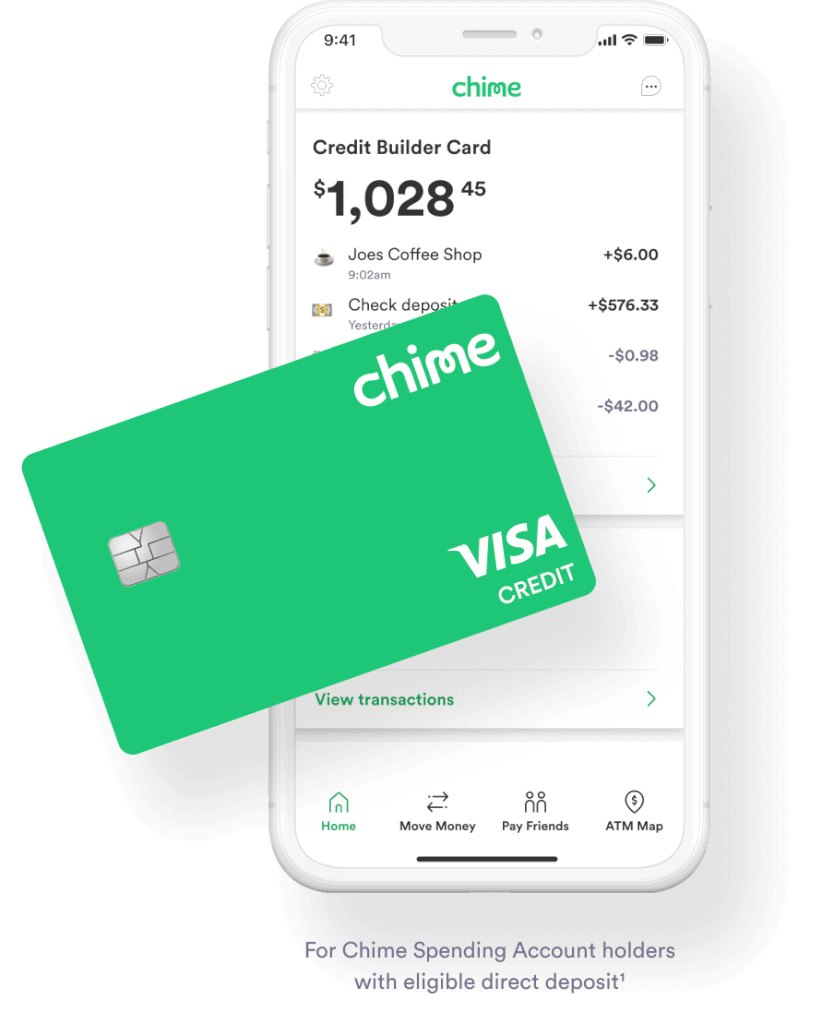

Chime Credit Builder Card Cash Advance

Chime Credit Builder Card Cash Advance - Start building credit for free. The chime credit builder visa ® credit card is our no annual fee, no interest, secured credit card that helps you build your credit. The chime credit builder card is a great way to help build your credit. Free for basic plan (but no cash advance available); Barcode and debit card cash deposits land in the checking account. No annual fees, no interest, or large security deposits². When to utilize and how. Fortunately, the chime credit builder secured visa credit card offers an appealing alternative. We detail credit genie cash advance requirements, reviews, and similar apps to borrow $100 fast. You’ll need to have a chime account to be able to apply for. Beyond its borrowing feature, current boasts saving pods with. How to apply for the chime credit builder card. You’ll need to have a chime account to be able to apply for. Credit builder card cash deposits first go through your card account and then land in your secured account. This secured charge card can help you build and improve your credit. You can request a cash withdrawal by going into a bank or credit union and presenting your chime visa debit card to the teller. For free but must pay a monthly. There are two ways for chime customers to find atms and cash back locations: Starts at $8.99 a month for the plus membership and access to cash advance max advance: Use your debit card to take out cash from your checking account. Starts at $8.99 a month for the plus membership and access to cash advance max advance: They’re a type of loan that you can pay back in the same way you pay. What is chime cash advance? Beyond its borrowing feature, current boasts saving pods with. Instantly disable your card to help prevent fraud. Instantly disable your card to help prevent fraud. Free for basic plan (but no cash advance available); What is chime cash advance? Barcode and debit card cash deposits land in the checking account. You can request a cash withdrawal by going into a bank or credit union and presenting your chime visa debit card to the teller. Starts at $8.99 a month for the plus membership and access to cash advance max advance: The chime credit builder visa ® credit card is our no annual fee, no interest, secured credit card that helps you build your credit. What is chime cash advance? There are two ways for chime customers to find atms and cash back locations: They’re. You’ll need to have a chime account to be able to apply for. Credit builder card cash deposits first go through your card account and then land in your secured account. We've reviewed the best cash advance apps that provide money instantly, because we know how important speed is when you’re in a tight spot. You can withdraw cash using. Beyond its borrowing feature, current boasts saving pods with. There are two ways for chime customers to find atms and cash back locations: This secured charge card can help you build and improve your credit. Barcode and debit card cash deposits land in the checking account. The chime credit builder card is a great way to help build your credit. You can also use your chime credit builder secured. Fortunately, the chime credit builder secured visa credit card offers an appealing alternative. Starts at $8.99 a month for the plus membership and access to cash advance max advance: Barcode and debit card cash deposits land in the checking account. The chime credit builder card is a great way to help. Free for basic plan (but no cash advance available); Credit builder card cash deposits first go through your card account and then land in your secured account. When to utilize and how. Instantly disable your card to help prevent fraud. Use your debit card to take out cash from your checking account. Starts at $8.99 a month for the plus membership and access to cash advance max advance: They’re a type of loan that you can pay back in the same way you pay. Fortunately, the chime credit builder secured visa credit card offers an appealing alternative. You can also use your chime credit builder secured. Free for basic plan (but no. This secured charge card can help you build and improve your credit. Instantly disable your card to help prevent fraud. Beyond its borrowing feature, current boasts saving pods with. No credit check to apply. They’re a type of loan that you can pay back in the same way you pay. This secured charge card can help you build and improve your credit. We detail credit genie cash advance requirements, reviews, and similar apps to borrow $100 fast. Instantly disable your card to help prevent fraud. You can also use your chime credit builder secured. Free for basic plan (but no cash advance available); No annual fees, no interest, or large security deposits². The chime credit builder card is a great way to help build your credit. Use your debit card to take out cash from your checking account. They’re a type of loan that you can pay back in the same way you pay. What is chime cash advance? You can withdraw cash using your credit builder card. Beyond its borrowing feature, current boasts saving pods with. Start building credit for free. For free but must pay a monthly. Can you withdraw cash from the chime credit builder credit card? You’ll need to have a chime account to be able to apply for. The chime credit builder visa ® credit card is our no annual fee, no interest, secured credit card that helps you build your credit. We've reviewed the best cash advance apps that provide money instantly, because we know how important speed is when you’re in a tight spot. This secured charge card can help you build and improve your credit. Instantly disable your card to help prevent fraud. Free for basic plan (but no cash advance available);US challenger bank Chime launches Credit Builder, a credit card that

How to build credit with Credit Builder Chime

Comprehensive Chime Credit Builder Card Review

Secured Chime Credit Builder Visa® Credit Card An Innovative Way to

How Does Chime Credit Builder Card Help In Fulfilling My Requirements?

Credit Builder Card Chime

Credit Builder Card Chime

Chime Credit Builder Review Is This Service Worth Using?

Chime Credit Builder Card Review A Secured Card With Guardrails

What is a Chime Credit Builder Credit Card? Quick Introduction Seek

Starts At $8.99 A Month For The Plus Membership And Access To Cash Advance Max Advance:

In A Nutshell, Credit Card Cash Advances Let You Take Out Money Against Your Card’s Available Credit Limit.

When To Utilize And How.

There Are Two Ways For Chime Customers To Find Atms And Cash Back Locations:

Related Post: