Can You Take Money Off Chime Credit Builder Card

Can You Take Money Off Chime Credit Builder Card - While it’s still a secured card and requires collateral, you create it by transferring money from your spending account to your credit builder card. The chime visa® debit card and the secured chime credit builder visa® credit card are issued by the bancorp bank, n.a. Yea they suck for me. If you don't pay it in 14 days, they will force pay it from other accounts or take your next deposit to cover it. After that, you can borrow. On your app, click on move money. You can use your credit builder card anywhere visa® is accepted and at the end of each month, you can use the money previously moved to pay for your monthly charges (we recommend. Now there is a “safe option” in the credit builder account, this means on the 23rd chime will automatically take the money out of your credit builder account and pay off the balance for. Using a credit card like credit builder for an atm cash withdrawal is called a “cash advance.”. You can use your chime credit builder secured credit card to make cash withdrawals at an atm. You can use money deposited. 2 money added to credit builder will be held in a secured deposit account as collateral for your credit builder visa card, and you can spend up to this amount. However, it's essential to understand the implications and consider. A chime credit builder card is a great tool to help you rebuild your credit. Or stride bank, n.a., pursuant to licenses from visa u.s.a. Your secured credit builder card has an atm withdrawal limit of $1,015 per day. On your app, click on move money. Yea they suck for me. You can use money deposited. If you don't pay it in 14 days, they will force pay it from other accounts or take your next deposit to cover it. On your app, click on move money. After that, you can borrow. You can move money from your chime credit builder secured account back into your chime spending account. The chime visa® debit card and the secured chime credit builder visa® credit card are issued by the bancorp bank, n.a. 2 money added to credit builder will be held in. Using a credit card like credit builder for an atm cash withdrawal is called a “cash advance.”. You can move money from your chime credit builder secured account back into your chime spending account. You can also manually pay. If the from setting is spending account, click on the arrow and it will take you to choosing between. On move. How to withdraw money from chime credit builder card👉 in this tutorial, we will show you how to easily withdraw money from your chime credit builder card. You can also manually pay. You can request a cash withdrawal by going into a bank or credit union and presenting your chime visa debit card to the teller. Yes, you can withdraw. Using a credit card like credit builder for an atm cash withdrawal is called a “cash advance.”. After that, you can borrow. Your secured credit builder card has an atm withdrawal limit of $1,015 per day. Can i withdraw from my chime credit builder card? If your credit builder available to spend is less than $1,015, you can withdraw up. 3 money added to credit builder will be held in a secured deposit account as collateral for your credit builder visa card, and you can spend up to this amount. A chime credit builder card is a great tool to help you rebuild your credit. Or stride bank, n.a., pursuant to licenses from visa u.s.a. However, it's essential to understand. 3 money added to credit builder will be held in a secured deposit account as collateral for your credit builder visa card, and you can spend up to this amount. Now there is a “safe option” in the credit builder account, this means on the 23rd chime will automatically take the money out of your credit builder account and pay. How to withdraw money from chime credit builder card👉 in this tutorial, we will show you how to easily withdraw money from your chime credit builder card. 2 money added to credit builder will be held in a secured deposit account as collateral for your credit builder visa card, and you can spend up to this amount. The chime visa®. Credit builder atm withdrawals don’t affect the withdrawal limits on your debit card. Your secured credit builder card has an atm withdrawal limit of $1,015 per day. You can move money from your chime credit builder secured account back into your chime spending account. At the end of the month, you can use the money in your secured account to. Or stride bank, n.a., pursuant to licenses from visa u.s.a. The chime visa® debit card and the secured chime credit builder visa® credit card are issued by the bancorp bank, n.a. You can move money from your chime credit builder secured account back into your chime spending account. You can use money deposited. Yes, you can withdraw cash from a. While it’s still a secured card and requires collateral, you create it by transferring money from your spending account to your credit builder card. You can request a cash withdrawal by going into a bank or credit union and presenting your chime visa debit card to the teller. If you don't pay it in 14 days, they will force pay. Can i use my chime credit builder card with no money? Or stride bank, n.a., pursuant to licenses from visa u.s.a. If your credit builder available to spend is less than $1,015, you can withdraw up to that amount from atms. If you don't pay it in 14 days, they will force pay it from other accounts or take your next deposit to cover it. You can request a cash withdrawal by going into a bank or credit union and presenting your chime visa debit card to the teller. But no fee or negative marks. While it’s still a secured card and requires collateral, you create it by transferring money from your spending account to your credit builder card. At the end of the month, you can use the money in your secured account to pay your balance automatically with the safer credit building feature. Yea they suck for me. On move money, click on transfer funds. Now there is a “safe option” in the credit builder account, this means on the 23rd chime will automatically take the money out of your credit builder account and pay off the balance for. 2 money added to credit builder will be held in a secured deposit account as collateral for your credit builder visa card, and you can spend up to this amount. You can use your chime credit builder secured credit card to make cash withdrawals at an atm. You can use money deposited. You can use your credit builder card anywhere visa® is accepted and at the end of each month, you can use the money previously moved to pay for your monthly charges (we recommend. After that, you can borrow.How to Withdraw Cash From Your Chime Credit Builder Card? DeviceMAG

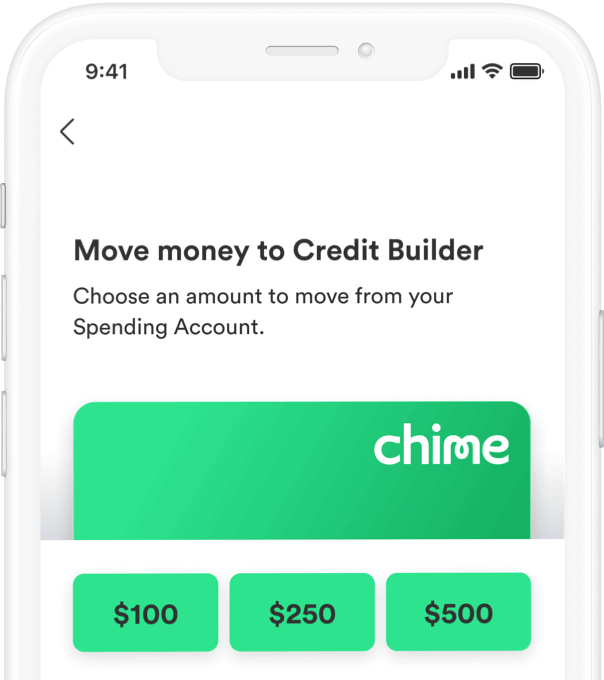

How To Move Money From Chime To Your Credit Builder Card(Transfer From

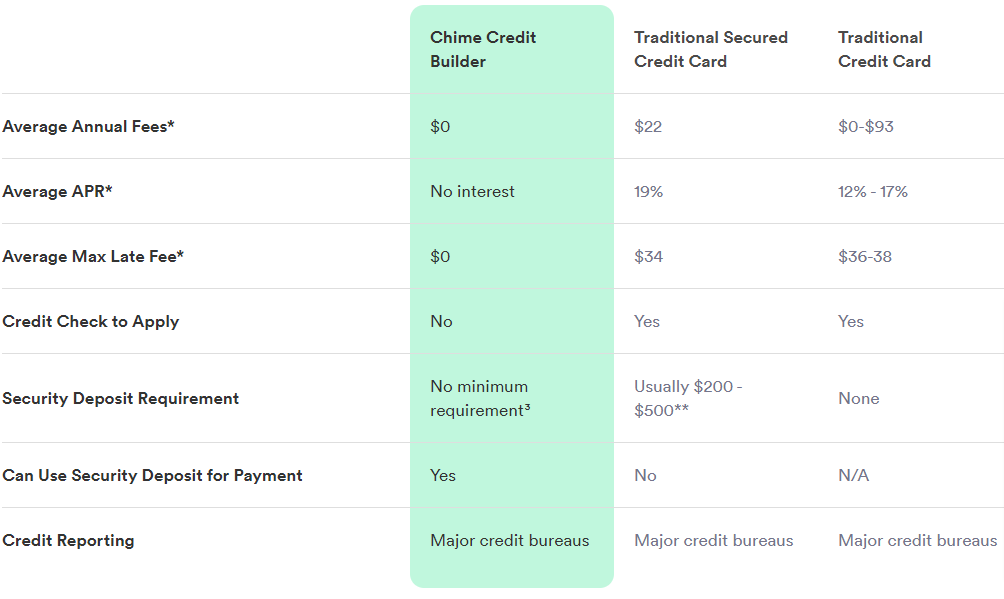

Credit Card To Build Credit Securely Chime

US challenger bank Chime launches Credit Builder, a credit card that

How Does Chime Credit Builder Work? Chime YouTube

Can you withdraw cash with Chime Credit Builder Card ? YouTube

How to Withdraw Money from Chime Credit Builder Card Quick Tutorial

Credit Builder Card Chime

(2023) How to move money from Chime credit builder card UniTopTen

Chime Credit Builder Review Can It Really Improve Your Credit?

However, You Cannot Use The Card.

Credit Builder Atm Withdrawals Don’t Affect The Withdrawal Limits On Your Debit Card.

A Chime Credit Builder Card Is A Great Tool To Help You Rebuild Your Credit.

Your Secured Credit Builder Card Has An Atm Withdrawal Limit Of $1,015 Per Day.

Related Post: