Chime Credit Builder Card Overdraft

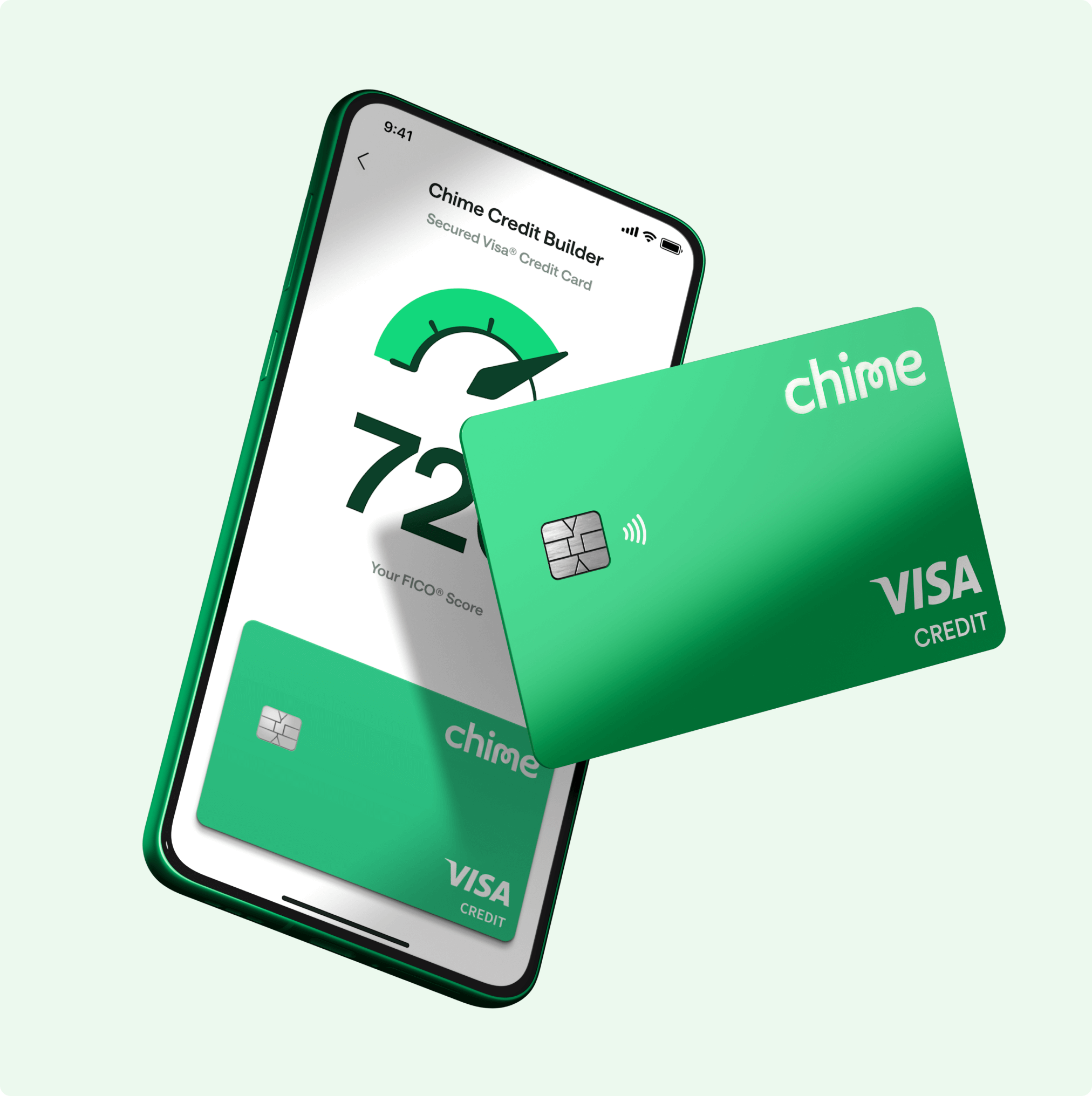

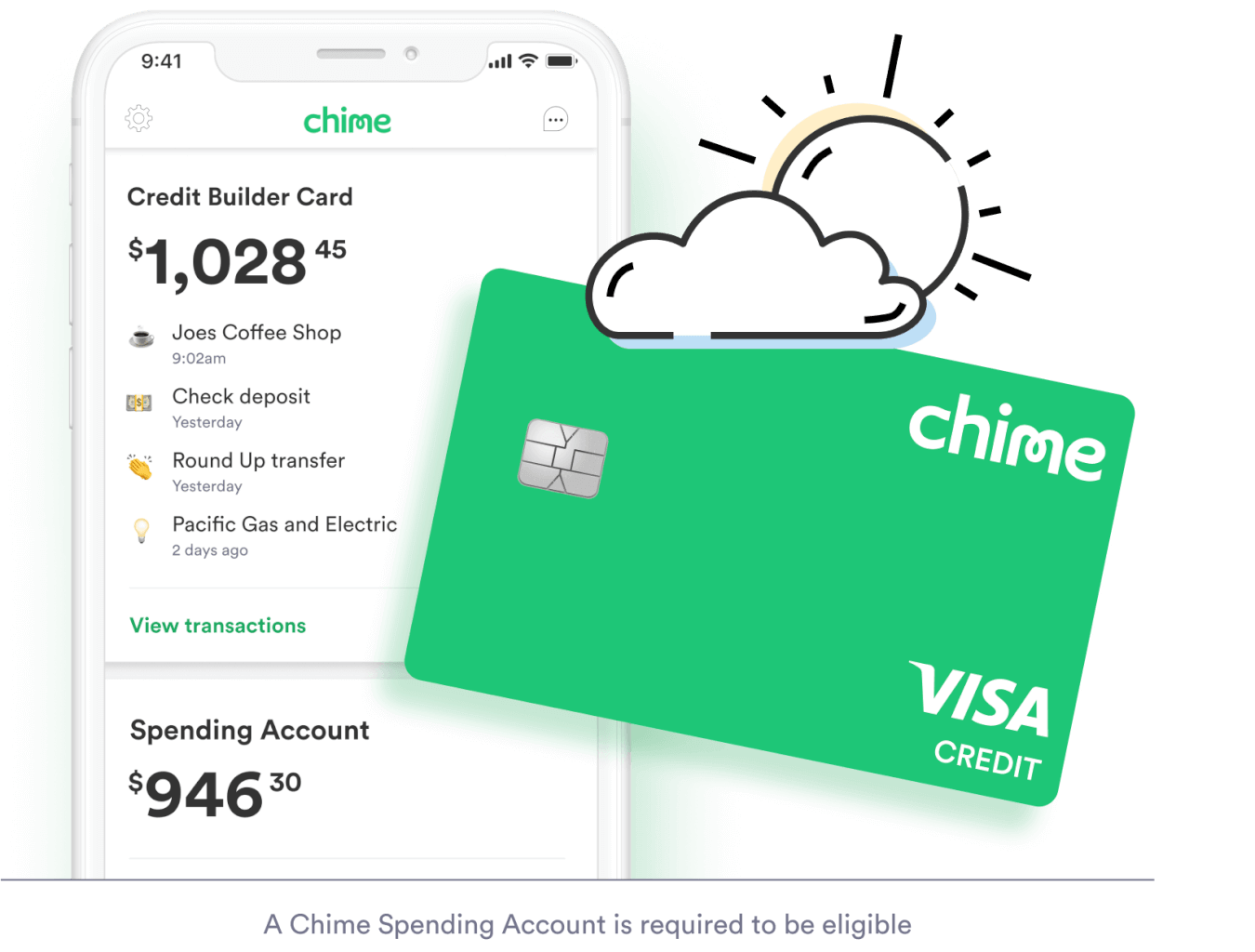

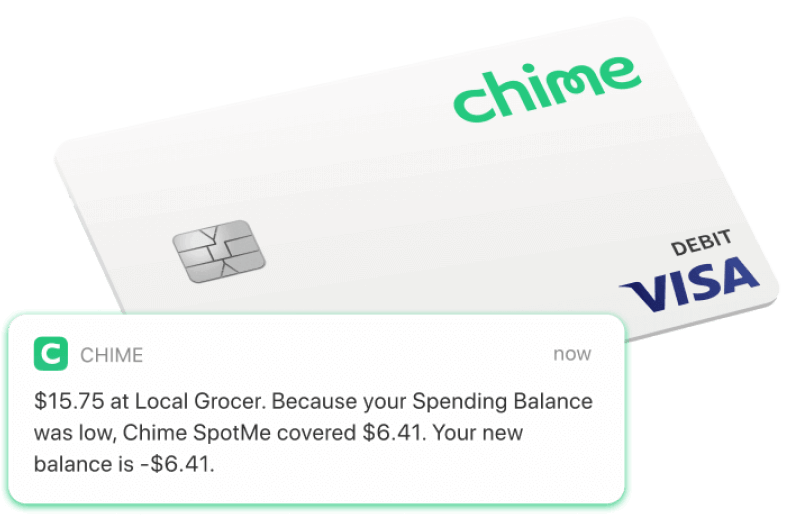

Chime Credit Builder Card Overdraft - No, there is no overdraft service available in chime credit builder card and you cannot exceed your credit limit i.e. Chime offers overdraft protection called spotme, but this feature doesn’t apply to the credit builder. Some banks allow you to link your checking account to your credit card or a line of credit for overdraft protection. Spotme lets eligible users overdraft. Free fico score access, free experian boost access, spotme overdraft coverage. My chime credit builder card is overdrawn. It has all the best banking features in one easy to use mobile app with no monthly fees. While the chime credit builder card itself does not have overdraft services, chime does provide a separate feature called spotme. The chime visa ® debit card and the secured chime credit builder visa. Overpayment of your credit card bill: While the chime credit builder card itself does not have overdraft services, chime does provide a separate feature called spotme. The maximum amount you can spend based on the funds available in your. 2 spotme ® for credit builder is an optional, no interest/no fee. Which allows you to overdraw your accounts up to $200 without any overdraft fees. Best cards for building credit find out which credit cards could help. Free fico score access, free experian boost access, spotme overdraft coverage. The chime visa ® debit card and the secured chime credit builder visa. This system is particularly designed to restrict your spending to only the amount you’ve transferred. You might accidentally overpay on your credit card. The chime credit builder visa ® credit card is our no annual fee, no interest, secured credit card that helps you build your credit. Free fico score access, free experian boost access, spotme overdraft coverage. Can you overdraft a chime credit builder card? My chime credit builder card is overdrawn. Spotme lets eligible users overdraft. No, there is no overdraft service available in chime credit builder card and you cannot exceed your credit limit i.e. You cannot overdraft with your chime credit builder card. My chime credit builder card is overdrawn. Chime offers overdraft protection called spotme, but this feature doesn’t apply to the credit builder. It has all the best banking features in one easy to use mobile app with no monthly fees. The chime credit builder visa ® credit card is our no. You might accidentally overpay on your credit card. The short answer is no. Some banks allow you to link your checking account to your credit card or a line of credit for overdraft protection. I didn't think that was possible, but it is. It has all the best banking features in one easy to use mobile app with no monthly. This is key to building your credit because it shows. Spotme¹ is now available as an overdraft. Linked credit card or line of credit: While the chime credit builder card itself does not have overdraft services, chime does provide a separate feature called spotme. It has all the best banking features in one easy to use mobile app with no. Overpayment of your credit card bill: 2 spotme ® for credit builder is an optional, no interest/no fee. You cannot overdraft with your chime credit builder card. Chime offers overdraft protection called spotme, but this feature doesn’t apply to the credit builder. Best cards for building credit find out which credit cards could help. Overpayment of your credit card bill: Can you overdraft a chime credit builder card? You could have added an. The chime credit builder secured visa is a secured credit card. The chime credit builder visa ® credit card is our no annual fee, no interest, secured credit card that helps you build your credit. Linked credit card or line of credit: I got an email submitted to customer support to inquire if i will be charged for an overdraft. One of the best things about the chime credit builder card is that it reports your activity to all three major credit bureaus. You might accidentally overpay on your credit card. Spotme¹ is now available. This system is particularly designed to restrict your spending to only the amount you’ve transferred. Spotme¹ is now available as an overdraft. You could have added an. Chime offers overdraft protection called spotme, but this feature doesn’t apply to the credit builder. The chime visa ® debit card and the secured chime credit builder visa. My chime credit builder card is overdrawn. You could have added an. Which allows you to overdraw your accounts up to $200 without any overdraft fees. Overpayment of your credit card bill: No, there is no overdraft service available in chime credit builder card and you cannot exceed your credit limit i.e. While the chime credit builder card itself does not have overdraft services, chime does provide a separate feature called spotme. Spotme lets eligible users overdraft. Some banks allow you to link your checking account to your credit card or a line of credit for overdraft protection. No, there is no overdraft service available in chime credit builder card and you. Linked credit card or line of credit: Overpayment of your credit card bill: I got an email submitted to customer support to inquire if i will be charged for an overdraft. Some banks allow you to link your checking account to your credit card or a line of credit for overdraft protection. It has all the best banking features in one easy to use mobile app with no monthly fees. Free fico score access, free experian boost access, spotme overdraft coverage. Spotme lets eligible users overdraft. Here are a few reasons why you might have a credit balance below $0: You cannot overdraft with your chime credit builder card. 2 spotme ® for credit builder is an optional, no interest/no fee. The chime credit builder secured visa is a secured credit card. The chime visa ® debit card and the secured chime credit builder visa. You might accidentally overpay on your credit card. This is key to building your credit because it shows. The maximum amount you can spend based on the funds available in your. Spotme¹ is now available as an overdraft.Chime Banking with No Monthly Fees. FeeFree Overdraft. Build Credit.

Chime Credit Builder Card Review No Credit Check + up to 200 Overdrafts

how to overdraft chime card inskeepscarboro99

Chime Banking with No Monthly Fees. FeeFree Overdraft. Build Credit.

Chime Banking with No Monthly Fees. FeeFree Overdraft. Build Credit.

Answers Chime Credit Builder Card & Spot Me Users Need To Know (2024)

Chime Banking with No Monthly Fees. FeeFree Overdraft. Build Credit.

Credit Builder Card Chime

Chime Banking with No Monthly Fees. FeeFree Overdraft. Build Credit.

Chime Banking with No Monthly Fees. FeeFree Overdraft. Build Credit.

The Short Answer Is No.

One Of The Best Things About The Chime Credit Builder Card Is That It Reports Your Activity To All Three Major Credit Bureaus.

Distinctly, Chime’s Credit Builder Does Not Facilitate An Overdraft Service.

While The Chime Credit Builder Card Itself Does Not Have Overdraft Services, Chime Does Provide A Separate Feature Called Spotme.

Related Post: