Commercial Building Loan Terms

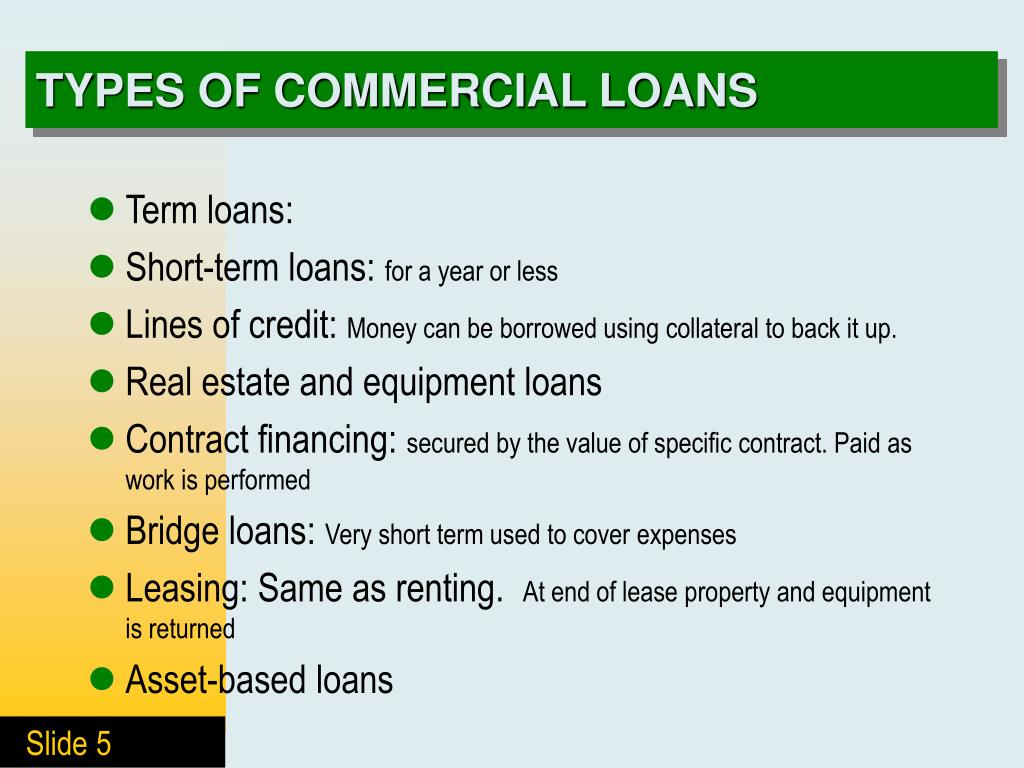

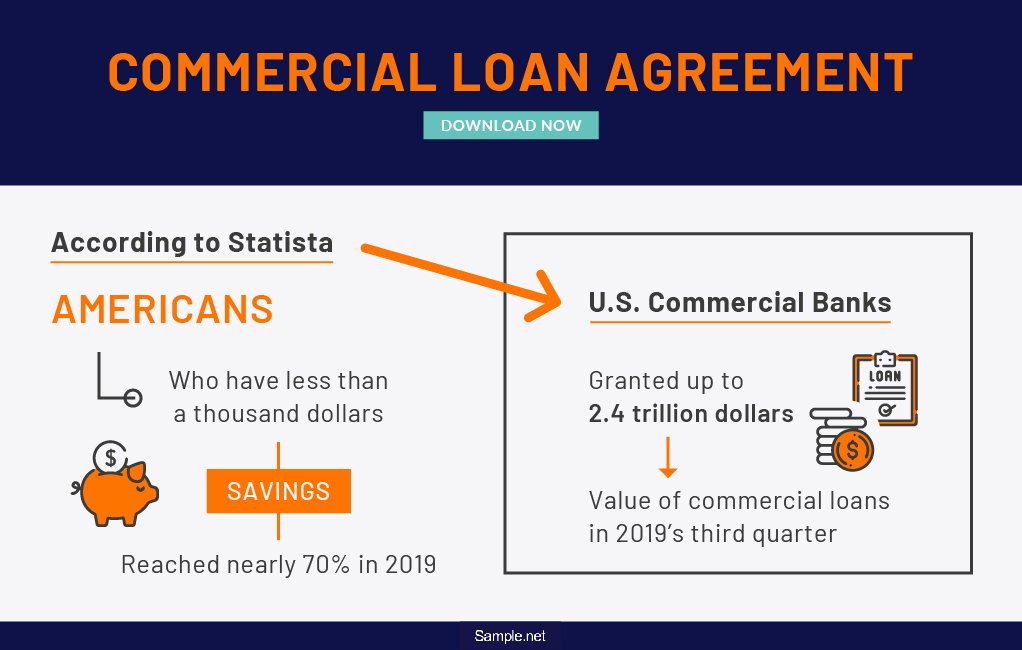

Commercial Building Loan Terms - In real life, virtually every commercial loan application has at least one or two black hairs. However, they might also be. Commercial real estate loans are for buying or developing properties used for business, not homes. Similarly, additional commercial loan originations should be expected, at least relative to 2023 and 2024’s low base. Commercial real estate loans are used to purchase, construct, rehabilitate or refinance commercial properties, as opposed to residential ones. We’ll focus on the latter—loans for physical property—but if you’re. Choosing the right commercial loan. Commercial loans are used to purchase, develop, or renovate properties intended for business use, such as offices, retail centers, and industrial buildings. To get a commercial loan, you’ll need to have good credit, make a down payment of 25 percent or more and plan to use the majority of the property being financed for your own. The terms commercial loan and commercial real estate loan tend to get thrown around interchangeably. Commercial real estate loans are used to purchase, construct, rehabilitate or refinance commercial properties, as opposed to residential ones. Explore the essentials of commercial loans, including their uses, eligibility, types, and repayment structures, to make informed business financing decisions. However, they might also be. Unlock commercial success with our comprehensive guide to terms for commercial real estate loans, including rates, fees, and requirements. So to help you get a handle on some of the most important (and commonly used) out there, this article will walk through five commercial real estate loan terms you should know if you’re trying. Common types of commercial real estate loans include sba cdc/504 loans, sba 7 (a) loans, commercial bank mortgages, and commercial bridge loans. Commercial real estate loans are for buying or developing properties used for business, not homes. Whether you’re buying an office. There are various types of cre loans, including traditional loans and. Commercial loans are used to purchase, develop, or renovate properties intended for business use, such as offices, retail centers, and industrial buildings. A bond is just a garden variety promissory note whereby some borrower promises to pay back. There are various types of cre loans, including traditional loans and. Commercial loans are used to purchase, develop, or renovate properties intended for business use, such as offices, retail centers, and industrial buildings. In real life, virtually every commercial loan application has at least. Common types of commercial real estate loans include sba cdc/504 loans, sba 7 (a) loans, commercial bank mortgages, and commercial bridge loans. There are various types of cre loans, including traditional loans and. Whether you’re buying an office. In real life, virtually every commercial loan application has at least one or two black hairs. Commercial real estate loans are an. Commercial real estate loans are for buying or developing properties used for business, not homes. In real life, virtually every commercial loan application has at least one or two black hairs. The office of the comptroller of the currency (occ) is issuing this bulletin to inform banks about policy guidance that applies to commercial loans, referred to as venture loans,.. Common types of commercial real estate loans include sba cdc/504 loans, sba 7 (a) loans, commercial bank mortgages, and commercial bridge loans. However, they might also be. Whether you’re buying an office. Commercial real estate loans are for buying or developing properties used for business, not homes. Loan terms are typically 20 years when used to purchase commercial real estate. There are various types of cre loans, including traditional loans and. We’ll focus on the latter—loans for physical property—but if you’re. Similarly, additional commercial loan originations should be expected, at least relative to 2023 and 2024’s low base. Choosing the right commercial loan. So to help you get a handle on some of the most important (and commonly used) out. Loan terms are typically 20 years when used to purchase commercial real estate (10 years for equipment purchases), and have interest rates between 3.5% and 5%. Sba 504 (suitable for commercial real estate loans of $350,000 and above), sba 7 (a) and sba express programs generally provide you with lower down payments and longer financing. Whether you’re buying an office.. Sba commercial vehicle loans come with low interest rates and long repayment terms, but can be hard to qualify for. A bond is just a garden variety promissory note whereby some borrower promises to pay back. Whether you’re buying an office. In real life, virtually every commercial loan application has at least one or two black hairs. Common types of. A bond is just a garden variety promissory note whereby some borrower promises to pay back. Unlock commercial success with our comprehensive guide to terms for commercial real estate loans, including rates, fees, and requirements. So to help you get a handle on some of the most important (and commonly used) out there, this article will walk through five commercial. So to help you get a handle on some of the most important (and commonly used) out there, this article will walk through five commercial real estate loan terms you should know if you’re trying. Sba commercial vehicle loans come with low interest rates and long repayment terms, but can be hard to qualify for. Unlock commercial success with our. Commercial loans are used to purchase, develop, or renovate properties intended for business use, such as offices, retail centers, and industrial buildings. We’ll focus on the latter—loans for physical property—but if you’re. A bond is just a garden variety promissory note whereby some borrower promises to pay back. Commercial real estate loans are used to purchase, construct, rehabilitate or refinance. Sba 504 (suitable for commercial real estate loans of $350,000 and above), sba 7 (a) and sba express programs generally provide you with lower down payments and longer financing. We’ll focus on the latter—loans for physical property—but if you’re. In real life, virtually every commercial loan application has at least one or two black hairs. Commercial real estate loans are for buying or developing properties used for business, not homes. Unlock commercial success with our comprehensive guide to terms for commercial real estate loans, including rates, fees, and requirements. The terms commercial loan and commercial real estate loan tend to get thrown around interchangeably. Whether you’re buying an office. Common types of commercial real estate loans include sba cdc/504 loans, sba 7 (a) loans, commercial bank mortgages, and commercial bridge loans. Commercial real estate loans are used to purchase, construct, rehabilitate or refinance commercial properties, as opposed to residential ones. Loan terms are typically 20 years when used to purchase commercial real estate (10 years for equipment purchases), and have interest rates between 3.5% and 5%. However, they might also be. Similarly, additional commercial loan originations should be expected, at least relative to 2023 and 2024’s low base. Commercial loans are used to purchase, develop, or renovate properties intended for business use, such as offices, retail centers, and industrial buildings. Sba commercial vehicle loans come with low interest rates and long repayment terms, but can be hard to qualify for. There are various types of cre loans, including traditional loans and. When selecting a commercial real estate loan, consider:Free Construction Loan Term Sheet Template Edit Online & Download

Typical Structure of a Commercial Mortgage Term Sheet

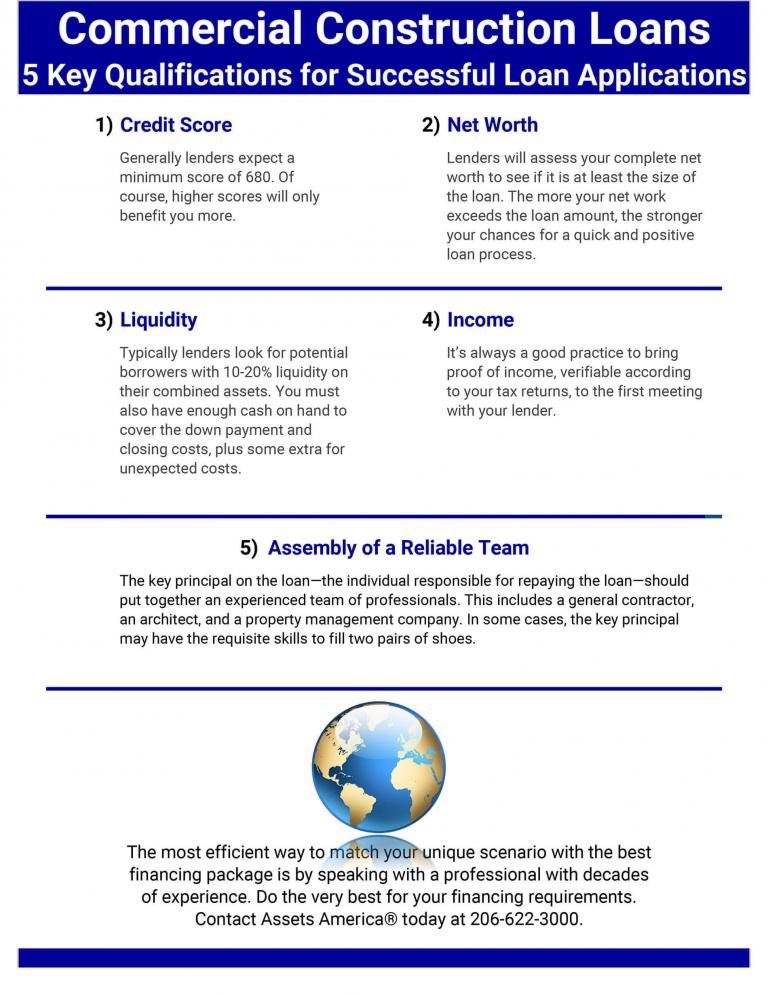

Commercial Construction Loans Guide + Financing from 5M

PPT All about the Commercial Construction Loans PowerPoint

PPT COMMERCIAL LENDING PowerPoint Presentation, free download ID

FREE 37+ Commercial Agreement Examples & Samples in MS Word PDF

FREE 10+ Construction Loan Agreement Samples in PDF MS Word

26+ SAMPLE Commercial Loan Agreement Templates in PDF MS Word

PPT All about the Commercial Construction Loans PowerPoint

The Complete Guide to Commercial Construction Loans NAI Blog

The Office Of The Comptroller Of The Currency (Occ) Is Issuing This Bulletin To Inform Banks About Policy Guidance That Applies To Commercial Loans, Referred To As Venture Loans,.

So To Help You Get A Handle On Some Of The Most Important (And Commonly Used) Out There, This Article Will Walk Through Five Commercial Real Estate Loan Terms You Should Know If You’re Trying.

A Bond Is Just A Garden Variety Promissory Note Whereby Some Borrower Promises To Pay Back.

Choosing The Right Commercial Loan.

Related Post: