Condo Building Insurance Coverage

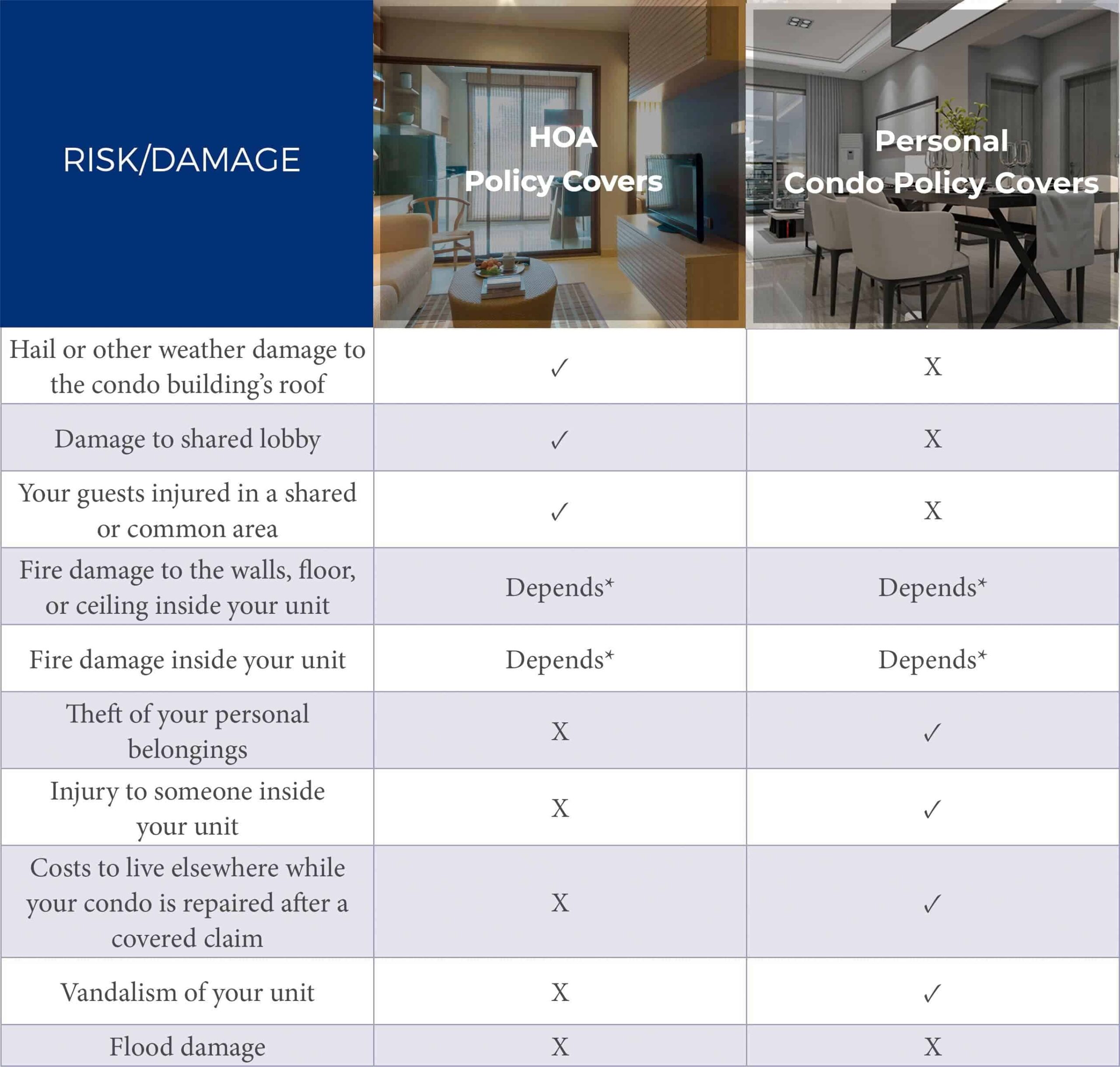

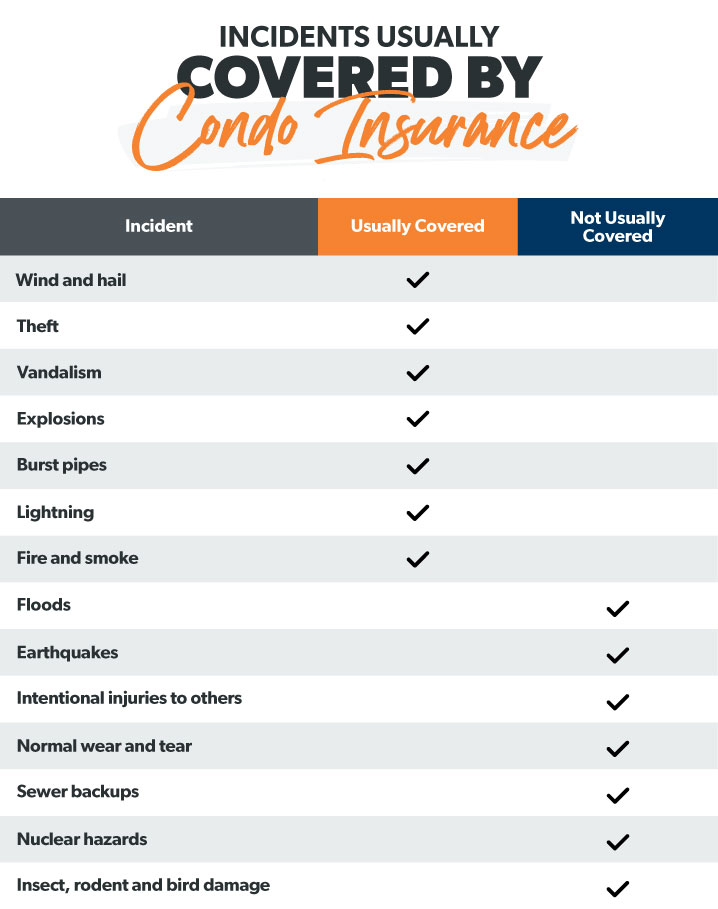

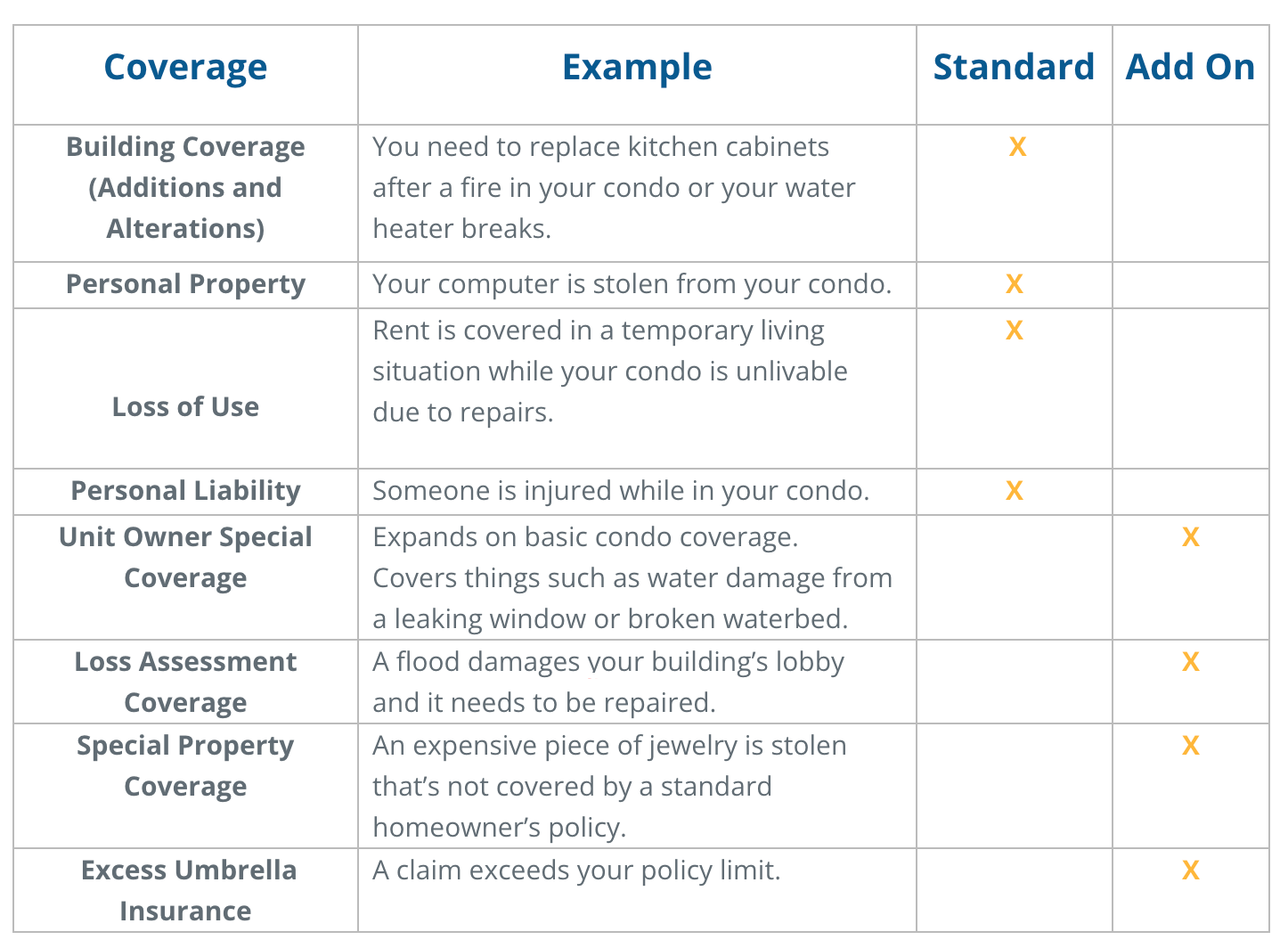

Condo Building Insurance Coverage - Saintilus says that in south florida, where properties are frequently exposed to hurricanes and flooding, hoa insurance costs have risen sharply in recent years. Safeguard your home and possessions with comprehensive coverage. A condo policy will generally cover interior. Condo association insurance is a type of policy designed specifically for homeowners’ associations (hoas) and condominium communities. While your condo association probably has a master policy covering the building and. Learn about condo liability coverage, loss assessment coverage and more, and find the coverage that's right for you. What gets covered by a condo insurance policy? Emory said many condos have experienced a 50% to 100% increase in insurance premiums over the last few years, related both to the fallout from the new inspection. Condo insurance serves to protect your condo and its contents from any disasters or theft. Discover the key benefits, costs, and tips to choose the right policy. Here’s a breakdown of what a typical condo insurance policy covers: Also known as an hoa master policy, condo association insurance generally covers all common areas of the condominium building, like a lounge or recreational room, as well as. A condo policy will generally cover interior. Understanding critical elements of hoa and condo insurance navigating the complexities of insurance coverage for homeowner associations (hoas) and condominium. Personal property is usually the largest coverage amount on a condo policy, unlike. Condo insurance provides protection for all of those things, as well as providing personal liability coverage, loss assessment coverage, and other benefits such as living expenses coverage if. Saintilus says that in south florida, where properties are frequently exposed to hurricanes and flooding, hoa insurance costs have risen sharply in recent years. When you live in a condo, you are covered in two different. The importance of condo association insurance. Condo living in chicago means knowing, understanding, and navigating specific rules and regulations, particularly when it comes to insurance claims and coverage. Condo insurance covers personal property, building property liability and loss of use. Condo insurance covers the interior walls and floors of your unit, your personal belongings, liability exposure and coverage for temporary living expenses after a covered. Condo insurance provides protection for all of those things, as well as providing personal liability coverage, loss assessment coverage, and other benefits such. While your condo association probably has a master policy covering the building and. Personal property is usually the largest coverage amount on a condo policy, unlike. Here’s a breakdown of what a typical condo insurance policy covers: Condo insurance covers personal property, building property liability and loss of use. Specifically, florida statute 718.111(11) provides that a condominium association must obtain. Condo association insurance is a type of policy designed specifically for homeowners’ associations (hoas) and condominium communities. While your condo association probably has a master policy covering the building and. Also known as an hoa master policy, condo association insurance generally covers all common areas of the condominium building, like a lounge or recreational room, as well as. Safeguard your. Condo insurance protects your home in a similar manner to regular home insurance. Condo insurance serves to protect your condo and its contents from any disasters or theft. If you live in an area prone to natural disasters, your risk of needing insurance is much higher. In orman's case, her condo. The importance of condo association insurance. Condo insurance covers the interior walls and floors of your unit, your personal belongings, liability exposure and coverage for temporary living expenses after a covered. When you live in a condo, you are covered in two different. Personal property is usually the largest coverage amount on a condo policy, unlike. A condo policy will generally cover interior. Condo association insurance. Specifically, florida statute 718.111(11) provides that a condominium association must obtain and maintain “[a]dequate property insurance, regardless of any requirement in the. Condo insurance protects your home in a similar manner to regular home insurance. Condo insurance covers the interior walls and floors of your unit, your personal belongings, liability exposure and coverage for temporary living expenses after a covered.. The main difference is that you likely won't need as much coverage because your. Condo living in chicago means knowing, understanding, and navigating specific rules and regulations, particularly when it comes to insurance claims and coverage. Condo insurance serves to protect your condo and its contents from any disasters or theft. Learn about condo liability coverage, loss assessment coverage and. Learn about condo liability coverage, loss assessment coverage and more, and find the coverage that's right for you. This includes coverage for the unit itself, including walls and fixtures. Saintilus says that in south florida, where properties are frequently exposed to hurricanes and flooding, hoa insurance costs have risen sharply in recent years. Your condo association’s master policy, or hoa. Personal property is usually the largest coverage amount on a condo policy, unlike. In turn, if an hoa loses insurance coverage or premiums spike dramatically, homeowners may struggle to find coverage, and lenders will stop granting new mortgages in. Condo insurance provides protection for all of those things, as well as providing personal liability coverage, loss assessment coverage, and other. Understanding critical elements of hoa and condo insurance navigating the complexities of insurance coverage for homeowner associations (hoas) and condominium. The main difference is that you likely won't need as much coverage because your. Emory said many condos have experienced a 50% to 100% increase in insurance premiums over the last few years, related both to the fallout from the. Condo insurance serves to protect your condo and its contents from any disasters or theft. This includes coverage for the unit itself, including walls and fixtures. When you live in a condo, you are covered in two different. Saintilus says that in south florida, where properties are frequently exposed to hurricanes and flooding, hoa insurance costs have risen sharply in recent years. Specifically, florida statute 718.111(11) provides that a condominium association must obtain and maintain “[a]dequate property insurance, regardless of any requirement in the. Understanding critical elements of hoa and condo insurance navigating the complexities of insurance coverage for homeowner associations (hoas) and condominium. Condo insurance covers the interior walls and floors of your unit, your personal belongings, liability exposure and coverage for temporary living expenses after a covered. In turn, if an hoa loses insurance coverage or premiums spike dramatically, homeowners may struggle to find coverage, and lenders will stop granting new mortgages in. Learn about condo liability coverage, loss assessment coverage and more, and find the coverage that's right for you. In orman's case, her condo. Emory said many condos have experienced a 50% to 100% increase in insurance premiums over the last few years, related both to the fallout from the new inspection. Discover the key benefits, costs, and tips to choose the right policy. Condo living in chicago means knowing, understanding, and navigating specific rules and regulations, particularly when it comes to insurance claims and coverage. Condo insurance covers personal property, building property liability and loss of use. Also known as an hoa master policy, condo association insurance generally covers all common areas of the condominium building, like a lounge or recreational room, as well as. Here’s a breakdown of what a typical condo insurance policy covers:Condo Insurance Coverage Explained Onlia Insurance

Building Insurance for Condo Properties in the Philippines Blog

Understanding Insurance For Covering Your Condominium UnitJust The

Texas Condo Insurance Get Protected

Your Guide to Condo (HO6) Insurance Ramsey

Guide to Condo Insurance Coverage Protect Your Investment

How Condo Insurance Protects You & Why You Need It

MA Condo Insurance Cavallo & Signoriello

What Does Dwelling Mean In Condo Insurance at Amber Learned blog

Condo Insurance What You Need to Know WOWA.ca

While Your Condo Association Probably Has A Master Policy Covering The Building And.

Condo Insurance Provides Protection For All Of Those Things, As Well As Providing Personal Liability Coverage, Loss Assessment Coverage, And Other Benefits Such As Living Expenses Coverage If.

A Condo Policy Will Generally Cover Interior.

If You Live In An Area Prone To Natural Disasters, Your Risk Of Needing Insurance Is Much Higher.

Related Post: