Chime Credit Building

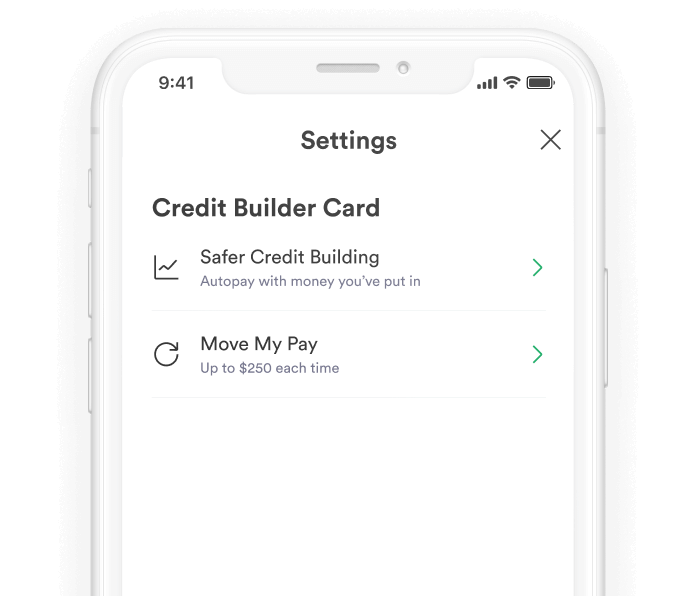

Chime Credit Building - Browse featuresno upfront depositbuild payment history To set up direct deposit, you must provide your chime routing number and account number to your payroll or benefits provider. The chime credit builder secured visa® credit card is a relatively new spin on secured cards that has easier access by removing a minimum security deposit, many major credit card fees. Chime ® is a financial technology company, not a bank. 7 no interest, no annual fees, no credit check to apply. No interest* with the secured chime ® credit builder visa ® credit card; A new way to build credit. Also, there are two ways to find the issuing bank partner for your checking account in the chime app: Apply for a chime credit builder card to fuel your credit journey. It has no interest*, no annual fees*, and doesn’t need a credit check. Build credit with no annual fee. No interest* with the secured chime ® credit builder visa ® credit card; What is credit builder and how to enroll; You can get this information using the chime mobile app or. Why does chime report my credit builder balance to a credit bureau? Apply for a chime credit builder card to fuel your credit journey. To set up direct deposit, you must provide your chime routing number and account number to your payroll or benefits provider. The chime credit builder secured visa® credit card is a relatively new spin on secured cards that has easier access by removing a minimum security deposit, many major credit card fees. How to use credit builder; It has no interest*, no annual fees*, and doesn’t need a credit check. No monthly fees and no hard credit. Browse featuresno upfront depositbuild payment history How to use credit builder; A new way to build credit. Apply for a chime credit builder card to fuel your credit journey. 7 no interest, no annual fees, no credit check to apply. It has no interest*, no annual fees*, and doesn’t need a credit check. Banking services provided by the bancorp bank, n.a. Apply for a chime credit builder card to fuel your credit journey. Also, there are two ways to find the issuing bank partner for your checking account in. No interest* with the secured chime ® credit builder visa ® credit card; To set up direct deposit, you must provide your chime routing number and account number to your payroll or benefits provider. Chime launched credit builder with stride bank, n.a in june 2020, which is a credit card designed to help consumers build their credit history. The issuing. Chime launched credit builder with stride bank, n.a in june 2020, which is a credit card designed to help consumers build their credit history. Looking for an innovative secured credit card to increase your credit score? [37] chime was the most downloaded. A new way to build credit. Mypay™ line of credit provided by. No monthly fees and no hard credit. Build credit with no annual fee. Chime launched credit builder with stride bank, n.a in june 2020, which is a credit card designed to help consumers build their credit history. What is credit builder and how to enroll; The chime credit builder secured visa® credit card is a relatively new spin on secured. Mypay™ line of credit provided by. The secured chime credit builder visa ® credit card³ doesn’t have any annual. How to use credit builder; What is credit builder and how to enroll; The issuing bank partner can be found on the back of your chime visa® debit card. To set up direct deposit, you must provide your chime routing number and account number to your payroll or benefits provider. Chime launched credit builder with stride bank, n.a in june 2020, which is a credit card designed to help consumers build their credit history. The secured chime credit builder visa ® credit card³ doesn’t have any annual. [37] chime. A new way to build credit. The issuing bank partner can be found on the back of your chime visa® debit card. The chime credit builder secured visa® credit card is a relatively new spin on secured cards that has easier access by removing a minimum security deposit, many major credit card fees. No interest* with the secured chime ®. How to use credit builder; Also, there are two ways to find the issuing bank partner for your checking account in the chime app: The chime credit builder secured visa® credit card is a relatively new spin on secured cards that has easier access by removing a minimum security deposit, many major credit card fees. The chime credit builder visa. Browse featuresno upfront depositbuild payment history You can get this information using the chime mobile app or. Looking for an innovative secured credit card to increase your credit score? Build credit with no annual fee. What is credit builder and how to enroll; Apply for a chime credit builder card to fuel your credit journey. Browse featuresno upfront depositbuild payment history Also, there are two ways to find the issuing bank partner for your checking account in the chime app: Chime ® is a financial technology company, not a bank. The issuing bank partner can be found on the back of your chime visa® debit card. Build credit with no annual fee. To set up direct deposit, you must provide your chime routing number and account number to your payroll or benefits provider. The chime credit builder visa ® credit card is our no annual fee, no interest, secured credit card that helps you build your credit. No monthly fees and no hard credit. It has no interest*, no annual fees*, and doesn’t need a credit check. Why does chime report my credit builder balance to a credit bureau? How to use credit builder; 7 no interest, no annual fees, no credit check to apply. Or stride bank, n.a., members fdic. The secured chime credit builder visa ® credit card³ doesn’t have any annual. You can get this information using the chime mobile app or.Credit Builder Card Chime

Chime Credit Builder Review What You Need To Know Clark Howard

How to build credit with Credit Builder Chime

Chime headquarters in San Francisco, California Stock Photo Alamy

Secured Credit Card to Build Credit Chime

Chime Credit Builder Review Is This Service Worth Using?

Chime® Credit Builder Review Best Way to Build Credit? YouTube

Chime Credit Builder Card Review A Secured Card With Guardrails

How to build credit with Credit Builder Chime

Chime Credit Builder Credit Card Review Build Credit

Help Increase Your Fico Score ® By An Average Of 30 Points With Our New Secured Credit Card.

Chime Launched Credit Builder With Stride Bank, N.a In June 2020, Which Is A Credit Card Designed To Help Consumers Build Their Credit History.

[37] Chime Was The Most Downloaded.

No Interest* With The Secured Chime ® Credit Builder Visa ® Credit Card;

Related Post: