Commercial Building Depreciation Life

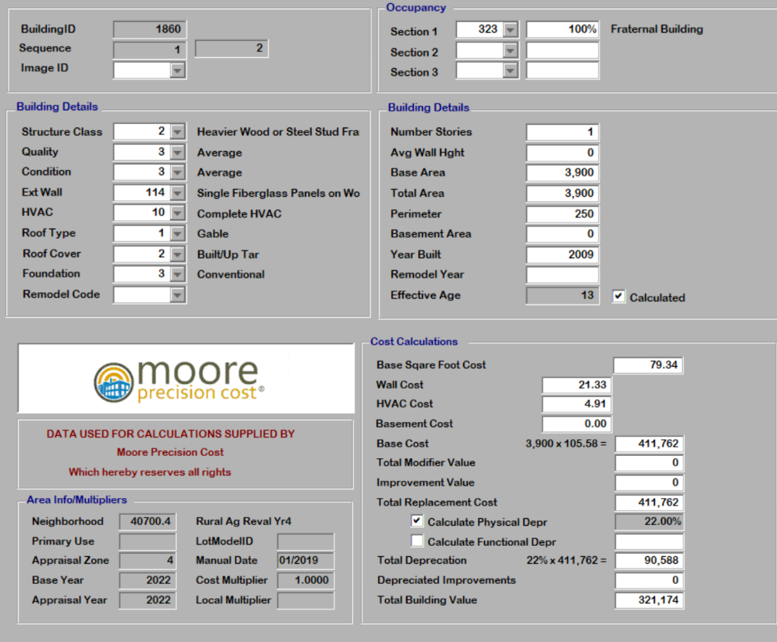

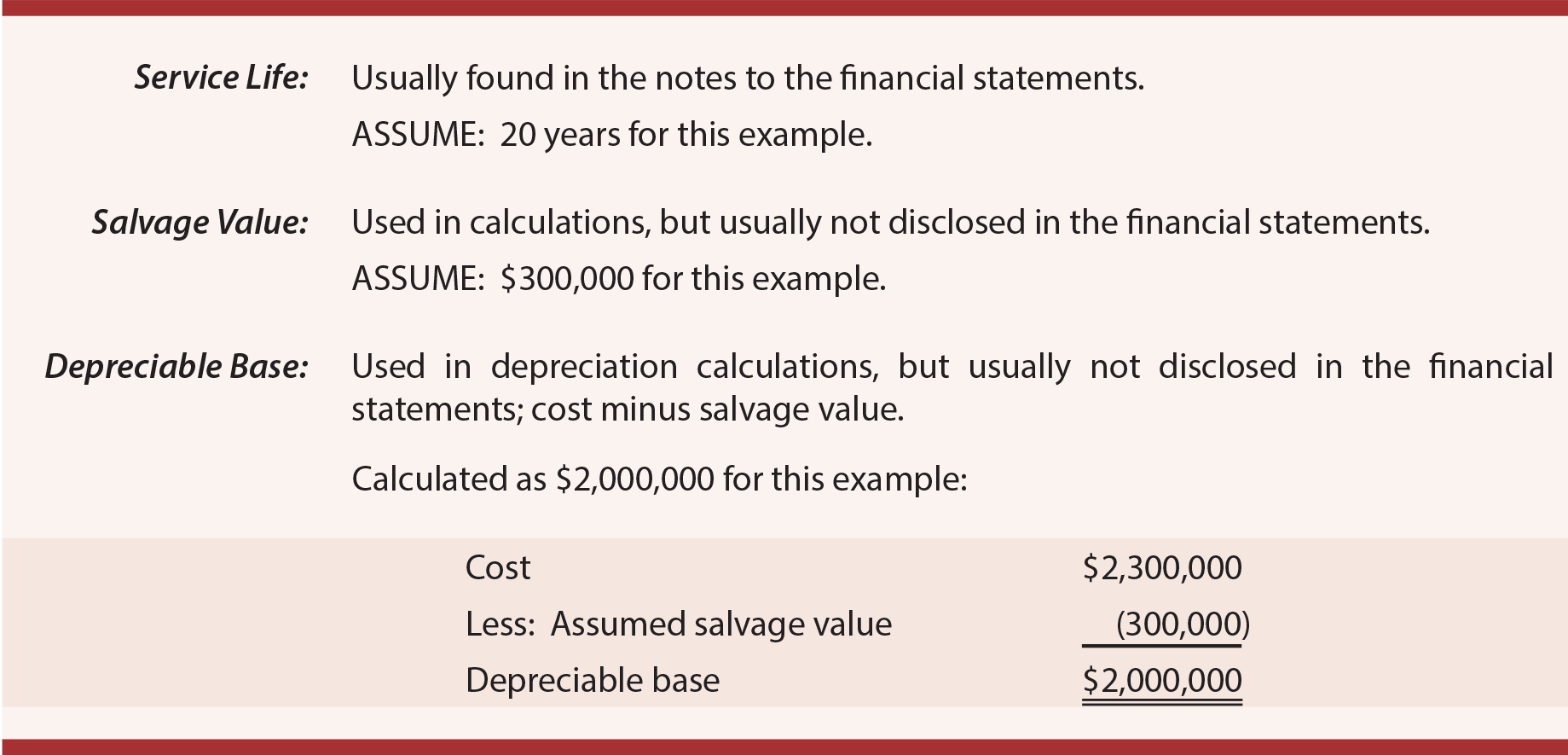

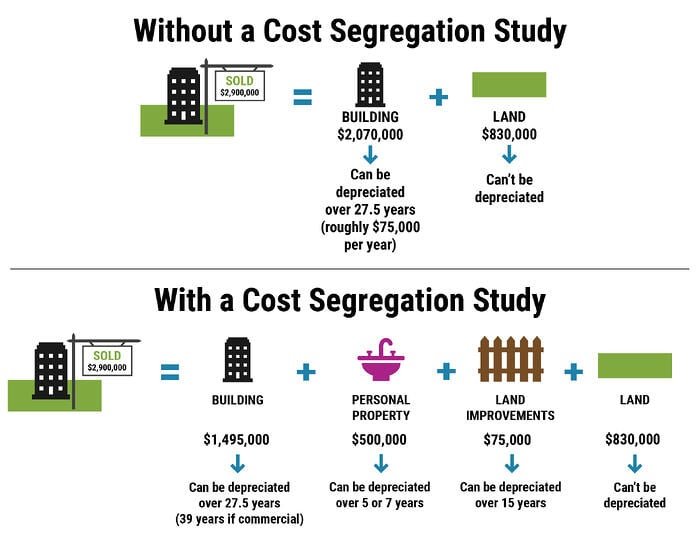

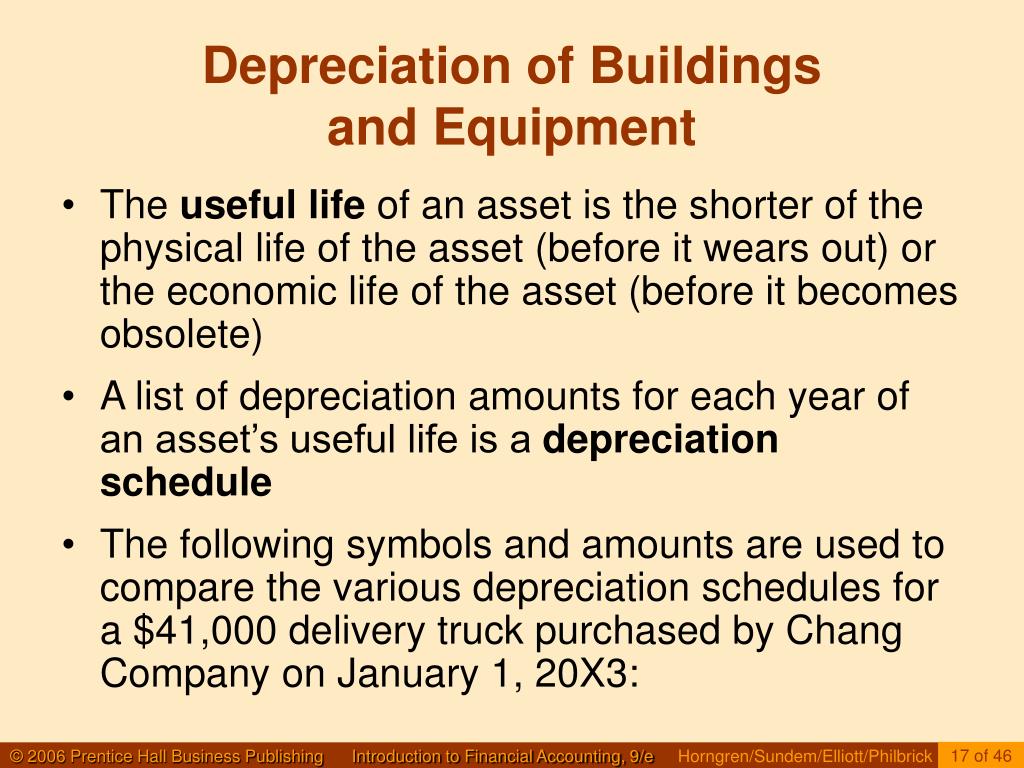

Commercial Building Depreciation Life - Residential rental property is depreciated over a lengthy 27.5 years. Many real estate investors consider depreciation to. For commercial properties a 39 year depreciation schedule can be used. A commercial building valued at $1,000,000 has an assessed value of $250,000. Residential buildings residential buildings typically have a depreciation rate of around 5% per year. In its simplest form, depreciation represents the reduction in the value of an asset over time. For tax purposes in the united states, the irs assigns a useful life of 39 years to commercial properties, meaning the building's value can be deducted in equal portions (using. Depreciation of a building is the. Understanding the depreciation life of a commercial roof is essential for businesses to manage assets effectively and optimize tax benefits. Find out the factors that influence commercial property values,. In its simplest form, depreciation represents the reduction in the value of an asset over time. This ‘useful life’ of the property doesn’t include the land value, only the building and improvements. Residential buildings residential buildings typically have a depreciation rate of around 5% per year. Typically, a residential property will be depreciated over 27.5 years. Learn how to deduct a portion of the cost of commercial buildings and improvements every year over 39 years, or use special tax breaks to accelerate depreciation. Commercial properties like office and retail buildings have a 25% loa. Commercial buildings are typically depreciated over 39 years, allowing owners to spread out the property's cost and reduce. The process begins by determining the asset’s. Calculating depreciation for commercial property involves a systematic approach that incorporates various factors and decisions. For commercial properties a 39 year depreciation schedule can be used. Learn how to deduct a portion of the cost of commercial buildings and improvements every year over 39 years, or use special tax breaks to accelerate depreciation. Find out the factors that influence commercial property values,. The idea is that you want to establish the time. But, could these be expensed under the repair regulations?. In its simplest form, depreciation. Understanding the concept of building depreciation and its useful life is pivotal in the realm of real estate, accounting, and asset management. For commercial properties a 39 year depreciation schedule can be used. Calculating depreciation for commercial property involves a systematic approach that incorporates various factors and decisions. Residential rental property is depreciated over a lengthy 27.5 years. Many real. The internal revenue service (irs) allows commercial real estate investors to reduce the value of their investment property in equal installments over a period of 39 years. For commercial properties a 39 year depreciation schedule can be used. The idea is that you want to establish the time. Note that the ccao administers. For commercial properties, which generate income over. Depreciation of a building is the. This rate is relatively lower compared to commercial or industrial. This ‘useful life’ of the property doesn’t include the land value, only the building and improvements. Note that the ccao administers. No you don't have the option of choosing a shorter depreciable life even when you know it won't last 39 years. No you don't have the option of choosing a shorter depreciable life even when you know it won't last 39 years. For tax purposes in the united states, the irs assigns a useful life of 39 years to commercial properties, meaning the building's value can be deducted in equal portions (using. Understanding depreciation in rental property. This rate is relatively. Note that the ccao administers. The idea is that you want to establish the time. Find out the factors that influence commercial property values,. Many real estate investors consider depreciation to. The lifespan of a roof impacts financial. No you don't have the option of choosing a shorter depreciable life even when you know it won't last 39 years. Commercial and residential buildings can be depreciated over a certain number of years based on the type of property. For tax purposes in the united states, the irs assigns a useful life of 39 years to commercial properties, meaning. The internal revenue service (irs) allows commercial real estate investors to reduce the value of their investment property in equal installments over a period of 39 years. Understanding the depreciation life of a commercial roof is essential for businesses to manage assets effectively and optimize tax benefits. This ‘useful life’ of the property doesn’t include the land value, only the. The idea is that you want to establish the time. This ‘useful life’ of the property doesn’t include the land value, only the building and improvements. Commercial and residential buildings can be depreciated over a certain number of years based on the type of property. Commercial real estate depreciation is a key tax deduction that allows property owners to recover. This rate is relatively lower compared to commercial or industrial. Commercial buildings are typically depreciated over 39 years, allowing owners to spread out the property's cost and reduce. Note that the ccao administers. Learn how to calculate and claim depreciation for commercial buildings and land, and how it affects your taxes and income. Many real estate investors consider depreciation to. Typically, a residential property will be depreciated over 27.5 years. Commercial properties like office and retail buildings have a 25% loa. Understanding the depreciation life of a commercial roof is essential for businesses to manage assets effectively and optimize tax benefits. In its simplest form, depreciation represents the reduction in the value of an asset over time. Find out the factors that influence commercial property values,. A commercial building valued at $1,000,000 has an assessed value of $250,000. The process begins by determining the asset’s. Residential rental property is depreciated over a lengthy 27.5 years. The internal revenue service (irs) allows commercial real estate investors to reduce the value of their investment property in equal installments over a period of 39 years. Commercial real estate depreciation is a key tax deduction that allows property owners to recover the cost of their investment over time. Note that the ccao administers. Depreciation of a building is the. Commercial and residential buildings can be depreciated over a certain number of years based on the type of property. Unlike employee wages or utility bills, taxpayers do not get an immediate tax deduction for the purchase of a building. Many real estate investors consider depreciation to. This ‘useful life’ of the property doesn’t include the land value, only the building and improvements.Commercial Building Depreciation Commercial Appraisal File 1

Popular Depreciation Methods To Calculate Asset Value Over The Years

Commercial Building Carpet Depreciation Life Two Birds Home

Depreciation for Building Definition, Formula, and Excel Examples

Depreciation Concepts

Understanding the Depreciation of a Commercial Building

Understanding the Depreciation of a Commercial Building

Depreciation Hacks How Cost Segregation Can Give Your Commercial

Depreciation for Building Definition, Formula, and Excel Examples

PPT LongLived Assets and Depreciation PowerPoint Presentation ID

Commercial Buildings Are Typically Depreciated Over 39 Years, Allowing Owners To Spread Out The Property's Cost And Reduce.

For Commercial Properties, Which Generate Income Over Many Years, Depreciation Allows Businesses To Spread Out The Cost Of The Building Over Its Useful Life, Matching The Expense With.

But, Could These Be Expensed Under The Repair Regulations?.

Understanding Depreciation In Rental Property.

Related Post: