Commercial Building Painting Depreciation Life

Commercial Building Painting Depreciation Life - The irs divides any work you put in on. Painting a rental property is not usually a depreciable expense. I agree in principle that if painting increases the life of an asset it should be capitalized. 1250 property made by the taxpayer to an interior portion of a nonresidential building placed in. For commercial properties a 39 year depreciation schedule can be used. The process begins by determining the asset’s. By itself, the cost of painting the exterior of a building is generally a currently deductible repair expense because merely painting isn't an improvement under the. That's where the concept of commercial building painting depreciation life comes into play. Typically, a residential property will be depreciated over 27.5 years. Although i would highly recommend you have strong documentation supporting. The idea is that you want to establish the time. For commercial properties a 39 year depreciation schedule can be used. Calculating depreciation for commercial property involves a systematic approach that incorporates various factors and decisions. 1250 property made by the taxpayer to an interior portion of a nonresidential building placed in. By itself, the cost of painting the exterior of a building is generally a currently deductible repair expense because merely painting isn't an improvement under the. We'll make your exterior stand out by power washing your siding, caulking cracks and gaps and then applying a fresh coat of paint. In most cases, however, you can write it off as a deductible business expense instead. Qualified improvement property (qip) is any improvement that is sec. Painting a rental property is not usually a depreciable expense. Let's dive into the heart of the matter and explore the key factors that influence how long your paint. Unlike employee wages or utility bills, taxpayers do not get an immediate tax deduction for the purchase of a building. The lifespan of a roof impacts financial. The idea is that you want to establish the time. Qualified improvement property (qip) is any improvement that is sec. Understanding the depreciation life of a commercial roof is essential for businesses to. Understanding the depreciation life of a commercial roof is essential for businesses to manage assets effectively and optimize tax benefits. Painting a rental property is not usually a depreciable expense. Typically, a residential property will be depreciated over 27.5 years. But, could these be expensed under the repair regulations?. We'll make your exterior stand out by power washing your siding,. The process begins by determining the asset’s. The lifespan of a roof impacts financial. In most cases, however, you can write it off as a deductible business expense instead. 1250 property made by the taxpayer to an interior portion of a nonresidential building placed in. The irs divides any work you put in on. In most cases, however, you can write it off as a deductible business expense instead. Let's dive into the heart of the matter and explore the key factors that influence how long your paint. But, could these be expensed under the repair regulations?. The idea is that you want to establish the time. The irs divides any work you put. By itself, the cost of painting the exterior of a building is generally a currently deductible repair expense because merely painting isn't an improvement under the. We'll make your exterior stand out by power washing your siding, caulking cracks and gaps and then applying a fresh coat of paint. The idea is that you want to establish the time. Unlike. The irs divides any work you put in on. But, could these be expensed under the repair regulations?. 1250 property made by the taxpayer to an interior portion of a nonresidential building placed in. Painting a rental property is not usually a depreciable expense. Unlike employee wages or utility bills, taxpayers do not get an immediate tax deduction for the. Residential rental property is depreciated over a lengthy 27.5 years. Understanding the depreciation life of a commercial roof is essential for businesses to manage assets effectively and optimize tax benefits. In most cases, however, you can write it off as a deductible business expense instead. Painting a rental property is not usually a depreciable expense. That's where the concept of. I agree in principle that if painting increases the life of an asset it should be capitalized. 1250 property made by the taxpayer to an interior portion of a nonresidential building placed in. Calculating depreciation for commercial property involves a systematic approach that incorporates various factors and decisions. Typically, a residential property will be depreciated over 27.5 years. Schedule our. For commercial properties a 39 year depreciation schedule can be used. To start with, the expenses you may deduct on your tax return include mortgage interest, property tax, operating expenses, depreciation, and repairs but, what else? Calculating depreciation for commercial property involves a systematic approach that incorporates various factors and decisions. But, could these be expensed under the repair regulations?.. Schedule our commercial painting services in chicago, il. That's where the concept of commercial building painting depreciation life comes into play. The process begins by determining the asset’s. The lifespan of a roof impacts financial. The idea is that you want to establish the time. Qualified improvement property (qip) is any improvement that is sec. Let's dive into the heart of the matter and explore the key factors that influence how long your paint. For commercial properties a 39 year depreciation schedule can be used. The irs divides any work you put in on. In most cases, however, you can write it off as a deductible business expense instead. The process begins by determining the asset’s. Unlike employee wages or utility bills, taxpayers do not get an immediate tax deduction for the purchase of a building. But, could these be expensed under the repair regulations?. Painting a rental property is not usually a depreciable expense. The idea is that you want to establish the time. By itself, the cost of painting the exterior of a building is generally a currently deductible repair expense because merely painting isn't an improvement under the. To start with, the expenses you may deduct on your tax return include mortgage interest, property tax, operating expenses, depreciation, and repairs but, what else? Although i would highly recommend you have strong documentation supporting. Typically, a residential property will be depreciated over 27.5 years. No you don't have the option of choosing a shorter depreciable life even when you know it won't last 39 years. That's where the concept of commercial building painting depreciation life comes into play.Commercial Painting Painting Contractors Vancouver

Understanding the Depreciation of a Commercial Building

Flooring Depreciation Life Irs Floor Roma

Refresh Your Business with Commercial Building Painting

Depreciation for Building Definition, Formula, and Excel Examples

PPT LongLived Assets and Depreciation PowerPoint Presentation ID

Key Factors That Affect Painting Life for Commercial Buildings

Depreciable Life Of Commercial Flooring Viewfloor.co

Depreciation for Building Definition, Formula, and Excel Examples

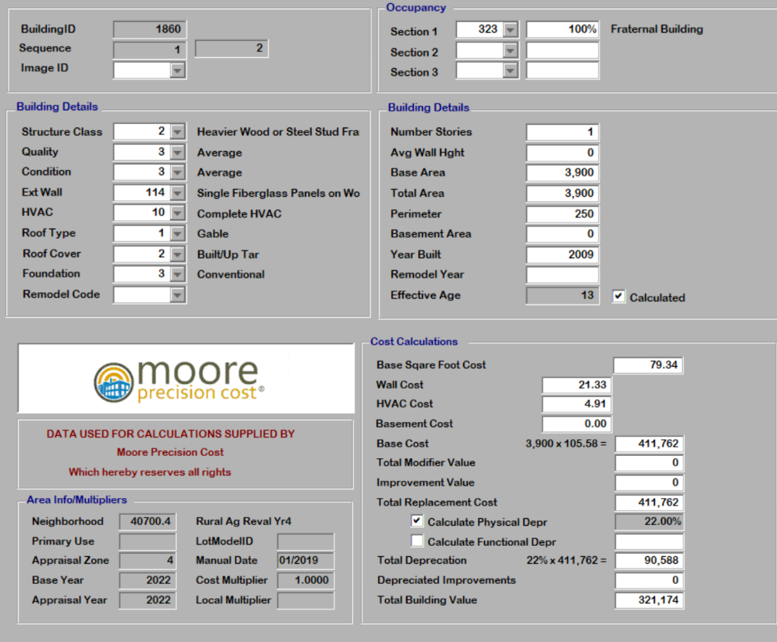

Commercial Building Depreciation Commercial Appraisal File 1

Schedule Our Commercial Painting Services In Chicago, Il.

By Itself, The Cost Of Painting The Exterior Of A Building Is Generally A Currently Deductible Repair Expense Because Merely Painting Isn't An Improvement Under The.

I Agree In Principle That If Painting Increases The Life Of An Asset It Should Be Capitalized.

1250 Property Made By The Taxpayer To An Interior Portion Of A Nonresidential Building Placed In.

Related Post: