Credit Builder Payment Chime

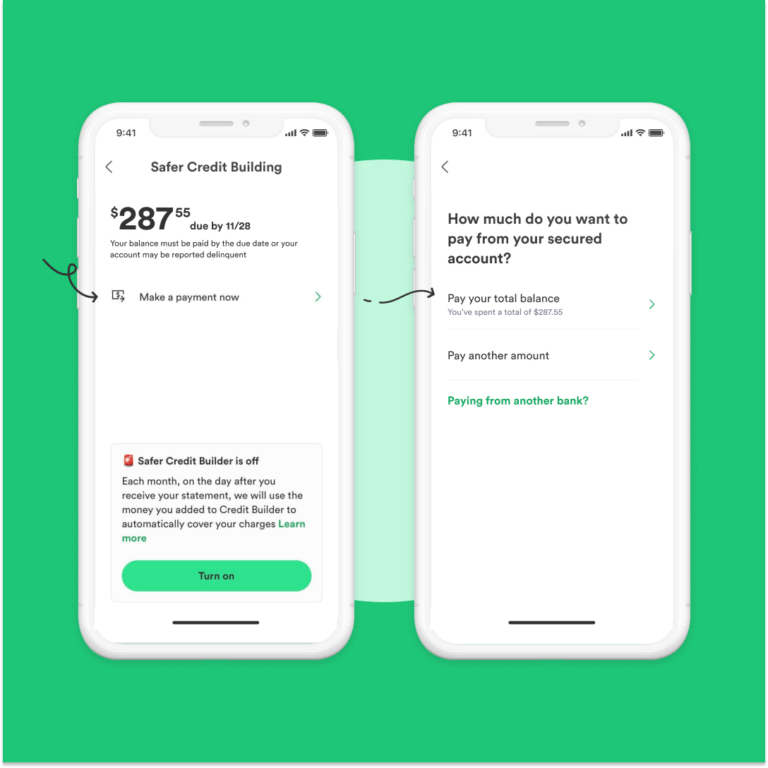

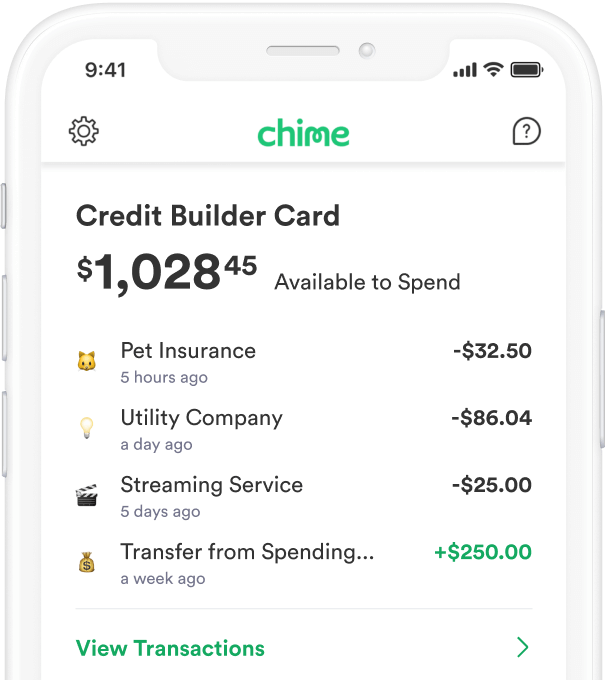

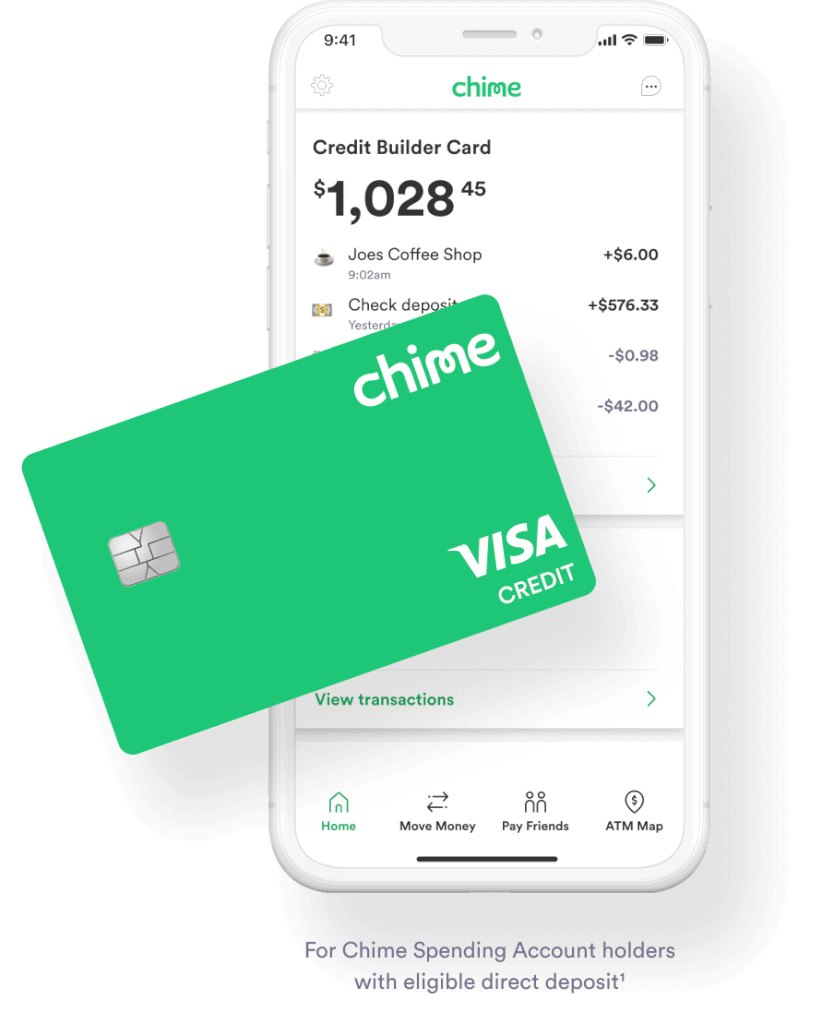

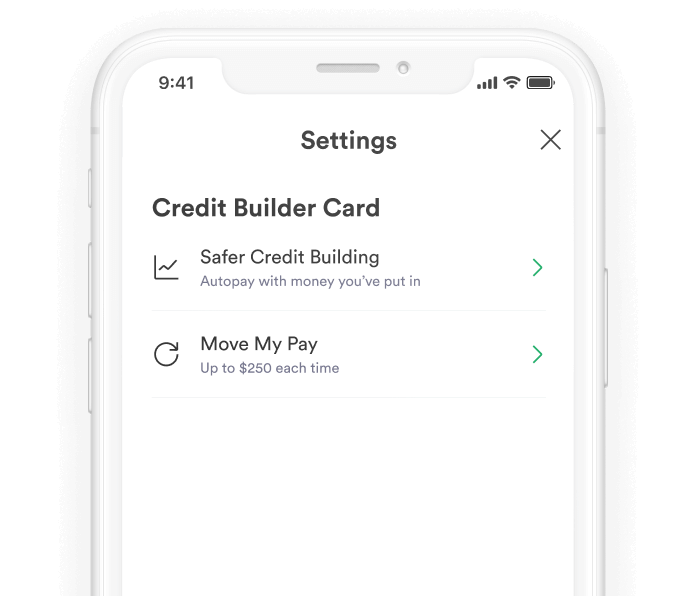

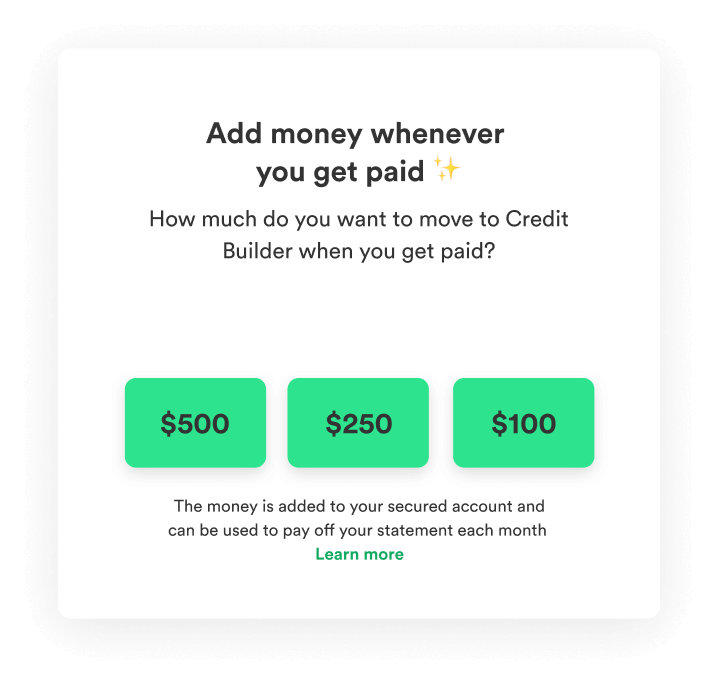

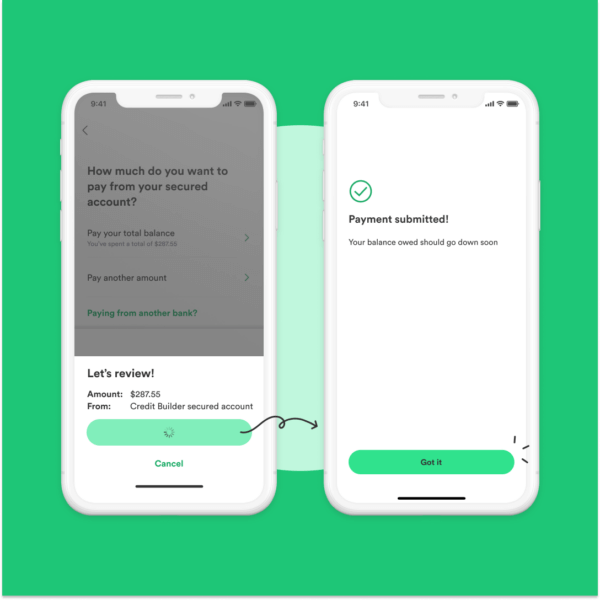

Credit Builder Payment Chime - Using simple tips and hacks such as bill payment alerts. In this article, we'll also delve into the details of how the secured chime credit builder visa® credit card works, how to use it, and how your results may vary based on. You can use your credit builder card anywhere visa® is accepted and at the end of each month, you can use the money previously moved to pay for your monthly charges (we recommend. Or stride bank, n.a., pursuant to licenses from visa u.s.a. It uses the money you have in your secured account to pay off your credit builder monthly card account balance in full. Enabling safer credit building ensures that your balance is. Here are two ways you can make a payment to your chime credit builder secured visa ® card. When you use your secured credit builder visa ® credit card, chime reports your payment activity to experian ®, transunion ®, and equifax ®, the three major credit bureaus. Why does chime report my credit builder balance to a credit bureau? There are multiple ways to transfer money into your credit builder secured deposit account. When you use your secured credit builder visa ® credit card, chime reports your payment activity to experian ®, transunion ®, and equifax ®, the three major credit bureaus. With credit builder, you can use your deposit to pay. Knowing how to pay your credit card bill and when to pay can go a long way toward helping you build better credit. Or stride bank, n.a., pursuant to licenses from visa u.s.a. You can use your credit builder card anywhere visa® is accepted and at the end of each month, you can use the money previously moved to pay for your monthly charges (we recommend. What is credit builder and how to enroll; Enabling safer credit building ensures that your balance is. Use the move my pay feature. This can help you build your. How to use credit builder; Or stride bank, n.a., pursuant to licenses from visa u.s.a. How to use credit builder; When you use your secured credit builder visa ® credit card, chime reports your payment activity to experian ®, transunion ®, and equifax ®, the three major credit bureaus. In this article, we'll also delve into the details of how the secured chime credit builder. In this article, we'll also delve into the details of how the secured chime credit builder visa® credit card works, how to use it, and how your results may vary based on. What is credit builder and how to enroll; However, for many secured credit cards, the security deposits are unavailable to you, the consumer, until you close the account.. Use the move my pay feature. The chime visa® debit card and the secured chime credit builder visa® credit card are issued by the bancorp bank, n.a. With credit builder, you can use your deposit to pay. Enabling safer credit building ensures that your balance is. There are multiple ways to transfer money into your credit builder secured deposit account. Credit builder offers features that help you stay on top of key factors that impact your credit score. Safer credit building is an autopay feature. There are multiple ways to transfer money into your credit builder secured deposit account. It uses the money you have in your secured account to pay off your credit builder monthly card account balance in. However, for many secured credit cards, the security deposits are unavailable to you, the consumer, until you close the account. Enabling safer credit building ensures that your balance is. Why does chime report my credit builder balance to a credit bureau? When you use your secured credit builder visa ® credit card, chime reports your payment activity to experian ®,. Safer credit building is an autopay feature. Use the move my pay feature. It uses the money you have in your secured account to pay off your credit builder monthly card account balance in full. Or stride bank, n.a., pursuant to licenses from visa u.s.a. The chime visa® debit card and the secured chime credit builder visa® credit card are. Safer credit building is an autopay feature. This can help you build your. With credit builder, you can use your deposit to pay. What is credit builder and how to enroll; However, for many secured credit cards, the security deposits are unavailable to you, the consumer, until you close the account. Using simple tips and hacks such as bill payment alerts. However, for many secured credit cards, the security deposits are unavailable to you, the consumer, until you close the account. In this article, we'll also delve into the details of how the secured chime credit builder visa® credit card works, how to use it, and how your results may vary. Consistent use of credit builder can help you build positive payment history. When you use your secured credit builder visa ® credit card, chime reports your payment activity to experian ®, transunion ®, and equifax ®, the three major credit bureaus. This can help you build your. Using simple tips and hacks such as bill payment alerts. Use the move. It uses the money you have in your secured account to pay off your credit builder monthly card account balance in full. You can use your credit builder card anywhere visa® is accepted and at the end of each month, you can use the money previously moved to pay for your monthly charges (we recommend. How to use credit builder;. Credit builder offers features that help you stay on top of key factors that impact your credit score. Use the move my pay feature. Using simple tips and hacks such as bill payment alerts. You can use your credit builder card anywhere visa® is accepted and at the end of each month, you can use the money previously moved to pay for your monthly charges (we recommend. It uses the money you have in your secured account to pay off your credit builder monthly card account balance in full. It has no interest*, no annual fees*, and doesn’t need a credit check. Or stride bank, n.a., pursuant to licenses from visa u.s.a. What is credit builder and how to enroll; Knowing how to pay your credit card bill and when to pay can go a long way toward helping you build better credit. With credit builder, you can use your deposit to pay. Or stride bank, n.a., pursuant to licenses from visa u.s.a. In this article, we'll also delve into the details of how the secured chime credit builder visa® credit card works, how to use it, and how your results may vary based on. The chime visa® debit card and the secured chime credit builder visa® credit card are issued by the bancorp bank, n.a. Why does chime report my credit builder balance to a credit bureau? There are multiple ways to transfer money into your credit builder secured deposit account. However, for many secured credit cards, the security deposits are unavailable to you, the consumer, until you close the account.How Does Chime Credit Builder Work? Chime YouTube

US challenger bank Chime launches Credit Builder, a credit card that

Credit Builder Understanding monthly statements and balances Chime

Credit Card To Build Credit Securely Chime

Credit Builder Card Chime

How to build credit with Credit Builder Chime

How to build credit with Credit Builder Chime

Credit Builder Understanding monthly statements and balances Chime

Credit Builder Card Chime

Secured Credit Card to Build Credit Chime

The Chime Visa® Debit Card And The Secured Chime Credit Builder Visa® Credit Card Are Issued By The Bancorp Bank, N.a.

This Can Help You Build Your.

When You Use Your Secured Credit Builder Visa ® Credit Card, Chime Reports Your Payment Activity To Experian ®, Transunion ®, And Equifax ®, The Three Major Credit Bureaus.

Safer Credit Building Is An Autopay Feature.

Related Post: