Chime Credit Card Builder Vs Mastercard

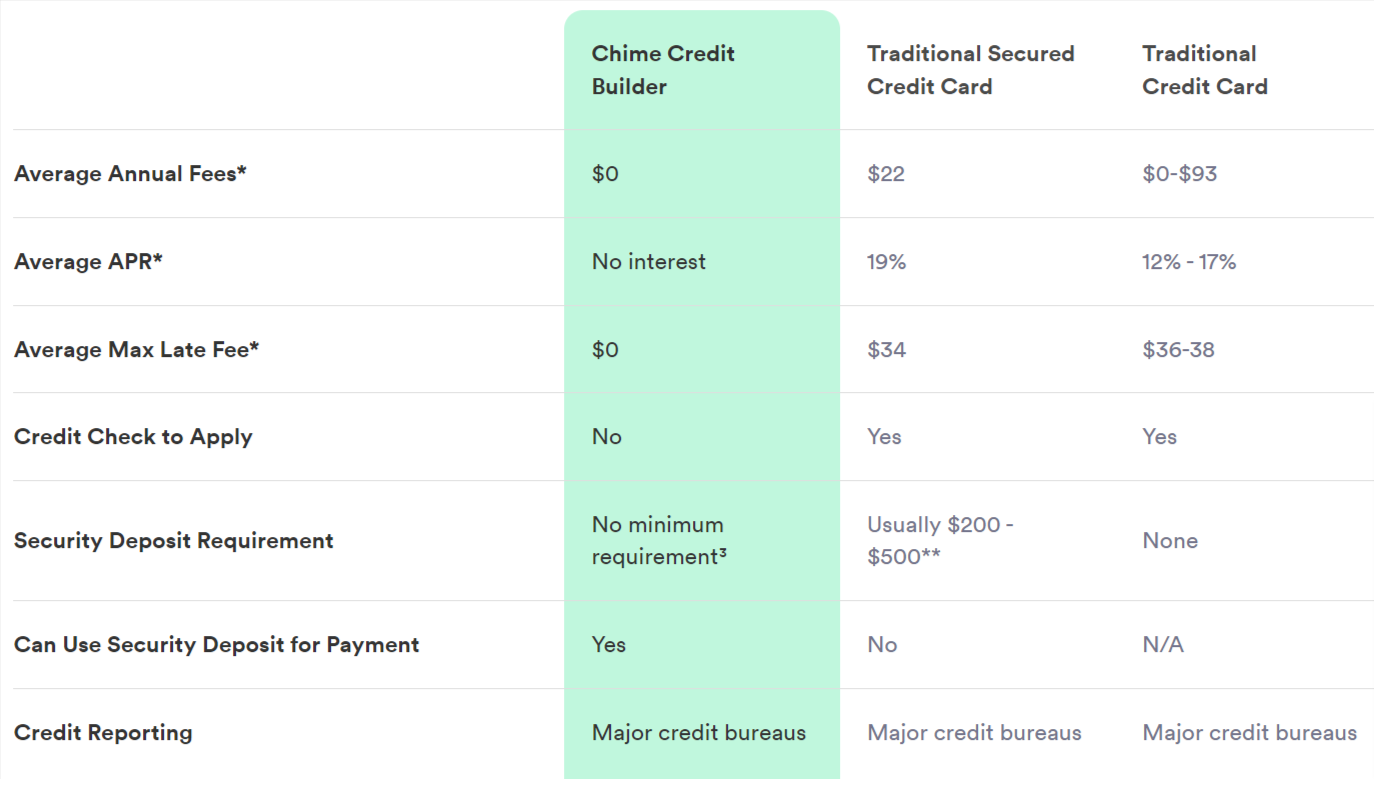

Chime Credit Card Builder Vs Mastercard - Chime reports payments to major. Chime's credit builder secured visa keeps things easy for everyone. Chime® credit builder secured visa® card vs. This card stands out for its lack of fees and. Chime reports to the bureaus as a charge card, not a credit card. As the two largest credit card networks, visa and mastercard share many key features, making them nearly interchangeable for most consumers: The chime credit builder secured visa and the capital one secured mastercard are two options for individuals looking to rebuild or establish their credit. Almost 48 million americans have “poor” credit, with countless others in the “fair” category. No extra charges like annual fees. No monthly fees and no hard credit. Chime reports payments to major. There’s no credit limit to report and no utilization to report. Let's compare them side by side: The chime credit builder secured visa and the capital one secured mastercard are two options for individuals looking to rebuild or establish their credit. Chime's credit builder secured visa credit card* is a secured credit card with no annual fee or interest that allows you to build your credit. No monthly fees and no hard credit. Chime gets a score of 3.5/5, one of the better ratings for a credit builder credit card. No extra charges like annual fees. Chime credit builder secured visa and citi secured mastercard are both options for individuals looking to build or rebuild their credit. Chime® credit builder secured visa® card vs. No interest* with the secured chime ® credit builder visa ® credit card; Chime gets a score of 3.5/5, one of the better ratings for a credit builder credit card. The chime credit builder visa ® credit card is our no annual fee, no interest, secured credit card that helps you build your credit. There’s no credit limit to report. Chime reports payments to major. Let's compare them side by side: Both the cardname and the chime credit builder secured card are intended to. Chime credit builder secured visa and citi secured mastercard are both options for individuals looking to build or rebuild their credit. This card stands out for its lack of fees and. Chime reports payments to major. The chime credit builder secured visa and the capital one secured mastercard are two options for individuals looking to rebuild or establish their credit. No extra charges like annual fees. The chime credit builder visa ® credit card is our no annual fee, no interest, secured credit card that helps you build your credit. As. Both the cardname and the chime credit builder secured card are intended to. Chime credit builder secured visa and citi secured mastercard are both options for individuals looking to build or rebuild their credit. There’s no credit limit to report and no utilization to report. No interest* with the secured chime ® credit builder visa ® credit card; Chime reports. The chime credit builder secured visa and the capital one secured mastercard are two options for individuals looking to rebuild or establish their credit. As the two largest credit card networks, visa and mastercard share many key features, making them nearly interchangeable for most consumers: No extra charges like annual fees. Chime's credit builder secured visa keeps things easy for. As the two largest credit card networks, visa and mastercard share many key features, making them nearly interchangeable for most consumers: The chime credit builder secured visa and the capital one secured mastercard are two options for individuals looking to rebuild or establish their credit. There’s no credit limit to report and no utilization to report. No interest* with the. Chime® credit builder secured visa® card vs. As the two largest credit card networks, visa and mastercard share many key features, making them nearly interchangeable for most consumers: Almost 48 million americans have “poor” credit, with countless others in the “fair” category. Secured credit cards report as if they’re regular credit cards, with a. Chime reports payments to major. Almost 48 million americans have “poor” credit, with countless others in the “fair” category. Chime credit builder secured visa and citi secured mastercard are both options for individuals looking to build or rebuild their credit. The chime credit builder secured visa and the capital one secured mastercard are two options for individuals looking to rebuild or establish their credit. There’s. There’s no credit limit to report and no utilization to report. The chime credit builder visa ® credit card is our no annual fee, no interest, secured credit card that helps you build your credit. Chime® credit builder secured visa® card vs. This card stands out for its lack of fees and. Chime reports payments to major. No extra charges like annual fees. Secured credit cards report as if they’re regular credit cards, with a. Chime reports to the bureaus as a charge card, not a credit card. Chime® credit builder secured visa® card vs. No monthly fees and no hard credit. Almost 48 million americans have “poor” credit, with countless others in the “fair” category. No interest* with the secured chime ® credit builder visa ® credit card; Secured credit cards report as if they’re regular credit cards, with a. Both the cardname and the chime credit builder secured card are intended to. Chime gets a score of 3.5/5, one of the better ratings for a credit builder credit card. Chime reports payments to major. The chime credit builder secured visa and the capital one secured mastercard are two options for individuals looking to rebuild or establish their credit. No monthly fees and no hard credit. This card stands out for its lack of fees and. Chime's credit builder secured visa keeps things easy for everyone. Chime credit builder secured visa and citi secured mastercard are both options for individuals looking to build or rebuild their credit. As the two largest credit card networks, visa and mastercard share many key features, making them nearly interchangeable for most consumers: Chime's credit builder secured visa credit card* is a secured credit card with no annual fee or interest that allows you to build your credit. Let's compare them side by side: The chime credit builder visa ® credit card is our no annual fee, no interest, secured credit card that helps you build your credit.Credit Builder Card Chime

Chime Credit Builder Secured Visa® Credit Card Review

Secured Credit Card vs. Unsecured Credit Card Chime

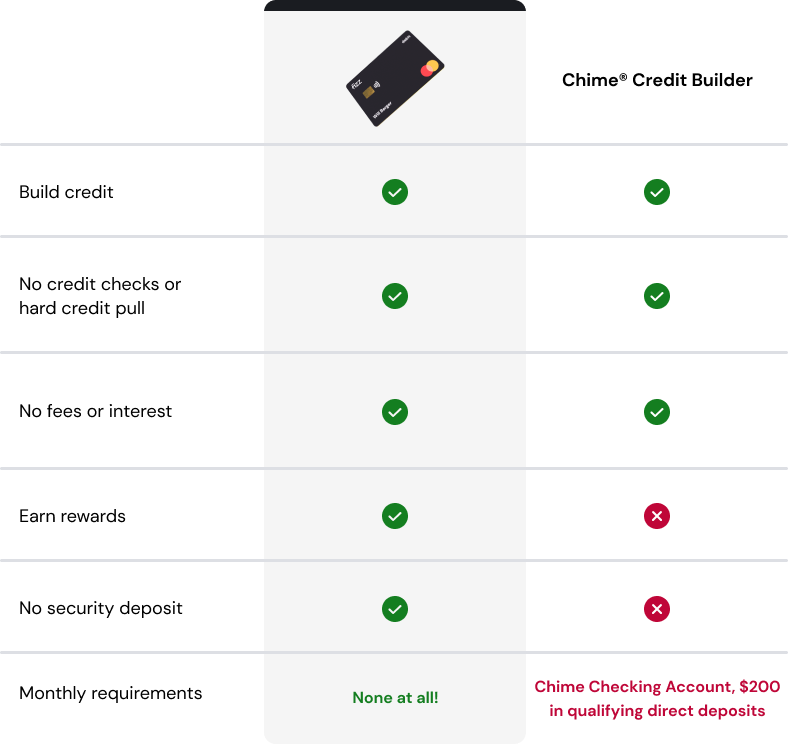

Chime Card vs Upgrade Card More Than Building Your Credit?

Fizz vs Chime Credit Builder

Chime Credit Builder Secured Visa vs. Citi Secured Mastercard 2024

Chime Credit Builder Considered Secured Credit Card

Chime Credit Builder Review What You Need To Know Clark Howard

US challenger bank Chime launches Credit Builder, a credit card that

SoFi Credit Card vs. Chime Credit Builder Which Card is BEST? YouTube

There’s No Credit Limit To Report And No Utilization To Report.

Chime® Credit Builder Secured Visa® Card Vs.

Chime Reports To The Bureaus As A Charge Card, Not A Credit Card.

No Extra Charges Like Annual Fees.

Related Post: