Commercial Building Value Estimator

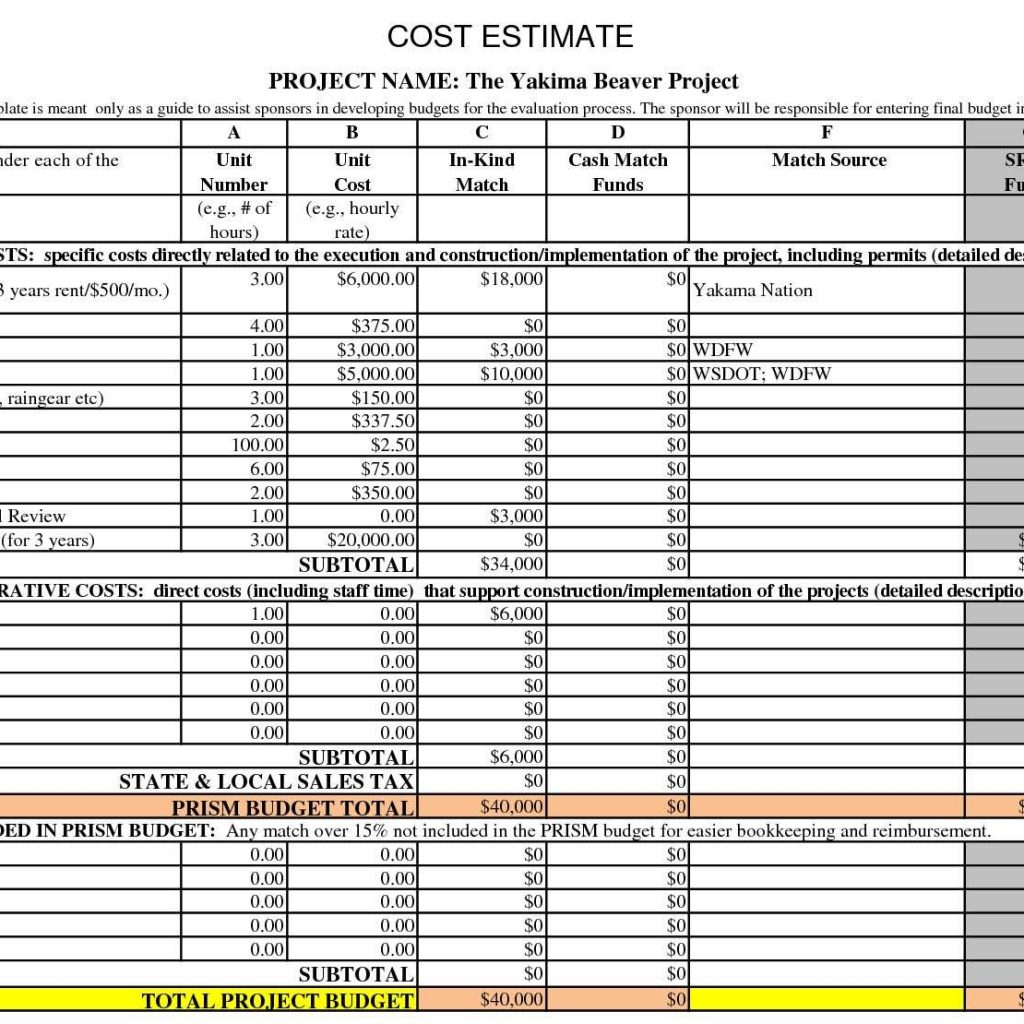

Commercial Building Value Estimator - How do you value a commercial real estate property? This guide outlines four methods to determine a property's valuation The income approach is one of the most commonly. There are multiple approaches in how to determine the fair market value of commercial property, and each has its own advantages and disadvantages depending on your. Learn how to calculate commercial property value with expert precision. When you are in the process of negotiating a commercial real estate deal, it is critical to be aware of the estimated value of the building that you intend to purchase. Find out more about these methods and other helpful tools for the. Investigate the listing price or market value of three to five other commercial properties in the area, and compare the properties themselves to the one you’re interested in. Trying to figure out how much an apartment building or other commercial property is worth? Noi = gross rental income − operating expenses. Then follow these steps to find out the value of commercial property. There’s a surprisingly low amount of current or accurate data online about specific valuations as it relates to commercial real estate. How do you value a commercial real estate property? Try our commercial property valuation calculator to easily estimate and understand the approximate value of a commercial property based on its income and cap rate. When you are in the process of negotiating a commercial real estate deal, it is critical to be aware of the estimated value of the building that you intend to purchase. At its simplest, commercial real. The income approach is one of the most commonly. Noi = gross rental income − operating expenses. This guide outlines four methods to determine a property's valuation Find out more about these methods and other helpful tools for the. Noi is the amount of income a property. When you are in the process of negotiating a commercial real estate deal, it is critical to be aware of the estimated value of the building that you intend to purchase. At its simplest, commercial real. Investigate the listing price or market value of three to five other commercial properties in the. Cost, sales comparison and income are the three main commercial real estate valuation approaches. There are multiple approaches in how to determine the fair market value of commercial property, and each has its own advantages and disadvantages depending on your. For that reason, we’re going to use. Uncover the potential of your investment. There’s a surprisingly low amount of current. Noi = gross rental income − operating expenses. This guide outlines four methods to determine a property's valuation Cost, sales comparison and income are the three main commercial real estate valuation approaches. Learn how to calculate commercial property value with expert precision. Unlock the secrets of commercial property valuation like a pro! Find out more about these methods and other helpful tools for the. When you are in the process of negotiating a commercial real estate deal, it is critical to be aware of the estimated value of the building that you intend to purchase. At its simplest, commercial real. The calculator calculates the growth rate and. This guide outlines four methods. Trying to figure out how much an apartment building or other commercial property is worth? How do you value a commercial real estate property? Unlock the secrets of commercial property valuation like a pro! There’s a surprisingly low amount of current or accurate data online about specific valuations as it relates to commercial real estate. Try our commercial property valuation. For that reason, we’re going to use. Then follow these steps to find out the value of commercial property. Track the appreciation of commercial property value over a specific period by entering the initial purchase price and the current market value. When you are in the process of negotiating a commercial real estate deal, it is critical to be aware. Investigate the listing price or market value of three to five other commercial properties in the area, and compare the properties themselves to the one you’re interested in. This guide outlines four methods to determine a property's valuation Then follow these steps to find out the value of commercial property. Cost, sales comparison and income are the three main commercial. The income approach is one of the most commonly. When you are in the process of negotiating a commercial real estate deal, it is critical to be aware of the estimated value of the building that you intend to purchase. Here’s a guide to help you understand the key methods and factors involved in assessing commercial real estate value. Track. For that reason, we’re going to use. There are multiple approaches in how to determine the fair market value of commercial property, and each has its own advantages and disadvantages depending on your. Find out more about these methods and other helpful tools for the. The calculator calculates the growth rate and. Noi is the amount of income a property. Track the appreciation of commercial property value over a specific period by entering the initial purchase price and the current market value. The income approach is one of the most commonly. This guide outlines four methods to determine a property's valuation At its simplest, commercial real. When you are in the process of negotiating a commercial real estate deal, it. Trying to figure out how much an apartment building or other commercial property is worth? Then follow these steps to find out the value of commercial property. Here’s a guide to help you understand the key methods and factors involved in assessing commercial real estate value. Find out more about these methods and other helpful tools for the. Track the appreciation of commercial property value over a specific period by entering the initial purchase price and the current market value. Noi = gross rental income − operating expenses. How do you value a commercial real estate property? Unlock the secrets of commercial property valuation like a pro! There’s a surprisingly low amount of current or accurate data online about specific valuations as it relates to commercial real estate. The calculator calculates the growth rate and. Investigate the listing price or market value of three to five other commercial properties in the area, and compare the properties themselves to the one you’re interested in. For that reason, we’re going to use. Noi is the amount of income a property. The income approach is one of the most commonly. Uncover the potential of your investment. Try our commercial property valuation calculator to easily estimate and understand the approximate value of a commercial property based on its income and cap rate.Commercial Construction Estimating Spreadsheet with Commercial

Commercial Construction Project Sample Estimate

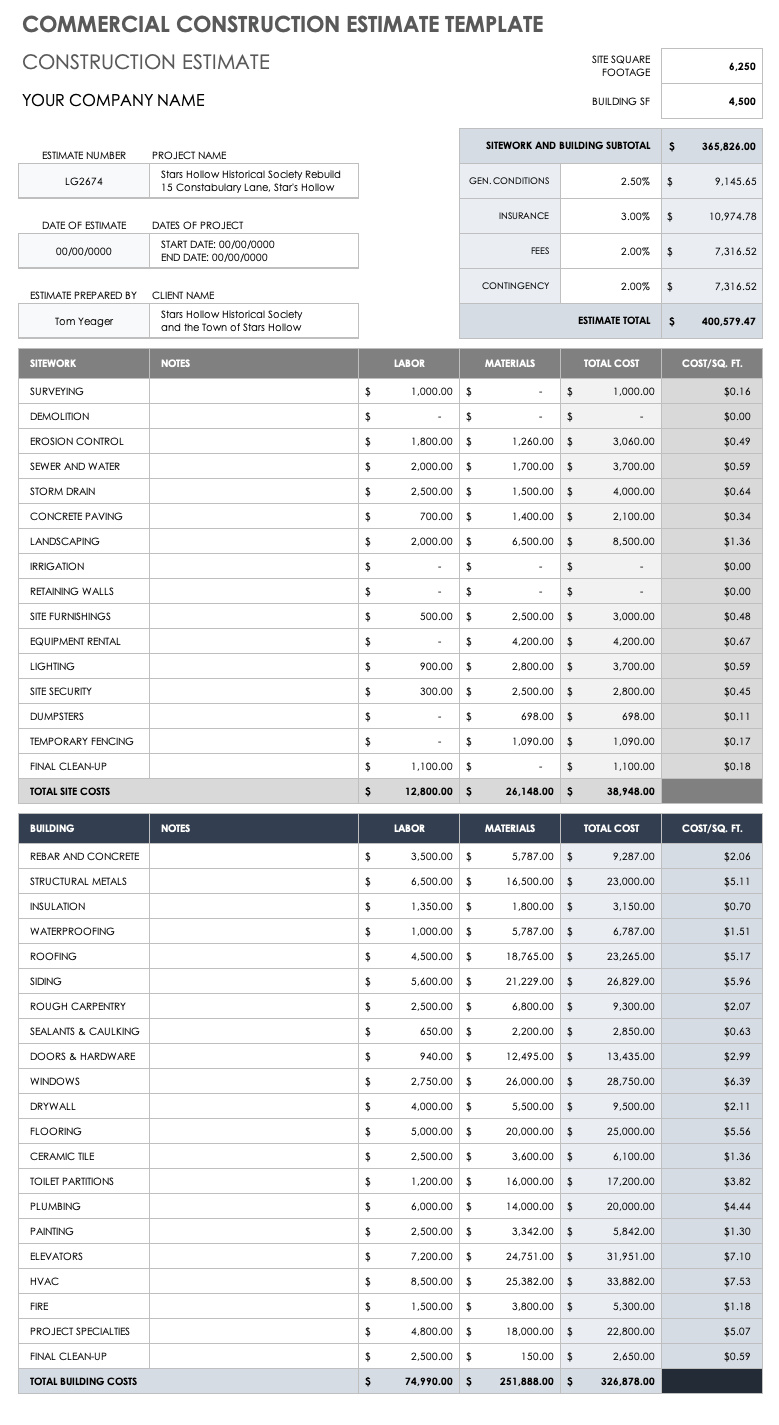

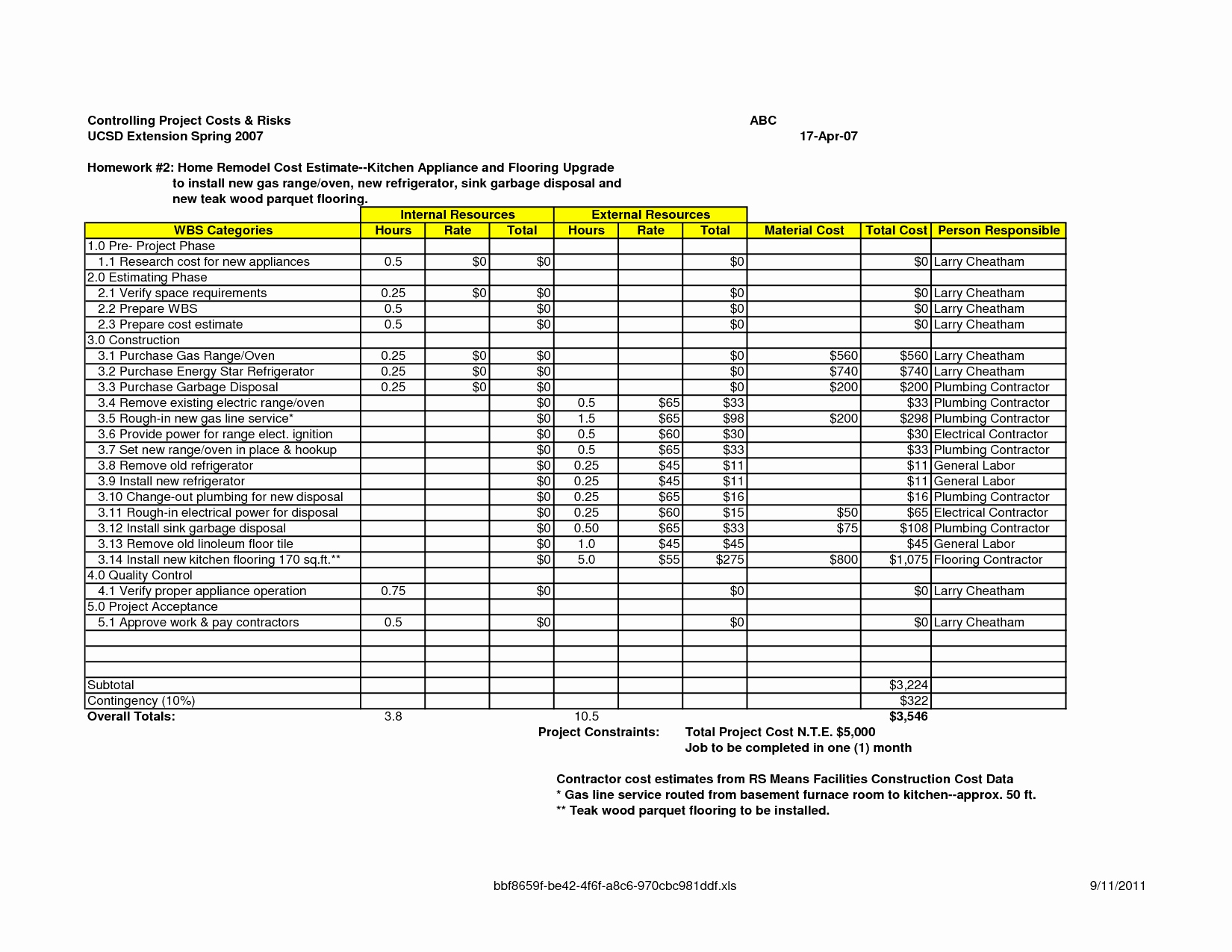

Free Construction Estimate Templates Smartsheet

Commercial building estimate calculator postspna

Commercial Construction Project Sample Estimate

Commercial Construction Cost Estimate Spreadsheet —

Comprehensive Estimate Commercial and Residential Estimating

Commercial building estimate calculator nohsagf

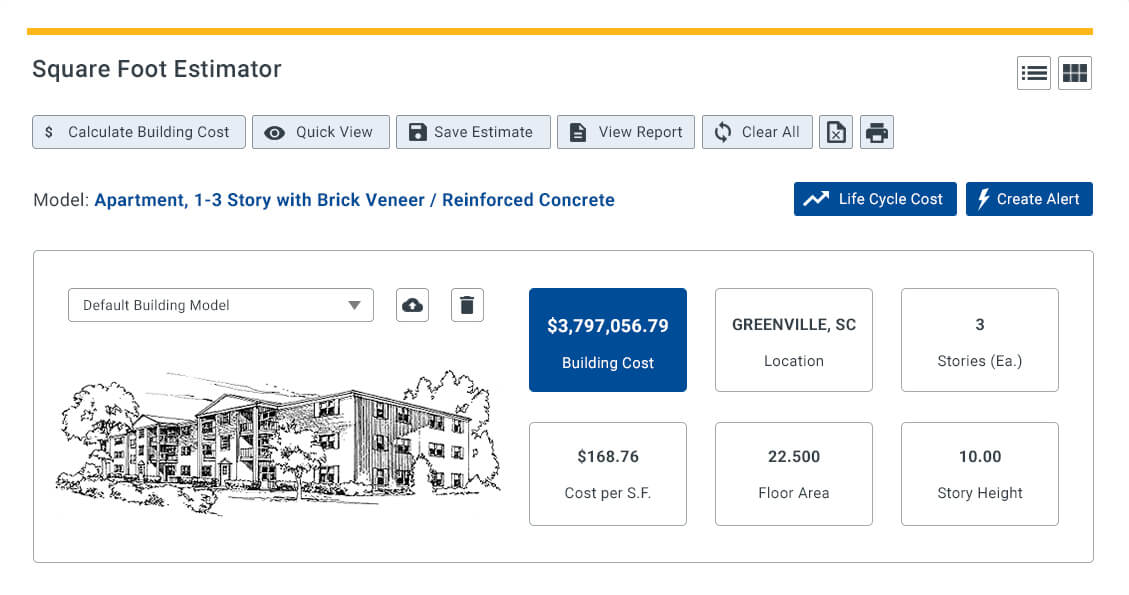

Commercial Construction Square Foot Cost Models

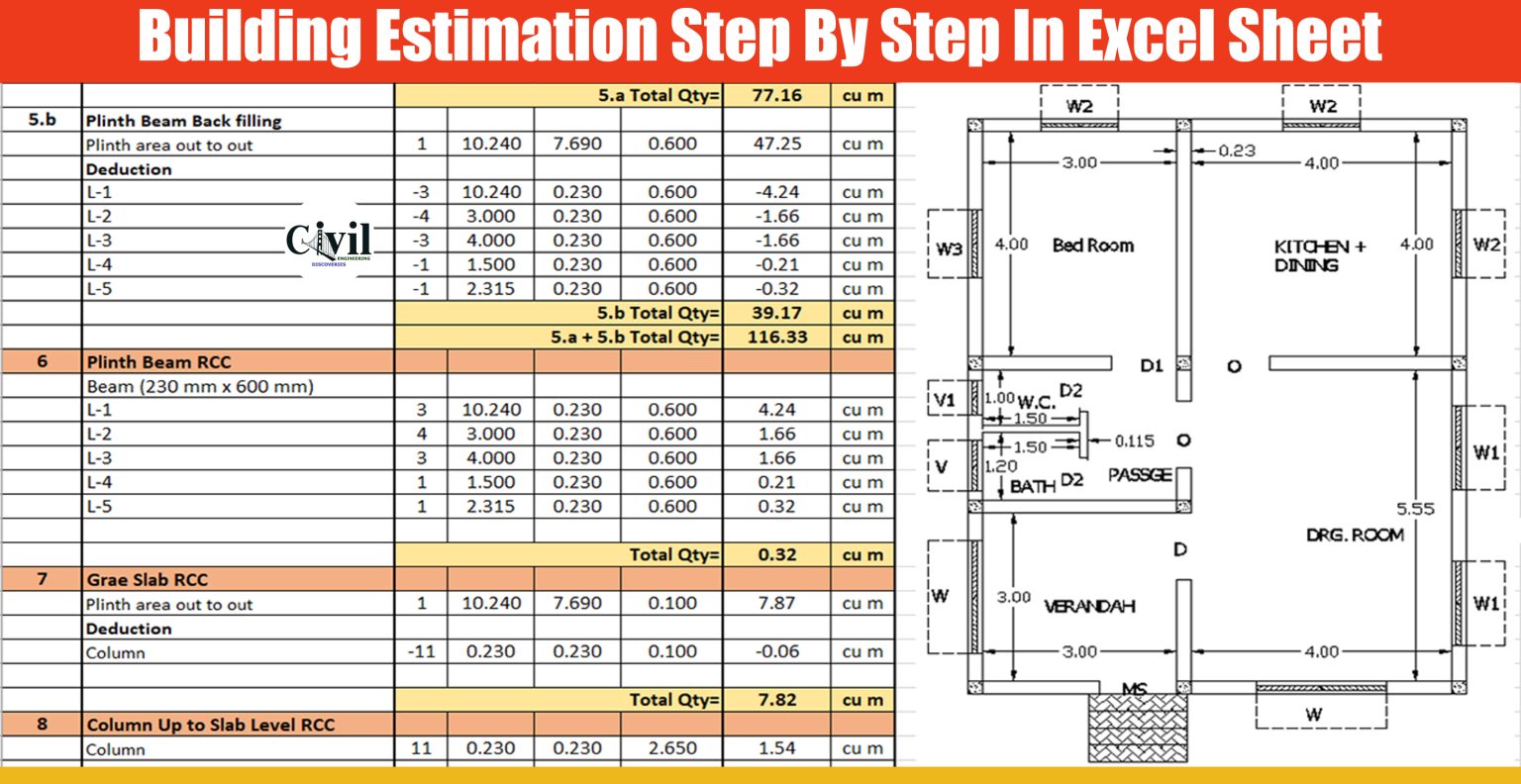

Building Estimation Step By Step In Excel Sheet Engineering Discoveries

Cost, Sales Comparison And Income Are The Three Main Commercial Real Estate Valuation Approaches.

Learn How To Calculate Commercial Property Value With Expert Precision.

When You Are In The Process Of Negotiating A Commercial Real Estate Deal, It Is Critical To Be Aware Of The Estimated Value Of The Building That You Intend To Purchase.

This Guide Outlines Four Methods To Determine A Property's Valuation

Related Post: