Capital Allowances On Buildings

Capital Allowances On Buildings - Following the introduction of the structures and buildings allowance (sba) in 2018, the cost of physically constructing or extending a commercial building will now qualify for. The aim of capital allowances is to allow you to claim a proportion of the cost from your taxable profits, thereby reducing your tax bill. Capital allowances encompass several categories, each addressing specific expenditures associated with commercial property investments. This distinction is critical for determining allowable deductions and involves. Explore effective strategies to maximize tax savings through capital allowances on business assets, ensuring compliance and optimal financial benefits. Capital assets are real or personal property that have a value equal to or greater than the capitalization threshold for the particular classification of the asset and have an. Capital allowances provide tax reliefs that businesses can claim on certain types of spending to encourage investment. See the fine art collection at this building. Only capital expenditures related to building construction or renovation qualify under the irc. View expiring lease/occupancy information for more than 8,600 leased and 1,500 government owned buildings. The federal government bought the building in 1942. See the fine art collection at this building. Capital assets are real or personal property that have a value equal to or greater than the capitalization threshold for the particular classification of the asset and have an. Capital allowances are akin to a tax deductible expense and are available in respect of qualifying capital expenditure incurred on the provision of certain assets in use for. Capital allowances provide tax reliefs that businesses can claim on certain types of spending to encourage investment. In simple terms, capital allowances are a way to claim tax relief on qualifying assets that are part of your. View expiring lease/occupancy information for more than 8,600 leased and 1,500 government owned buildings. Explore effective strategies to maximize tax savings through capital allowances on business assets, ensuring compliance and optimal financial benefits. Only capital expenditures related to building construction or renovation qualify under the irc. Following the introduction of the structures and buildings allowance (sba) in 2018, the cost of physically constructing or extending a commercial building will now qualify for. The federal government bought the building in 1942. This distinction is critical for determining allowable deductions and involves. Learn what activities and expenditures will qualify for structures and buildings allowance (sba) to see if your business can benefit. Capital allowances provide tax reliefs that businesses can claim on certain types of spending to encourage investment. Only capital expenditures related to. Capital assets are real or personal property that have a value equal to or greater than the capitalization threshold for the particular classification of the asset and have an. Capital allowances are akin to a tax deductible expense and are available in respect of qualifying capital expenditure incurred on the provision of certain assets in use for. What are capital. Capital allowances provide tax reliefs that businesses can claim on certain types of spending to encourage investment. See the fine art collection at this building. Learn what activities and expenditures will qualify for structures and buildings allowance (sba) to see if your business can benefit. Only capital expenditures related to building construction or renovation qualify under the irc. This distinction. The federal government bought the building in 1942. Capital allowances are akin to a tax deductible expense and are available in respect of qualifying capital expenditure incurred on the provision of certain assets in use for. This distinction is critical for determining allowable deductions and involves. What are capital allowances on commercial property? Learn what activities and expenditures will qualify. What are capital allowances on commercial property? Following the introduction of the structures and buildings allowance (sba) in 2018, the cost of physically constructing or extending a commercial building will now qualify for. Capital allowances provide tax reliefs that businesses can claim on certain types of spending to encourage investment. Capital allowances are akin to a tax deductible expense and. Capital allowances encompass several categories, each addressing specific expenditures associated with commercial property investments. See the fine art collection at this building. In simple terms, capital allowances are a way to claim tax relief on qualifying assets that are part of your. Capital assets are real or personal property that have a value equal to or greater than the capitalization. Explore effective strategies to maximize tax savings through capital allowances on business assets, ensuring compliance and optimal financial benefits. What are capital allowances on commercial property? Capital allowances are akin to a tax deductible expense and are available in respect of qualifying capital expenditure incurred on the provision of certain assets in use for. The aim of capital allowances is. Capital allowances are akin to a tax deductible expense and are available in respect of qualifying capital expenditure incurred on the provision of certain assets in use for. Learn what activities and expenditures will qualify for structures and buildings allowance (sba) to see if your business can benefit. What are capital allowances on commercial property? They are, in effect, compensation. This distinction is critical for determining allowable deductions and involves. In simple terms, capital allowances are a way to claim tax relief on qualifying assets that are part of your. Capital allowances provide tax reliefs that businesses can claim on certain types of spending to encourage investment. Capital allowances encompass several categories, each addressing specific expenditures associated with commercial property. See the fine art collection at this building. The aim of capital allowances is to allow you to claim a proportion of the cost from your taxable profits, thereby reducing your tax bill. Learn what activities and expenditures will qualify for structures and buildings allowance (sba) to see if your business can benefit. They are, in effect, compensation for. In. Learn what activities and expenditures will qualify for structures and buildings allowance (sba) to see if your business can benefit. Following the introduction of the structures and buildings allowance (sba) in 2018, the cost of physically constructing or extending a commercial building will now qualify for. Capital allowances encompass several categories, each addressing specific expenditures associated with commercial property investments. The federal government bought the building in 1942. View expiring lease/occupancy information for more than 8,600 leased and 1,500 government owned buildings. Capital allowances provide tax reliefs that businesses can claim on certain types of spending to encourage investment. They are, in effect, compensation for. Only capital expenditures related to building construction or renovation qualify under the irc. Capital allowances are akin to a tax deductible expense and are available in respect of qualifying capital expenditure incurred on the provision of certain assets in use for. In simple terms, capital allowances are a way to claim tax relief on qualifying assets that are part of your. Capital assets are real or personal property that have a value equal to or greater than the capitalization threshold for the particular classification of the asset and have an. The aim of capital allowances is to allow you to claim a proportion of the cost from your taxable profits, thereby reducing your tax bill.Capital Allowances Industrial buildings What are the requirements

Structures and Buildings Allowance Capital Allowances PD Tax

Capital Allowances on Buildings What You Need to Know Thomas Nock

What Is Capital Allowance and Industrial Building Allowance? How to

PPT Capital Allowances An Overview PowerPoint Presentation, free

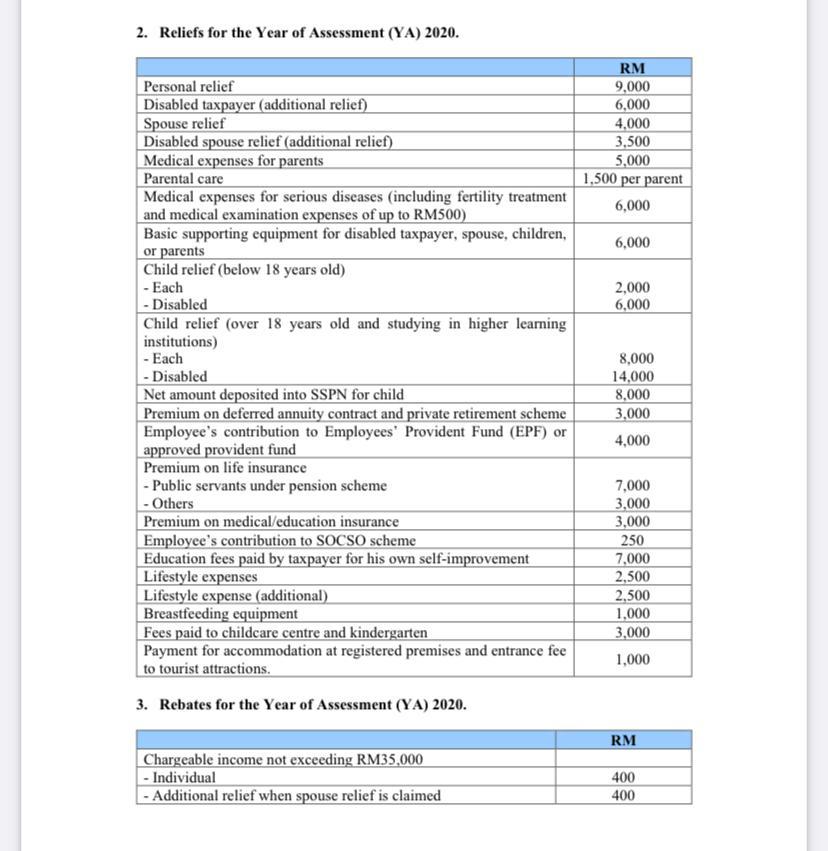

5. Capital and industrial building allowances Initial

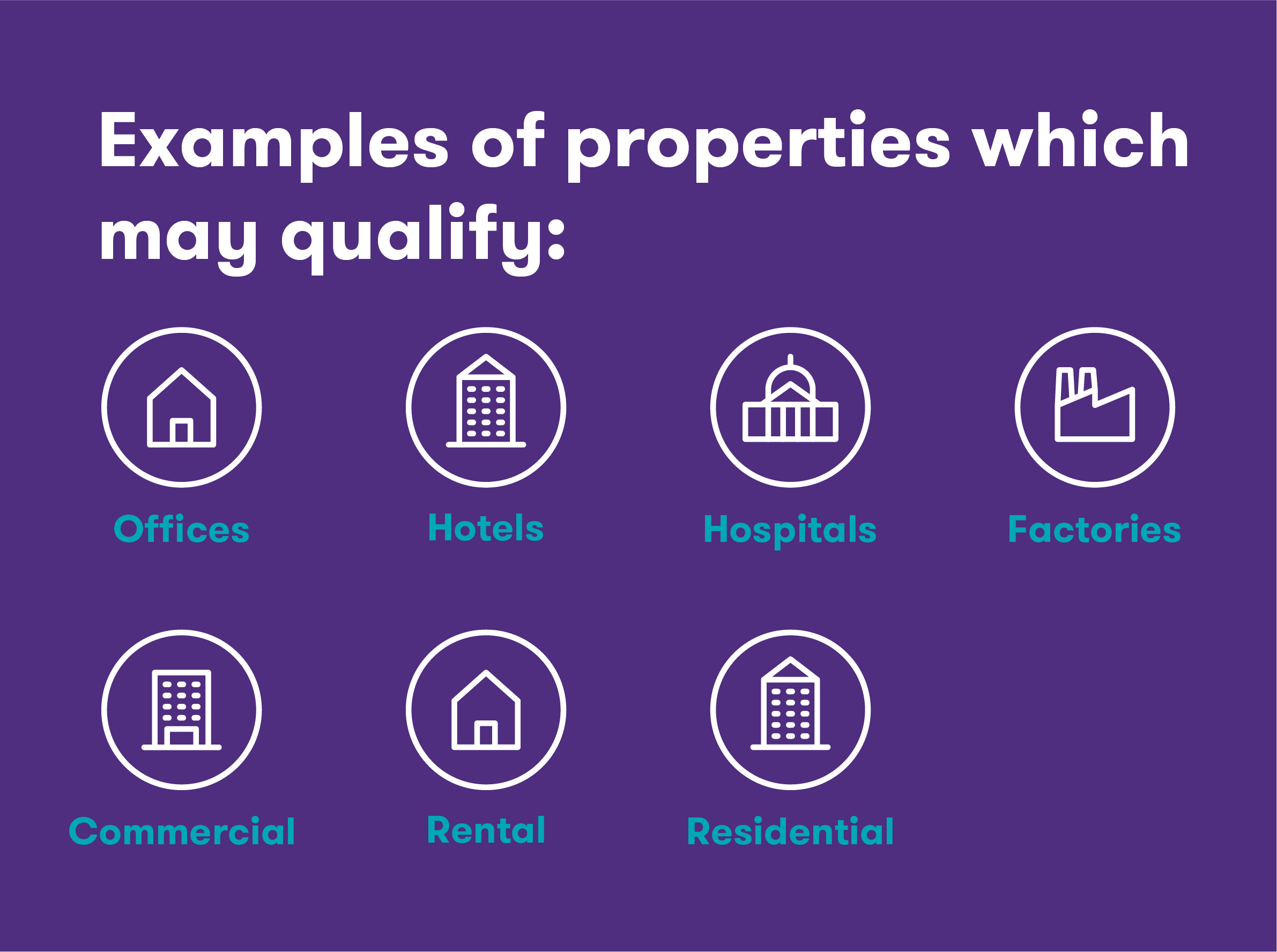

Capital Allowances commercial buildings What are the requirements

Capital Allowances Structures and Building Allowance

Capital Allowances Grant Thornton

Chapter 6 Capital Allowance Industrial Building Allowance PDF

This Distinction Is Critical For Determining Allowable Deductions And Involves.

See The Fine Art Collection At This Building.

What Are Capital Allowances On Commercial Property?

Explore Effective Strategies To Maximize Tax Savings Through Capital Allowances On Business Assets, Ensuring Compliance And Optimal Financial Benefits.

Related Post: