Can You Get A Fha Loan To Build A House

Can You Get A Fha Loan To Build A House - There are two programs available: Fha construction loans come with two types of mortgage insurance: A fha construction loan is a home loan insured by the federal housing administration that allows qualified borrowers to finance the build or rehab of a new home. A prefabricated house built before june 15, 1976, can be moved and used as a permanent home. If you have a credit score of 580 or higher, your down payment will likely be $13,125. Like standard fha mortgages, these. So, not only can you build a house with an fha loan, but there are multiple ways to do it. To get an fha construction loan, you will need to follow a series of steps ranging from purchasing the land to paying the builders throughout the construction phase. While there are exceptions, such as fha loans for those who need to. If you’d rather build a home than buy one, an fha construction loan could help pay for the project. To get an fha construction loan, you will need to follow a series of steps ranging from purchasing the land to paying the builders throughout the construction phase. The federal housing administration (fha) insures loans from approved mortgage lenders,. In 2025, that is $524,225 in most areas. If your home needs repairs to make it more livable, an fha title 1 loan could help. Yes, a new home can be purchased with an fha loan. You can either buy a home from a builder with a traditional fha loan or you can use. The land purchase, plans, permits, approved fees, labor and materials. Building a dream home can be daunting, especially when it comes to financing. Also known as a 3 in 1 mortgage, an. Let's find out how an fha construction loan can help you buy land and build your house the way you envision it. In 2025, that is $524,225 in most areas. In typical cases, you can technically only have an fha loan for one primary residence at a time. Federal housing administration (fha) construction loans allow you to finance renovations to an existing home or the construction of a new home. Also known as a 3 in 1 mortgage, an. What is an. Fha construction loans come with two types of mortgage insurance: Fha construction loans can be rolled into an fha permanent mortgage. So, not only can you build a house with an fha loan, but there are multiple ways to do it. The land purchase, plans, permits, approved fees, labor and materials. Building a dream home can be daunting, especially when. If your credit score ranges between 500 and. Yes, a new home can be purchased with an fha loan. The land purchase, plans, permits, approved fees, labor and materials. If your home needs repairs to make it more livable, an fha title 1 loan could help. There are two programs available: Fha construction loans can be rolled into an fha permanent mortgage. Let's find out how an fha construction loan can help you buy land and build your house the way you envision it. If your credit score ranges between 500 and. Fha building construction loans cover all costs associated with construction on your property: Not eligible for fha financing: Federal housing administration (fha) construction loans allow you to finance renovations to an existing home or the construction of a new home. Let’s assume you’re interested in buying a house with a $375,000 fha mortgage loan. Building a dream home can be daunting, especially when it comes to financing. When it comes to fha construction loans, there are two main. While there are exceptions, such as fha loans for those who need to. What is an fha construction loan? If your home needs repairs to make it more livable, an fha title 1 loan could help. There are two programs available: Building a dream home can be daunting, especially when it comes to financing. Fha construction loans come with two types of mortgage insurance: You can either buy a home from a builder with a traditional fha loan or you can use. However, there are also fha loans out there that can assist you if you’re. Borrowers with a minimum credit score of 500 can secure an fha loan with a 10% down payment,. What is an fha construction loan? Building a dream home can be daunting, especially when it comes to financing. The land purchase, plans, permits, approved fees, labor and materials. There are two programs available: In 2025, that is $524,225 in most areas. What is an fha construction loan? So, not only can you build a house with an fha loan, but there are multiple ways to do it. Also known as a 3 in 1 mortgage, an. If your home needs repairs to make it more livable, an fha title 1 loan could help. Let's find out how an fha construction loan. To get an fha construction loan, you will need to follow a series of steps ranging from purchasing the land to paying the builders throughout the construction phase. Fha construction loans can be rolled into an fha permanent mortgage. An fha construction loan offers a pathway to turn those dreams into reality, with easier. Yes, a new home can be. However, there are also fha loans out there that can assist you if you’re. So, not only can you build a house with an fha loan, but there are multiple ways to do it. Fha construction loans can be rolled into an fha permanent mortgage. There are two programs available: A fha construction loan is a home loan insured by the federal housing administration that allows qualified borrowers to finance the build or rehab of a new home. A prefabricated house built before june 15, 1976, can be moved and used as a permanent home. In 2025, that is $524,225 in most areas. If you’d rather build a home than buy one, an fha construction loan could help pay for the project. Like standard fha mortgages, these. Federal housing administration (fha) construction loans allow you to finance renovations to an existing home or the construction of a new home. To qualify for an fha construction loan, you’ll need a credit score of at least 580. Yes, fha loans are commonly leveraged by those who are looking to buy an existing home. To get an fha construction loan, you will need to follow a series of steps ranging from purchasing the land to paying the builders throughout the construction phase. If you have a credit score of 580 or higher, your down payment will likely be $13,125. The federal housing administration (fha) insures loans from approved mortgage lenders,. Fha construction loans come with two types of mortgage insurance:Can I Buy Land And Build A House With An FHA Loan?

FHA New Construction Loan Requirements Guidelines & Property Types

The Ultimate Guide to FHA Home Construction Loans Everything You Need

Can You Build a Home with an FHA Loan? Craig Sharp Homes

FHA Mortgage Loans Updated Shop FHA Approved Lenders

Can You Get Fha Loan On Mobile Home Loan Walls

FHA Construction Loan for 2025 One Time Close FHA Lenders

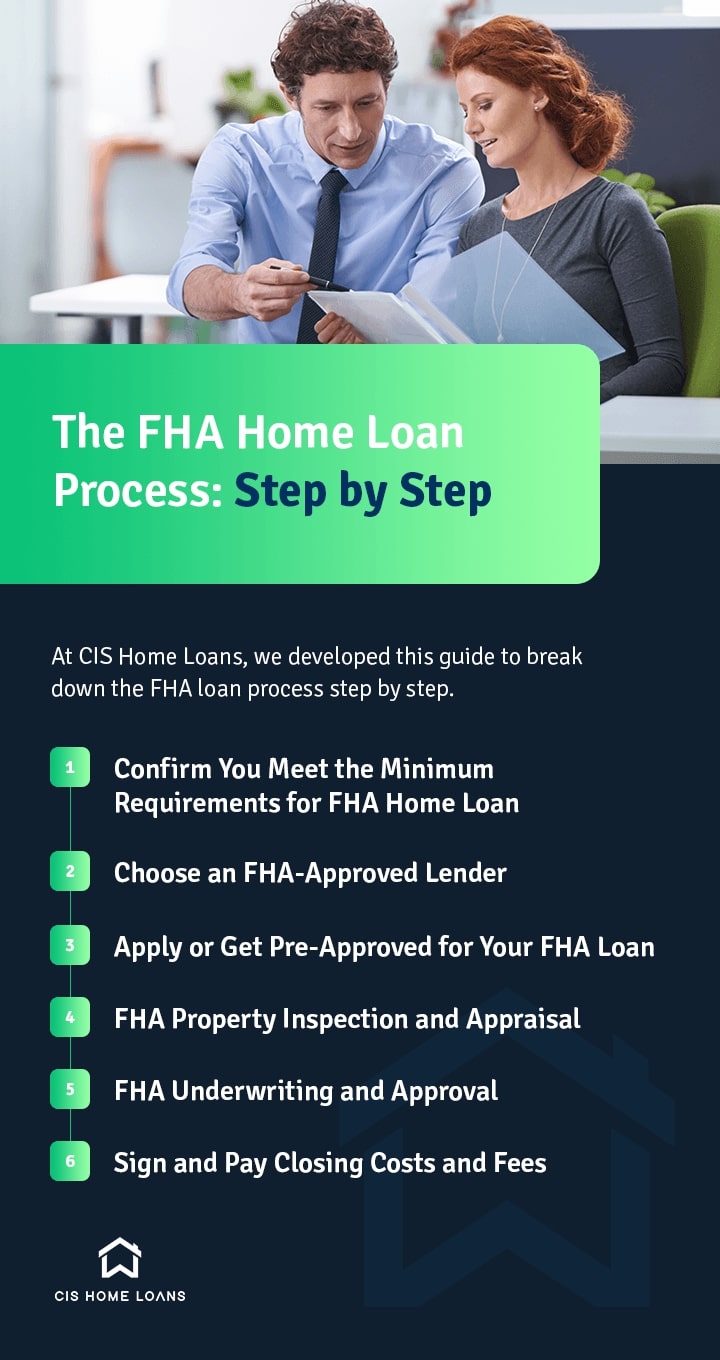

The FHA Home Loan Process Step by Step CIS Home Loans

How to Get a Florida FHA Loan FirstTime Home Buyers Guide

Federal Housing Administration (FHA) Loan Requirements, Limits, How to

Also Known As A 3 In 1 Mortgage, An.

In Typical Cases, You Can Technically Only Have An Fha Loan For One Primary Residence At A Time.

What Is An Fha Construction Loan?

If Your Credit Score Ranges Between 500 And.

Related Post:

:max_bytes(150000):strip_icc()/FHAnew-V1-a128f12bf4584ae8a9a5b7d0214cd8e4.png)