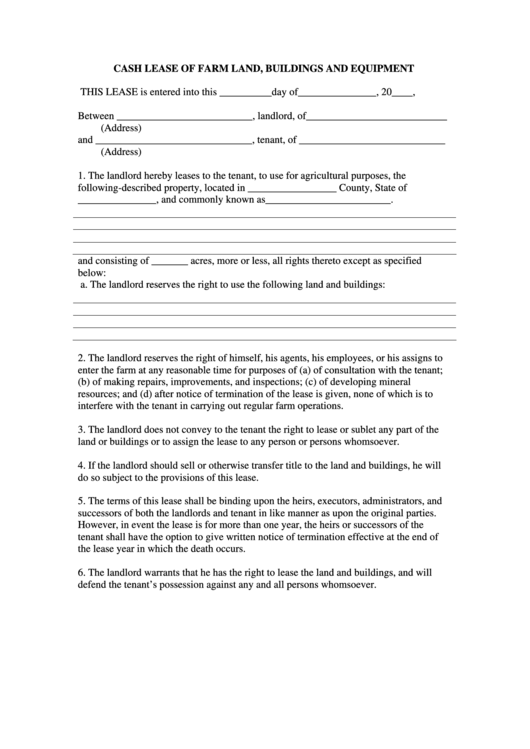

Cash Lease Of Farm Land Buildings And Equipment

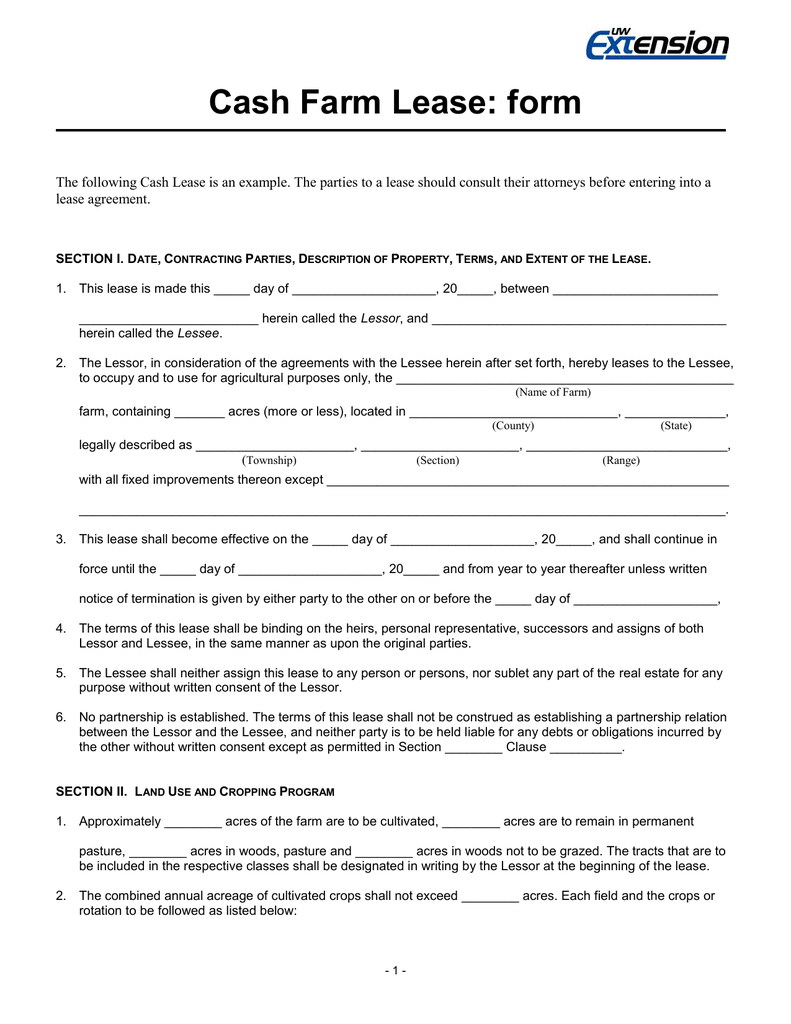

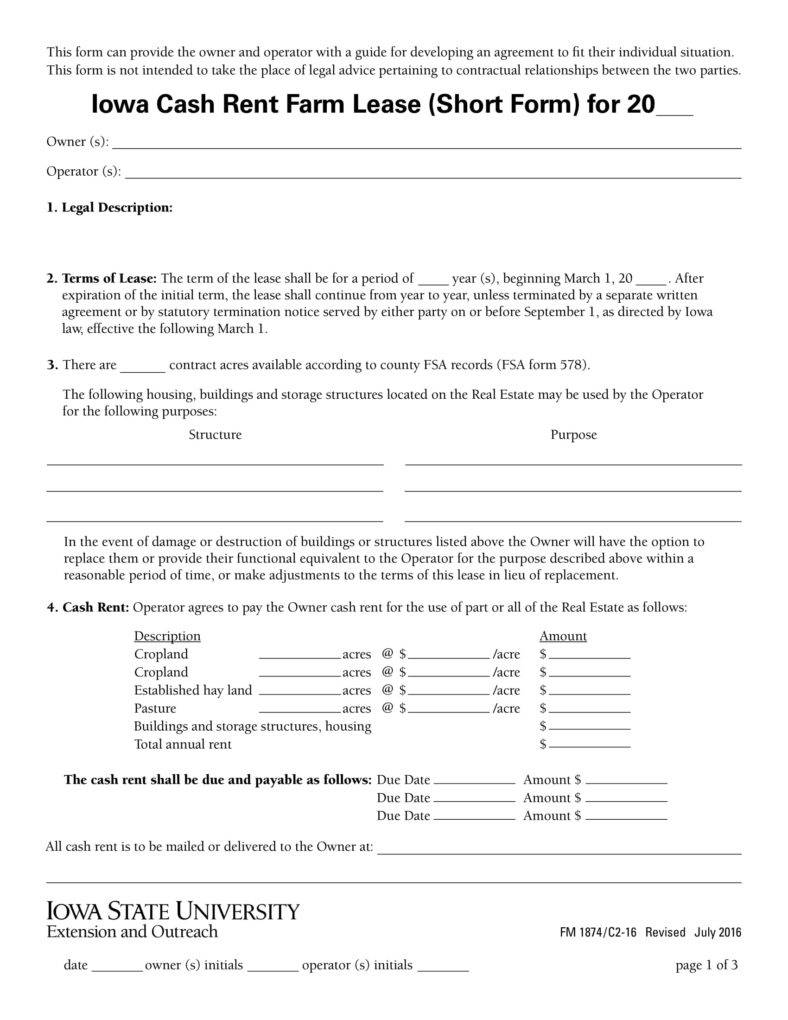

Cash Lease Of Farm Land Buildings And Equipment - When landowners desire to maximize exposure while leasing their farmland, we post their farm for rent on this page. Airslate signnow combines ease of use, affordability and security in one online. Generally, a farm lease should be in writing for many reasons. Farmers and ranchers often seek additional land for: The farm leases could be cash rent, crop share, or custom farm. We’ve covered the topic of leasing a number of ways—the main types of leases and their applications, how to arrive at a mutually satisfying landowner/tenant agreement, and. This is where the tenant usually pays a fixed dollar amount in rent (either on a per acre or whole farm basis). A flexible cash lease allows the landlord and tenant to adjust the rent payment based on changes in crop prices and yields. Suggestions for completing and using this lease form are available from your county extension adviser and from illinois extension circular 1199, farm leases for illinois. Cross out any provisions that are. Generally, a farm lease should be in writing for many reasons. Lease options besides cash rent and share rent include variable cash rent and custom farming. This is where the tenant usually pays a fixed dollar amount in rent (either on a per acre or whole farm basis). Airslate signnow combines ease of use, affordability and security in one online. This form can provide the landowner and operator with a guide. Owning and maintaining farm equipment represents a significant financial challenge for many farmers across the us and canada. Fill it online and save as a pdf or word document for free. However, a farm tenant in possession of illinois farmland under an oral lease has some protection under the law. With a true lease, your payments can be deducted. Farmers and ranchers often seek additional land for: Generally, a farm lease should be in writing for many reasons. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Owning and maintaining farm equipment represents a significant financial challenge for many farmers across the us and canada. Airslate signnow combines ease of use, affordability and security in one online. Leasing used agricultural equipment also comes. According to usda's national agricultural statistic service (nass), agricultural producers lease over 42 percent of all agricultural land in maryland, or 850,512 acres in 2012 (ag census,. This form can provide the landowner and operator with a guide. Airslate signnow combines ease of use, affordability and security in one online. While written leases are best, if there is not a. When landowners desire to maximize exposure while leasing their farmland, we post their farm for rent on this page. The farm leases could be cash rent, crop share, or custom farm. Owning and maintaining farm equipment represents a significant financial challenge for many farmers across the us and canada. Suggestions for completing and using this lease form are available from. The tenant will maintain the buildings and equipment during his tenancy in as good condition as at the beginning, normal wear and depreciation beyond tenant’s control excepted.9. The lease form represents a basic model for an agricultural lease. If your land has fertile soil and access to water, leasing it for agriculture can be a steady source of income. Cross. This is where the tenant usually pays a fixed dollar amount in rent (either on a per acre or whole farm basis). The tenant will maintain the buildings and equipment during his tenancy in as good condition as at the beginning, normal wear and depreciation beyond tenant’s control excepted.9. A flexible cash lease allows the landlord and tenant to adjust. This form can provide the landowner and operator with a guide. The tenant will maintain the buildings and equipment during his tenancy in as good condition as at the beginning, normal wear and depreciation beyond tenant’s control excepted.9. For instance, if crop prices are. This is where the tenant usually pays a fixed dollar amount in rent (either on a. Cross out any provisions that are. The tenant will maintain the buildings and equipment during his tenancy in as good condition as at the beginning, normal wear and depreciation beyond tenant’s control excepted.9. Airslate signnow combines ease of use, affordability and security in one online. Leasing used agricultural equipment also comes with notable tax benefits: The lease form represents a. If your land has fertile soil and access to water, leasing it for agriculture can be a steady source of income. Cross out any provisions that are. We’ve covered the topic of leasing a number of ways—the main types of leases and their applications, how to arrive at a mutually satisfying landowner/tenant agreement, and. Farmers and ranchers often seek additional. Suggestions for completing and using this lease form are available from your county extension adviser and from illinois extension circular 1199, farm leases for illinois. With a true lease, your payments can be deducted. These types of leases may be modified. Lease options besides cash rent and share rent include variable cash rent and custom farming. It outlines the terms. Lease options besides cash rent and share rent include variable cash rent and custom farming. The lease form represents a basic model for an agricultural lease. Generally, a farm lease should be in writing for many reasons. With a true lease, your payments can be deducted. The tenant will maintain the buildings and equipment during his tenancy in as good. We’ve covered the topic of leasing a number of ways—the main types of leases and their applications, how to arrive at a mutually satisfying landowner/tenant agreement, and. The tenant will maintain the buildings and equipment during his tenancy in as good condition as at the beginning, normal wear and depreciation beyond tenant’s control excepted.9. According to usda's national agricultural statistic service (nass), agricultural producers lease over 42 percent of all agricultural land in maryland, or 850,512 acres in 2012 (ag census,. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Up to 40% cash back this document is a cash lease agreement for farm land, buildings, and equipment between a landlord and a tenant. To illustrate, farm credit canada. With a true lease, your payments can be deducted. Lease options besides cash rent and share rent include variable cash rent and custom farming. However, a farm tenant in possession of illinois farmland under an oral lease has some protection under the law. The farm leases could be cash rent, crop share, or custom farm. These types of leases may be modified. Suggestions for completing and using this lease form are available from your county extension adviser and from illinois extension circular 1199, farm leases for illinois. Owning and maintaining farm equipment represents a significant financial challenge for many farmers across the us and canada. The parties to the lease or their legal counsel may wish to consider modifications to better meet the needs of the. Cross out any provisions that are. While written leases are best, if there is not a written lease in place, the.12 Free Sample Professional Farm Land Lease Agreement Templates

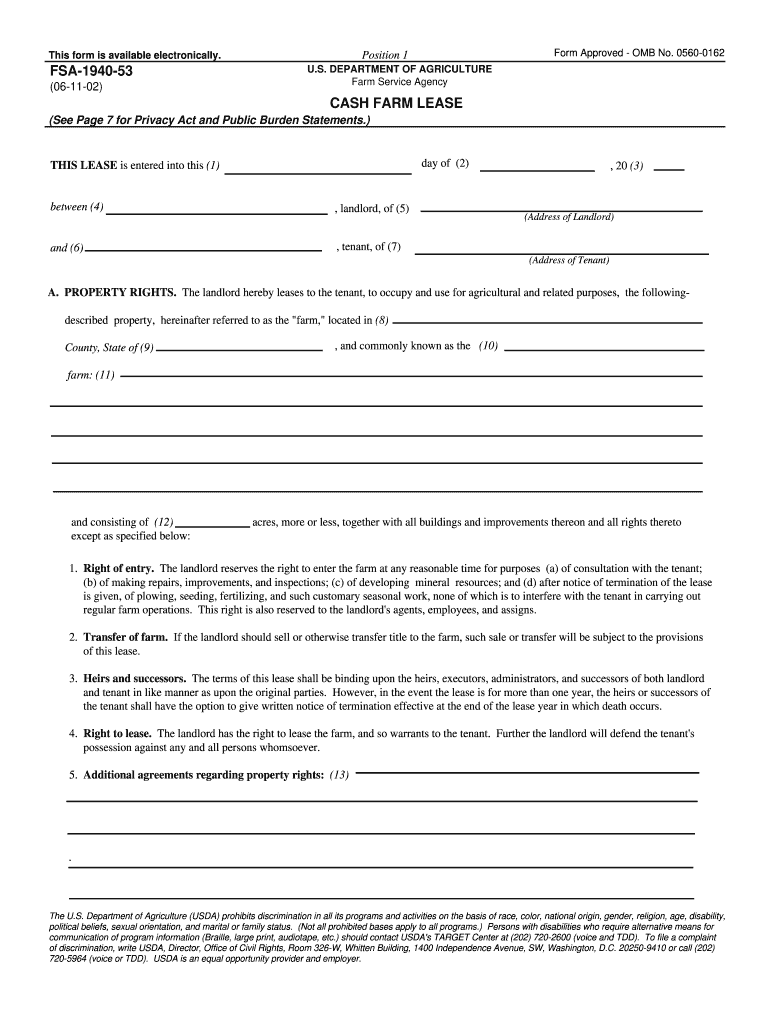

Simple Cash Farm Lease Agreement 20022025 Form Fill Out and Sign

12 Free Sample Professional Farm Land Lease Agreement Templates

Cash Farm Lease multiple page form (Word document)

Farm Lease or Rental Cash Farm Lease Rental Cash Form US Legal Forms

14+ Farm Lease Agreement Templates PDF, Word Free & Premium Templates

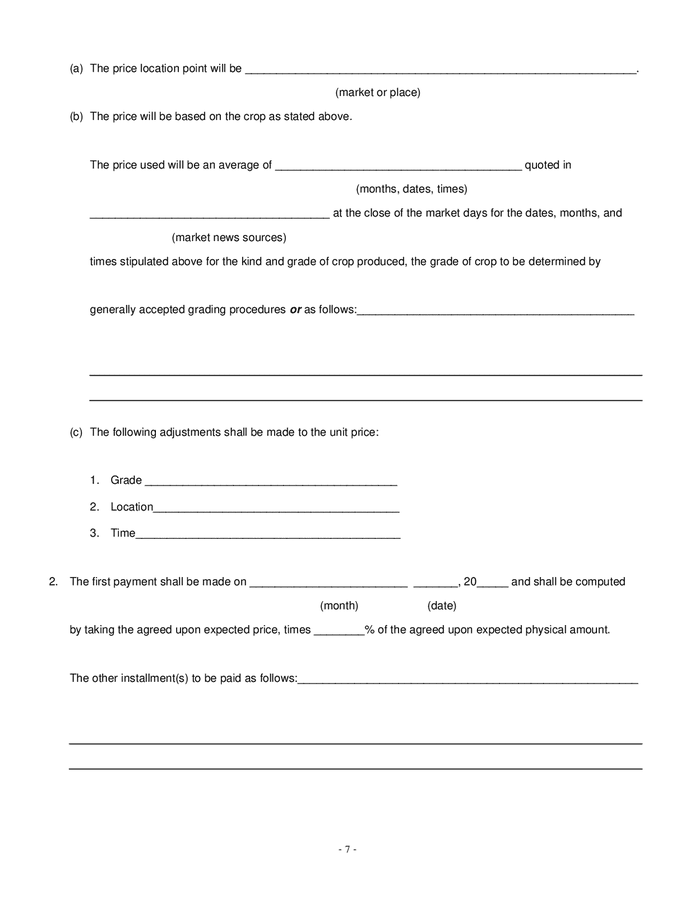

Cash farm lease form in Word and Pdf formats page 7 of 16

14+ Farm Lease Agreement Templates PDF, Word Free & Premium Templates

Fillable Cash Lease Of Farm Land, Buildings And Equipment Template

10+ Sample Basic Lease Agreement Templates Sample Templates

The Lease Form Represents A Basic Model For An Agricultural Lease.

This Form Can Provide The Landowner And Operator With A Guide.

For Instance, If Crop Prices Are.

A Flexible Cash Lease Allows The Landlord And Tenant To Adjust The Rent Payment Based On Changes In Crop Prices And Yields.

Related Post: