Commercial Building Valuation Calculator

Commercial Building Valuation Calculator - Input construction costs, depreciation, and land value to determine the property’s value using. Noi = gross rental income − operating expenses. Estimate the property value by considering the cost to rebuild or replace the commercial building. To accurately value commercial real estate, assessors use various approaches including the income approach, replacement cost approach, and market value approach. Try our commercial property valuation calculator to easily estimate and understand the approximate value of a commercial property based on its income and cap rate. The value for commercial rental properties is driven by a variety of factors including market supply and demand, utility of the property, how easily transferable it is, and. This method calculates the property’s value by adding the land value to the cost of constructing the building today, then subtracting any depreciation to account for the property’s. Nationwide can help you protect your property and business with insurance services. How to calculate commercial property value there are two methods to value standard, single tenancy commercial spaces: As a general rule of thumb, commercial banks & valuers will use this method to value a. An income capitalisation and a direct, or cost,. Property value = 16.6 x £30,000. Noi is the amount of income a property. To accurately value commercial real estate, assessors use various approaches including the income approach, replacement cost approach, and market value approach. Noi = gross rental income − operating expenses. To calculate the value of your property, use this formula: How to calculate commercial property value there are two methods to value standard, single tenancy commercial spaces: Nationwide can help you protect your property and business with insurance services. Learn how to determine the value of your commercial property using multiple methods and factors. This method calculates the property’s value by adding the land value to the cost of constructing the building today, then subtracting any depreciation to account for the property’s. Noi = gross rental income − operating expenses. Calculate the value of your commercial property based on the income stream of the property. Uncover the potential of your investment. This method calculates the property’s value by adding the land value to the cost of constructing the building today, then subtracting any depreciation to account for the property’s. Use our construction. Noi = gross rental income − operating expenses. How to calculate commercial property value there are two methods to value standard, single tenancy commercial spaces: An income capitalisation and a direct, or cost,. Nationwide can help you protect your property and business with insurance services. Try our commercial property valuation calculator to easily estimate and understand the approximate value of. Noi = gross rental income − operating expenses. Ideal for real estate investors and developers assessing property investments. The value for commercial rental properties is driven by a variety of factors including market supply and demand, utility of the property, how easily transferable it is, and. Nationwide can help you protect your property and business with insurance services. Calculate the. Estimate the property value by considering the cost to rebuild or replace the commercial building. Use our construction cost calculator to quickly estimate new construction costs on over 50 building types. Nationwide can help you protect your property and business with insurance services. To accurately value commercial real estate, assessors use various approaches including the income approach, replacement cost approach,. How to calculate commercial property value there are two methods to value standard, single tenancy commercial spaces: This method calculates the property’s value by adding the land value to the cost of constructing the building today, then subtracting any depreciation to account for the property’s. Input construction costs, depreciation, and land value to determine the property’s value using. Property value. To accurately value commercial real estate, assessors use various approaches including the income approach, replacement cost approach, and market value approach. Uncover the potential of your investment. Estimate the property value by considering the cost to rebuild or replace the commercial building. Calculate the value of commercial properties with the property valuation calculator. As a general rule of thumb, commercial. Learn how to determine the value of your commercial property using multiple methods and factors. To calculate the value of your property, use this formula: To accurately value commercial real estate, assessors use various approaches including the income approach, replacement cost approach, and market value approach. Use our construction cost calculator to quickly estimate new construction costs on over 50. How to calculate commercial property value there are two methods to value standard, single tenancy commercial spaces: Property value = average grm x annual gross rental income. This method calculates the property’s value by adding the land value to the cost of constructing the building today, then subtracting any depreciation to account for the property’s. Calculate the value of your. To calculate the value of your property, use this formula: An income capitalisation and a direct, or cost,. Input construction costs, depreciation, and land value to determine the property’s value using. To accurately value commercial real estate, assessors use various approaches including the income approach, replacement cost approach, and market value approach. How to calculate commercial property value there are. Input construction costs, depreciation, and land value to determine the property’s value using. Uncover the potential of your investment. This method calculates the property’s value by adding the land value to the cost of constructing the building today, then subtracting any depreciation to account for the property’s. Calculate the value of your commercial property based on the income stream of. Use our construction cost calculator to quickly estimate new construction costs on over 50 building types. Estimate the property value by considering the cost to rebuild or replace the commercial building. Ideal for real estate investors and developers assessing property investments. To accurately value commercial real estate, assessors use various approaches including the income approach, replacement cost approach, and market value approach. Property value = 16.6 x £30,000. Calculate the value of your commercial property based on the income stream of the property. To calculate the value of your property, use this formula: Try our commercial property valuation calculator to easily estimate and understand the approximate value of a commercial property based on its income and cap rate. Calculate the value of commercial properties with the property valuation calculator. Noi is the amount of income a property. How to calculate commercial property value there are two methods to value standard, single tenancy commercial spaces: Noi = gross rental income − operating expenses. The value for commercial rental properties is driven by a variety of factors including market supply and demand, utility of the property, how easily transferable it is, and. An income capitalisation and a direct, or cost,. Property value = average grm x annual gross rental income. As a general rule of thumb, commercial banks & valuers will use this method to value a.Commercial Real Estate Valuation Model.xls Google Sheets

The Best Free Commercial Property Valuation Calculator for Maximising

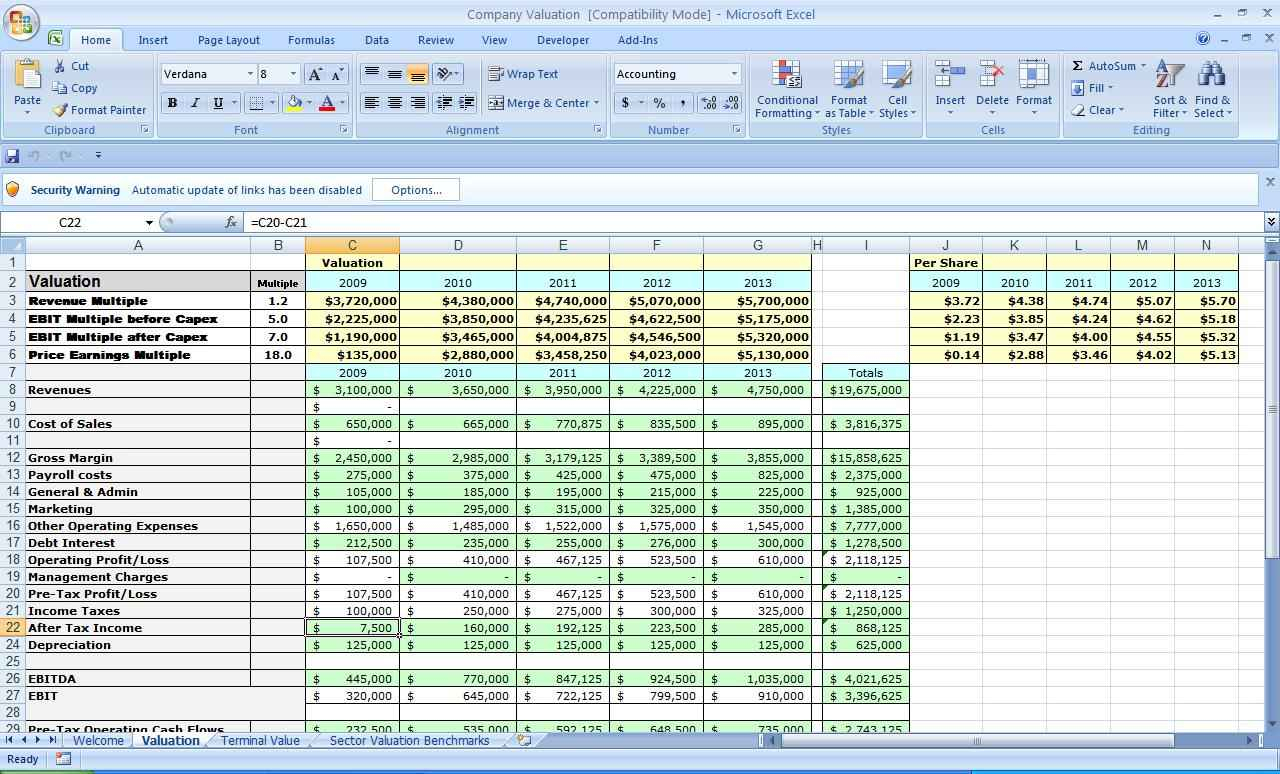

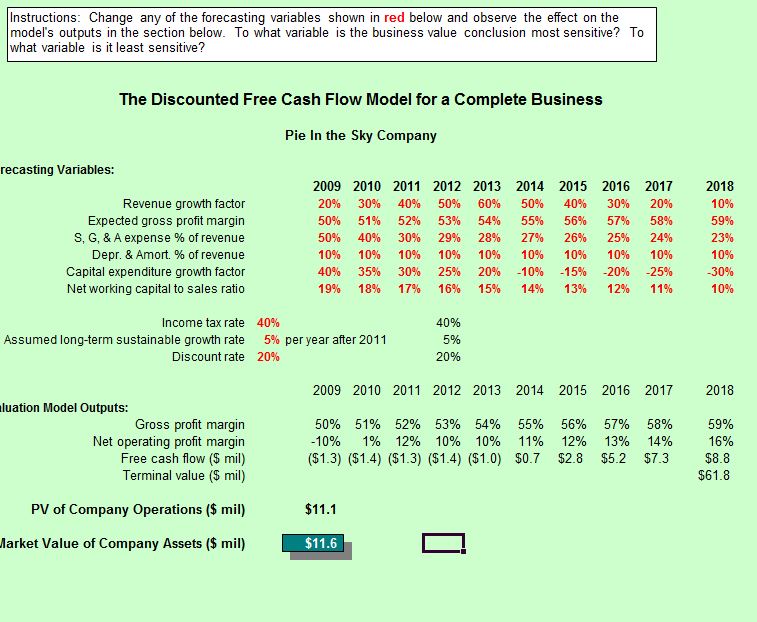

Company Valuation Excel Spreadsheet Spreadsheet Downloa company

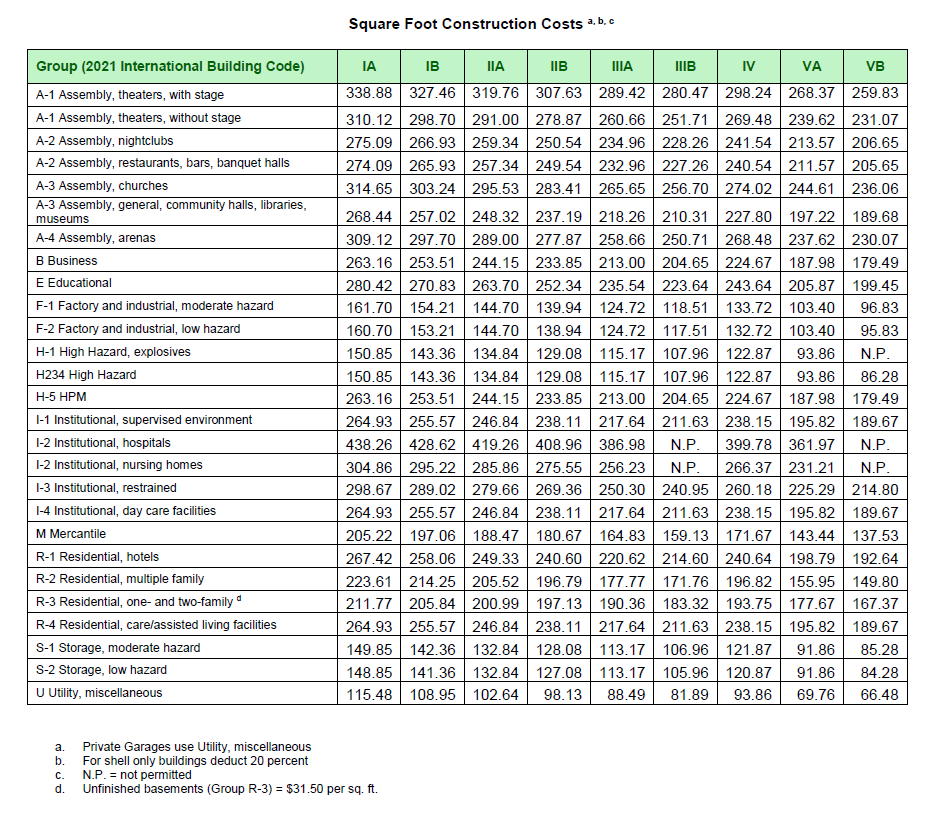

Icc Building Valuation Table 2025 Casie Cynthia

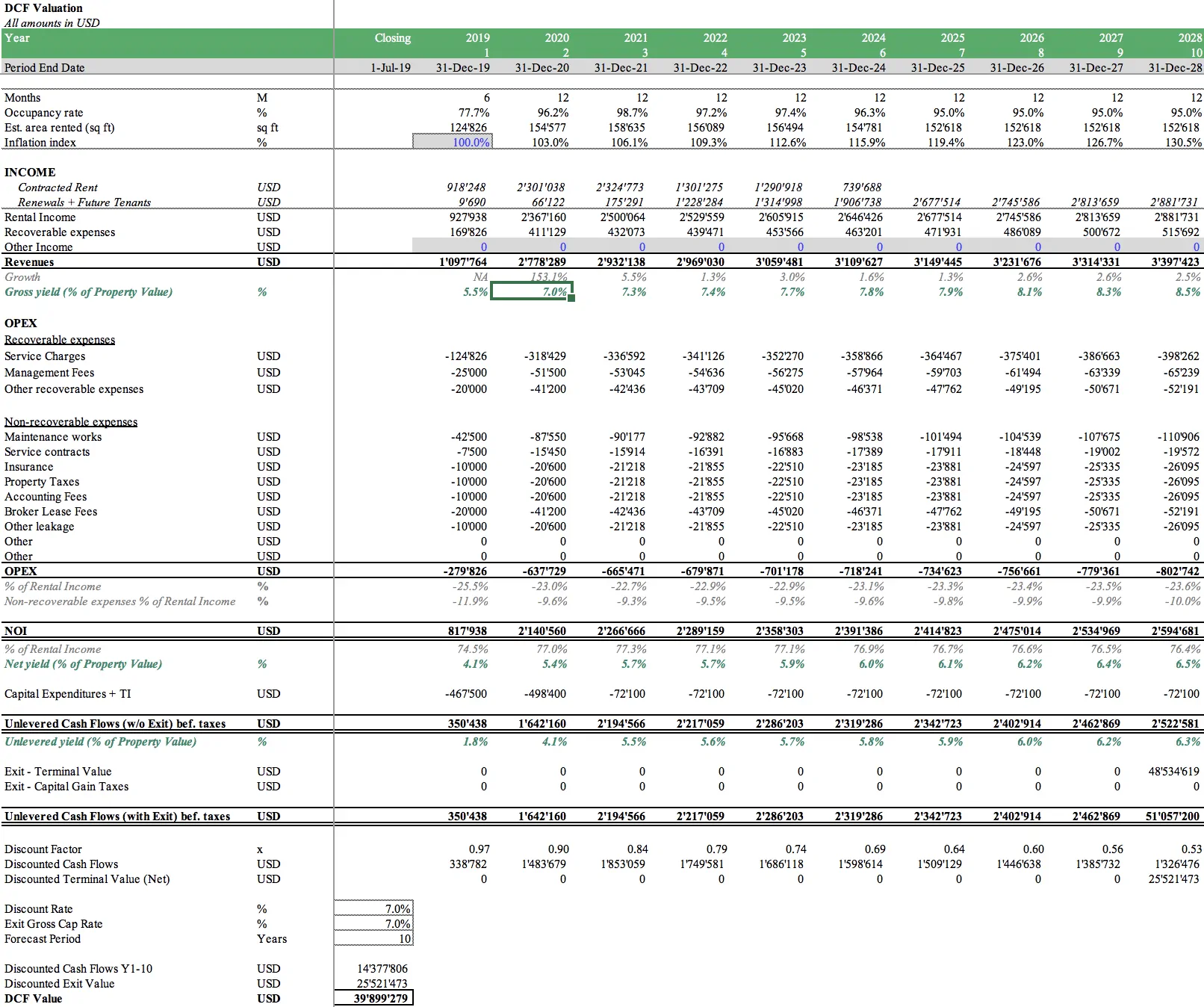

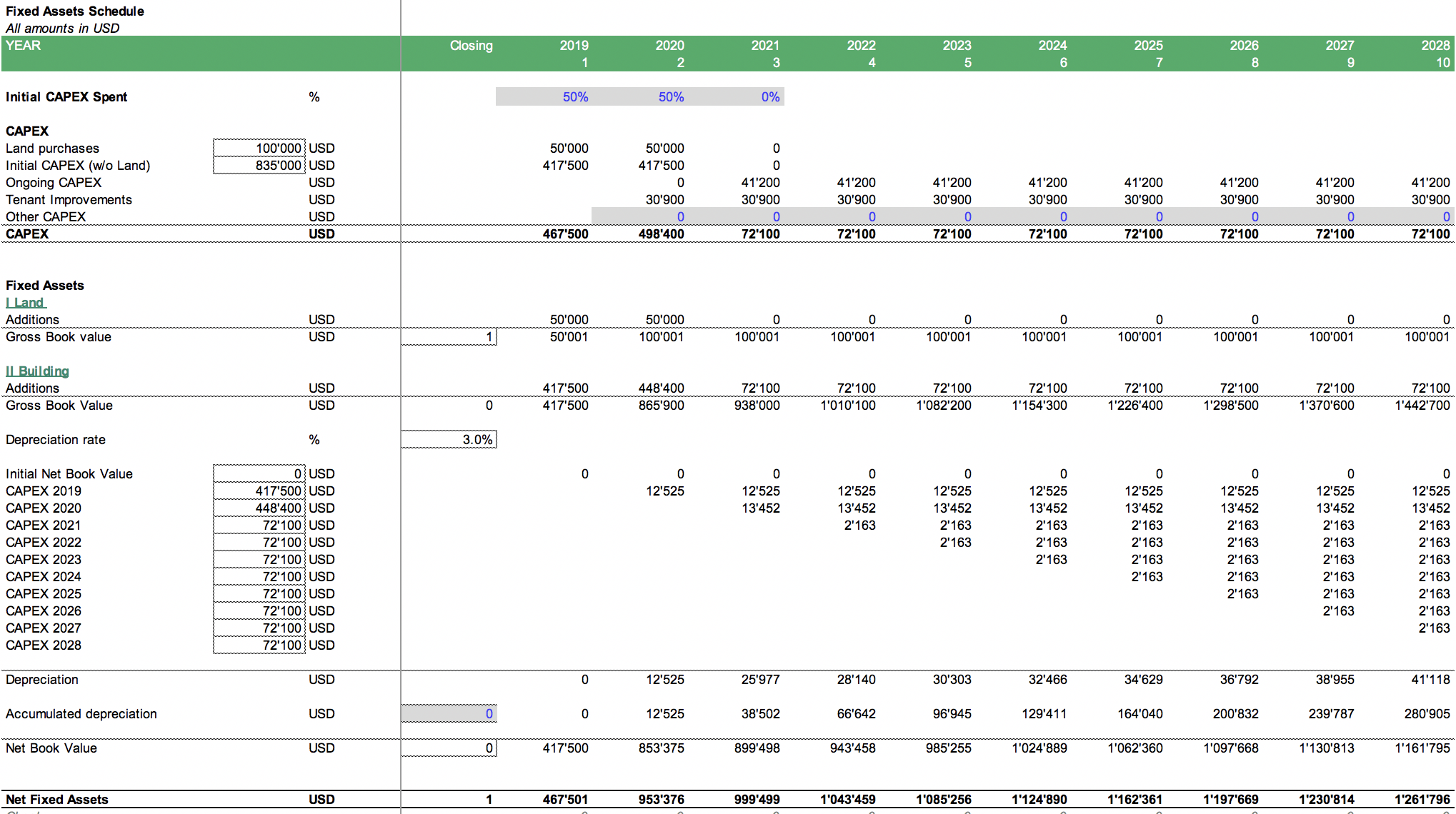

Commercial Real Estate Valuation Model eFinancialModels

The Commercial Property Valuation Calculator with Knowledge

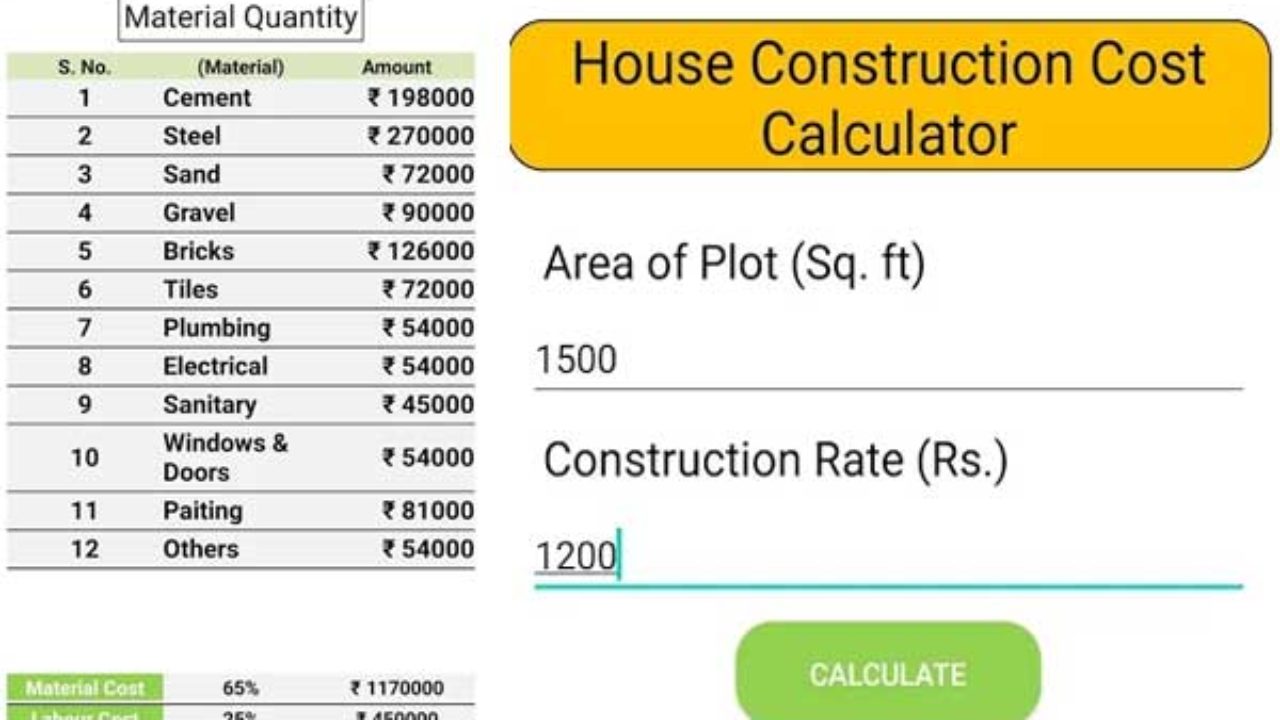

Commercial building estimate calculator postspna

Business Valuation Calculator Free Business Valuation Calculator

Commercial Real Estate Valuation Model eFinancialModels

Nationwide Can Help You Protect Your Property And Business With Insurance Services.

This Method Calculates The Property’s Value By Adding The Land Value To The Cost Of Constructing The Building Today, Then Subtracting Any Depreciation To Account For The Property’s.

Learn How To Determine The Value Of Your Commercial Property Using Multiple Methods And Factors.

Simply Input Your Gross Monthly Rental,.

Related Post: