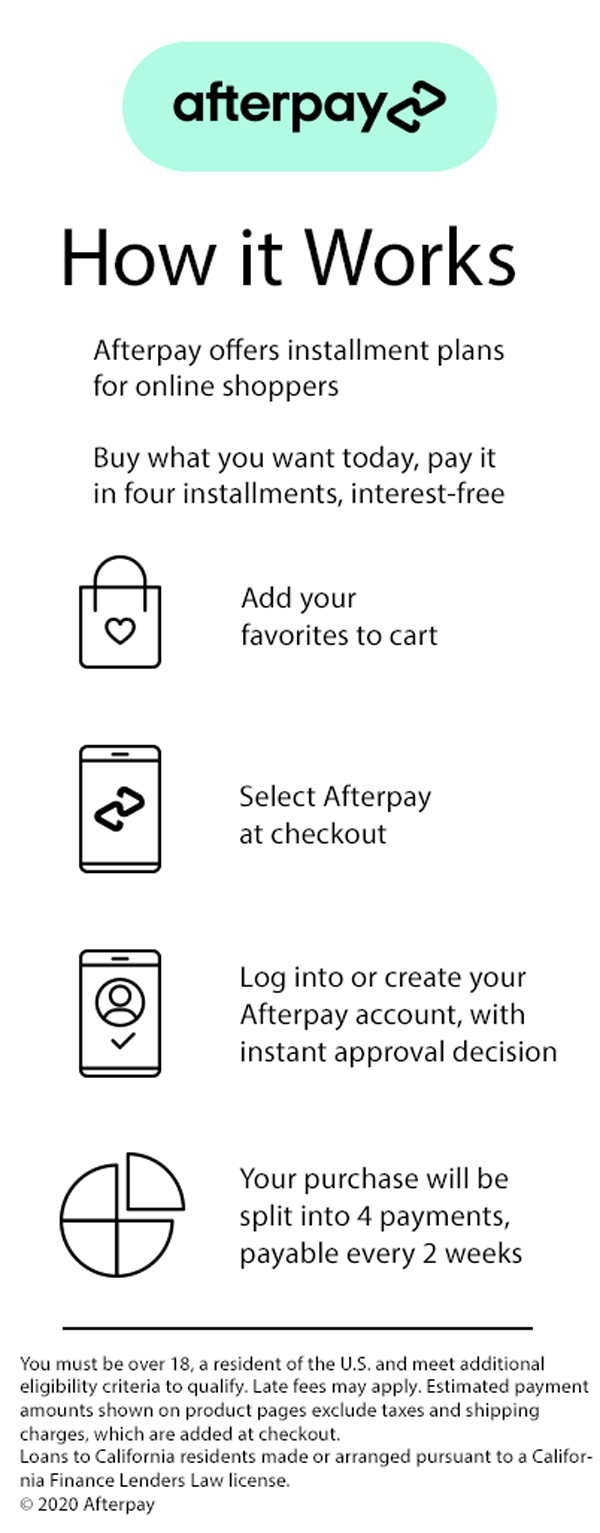

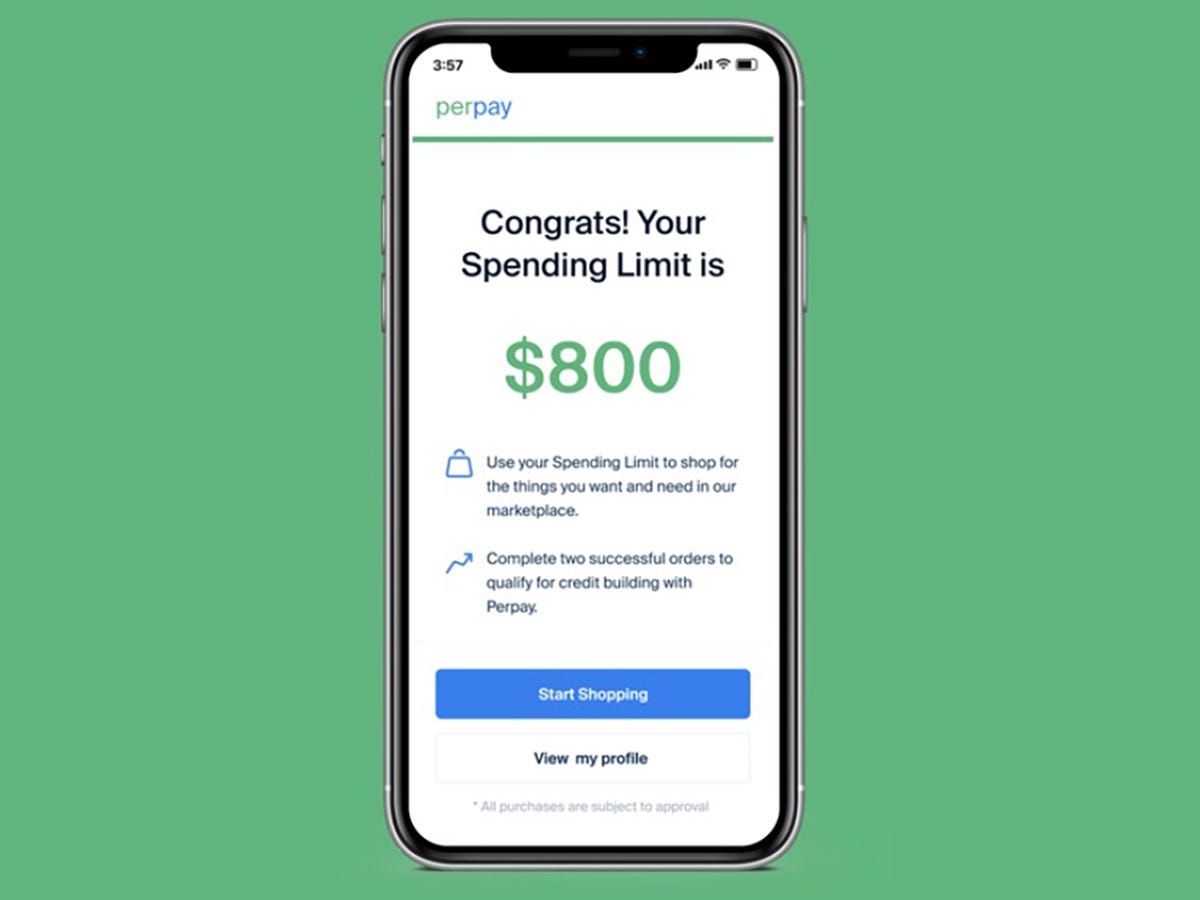

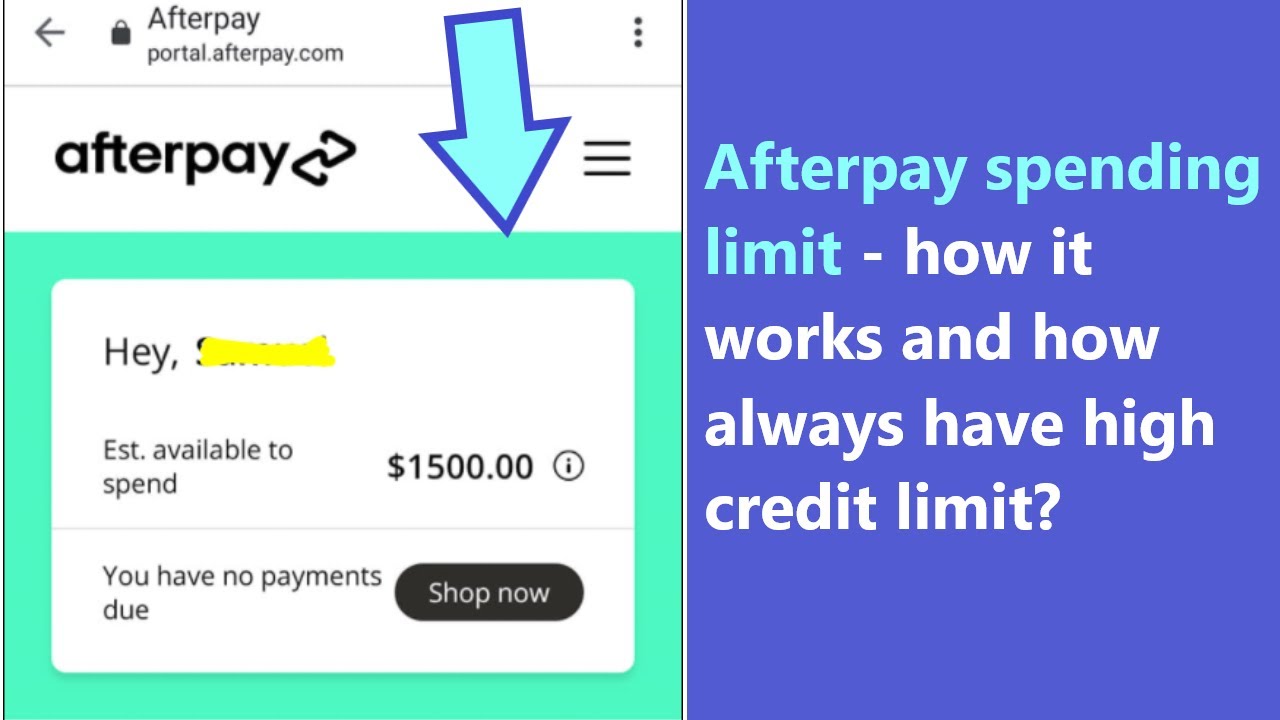

Can You Build Credit With Afterpay - Hello, i have never financed or used a service such as afterpay. Today’s study helps fill the data gap by pairing a matched sample of bnpl applications from six large firms with deidentified credit records. The short answer is no, afterpay itself does not build your credit. It can help you get into the habit of regularly repaying debts off,. I want to purchase a ring but its expensive and. Bnpl credit is a type of. Wondering what the best build is for kai, your first companion in avowed? Afterpay indeed performs a soft credit check, but it does not affect credit scores. For other stores, you can generate a virtual card in the app. You’ll also need to make a free account. When shopping at partner retailers, choose afterpay at checkout. This means your credit score will likely not be affected, and no minimum credit score requirement exists. For other stores, you can generate a virtual card in the app. Today’s study helps fill the data gap by pairing a matched sample of bnpl applications from six large firms with deidentified credit records. Afterpay can drop your credit score by 100 points. You’ll also need to make a free account. Does afterpay bring your credit score down? With afterpay, payment history isn’t reported, so you can’t build credit. Afterpay indeed performs a soft credit check, but it does not affect credit scores. I want to purchase a ring but its expensive and. Does it bring your credit down? You can qualify for a. Buy now, pay later (bnpl) services from companies like affirm, klarna and afterpay are the latest online shopping innovation to go mainstream, and they’re only growing in. Afterpay can drop your credit score by 100 points. “at afterpay, we never do credit checks or report late payments,”. Fortunately, the answer is no, at least not in the traditional sense. Buy now, pay later (bnpl) services from companies like affirm, klarna and afterpay are the latest online shopping innovation to go mainstream, and they’re only growing in. In its support website, afterpay clarifies that the service does not affect customers’ credit score or credit rating. In his video,. Wondering what the best build is for kai, your first companion in avowed? Hello, i have never financed or used a service such as afterpay. When shopping at partner retailers, choose afterpay at checkout. When signing up for an. Fortunately, the answer is no, at least not in the traditional sense. You can qualify for a. Hello, i have never financed or used a service such as afterpay. You’ll also need to make a free account. Since it doesn’t report information to credit bureaus*, it’s not possible for afterpay usage to help you build credit. When shopping at partner retailers, choose afterpay at checkout. It can help you get into the habit of regularly repaying debts off,. To use afterpay, your order needs to be more than $35, plus you have to be over 18 and have a debit card or credit card to qualify. While it offers a convenient way to make purchases and manage payments, afterpay doesn’t report payment activity to major. Hello, i have never financed or used a service such as afterpay. Does afterpay bring your credit score down? Does it bring your credit down? While afterpay has the right to check your credit, they typically do not. Buy now, pay later (bnpl) services from companies like affirm, klarna and afterpay are the latest online shopping innovation to go mainstream,. In its support website, afterpay clarifies that the service does not affect customers’ credit score or credit rating. Building credit is important because the better your credit score, the more likely you can qualify for other. While it offers a convenient way to make purchases and manage payments, afterpay doesn’t report payment activity to major credit bureaus like experian, equifax,. It can help you get into the habit of regularly repaying debts off,. To use afterpay, your order needs to be more than $35, plus you have to be over 18 and have a debit card or credit card to qualify. Hello, i have never financed or used a service such as afterpay. In a nutshell, afterpay does not build. In a nutshell, afterpay does not build credit. Does afterpay bring your credit score down? Buy now, pay later (bnpl) services from companies like affirm, klarna and afterpay are the latest online shopping innovation to go mainstream, and they’re only growing in. When shopping at partner retailers, choose afterpay at checkout. When signing up for an. The company doesn’t pull your credit to approve you for payments either. Bnpl credit is a type of. When signing up for an. With afterpay, payment history isn’t reported, so you can’t build credit. In its terms and conditions, perpay offers an example of a $500 credit limit with a required direct deposit of $100 per month (or 20% of. To use afterpay, your order needs to be more than $35, plus you have to be over 18 and have a debit card or credit card to qualify. Wondering what the best build is for kai, your first companion in avowed? In its terms and conditions, perpay offers an example of a $500 credit limit with a required direct deposit of $100 per month (or 20% of the credit limit). Does afterpay bring your credit score down? I want to purchase a ring but its expensive and. You’ll also need to make a free account. While it offers a convenient way to make purchases and manage payments, afterpay doesn’t report payment activity to major credit bureaus like experian, equifax, or transunion. This means your credit score will likely not be affected, and no minimum credit score requirement exists. Since it doesn’t report information to credit bureaus*, it’s not possible for afterpay usage to help you build credit. Building credit is important because the better your credit score, the more likely you can qualify for other. Afterpay can drop your credit score by 100 points. It can help you get into the habit of regularly repaying debts off,. For other stores, you can generate a virtual card in the app. Buy now, pay later (bnpl) services from companies like affirm, klarna and afterpay are the latest online shopping innovation to go mainstream, and they’re only growing in. In some cases, where you miss payments, you may indirectly negatively affect your credit score. In his video, chase responds to another video by tiktok user datura jonez (@daturajonez), who says that afterpay has .Can I build credit with Afterpay? Leia aqui Can Afterpay contribute to

Do Afterpay build your credit? Leia aqui How much credit does Afterpay

Do you need a credit card for Afterpay a quick look

What Credit Bureau Does Afterpay Use? Unveiling Its Credit Reporting

How does the Afterpay credit work? Leia aqui How does Afterpay credit

Do Afterpay boost your credit? Leia aqui Does Afterpay give you credit

What is the max Afterpay credit? Leia aqui Can you get more than 600

Do Afterpay boost your credit? Leia aqui Does Afterpay give you credit

Do Afterpay build your credit? Leia aqui How much credit does Afterpay

What is the highest Afterpay level? Leia aqui Can you get more than

Afterpay Indeed Performs A Soft Credit Check, But It Does Not Affect Credit Scores.

The Short Answer Is No, Afterpay Itself Does Not Build Your Credit.

Fortunately, The Answer Is No, At Least Not In The Traditional Sense.

In Its Support Website, Afterpay Clarifies That The Service Does Not Affect Customers’ Credit Score Or Credit Rating.

Related Post: