Can You Get An Fha Loan To Build A House

Can You Get An Fha Loan To Build A House - Let’s assume you’re interested in buying a house with a $375,000 fha mortgage loan. Yes, a new home can be purchased with an fha loan. Deciding whether an assumable mortgage is right. When it comes to fha construction loans, there are two main types designed to meet different needs. Fha 203 (k) loans enable homeowners to purchase and/or renovate an already existing home. There are two types of fha construction loans: Like standard fha mortgages, these. There are two programs available: Find out the types of fha construction loans and the eligibility. If you have a credit score of 580 or higher, your down payment will likely be $13,125. There are two programs available: Find out the types of fha construction loans and the eligibility. This loan program, offered by the federal housing. Let’s assume you’re interested in buying a house with a $375,000 fha mortgage loan. Yes, a new home can be purchased with an fha loan. An upfront premium due before the construction begins, and an annual premium fee. The land purchase, plans, permits, approved fees, labor and materials. Federal housing administration (fha) construction loans allow you to finance renovations to an existing home or the construction of a new home. While there are exceptions, such as fha loans for those who need to. Deciding whether an assumable mortgage is right. If you're planning to build your dream home, an fha construction loan might be the financing option you need. While there are exceptions, such as fha loans for those who need to. Not eligible for fha financing: The land purchase, plans, permits, approved fees, labor and materials. Fha construction loans come with two types of mortgage insurance: The land purchase, plans, permits, approved fees, labor and materials. If you're planning to build your dream home, an fha construction loan might be the financing option you need. Learn how fha loans can help you to build or renovate your home with low down payment and flexible options. Fha construction loans come with two types of mortgage insurance: Let’s. This type of loan can further be broken into two separate loans: The land purchase, plans, permits, approved fees, labor and materials. Learn how fha loans can help you to build or renovate your home with low down payment and flexible options. Find out the types of fha construction loans and the eligibility. Like standard fha mortgages, these. You can either buy a home from a builder with a traditional fha loan or you can use. Unlike other fha loans, title 1 loans don’t require you to live in the home as your primary residence unless the property in question is a manufactured home. A prefabricated house built before june 15, 1976, can be moved and used as. Not eligible for fha financing: Deciding whether an assumable mortgage is right. Like standard fha mortgages, these. There are two types of fha construction loans: Fha 203 (k) loans enable homeowners to purchase and/or renovate an already existing home. While there are exceptions, such as fha loans for those who need to. The first loan is designed for brand new. When it comes to fha construction loans, there are two main types designed to meet different needs. There are two programs available: Fha building construction loans cover all costs associated with construction on your property: Fha construction loans can be rolled into an fha permanent mortgage. A prefabricated house built before june 15, 1976, can be moved and used as a permanent home. There are two types of fha construction loans: This loan program, offered by the federal housing. There are two programs available: Not eligible for fha financing: There are two types of fha construction loans: Fha 203 (k) loans enable homeowners to purchase and/or renovate an already existing home. If you have a credit score of 580 or higher, your down payment will likely be $13,125. This loan program, offered by the federal housing. The land purchase, plans, permits, approved fees, labor and materials. An upfront premium due before the construction begins, and an annual premium fee. This type of loan can further be broken into two separate loans: Find out the types of fha construction loans and the eligibility. Unlike other fha loans, title 1 loans don’t require you to live in the. The first loan is designed for brand new. Learn how fha loans can help you to build or renovate your home with low down payment and flexible options. Fha construction loans can be rolled into an fha permanent mortgage. There are two types of fha construction loans: This type of loan can further be broken into two separate loans: Federal housing administration (fha) construction loans allow you to finance renovations to an existing home or the construction of a new home. Not eligible for fha financing: Let’s assume you’re interested in buying a house with a $375,000 fha mortgage loan. This loan program, offered by the federal housing. While there are exceptions, such as fha loans for those who need to. When it comes to fha construction loans, there are two main types designed to meet different needs. Fha 203 (k) loans enable homeowners to purchase and/or renovate an already existing home. If you have a credit score of 580 or higher, your down payment will likely be $13,125. You can either buy a home from a builder with a traditional fha loan or you can use. To get an fha construction loan, you will need to follow a series of steps ranging from purchasing the land to paying the builders throughout the construction phase. Unlike other fha loans, title 1 loans don’t require you to live in the home as your primary residence unless the property in question is a manufactured home.How to Get a Florida FHA Loan FirstTime Home Buyers Guide

FHA Mortgage Loans Updated Shop FHA Approved Lenders

Can I Buy Land And Build A House With An FHA Loan?

Federal Housing Administration (FHA) Loan Requirements, Limits, How to

FHA Home Loan What You Need To Know Elkins, WV HomeOwnership

Can You Get Fha Loan On Mobile Home Loan Walls

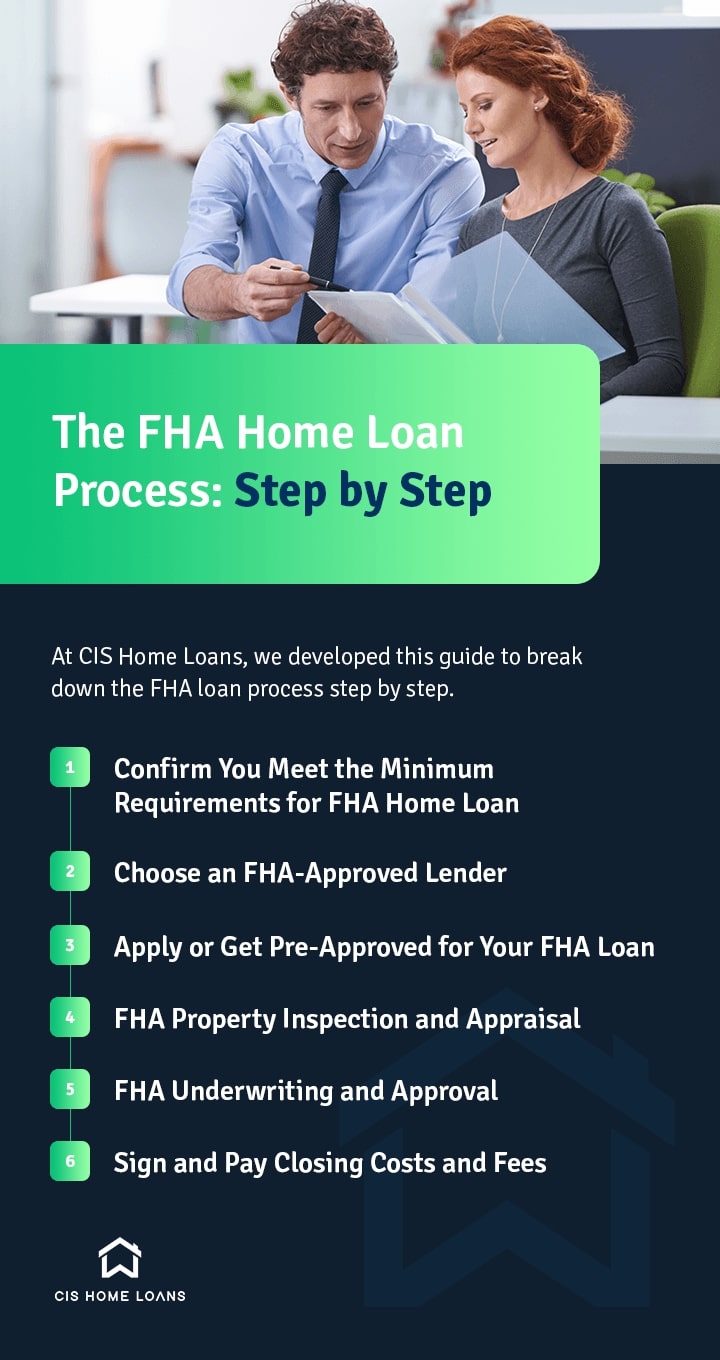

The FHA Home Loan Process Step by Step CIS Home Loans

FHA Construction Loan for 2025 One Time Close FHA Lenders

The Ultimate Guide to FHA Home Construction Loans Everything You Need

A Prefabricated House Built Before June 15, 1976, Can Be Moved And Used As A Permanent Home.

The Land Purchase, Plans, Permits, Approved Fees, Labor And Materials.

In Typical Cases, You Can Technically Only Have An Fha Loan For One Primary Residence At A Time.

Deciding Whether An Assumable Mortgage Is Right.

Related Post:

:max_bytes(150000):strip_icc()/FHAnew-V1-a128f12bf4584ae8a9a5b7d0214cd8e4.png)