Construction Loans To Build A House

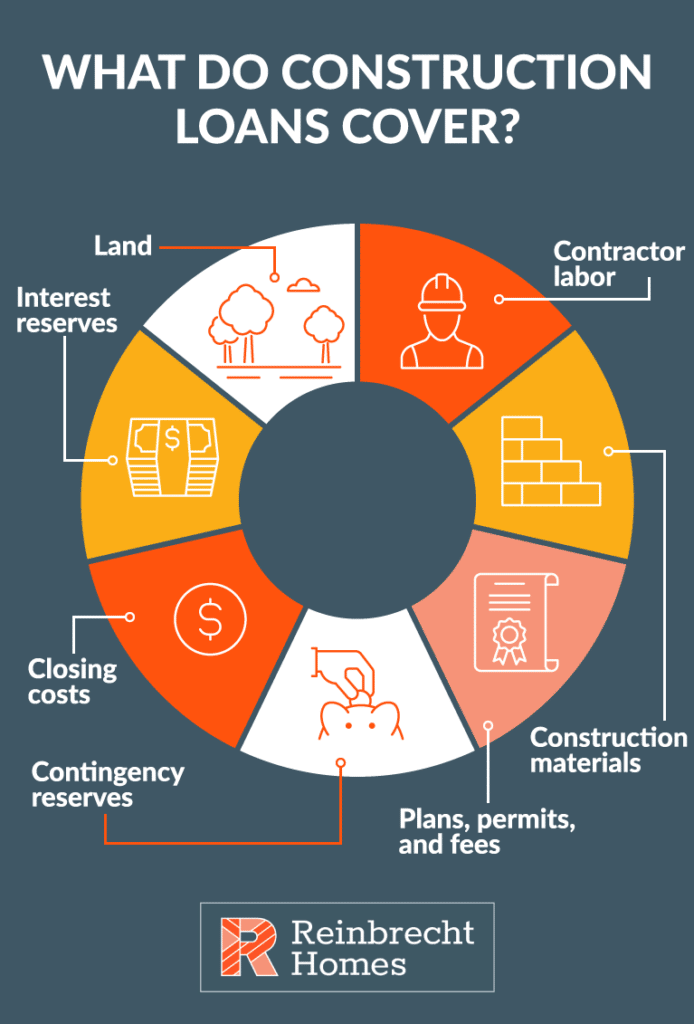

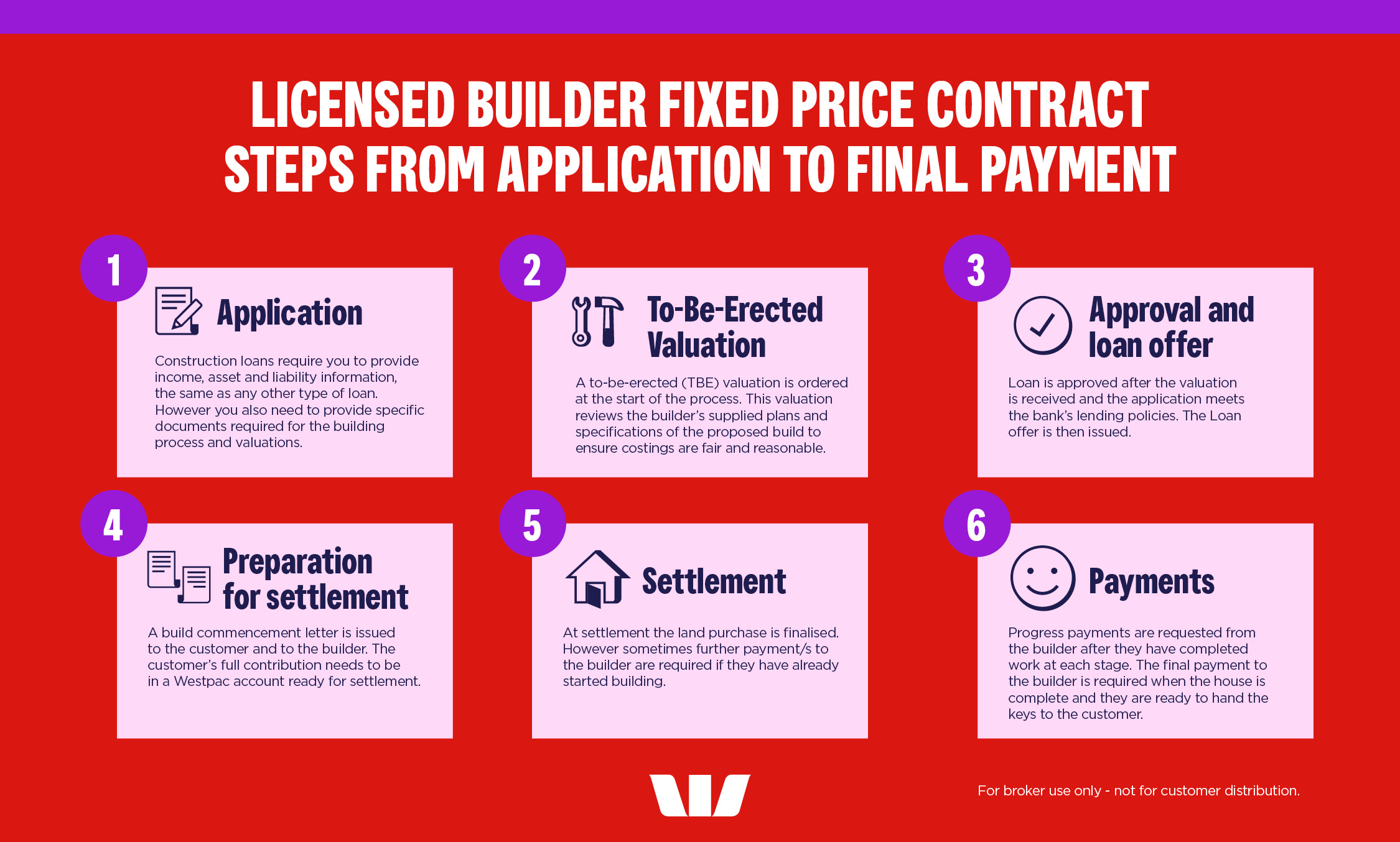

Construction Loans To Build A House - Here’s a comprehensive guide to help you understand. On average, the nahb reports that framing a house cost an average of $70,982 in 2024. Getting a construction loan to build your very own custom home from the ground up is a little different than buying an existing home. If your home needs repairs to make it more livable, an fha title 1 loan could help. 1st eagle mortgage construction loans allow you to build a new home, which can take from six to 24 months. Additionally, you can combine the loan amount with the cost of renovating or. Designing and building homes comes in so many shapes and sizes that having a single construction loan option does not suffice. Eligibility requirements for obtaining a. Upon completion, the permanent loan or 'end financing' will be used to. Construction loans let you finance the materials and labor to build a house from scratch — as opposed to a traditional mortgage loan, which is only for completed homes. Here’s a comprehensive guide to help you understand. Building a house or buying a house that's under construction means financing the building phase as well as the completed home — and finding an experienced and. Our lot loan gives you up to five years to allow enough time for construction. Getting a construction loan to build your very own custom home from the ground up is a little different than buying an existing home. Eligibility requirements for obtaining a. Upon completion, the permanent loan or 'end financing' will be used to. Project owners and contractors often assemble a. What this means for construction. Purchase up to ten acres of vacant land for new construction or recreational purposes. The federal housing administration (fha) insures loans from approved mortgage lenders,. Construction loans let you finance the materials and labor to build a house from scratch — as opposed to a traditional mortgage loan, which is only for completed homes. Here’s a comprehensive guide to help you understand. As for which type of loan you should get, many of the most common types of loans are available for newly built homes,. Our lot loan gives you up to five years to allow enough time for construction. Additionally, you can combine the loan amount with the cost of renovating or. A construction loan is a specific type of loan used to pay for building or remodeling a property. On average, the nahb reports that framing a house cost an average of $70,982. Our lot loan gives you up to five years to allow enough time for construction. Project owners and contractors often assemble a. Therefore, lenders offer different types of. Getting a construction loan to build your very own custom home from the ground up is a little different than buying an existing home. Construction loans let you finance the materials and. 1st eagle mortgage construction loans allow you to build a new home, which can take from six to 24 months. • construction loans finance new home builds or major renovations, covering various costs. Purchase up to ten acres of vacant land for new construction or recreational purposes. Building a house or buying a house that's under construction means financing the. If your home needs repairs to make it more livable, an fha title 1 loan could help. Eligibility requirements for obtaining a. Construction loans let you finance the materials and labor to build a house from scratch — as opposed to a traditional mortgage loan, which is only for completed homes. We have the perfect construction loan solution to help.. Purchase up to ten acres of vacant land for new construction or recreational purposes. On average, the nahb reports that framing a house cost an average of $70,982 in 2024. Our lot loan gives you up to five years to allow enough time for construction. The federal housing administration (fha) insures loans from approved mortgage lenders,. Designing and building homes. Accessing enough funding for a construction project can represent a huge challenge for general contractors. Getting a construction loan to build your very own custom home from the ground up is a little different than buying an existing home. Purchase up to ten acres of vacant land for new construction or recreational purposes. Unlike traditional mortgage loans, which are for. We have the perfect construction loan solution to help. Here’s a comprehensive guide to help you understand. The interest rates for construction loans are often higher due to increased risks associated with the building process. Additionally, you can combine the loan amount with the cost of renovating or. Upon completion, the permanent loan or 'end financing' will be used to. Project owners and contractors often assemble a. If your home needs repairs to make it more livable, an fha title 1 loan could help. Therefore, lenders offer different types of. Unlike traditional mortgage loans, which are for buying existing homes, construction loans. A construction loan is a specific type of loan used to pay for building or remodeling a property. Our lot loan gives you up to five years to allow enough time for construction. Purchase up to ten acres of vacant land for new construction or recreational purposes. What this means for construction. On average, the nahb reports that framing a house cost an average of $70,982 in 2024. Construction loans are designed to cover the costs of building. Accessing enough funding for a construction project can represent a huge challenge for general contractors. Foundations were less expensive, averaging out to $44,748 per new house. Unlike traditional mortgage loans, which are for buying existing homes, construction loans. Project owners and contractors often assemble a. We have the perfect construction loan solution to help. If your home needs repairs to make it more livable, an fha title 1 loan could help. On average, the nahb reports that framing a house cost an average of $70,982 in 2024. Eligibility requirements for obtaining a. Designing and building homes comes in so many shapes and sizes that having a single construction loan option does not suffice. Purchase up to ten acres of vacant land for new construction or recreational purposes. Construction loans are designed to cover the costs of building a new home or undertaking significant renovations. Getting a construction loan to build your very own custom home from the ground up is a little different than buying an existing home. Additionally, you can combine the loan amount with the cost of renovating or. Building a house or buying a house that's under construction means financing the building phase as well as the completed home — and finding an experienced and. Construction loans let you finance the materials and labor to build a house from scratch — as opposed to a traditional mortgage loan, which is only for completed homes. As for which type of loan you should get, many of the most common types of loans are available for newly built homes, including conventional, fha, va, usda, and others at both fixed and.Construction Loans 101 Everything You Need To Know

How Do New Construction Loans Work? Construction loans, New home

Construction Loans 101 Everything You Need To Know

Construction Loans 101 Everything You Need To Know

Using a Construction Loan to Build Your Dream House My Lender Jackie

Construction Loans How Do They Work? Rocket Mortgage

Construction Option Loans

How Does A Construction Loan Work To Build A House Storables

Construction Loan Ad Germantown Trust & Savings Bank Breese

VA Construction Loans How to Build a Home with a VA Loan

• Construction Loans Finance New Home Builds Or Major Renovations, Covering Various Costs.

Upon Completion, The Permanent Loan Or 'End Financing' Will Be Used To.

The Federal Housing Administration (Fha) Insures Loans From Approved Mortgage Lenders,.

The Interest Rates For Construction Loans Are Often Higher Due To Increased Risks Associated With The Building Process.

Related Post: