Cash Paid To Purchase A New Office Building

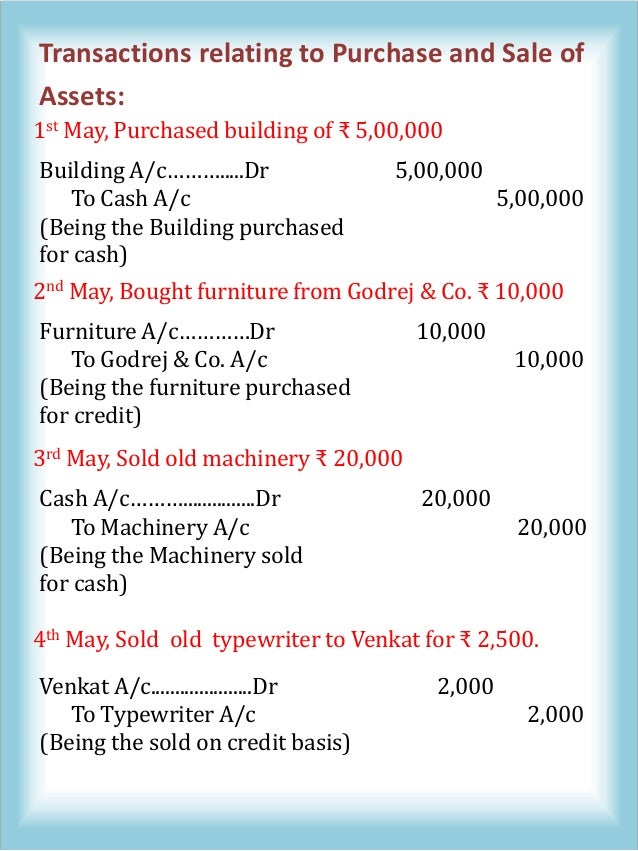

Cash Paid To Purchase A New Office Building - For each item below, indicate the type of business activity: Cash paid to suppliers e. Cash paid to purchase a new office building. Prepare a retained earnings statement for the year ending december 31, 2025. The company paid a net purchase price of $150,000, brokerage fees of $5,000, legal fees of $2,000, and freight and insurance in transit of $3,000. Cash paid to stockholders and received from issuing new. Cash paid to purchase a new office building. Pay $165,000 down and make payments of $4760,58 over 15 years. In each case, identify whether the item would appear on the balance sheet or income statement. This information relates to sunland co. There are 2 steps to solve this one. In addition, the company paid $1,500 to. When a business buys a building, its cost includes: Cash received from customers and paid to suppliers are operating activities; Cash paid to stockholders (dividends) c. Cash paid to stockholders and received from issuing new. The company is considering two options: The items are classified as follows: Would cash paid for a building be reported on the statement of cash flows as an operating activity, an investing activity, or a financing activity on the statement of cash flows, or does. (a) cash received from customers. Cash received from customers b. New construction costs in the area: This information relates to sunland co. For each option, determine (1) the total cash paid for the building over 15 years, including the down payment, and (2) total. At $55 per square foot, this purchase represents exceptional value in today’s market. At $55 per square foot, this purchase represents exceptional value in today’s market. Cash paid to purchase a new office. Cash paid to purchase a new office building. Pay $165,000 down and make payments of $4760,58 over 15 years. Study with quizlet and memorize flashcards containing terms like an expression about whether financial statements conform with generally accepted accounting principles,. The operating activities section of the cash flow statement provides information about a company's c. Study with quizlet and memorize flashcards containing terms like an expression about whether financial statements conform with generally accepted accounting principles, a. Cash paid to purchase a new office building. Cash paid to stockholders and received from issuing new. (select all that apply.)cash paid to. Pay $0 down and make monthly payments of $5,930.95. Cash paid to stockholders and received from issuing new. Cash received from customers and paid to suppliers are operating activities; Pharoah lakes park is a private camping ground near the mount miguel recreation area. This information relates to sunland co. There are 2 steps to solve this one. Using the information above, prepare a balance sheet as of december 31, 2022. For each item below, indicate the type of business activity: In each case, identify whether the item would appear on the balance sheet or income statement. The operating activities section of the cash flow statement provides information about a. When a business buys a building, its cost includes: Cash received from customers and paid to suppliers are operating activities; Cash paid to purchase a new office building. Would cash paid for a building be reported on the statement of cash flows as an operating activity, an investing activity, or a financing activity on the statement of cash flows, or. In each case, identify whether the item would appear on the balance sheet or income statement. Pay $0 down and make monthly payments of $5,930.95. The operating activities section of the cash flow statement provides information about a company's c. (select all that apply.)cash paid to employeespurchase of landcash paid to suppliers cash collected from customerspurchase of a new office. New construction costs in the area: The purchased building journal entry is to record a capital expenditure that is recognized as an asset. Operating activities, investing activities, or financing activities. At $55 per square foot, this purchase represents exceptional value in today’s market. Not the question you’re looking for? Cash paid to purchase a new office. Not the question you’re looking for? Cash paid to purchase a new office building. Would cash paid for a building be reported on the statement of cash flows as an operating activity, an investing activity, or a financing activity on the statement of cash flows, or does. The purchase price, repair and remodeling. The items are classified as follows: Would cash paid for a building be reported on the statement of cash flows as an operating activity, an investing activity, or a financing activity on the statement of cash flows, or does. The company is considering two options: New construction costs in the area: The operating activities section of the cash flow statement. New construction costs in the area: When a business buys a building, its cost includes: For each option, determine (1) the total cash paid for the building over 15 years, including the down payment, and (2) total. Would cash paid for a building be reported on the statement of cash flows as an operating activity, an investing activity, or a financing activity on the statement of cash flows, or does. Cash paid to purchase a new office building. Cash paid to purchase a new office building. The operating activities section of the cash flow statement provides information about a company's c. At $55 per square foot, this purchase represents exceptional value in today’s market. Cash received from customers and paid to suppliers are operating activities; Prepare a retained earnings statement for the year ending december 31, 2025. Cash paid to purchase a new office. We will debit the building and credit the liability or bank for recording. (select all that apply.)cash paid to employeespurchase of landcash paid to suppliers cash collected from customerspurchase of a new office building your solution’s ready to go!. In each case, identify whether the item would appear on the balance sheet or income statement. Cash paid to stockholders (dividends) c. The purchase price, repair and remodeling costs, unpaid taxes assumed by the purchaser, legal.Journal Entry For Purchase With Personal Funds

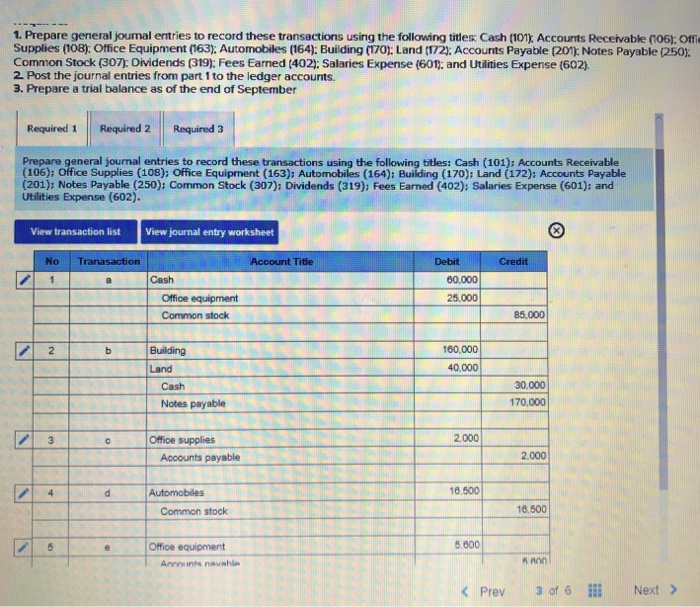

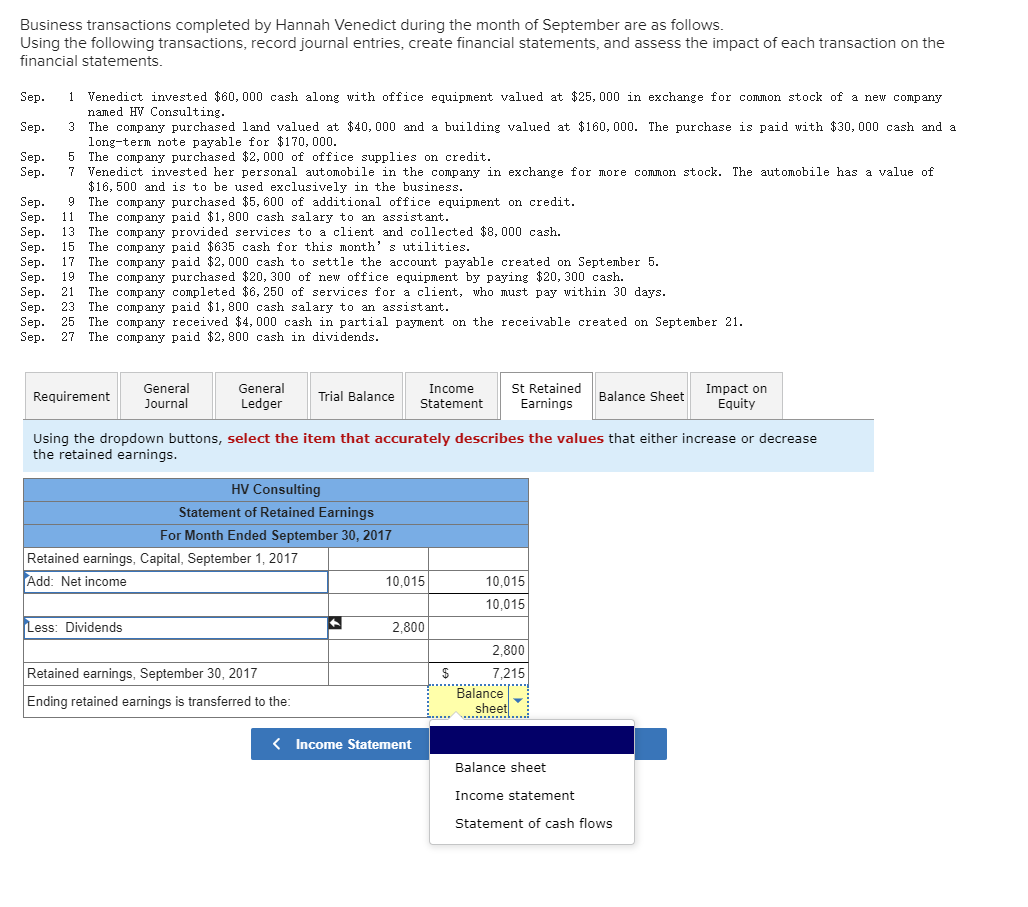

[Solved] Business transactions completed by Hannah Vendedict during the

Mohit has the following transactions, prepare accounting equation

Bought Office Furniture For Cash Journal Entry Furniture Walls

(Solved Homework) Business transactions completed by Hannah Venedict

Examples Archives Double Entry Bookkeeping

Solved A journal entry for a 300 payment to purchase office

Solved Bridge City Consulting bought a building and the land

How To Create An Statement For A New Business

What Is The Correct Journal Entry For The Transaction Paid Cash For An

The Company Paid A Net Purchase Price Of $150,000, Brokerage Fees Of $5,000, Legal Fees Of $2,000, And Freight And Insurance In Transit Of $3,000.

Using The Information Above, Prepare A Balance Sheet As Of December 31, 2022.

Cash Paid To Suppliers E.

Pay $0 Down And Make Monthly Payments Of $5,930.95.

Related Post: