Citi Wealth Builder Review

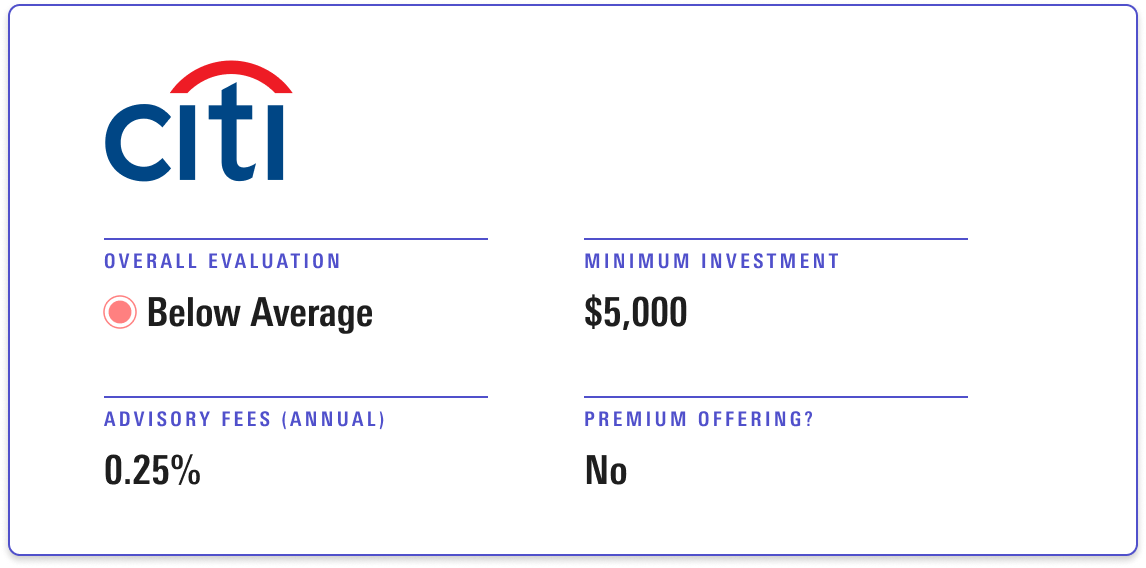

Citi Wealth Builder Review - Their account had tons of realized. Citi personal wealth management also has a robo advisor called citi wealth. Citi personal wealth management review, investment account cons. The latter setup, called citi wealth builder, trades a small selection of etfs with low expense ratios. And its subsidiaries (citi”) invite all qualified interested applicants to apply for career opportunities. Citigroup is the latest financial services firm to offer a digital advice platform designed to draw retail banking clients into lucrative wealth management relationships. Citi offers citi wealth builder, which is an automated program. Citi manages the etf/bonds and they outsource the stock/equities to a 3rd party. Citi wealth builder reviews, customer complaints, and cost. Find out all about citi personal wealth management, its services, investment philosophy, pricing structure, pros and cons, and more. Citi wealth builder reviews, customer complaints, and cost. Citi personal wealth management aims to offer citi clients investment products and wealth management services alongside the brand’s. Find out all about citi personal wealth management, its services, investment philosophy, pricing structure, pros and cons, and more. Citi offers citi wealth builder, which is an automated program. The 3rd party churns and does individual stock picking. If you are a person with a disability and need a reasonable accommodation to. It also has a wealth management service that adds actual human advisors to the mix. • a human financial advisor can be added to the picture through. Looking for a different option that charges fewer fees and offers lower investment minimums? And its subsidiaries (citi”) invite all qualified interested applicants to apply for career opportunities. Citi personal wealth management also has a robo advisor called citi wealth. The 3rd party churns and does individual stock picking. Citi wealth builder reviews, customer complaints, and cost. It also has a wealth management service that adds actual human advisors to the mix. Citi offers citi wealth builder, which is an automated program. Citi manages the etf/bonds and they outsource the stock/equities to a 3rd party. Citigroup is the latest financial services firm to offer a digital advice platform designed to draw retail banking clients into lucrative wealth management relationships. Their account had tons of realized. Citi personal wealth management review, investment account cons. And its subsidiaries (citi”) invite all qualified interested applicants. • a human financial advisor can be added to the picture through. Their account had tons of realized. Citi offers citi wealth builder, which is an automated program. After completing and submitting a financial profile. And its subsidiaries (citi”) invite all qualified interested applicants to apply for career opportunities. Citigroup is the latest financial services firm to offer a digital advice platform designed to draw retail banking clients into lucrative wealth management relationships. There are no other investment products available, and all. Is citi personal wealth management right for you? And its subsidiaries (citi”) invite all qualified interested applicants to apply for career opportunities. Citi offers citi wealth builder,. Citi offers citi wealth builder, which is an automated program. Citi wealth builder is a program that matches clients to a portfolio which best fits their specific time horizon, risk tolerance, and investment goals. Citi personal wealth management also has a robo advisor called citi wealth. The 3rd party churns and does individual stock picking. If you are a person. Looking for a different option that charges fewer fees and offers lower investment minimums? And its subsidiaries (citi”) invite all qualified interested applicants to apply for career opportunities. And its subsidiaries (citi”) invite all qualified interested applicants to apply for career opportunities. The 3rd party churns and does individual stock picking. Citi personal wealth management also has a robo advisor. And its subsidiaries (citi”) invite all qualified interested applicants to apply for career opportunities. The 3rd party churns and does individual stock picking. Citi wealth builder reviews, customer complaints, and cost. Citi personal wealth management aims to offer citi clients investment products and wealth management services alongside the brand’s. Citi wealth builder is a program that matches clients to a. Citi manages the etf/bonds and they outsource the stock/equities to a 3rd party. Find out all about citi personal wealth management, its services, investment philosophy, pricing structure, pros and cons, and more. There are no other investment products available, and all. Citi personal wealth management offers financial planning for clients who generally have $200,000 or more in investable assets. Citi. Citi personal wealth management offers financial planning for clients who generally have $200,000 or more in investable assets. Citigroup is the latest financial services firm to offer a digital advice platform designed to draw retail banking clients into lucrative wealth management relationships. After completing and submitting a financial profile. Citi personal wealth management review, investment account cons. Their account had. There are no other investment products available, and all. Is citi personal wealth management right for you? And its subsidiaries (citi”) invite all qualified interested applicants to apply for career opportunities. It also has a wealth management service that adds actual human advisors to the mix. Citi wealth builder is a program that matches clients to a portfolio which best. Citi’s introduction of robo advisor wealth builder marks the latest major bank to launch an automated digital wealth management platform. Citi personal wealth management aims to offer citi clients investment products and wealth management services alongside the brand’s. Find out all about citi personal wealth management, its services, investment philosophy, pricing structure, pros and cons, and more. Citigroup is the latest financial services firm to offer a digital advice platform designed to draw retail banking clients into lucrative wealth management relationships. Citi personal wealth management offers financial planning for clients who generally have $200,000 or more in investable assets. Citi wealth builder is a program that matches clients to a portfolio which best fits their specific time horizon, risk tolerance, and investment goals. And its subsidiaries (citi”) invite all qualified interested applicants to apply for career opportunities. Citi personal wealth management review, investment account cons. • a human financial advisor can be added to the picture through. It also has a wealth management service that adds actual human advisors to the mix. If you are a person with a disability and need a reasonable accommodation to. And its subsidiaries (citi”) invite all qualified interested applicants to apply for career opportunities. There are no other investment products available, and all. Citi offers citi wealth builder, which is an automated program. If you are a person with a disability and need a reasonable. Is citi personal wealth management right for you?Citi Wealth First Account High Rates & Best for Citigold Clients

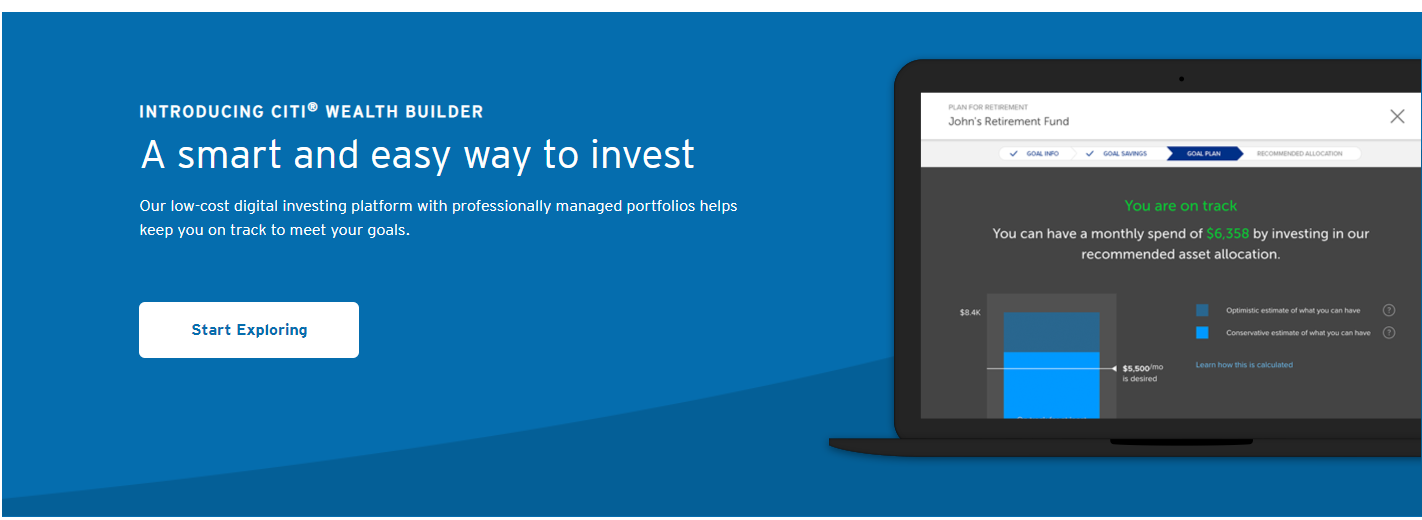

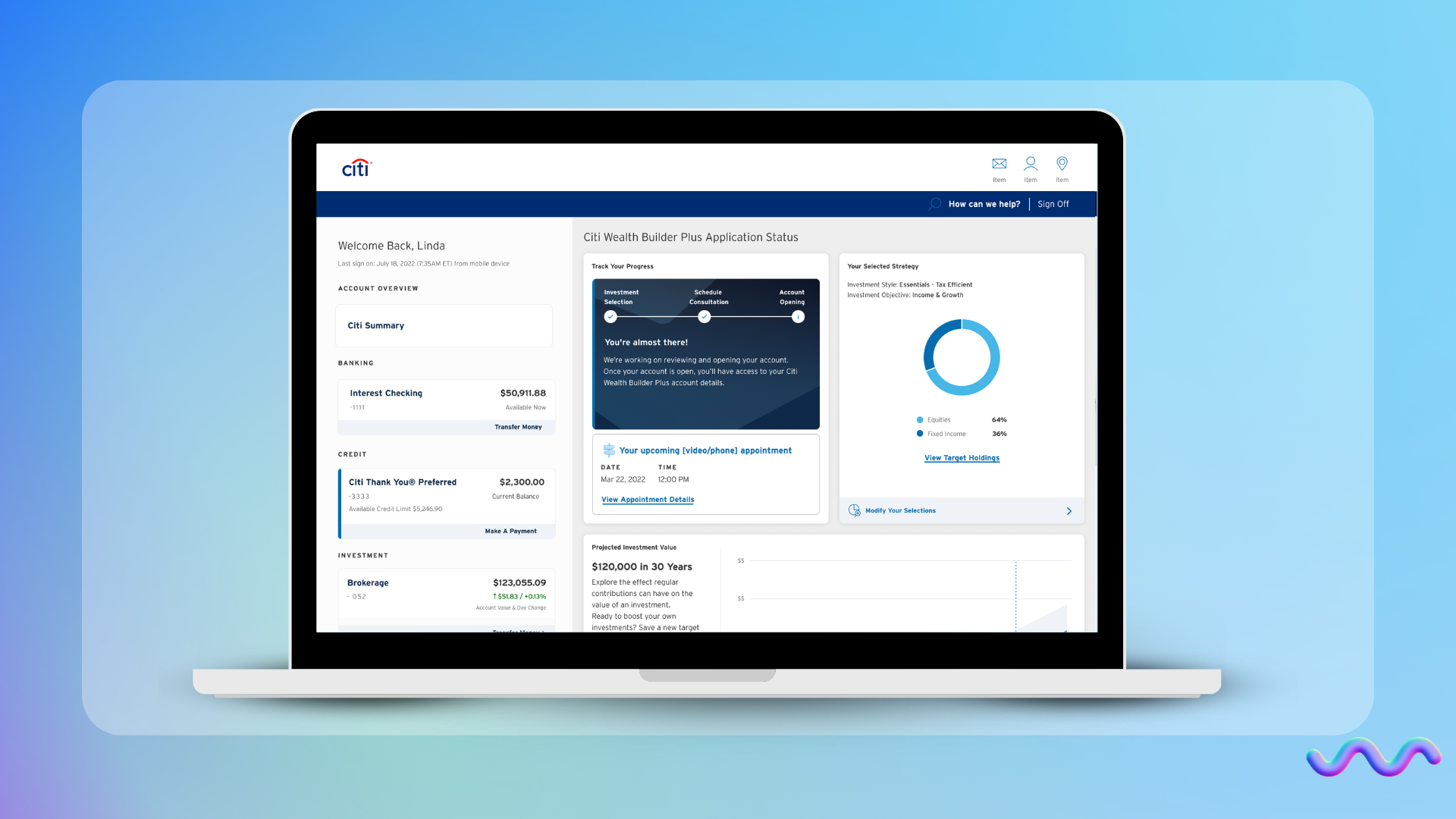

Citi Announces Citi Wealth Builder Digital Investment Platform

Citi Personal Wealth Management Account Bonus, Get Up to 5,000

Citi Wealth Builder a low cost digital investment pltaform rolls out

The Best RoboAdvisors of 2023 Morningstar

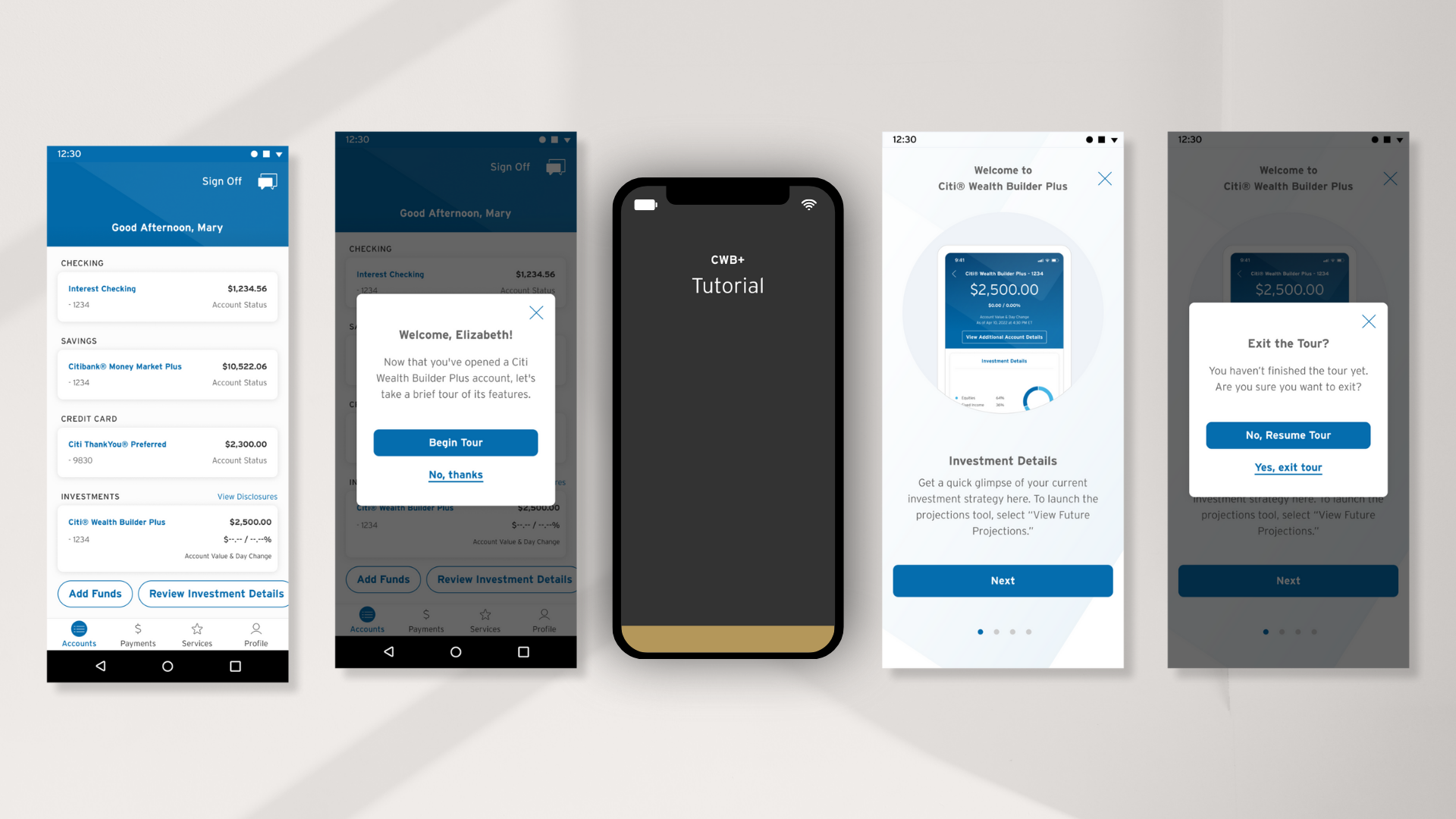

Citi® Wealth Builder Plus Pradeep Patil

Citi Wealth Management Up To 5,000 Bonus Doctor Of Credit

Citi Credit Card Features from Benefit Builder

Citi Unveils Digital Investment Platform “Citi Wealth Builder

Citi® Wealth Builder Plus Pradeep Patil

Their Account Had Tons Of Realized.

After Completing And Submitting A Financial Profile.

Citi Personal Wealth Management Also Has A Robo Advisor Called Citi Wealth.

Citi Wealth Builder Reviews, Customer Complaints, And Cost.

Related Post:

.png#keepProtocol)