Credit Builder Loan Online

Credit Builder Loan Online - Decide on a loan amount. A credit builder loan is for qualifying members who have no credit history but would like to build one. In this article, review how a credit builder loan works, the pros and cons, and. Many lenders offer credit builder loans as a way to build or repair a credit history as an alternative to taking on debt in the form of a credit card or a personal line of credit. Credit builder is a combination loan and savings program that may help you establish a good payment history, an important step in building a higher credit score. As noted already, you can typically borrow anywhere from $300 to $1,000. Credit builder loans have an annual percentage rate (apr) ranging from 5.99% apr to 29.99% apr, are offered by affiliates of moneylion and subject to approval. Turning a bad credit profile into a good one doesn’t happen overnight, but it is possible with a credit builder loan from usalliance! This financial product is designed to help people with limited or poor credit histories access a modest loan amount and increase. Compare interest rates, terms and any potential fees from multiple. And because of their design, they offer a nice little nest egg once. In this article, review how a credit builder loan works, the pros and cons, and. Taking out a loan and paying it back on time and in full can do wonders for. This unique loan works similarly to a savings secured loan, except you do not need. Compare interest rates, terms and any potential fees from multiple. This financial product is designed to help people with limited or poor credit histories access a modest loan amount and increase. The best credit builder loans allow people with poor credit to improve their score at minimal cost. Credit builder loans have an annual percentage rate (apr) ranging from 5.99% apr to 29.99% apr, are offered by affiliates of moneylion and subject to approval. Credit builder plans starting at $5/month * that help you build credit when you pay on time. Many lenders offer credit builder loans as a way to build or repair a credit history as an alternative to taking on debt in the form of a credit card or a personal line of credit. This unique loan works similarly to a savings secured loan, except you do not need. Compare interest rates, terms and any potential fees from multiple. As noted already, you can typically borrow anywhere from $300 to $1,000. A credit builder loan is for qualifying members who have no credit history but would like to build one. In this article, review. Our credit builder loan holds the amount that you. As noted already, you can typically borrow anywhere from $300 to $1,000. This unique loan works similarly to a savings secured loan, except you do not need. A credit builder loan is for qualifying members who have no credit history but would like to build one. Credit builder loans have an. This financial product is designed to help people with limited or poor credit histories access a modest loan amount and increase. And because of their design, they offer a nice little nest egg once. Compare interest rates, terms and any potential fees from multiple. Turning a bad credit profile into a good one doesn’t happen overnight, but it is possible. As noted already, you can typically borrow anywhere from $300 to $1,000. And because of their design, they offer a nice little nest egg once. Decide on a loan amount. This unique loan works similarly to a savings secured loan, except you do not need. Credit builder is a combination loan and savings program that may help you establish a. Compare interest rates, terms and any potential fees from multiple. Taking out a loan and paying it back on time and in full can do wonders for. This financial product is designed to help people with limited or poor credit histories access a modest loan amount and increase. And because of their design, they offer a nice little nest egg. Credit builder loans have an annual percentage rate (apr) ranging from 5.99% apr to 29.99% apr, are offered by affiliates of moneylion and subject to approval. Credit builder plans starting at $5/month * that help you build credit when you pay on time. In this article, review how a credit builder loan works, the pros and cons, and. Decide on. Taking out a loan and paying it back on time and in full can do wonders for. Credit builder plans starting at $5/month * that help you build credit when you pay on time. Decide on a loan amount. Compare interest rates, terms and any potential fees from multiple. Turning a bad credit profile into a good one doesn’t happen. Credit builder plans starting at $5/month * that help you build credit when you pay on time. Credit builder is a combination loan and savings program that may help you establish a good payment history, an important step in building a higher credit score. This financial product is designed to help people with limited or poor credit histories access a. In this article, review how a credit builder loan works, the pros and cons, and. Decide on a loan amount. Turning a bad credit profile into a good one doesn’t happen overnight, but it is possible with a credit builder loan from usalliance! This financial product is designed to help people with limited or poor credit histories access a modest. Our credit builder loan holds the amount that you. And because of their design, they offer a nice little nest egg once. Credit builder loans have an annual percentage rate (apr) ranging from 5.99% apr to 29.99% apr, are offered by affiliates of moneylion and subject to approval. In this article, review how a credit builder loan works, the pros. This financial product is designed to help people with limited or poor credit histories access a modest loan amount and increase. Compare interest rates, terms and any potential fees from multiple. The best credit builder loans allow people with poor credit to improve their score at minimal cost. Credit builder plans starting at $5/month * that help you build credit when you pay on time. Turning a bad credit profile into a good one doesn’t happen overnight, but it is possible with a credit builder loan from usalliance! As noted already, you can typically borrow anywhere from $300 to $1,000. Many lenders offer credit builder loans as a way to build or repair a credit history as an alternative to taking on debt in the form of a credit card or a personal line of credit. Decide on a loan amount. In this article, review how a credit builder loan works, the pros and cons, and. Taking out a loan and paying it back on time and in full can do wonders for. Credit builder loans have an annual percentage rate (apr) ranging from 5.99% apr to 29.99% apr, are offered by affiliates of moneylion and subject to approval. And because of their design, they offer a nice little nest egg once.6 Best Credit Builder Loans for 2022 [No Credit Check, Online, Unsecured]

6 Best Credit Builder Loans for 2022 [No Credit Check, Online, Unsecured]

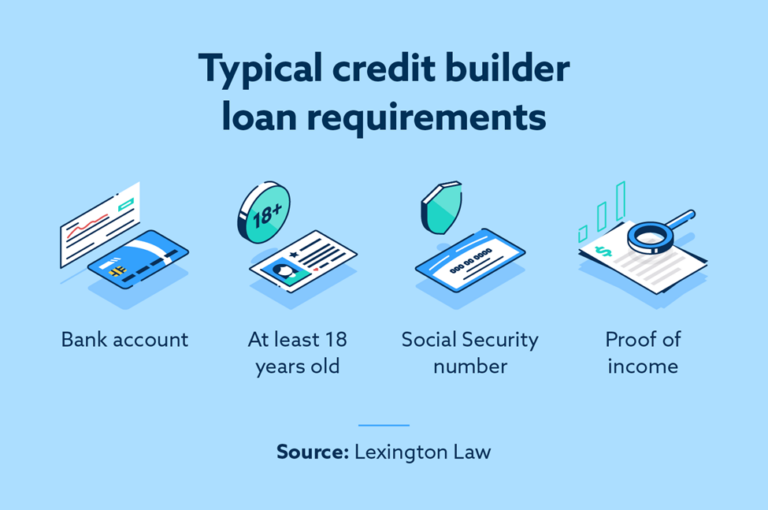

What Is a Credit Builder Loan and Is It for You? Lexington Law

What Is A Credit Builder Loan & How Does It Work? Self. Credit Builder.

What Is A Credit Builder Loan & How Does It Work? Self. Credit Builder.

What Is A Credit Builder Loan & How Does It Work? Self. Credit Builder.

What is a Credit Builder Loan and How Does it Work?

CreditBuilder Loan A Loan Designed to Build, Improve, or Rebuild Your

5 Best Credit Builder Loans in 2023 No Credit Check

Self Credit Builder Loan Review for 2022 No Credit Check

A Credit Builder Loan Is For Qualifying Members Who Have No Credit History But Would Like To Build One.

Credit Builder Is A Combination Loan And Savings Program That May Help You Establish A Good Payment History, An Important Step In Building A Higher Credit Score.

Our Credit Builder Loan Holds The Amount That You.

This Unique Loan Works Similarly To A Savings Secured Loan, Except You Do Not Need.

Related Post:

![6 Best Credit Builder Loans for 2022 [No Credit Check, Online, Unsecured]](https://digitalhoney.money/wp-content/uploads/2021/08/image-1-1024x727.png)

![6 Best Credit Builder Loans for 2022 [No Credit Check, Online, Unsecured]](https://digitalhoney.money/wp-content/uploads/2021/08/image-4-1536x852.png)