Credit Builder Card Like Chime

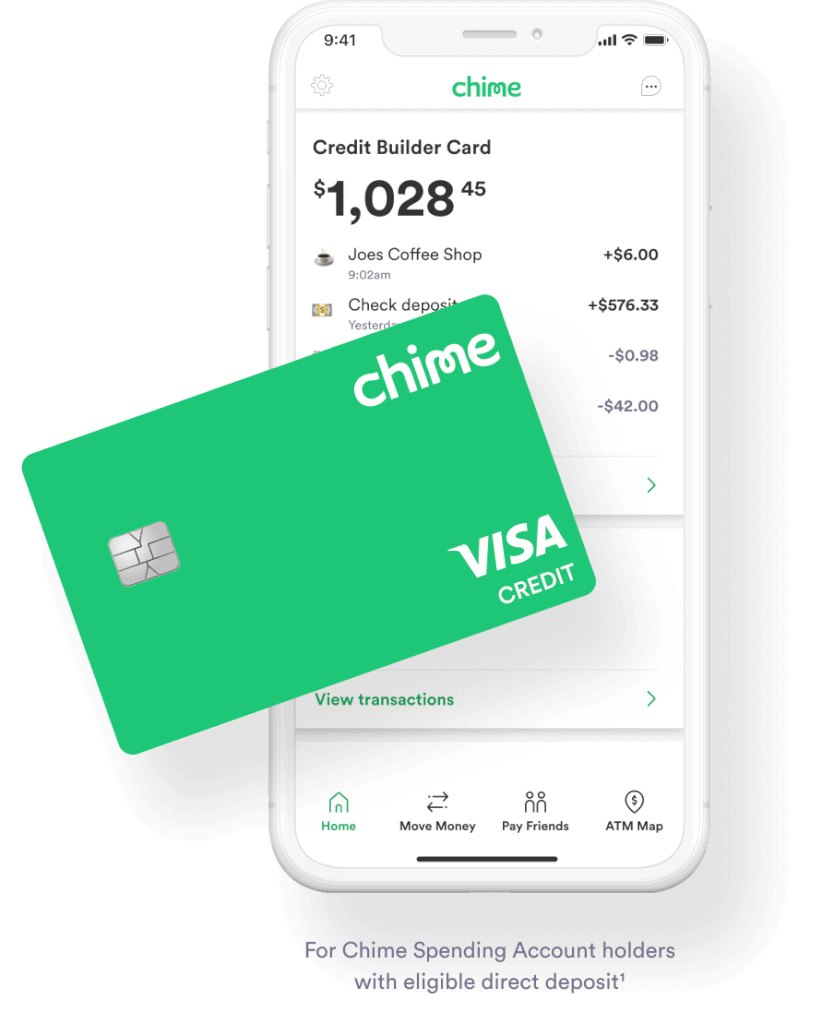

Credit Builder Card Like Chime - Looking for an alternative to chime for online checking? Chime, the popular online mobile banking platform, launched a secured credit card aimed at helping users build credit. Why we like this card: Some providers offer credit limit increases without additional deposits after demonstrating responsible use. No credit check to apply. You still need a local bank to make cash deposits. These cards are unique because they often don’t have interest charges and often skip the hard credit check, making them solid options for people new to credit cards or credit building. Some fintechs, like chime, extra and cleo, offer secured credit cards that function a lot like prepaid cards that report payments to credit bureaus. Chime offers a variety of products, from checking and savings accounts to money transfers. Easier to qualify for than unsecured cards; Some fintechs, like chime, extra and cleo, offer secured credit cards that function a lot like prepaid cards that report payments to credit bureaus. This is essentially what the chime card is, and it's a fine option. However, there are several other top online banks like chime. Unlike traditional credit cards, credit builder is a secured card that helps you build credit history with no annual fees and no interest. I don't know the specifics of the chime card but a quick search tells me it can absolutely lower your credit score if not used properly. Chime, the popular online mobile banking platform, launched a secured credit card aimed at helping users build credit. 1 there’s also no credit check to apply! Looking for an alternative to chime for online checking? Some providers offer credit limit increases without additional deposits after demonstrating responsible use. Instantly disable your card to help prevent fraud. Here’s what you should know and how it stacks up against fizz. The card lets you allocate money toward your credit limit; Instantly disable your card to help prevent fraud. You still need a local bank to make cash deposits. Looking for an alternative to chime for online checking? Some providers offer credit limit increases without additional deposits after demonstrating responsible use. The chime secured credit builder doesn’t require a credit check to apply, which could be helpful if you have a limited credit history or bad credit. Otherwise, online checking accounts can handle most of your banking needs. Start building credit for free. The chime credit builder credit. I don't know the specifics of the chime card but a quick search tells me it can absolutely lower your credit score if not used properly. No credit check to apply. The chime credit builder credit card can help you build credit with no annual fees, no interest 1, no large security deposits², and no credit checks necessary to apply.. Unlike traditional credit cards, credit builder is a secured card that helps you build credit history with no annual fees and no interest. No credit check to apply. New platforms like chime ® are uniquely designed to provide individuals with insufficient credit history an opportunity to build or improve their credit scores. They operate like a debit card, but increase. The chime credit builder visa® credit card is our no annual fee, no interest, secured credit card that helps you build your credit. However, there are several other top online banks like chime. This is essentially what the chime card is, and it's a fine option. Build credit using your own money to. Some fintechs, like chime, extra and cleo,. I don't know the specifics of the chime card but a quick search tells me it can absolutely lower your credit score if not used properly. Some fintechs, like chime, extra and cleo, offer secured credit cards that function a lot like prepaid cards that report payments to credit bureaus. The chime credit builder visa® credit card is our no. New platforms like chime ® are uniquely designed to provide individuals with insufficient credit history an opportunity to build or improve their credit scores. These cards are unique because they often don’t have interest charges and often skip the hard credit check, making them solid options for people new to credit cards or credit building. Why we like this card:. Some providers offer credit limit increases without additional deposits after demonstrating responsible use. I don't know the specifics of the chime card but a quick search tells me it can absolutely lower your credit score if not used properly. The chime credit builder visa® credit card is our no annual fee, no interest, secured credit card that helps you build. Chime offers a variety of products, from checking and savings accounts to money transfers. However, there are several other top online banks like chime. In this article, we will explore the best credit cards to build credit, based on your credit profiles and needs. They operate like a debit card, but increase your credit. There's no credit check, no interest. Start building credit for free. Another option is the extra debit card if you’re interested in earning rewards while you build credit. Many include free employee credit cards and basic expense management features. Build credit using your own money to. You still need a local bank to make cash deposits. Chime is one of the most popular fintech companies. 1 there’s also no credit check to apply! Easier to qualify for than unsecured cards; Build credit using your own money to. You can spend only as much as you put aside. Start building credit for free. You still need a local bank to make cash deposits. Chime, the popular online mobile banking platform, launched a secured credit card aimed at helping users build credit. These cards often provide monthly fico score access and credit education tools. The chime credit builder visa® credit card is our no annual fee, no interest, secured credit card that helps you build your credit. Some fintechs, like chime, extra and cleo, offer secured credit cards that function a lot like prepaid cards that report payments to credit bureaus. Why we like this card: The chime secured credit builder doesn’t require a credit check to apply, which could be helpful if you have a limited credit history or bad credit. Another option is the extra debit card if you’re interested in earning rewards while you build credit. Instantly disable your card to help prevent fraud. The chime credit builder credit card can help you build credit with no annual fees, no interest 1, no large security deposits², and no credit checks necessary to apply.US challenger bank Chime launches Credit Builder, a credit card that

Secured Chime Credit Builder Visa® Credit Card An Innovative Way to

Secured Credit Card to Build Credit Chime

US challenger bank Chime launches Credit Builder, a credit card that

Chime Credit Builder Card Review A Secured Card With Guardrails

What is a Chime Credit Builder Credit Card? Quick Introduction Seek

Chime Credit Builder Secured Visa® Credit Card Review

Credit Builder Card Chime

Credit Builder Card Chime

Chime Credit Builder Card Review 2022 Build Credit From ZERO YouTube

The Card Lets You Allocate Money Toward Your Credit Limit;

No Credit Check To Apply.

There's No Credit Check, No Interest And No Minimum Required Security Deposit.

Looking For An Alternative To Chime For Online Checking?

Related Post: