Commercial Building Depreciation

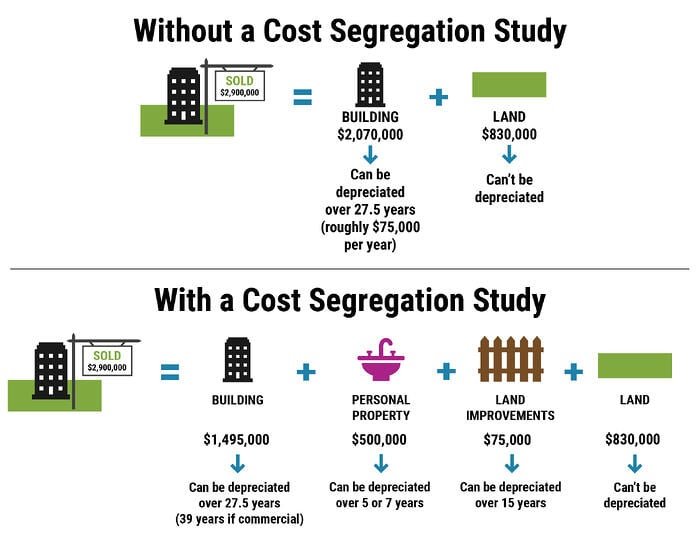

Commercial Building Depreciation - This allowance is taken after any allowable. The process begins by determining the asset’s. Understanding the depreciation life of a commercial roof is essential for businesses to manage assets effectively and optimize tax benefits. The lifespan of a roof impacts financial. This accounting concept allows property owners to deduct a part of a property’s cost over a certain period of years for tax reasons. For certain qualified property and certain specified plants, you can elect to take a special depreciation allowance of 80% or 60%. This ‘useful life’ of the property doesn’t include the land value, only the building and improvements. In commercial real estate, depreciation refers to the gradual decline in a property’s value due to wear and tear, obsolescence, or other causes. By recognizing a property's useful life for tax purposes, owners can strategically plan their finances and optimize their returns on commercial real estate investments. Commercial and residential buildings can be depreciated over a certain number of years based on the type of property. Commercial and residential buildings can be depreciated over a certain number of years based on the type of property. Calculating depreciation for commercial property involves a systematic approach that incorporates various factors and decisions. As a commercial property you want to depreciate it in a straight line over 39 years. For certain qualified property and certain specified plants, you can elect to take a special depreciation allowance of 80% or 60%. Many real estate investors consider depreciation to. Commercial buildings and improvements are depreciated over 39 years, but there are tax breaks that allow deductions to be taken more quickly for certain real estate investments. Learn what commercial property depreciation is, if your nn or nnn property qualifies, and which type will give you the highest irr by reading more here. This applies to the physical structures on the property, such as buildings, but not to the land itself, as land is. In commercial real estate, depreciation refers to the gradual decline in a property’s value due to wear and tear, obsolescence, or other causes. At its core, depreciation represents. Understanding the depreciation life of a commercial roof is essential for businesses to manage assets effectively and optimize tax benefits. For commercial properties, which generate income over many years, depreciation allows businesses to spread out the cost of the building over its useful life, matching the expense with. The internal revenue service (irs) allows commercial real estate investors to reduce. At its core, depreciation represents. That means that each year you can take 1/39th of the value of the improvements and take it as an. Understanding the depreciation life of a commercial roof is essential for businesses to manage assets effectively and optimize tax benefits. As a commercial property you want to depreciate it in a straight line over 39. In the intricate world of commercial real estate, few topics can be as consequential—yet often misunderstood—as depreciation. Many real estate investors consider depreciation to. Depreciation stands as a fundamental financial component in multifamily commercial and industrial real estate investments. Calculating depreciation for commercial property involves a systematic approach that incorporates various factors and decisions. This is because the law says. This applies to the physical structures on the property, such as buildings, but not to the land itself, as land is. At its core, depreciation represents. Depreciation simulates a building's gradual loss of value. Because commercial real estate is considered an asset rather than an expense, the internal revenue service won't let you write. Commercial and residential buildings can be. This ‘useful life’ of the property doesn’t include the land value, only the building and improvements. Learn what commercial property depreciation is, if your nn or nnn property qualifies, and which type will give you the highest irr by reading more here. This accounting concept allows property owners to deduct a part of a property’s cost over a certain period. This accounting concept allows property owners to deduct a part of a property’s cost over a certain period of years for tax reasons. By recognizing a property's useful life for tax purposes, owners can strategically plan their finances and optimize their returns on commercial real estate investments. The lifespan of a roof impacts financial. Mastery of depreciation schedules, asset categorizations,. This allowance is taken after any allowable. As a commercial property you want to depreciate it in a straight line over 39 years. This applies to the physical structures on the property, such as buildings, but not to the land itself, as land is. For certain qualified property and certain specified plants, you can elect to take a special depreciation. Because commercial real estate is considered an asset rather than an expense, the internal revenue service won't let you write. Commercial and residential buildings can be depreciated over a certain number of years based on the type of property. This allowance is taken after any allowable. Learn what commercial property depreciation is, if your nn or nnn property qualifies, and. Because commercial real estate is considered an asset rather than an expense, the internal revenue service won't let you write. The internal revenue service (irs) allows commercial real estate investors to reduce the value of their investment property in equal installments over a period of 39 years. For example, a commercial building has a useful life of 39 years, while. Commercial and residential buildings can be depreciated over a certain number of years based on the type of property. This accounting concept allows property owners to deduct a part of a property’s cost over a certain period of years for tax reasons. Depreciation stands as a fundamental financial component in multifamily commercial and industrial real estate investments. Commercial buildings are. For certain qualified property and certain specified plants, you can elect to take a special depreciation allowance of 80% or 60%. Calculating land and building values for tax purposes is a critical step toward maximizing your available tax deductions from depreciation. By recognizing a property's useful life for tax purposes, owners can strategically plan their finances and optimize their returns on commercial real estate investments. Learn what commercial property depreciation is, if your nn or nnn property qualifies, and which type will give you the highest irr by reading more here. Commercial and residential buildings can be depreciated over a certain number of years based on the type of property. In the intricate world of commercial real estate, few topics can be as consequential—yet often misunderstood—as depreciation. The process begins by determining the asset’s. The internal revenue service (irs) allows commercial real estate investors to reduce the value of their investment property in equal installments over a period of 39 years. This allowance is taken after any allowable. Depreciation stands as a fundamental financial component in multifamily commercial and industrial real estate investments. As a commercial property you want to depreciate it in a straight line over 39 years. This accounting concept allows property owners to deduct a part of a property’s cost over a certain period of years for tax reasons. For example, a commercial building has a useful life of 39 years, while machinery often has a shorter lifespan and higher depreciation using accelerated methods like the. Commercial buildings and improvements are depreciated over 39 years, but there are tax breaks that allow deductions to be taken more quickly for certain real estate investments. That means that each year you can take 1/39th of the value of the improvements and take it as an. For commercial properties, which generate income over many years, depreciation allows businesses to spread out the cost of the building over its useful life, matching the expense with.Understanding the Depreciation of a Commercial Building

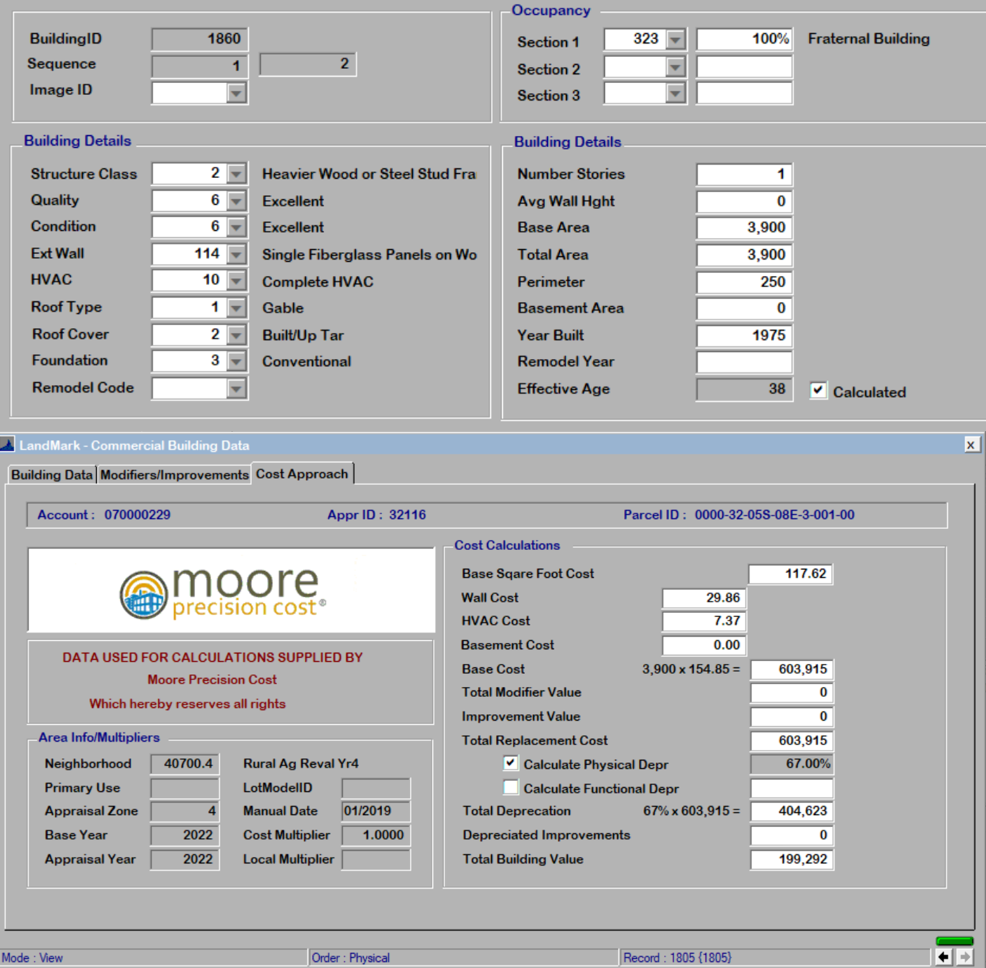

Commercial Building Depreciation Commercial Appraisal File 1

Depreciation for Building Definition, Formula, and Excel Examples

Depreciation Hacks How Cost Segregation Can Give Your Commercial

Solved BUILDING StraightLine Depreciation Schedule

Understanding the Depreciation of a Commercial Building

Depreciation for Building Definition, Formula, and Excel Examples

Popular Depreciation Methods To Calculate Asset Value Over The Years

PPT Revenue Laws Amendments 2007 PowerPoint Presentation, free

Understanding the Depreciation of a Commercial Building

Because Commercial Real Estate Is Considered An Asset Rather Than An Expense, The Internal Revenue Service Won't Let You Write.

The Lifespan Of A Roof Impacts Financial.

This Applies To The Physical Structures On The Property, Such As Buildings, But Not To The Land Itself, As Land Is.

Mastery Of Depreciation Schedules, Asset Categorizations, And Accelerated Depreciation Strategies Is Super Important For Aiming To Maximize Returns And Fortify Any Cash Flows.

Related Post: