Church Building Insurance Coverage

Church Building Insurance Coverage - While liability insurance covers the actions that could leave the church liable for damage to others, including injuries and damage to a person’s property or reputation, property coverage protects. Building replacement costs have risen more than 55% since 2019, so it is important for organizations to review their policies at least annually with their insurance. This includes the main sanctuary, ancillary buildings, fixtures, fittings, and. Learn how comprehensive property insurance from church insurance man provides peace of mind, financial security, and protection for your congregation’s future. Common factors that influence your church insurance rate include: The first and most essential. Coverage for your church building, equipment, and personal property against damage or loss. When it comes to protecting your place of worship, understanding the nuts and bolts of church building insurance is crucial. We offer a broad range of insurance solutions to help guard against the risks inherent to religious organizations. Church building insurance is a type of coverage that protects the physical structure of your church and its contents. Coverage for your church building, equipment, and personal property against damage or loss. Let’s break it down into simple terms, focusing on three key. The first and most essential. We offer a broad range of insurance solutions to help guard against the risks inherent to religious organizations. Our church insurance policies include the following: Building replacement costs have risen more than 55% since 2019, so it is important for organizations to review their policies at least annually with their insurance. Churches often face unique challenges and require specialized church insurance coverage to safeguard their buildings and assets. When it comes to figuring out insurance for your church, you need to plan for three things: Church building insurance is a type of coverage that protects the physical structure of your church and its contents. Commercial property insurance for your church covers your building and the structure's contents. The cost of your church insurance depends on the specific features and needs of your organization. And the deductible roughly tripled to $90,000 a year, about 40% of the church’s. Coverage for your church building, equipment, and personal property against damage or loss. Employees profession finding the best deal for coverage is always a priority for the cost. Let’s break. Learn how comprehensive property insurance from church insurance man provides peace of mind, financial security, and protection for your congregation’s future. Coverage for your church building, equipment, and personal property against damage or loss. The first and most essential. When it comes to figuring out insurance for your church, you need to plan for three things: Finding the right church. We offer a broad range of insurance solutions to help guard against the risks inherent to religious organizations. When it comes to figuring out insurance for your church, you need to plan for three things: When it comes to protecting your place of worship, understanding the nuts and bolts of church building insurance is crucial. Jeong did not have insurance. And the deductible roughly tripled to $90,000 a year, about 40% of the church’s. Employees profession finding the best deal for coverage is always a priority for the cost. Jeong did not have insurance at the time of the fire because of financial difficulties, so he’s facing the church’s estimated $200,000 in repairs without coverage. Finding the right church insurance. When it comes to figuring out insurance for your church, you need to plan for three things: Commercial property insurance for your church covers your building and the structure's contents. Common factors that influence your church insurance rate include: Employees profession finding the best deal for coverage is always a priority for the cost. Learn how comprehensive property insurance from. Our church insurance policies include the following: While liability insurance covers the actions that could leave the church liable for damage to others, including injuries and damage to a person’s property or reputation, property coverage protects. This includes the main sanctuary, ancillary buildings, fixtures, fittings, and. Finding the right church insurance provider involves considering coverage options, reading customer reviews, assessing. Ask your agent about insurance for churches, mosques, synagogues and other. Let’s break it down into simple terms, focusing on three key. Employees profession finding the best deal for coverage is always a priority for the cost. The cost of your church insurance depends on the specific features and needs of your organization. Building replacement costs have risen more than. This complete guide provides religious organizations with. Coverage for your church building, equipment, and personal property against damage or loss. When it comes to protecting your place of worship, understanding the nuts and bolts of church building insurance is crucial. Jeong did not have insurance at the time of the fire because of financial difficulties, so he’s facing the church’s. Learn how comprehensive property insurance from church insurance man provides peace of mind, financial security, and protection for your congregation’s future. Church building insurance is a type of coverage that protects the physical structure of your church and its contents. When it comes to figuring out insurance for your church, you need to plan for three things: While liability insurance. The first and most essential. Our church insurance policies include the following: Churches often face unique challenges and require specialized church insurance coverage to safeguard their buildings and assets. When it comes to protecting your place of worship, understanding the nuts and bolts of church building insurance is crucial. And the deductible roughly tripled to $90,000 a year, about 40%. We offer a broad range of insurance solutions to help guard against the risks inherent to religious organizations. This complete guide provides religious organizations with. Common factors that influence your church insurance rate include: Jeong did not have insurance at the time of the fire because of financial difficulties, so he’s facing the church’s estimated $200,000 in repairs without coverage. Let’s break it down into simple terms, focusing on three key. Our church insurance policies include the following: Churches often face unique challenges and require specialized church insurance coverage to safeguard their buildings and assets. When it comes to protecting your place of worship, understanding the nuts and bolts of church building insurance is crucial. Ask your agent about insurance for churches, mosques, synagogues and other. Commercial property insurance for your church covers your building and the structure's contents. Building replacement costs have risen more than 55% since 2019, so it is important for organizations to review their policies at least annually with their insurance. This includes the main sanctuary, ancillary buildings, fixtures, fittings, and. Church building insurance is a type of coverage that protects the physical structure of your church and its contents. Learn how comprehensive property insurance from church insurance man provides peace of mind, financial security, and protection for your congregation’s future. Coverage for your church building, equipment, and personal property against damage or loss. The cost of your church insurance depends on the specific features and needs of your organization.Church Insurance

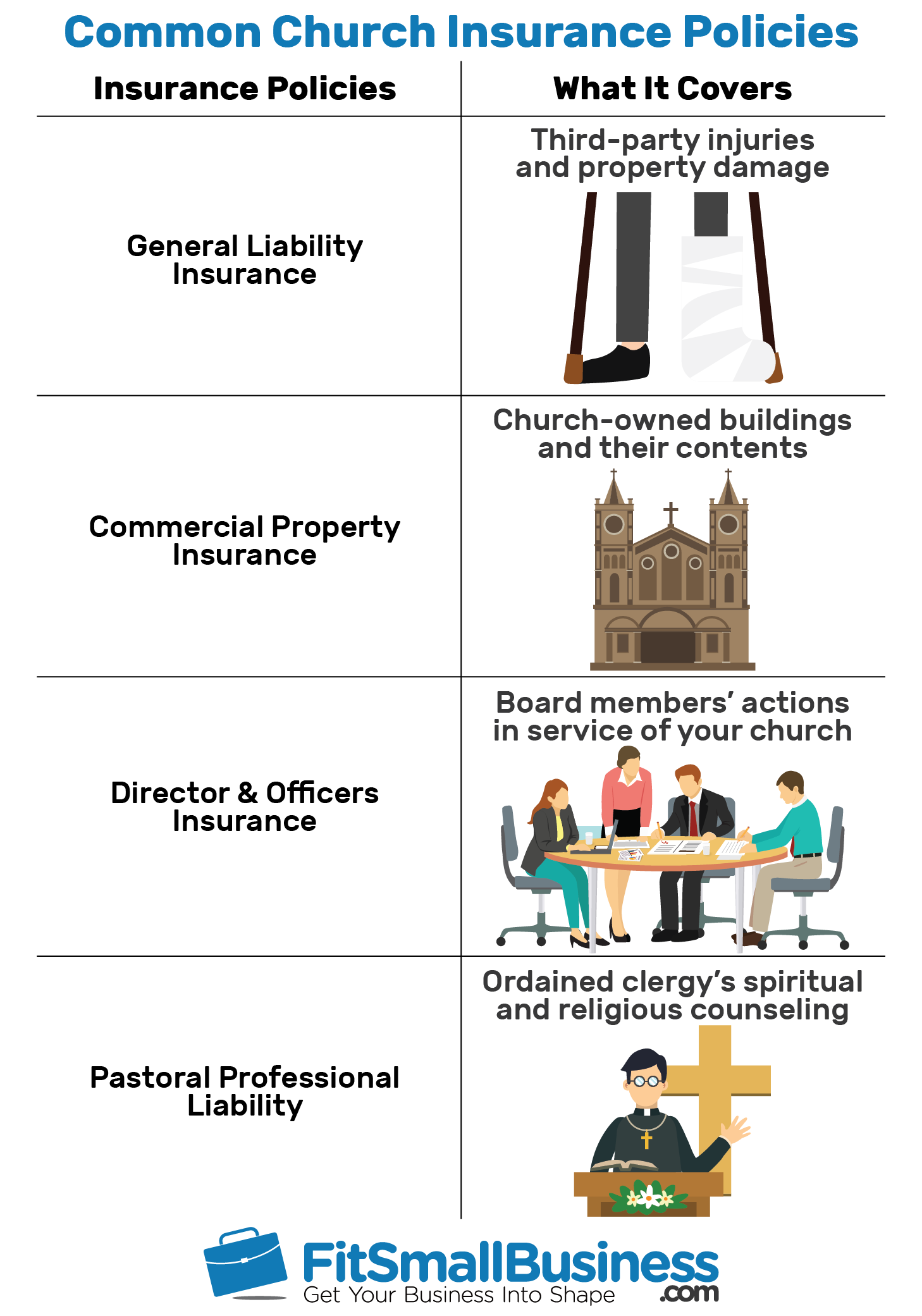

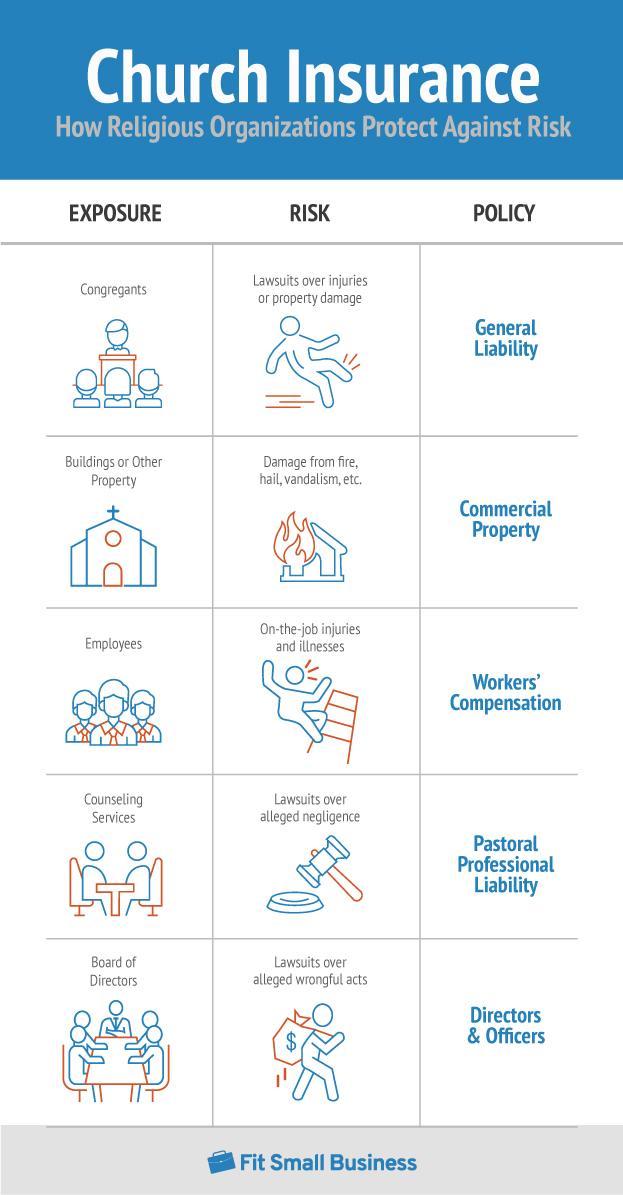

Church Insurance Cost, Coverage, & Top Companies

Church Insurance Explained House Of Worship Insurance YouTube

Church Insurance Terms to Know

Beginner's Guide to Church Insurance

Best Religious Buildings Insurance Coverage for Churches

What Things You Need To Know About Church Insurance. Church Insurance

Church Insurance Cost, Coverage & Top Companies

Choose the Best Insurance for Churches in 2021 Our Top Picks

How much does church insurance cost?

When It Comes To Figuring Out Insurance For Your Church, You Need To Plan For Three Things:

Employees Profession Finding The Best Deal For Coverage Is Always A Priority For The Cost.

While Liability Insurance Covers The Actions That Could Leave The Church Liable For Damage To Others, Including Injuries And Damage To A Person’s Property Or Reputation, Property Coverage Protects.

And The Deductible Roughly Tripled To $90,000 A Year, About 40% Of The Church’s.

Related Post: